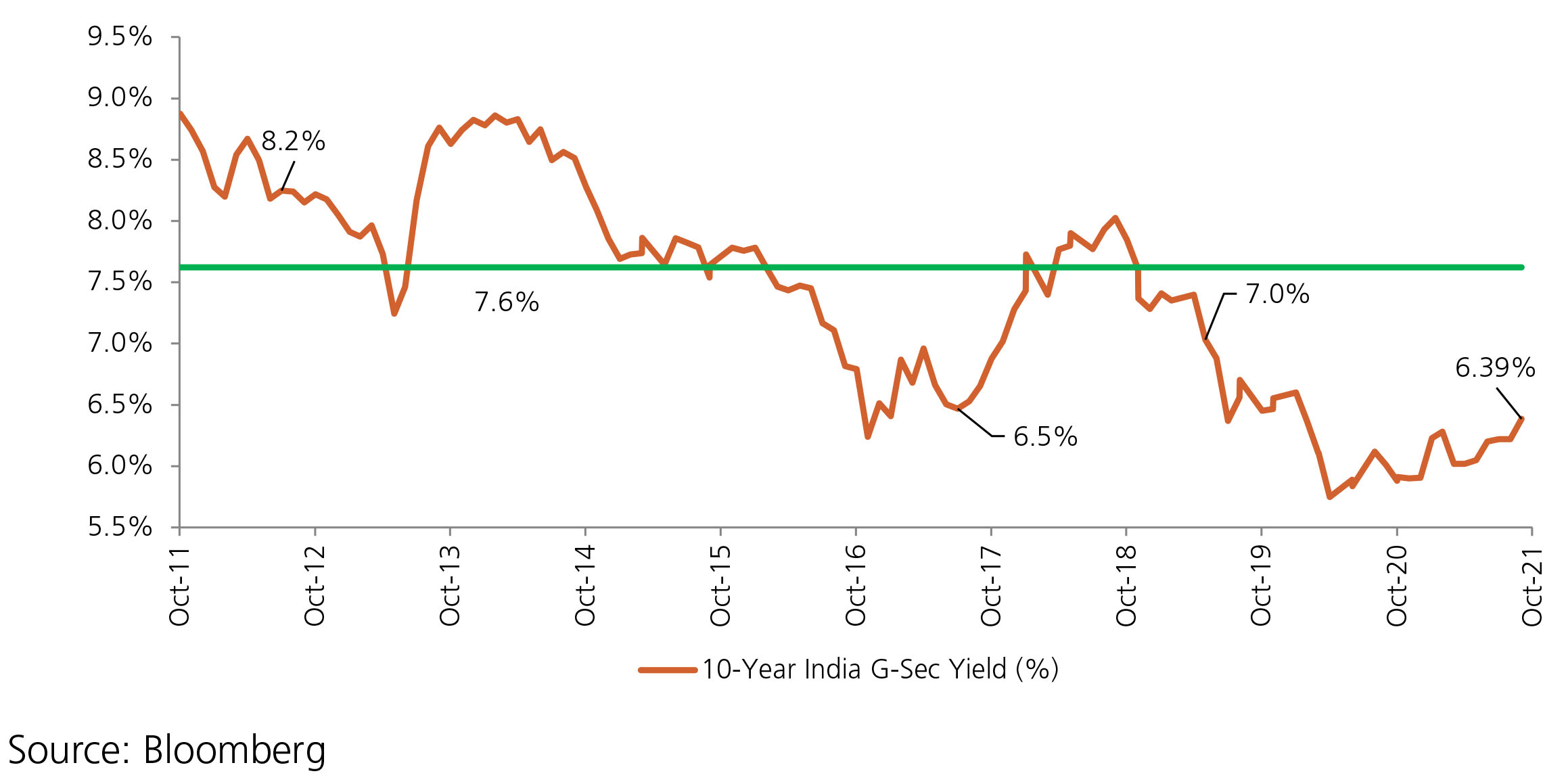

Yields drew cues from the RBI MPC meeting in October as the central bank clearly indicated an intent to move towards liquidity normalization. The RBI surprised the market by doing away with the G-SAP calendar programme altogether contrary to market expectations of some degree of tapering in the calendar. In addition, the central bank also outlined an increase in the amount of 14-Day VRRR from INR 4tn to INR 6tn in a phased manner in steps of INR 0.5tn over a period of two months. 28-Day VRRR auctions were also mentioned fleetingly as a possibility in coming months to complement 14-Day VRRR. Despite the RBI adding that it remained in readiness to intervene, as and when warranted by the liquidity situation, on a discretionary basis through instrumets such as G-SAP, Operation Twist (OT) and Open Market Operations (OMOs), yields sold off across the curve. Continued uptick in crude prices added to the pressure on yields. G-Sec yields closed 15-17 bps higher for the month on 10y+ segment, around 10 bps higher at in the mid-segment and almost 25bps higher at the very short end up to 3 years.