Month Gone By – Markets (period ended August 31, 2021)

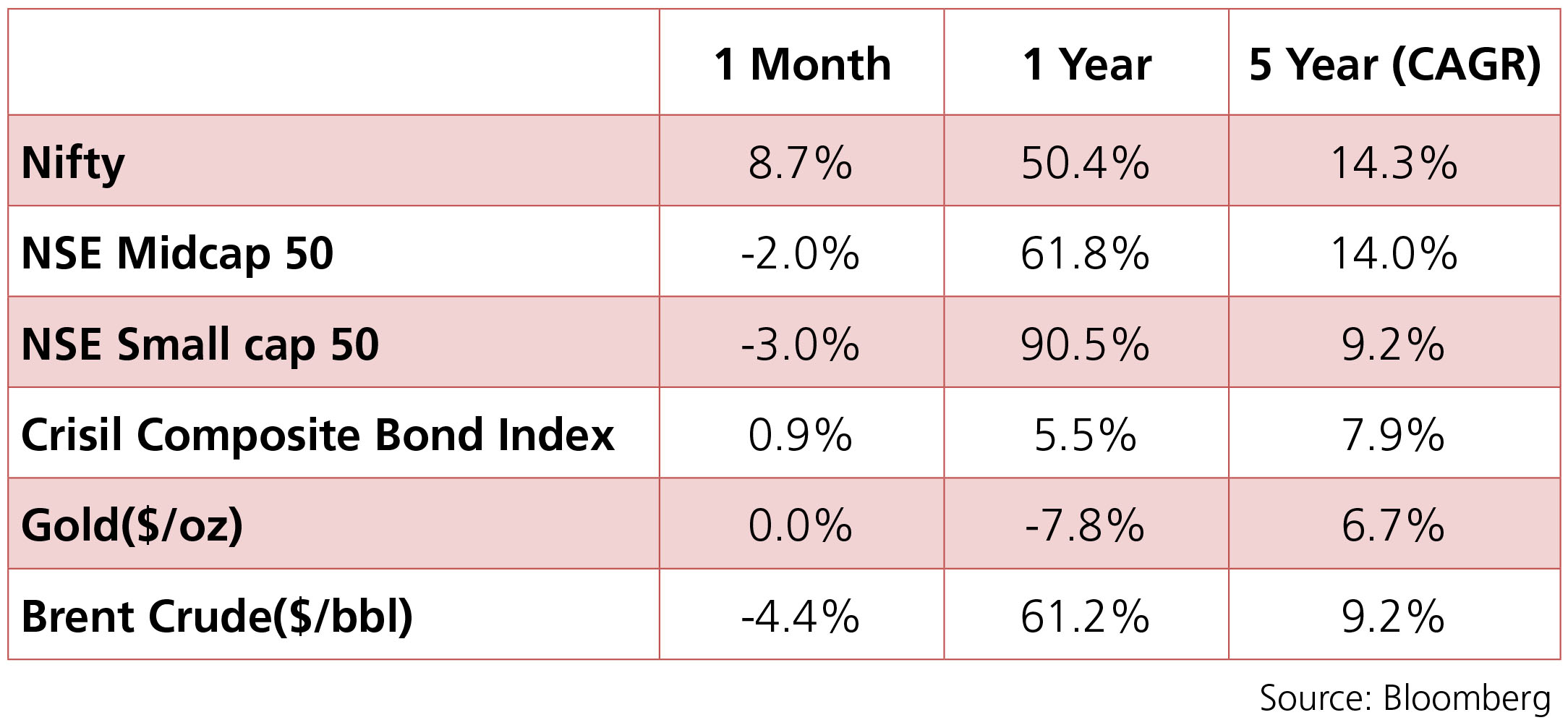

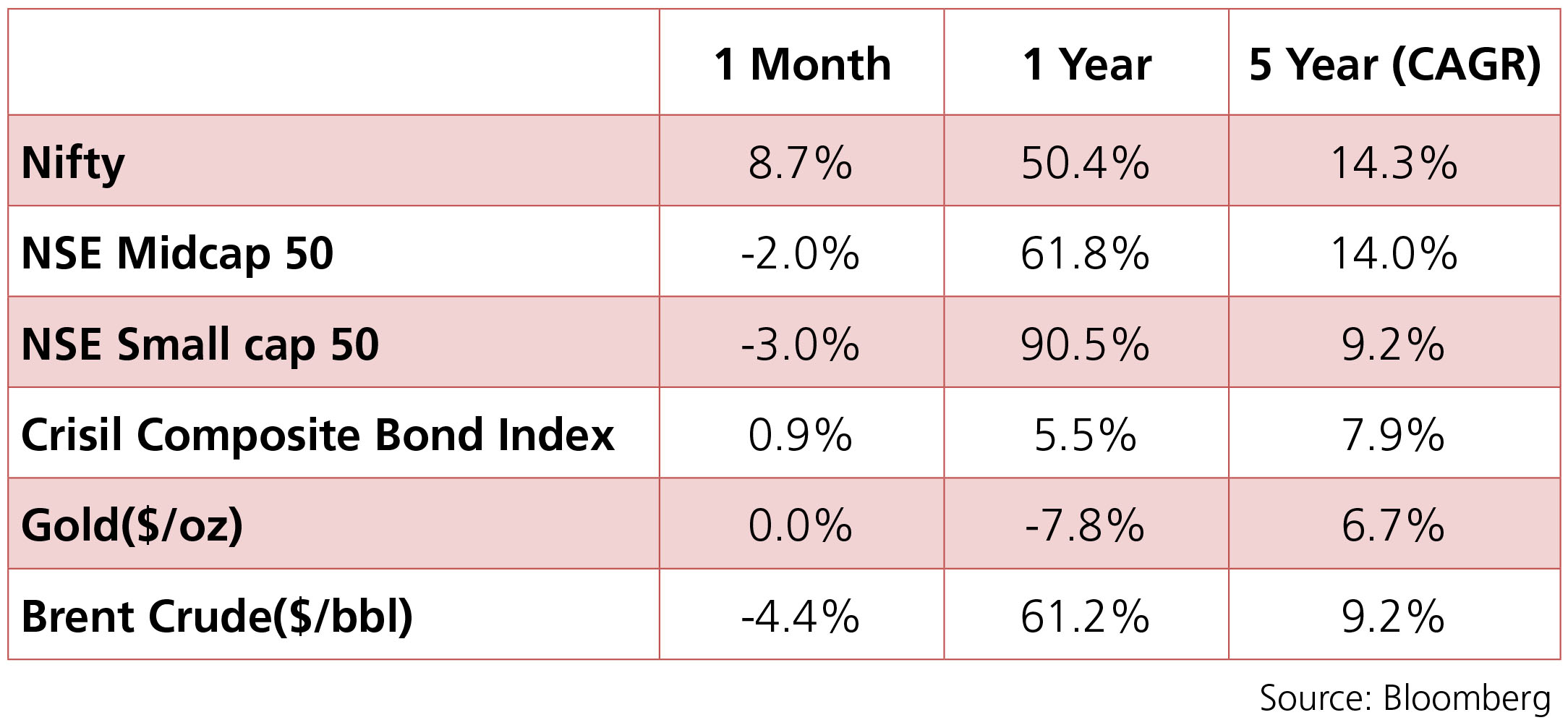

Markets continued to remain buoyant in the month of August with the Nifty index up 8.7% for the

month. IT, FMCG and Energy stocks have been the frontrunners while Pharma and Realty have been

the laggards. On the FX front, the INR has been holding steady between 74.1-74.3 but registered solid

gains post the communique from Jackson Hole that saw the pair breach the 73.0 level and end the

month at 72.9. The 10y benchmark has also been range-bound ranging between 6.20-6.25% for the

month.

The major domestic event for the month of August was the RBI Monetary Policy meeting that saw the RBI maintain its status-quo on interest rates and on its accommodative stance. All concerns regarding withdrawal of abundant liquidity and prospective change of stance that may have arisen from the dissent of one MPC member were dispelled quickly as the RBI reassured the markets of supportive monetary policy to entrench strong growth recovery post the pandemic.

Another closely watched event in the month of August was the Jackson Hole symposium of the US Fed. Market participants were looking for cues on how the Fed plans to undwind its massive monetary stimulus. The Fed has signalled that tapering is likely to commence towards the close of this year although it does not intend to tinker with interest rates at the same time. US Yields have broadly traded in the range of 1.17-1.36% over the month of August.

With respect to commodities, brent crude has averaged $70.4 for the month with volatility arising from rise in COVID cases in some parts of the world and the concerns over long-lasting impact of resurgence abating towards the end of the month. As demand outlook improves, the OPEC+ is expected to agree on raising output in its next meeting. Gold has largely traded in the range of $1700-1800/oz with gains capped due to the robust outlook on risk assets.

The major domestic event for the month of August was the RBI Monetary Policy meeting that saw the RBI maintain its status-quo on interest rates and on its accommodative stance. All concerns regarding withdrawal of abundant liquidity and prospective change of stance that may have arisen from the dissent of one MPC member were dispelled quickly as the RBI reassured the markets of supportive monetary policy to entrench strong growth recovery post the pandemic.

Another closely watched event in the month of August was the Jackson Hole symposium of the US Fed. Market participants were looking for cues on how the Fed plans to undwind its massive monetary stimulus. The Fed has signalled that tapering is likely to commence towards the close of this year although it does not intend to tinker with interest rates at the same time. US Yields have broadly traded in the range of 1.17-1.36% over the month of August.

With respect to commodities, brent crude has averaged $70.4 for the month with volatility arising from rise in COVID cases in some parts of the world and the concerns over long-lasting impact of resurgence abating towards the end of the month. As demand outlook improves, the OPEC+ is expected to agree on raising output in its next meeting. Gold has largely traded in the range of $1700-1800/oz with gains capped due to the robust outlook on risk assets.

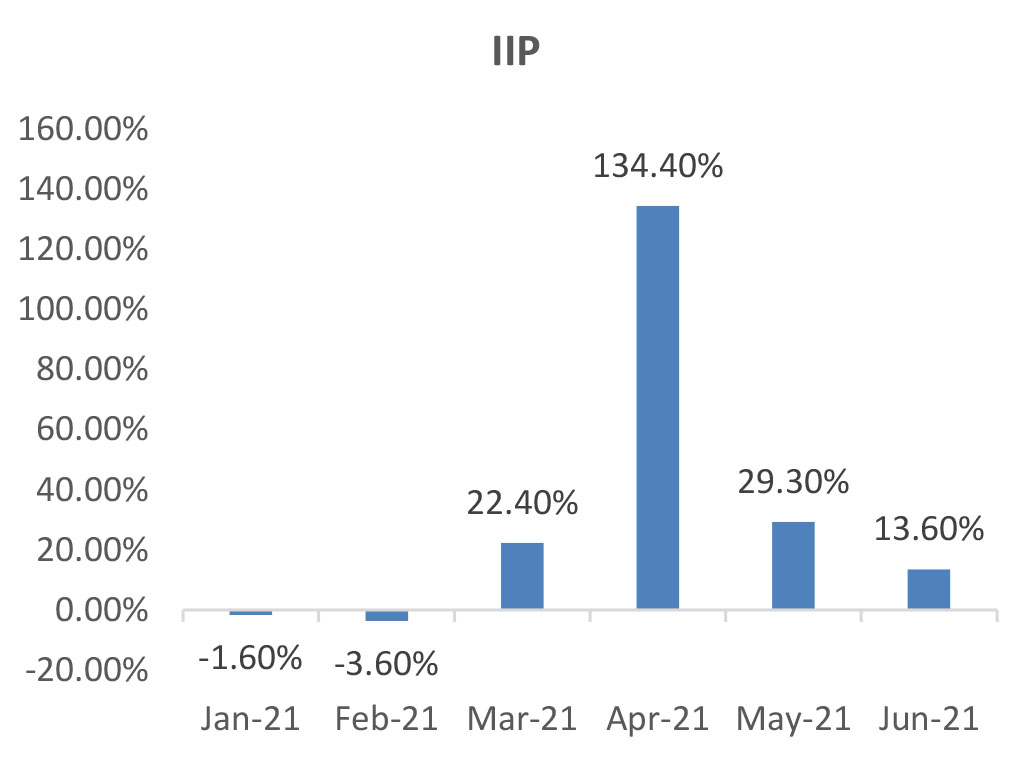

IIP: The country’s index of industrial production (IIP) surged by 13.6% y-o-y to 122.6 in the month of

June 2021 primarily due to gaining momentum and a low base in June 2020. Manufacturing which

contributes to 77.6% of the basket grew by 13%, while Mining and Electricity grew by 23.1% and

8.3% respectively.

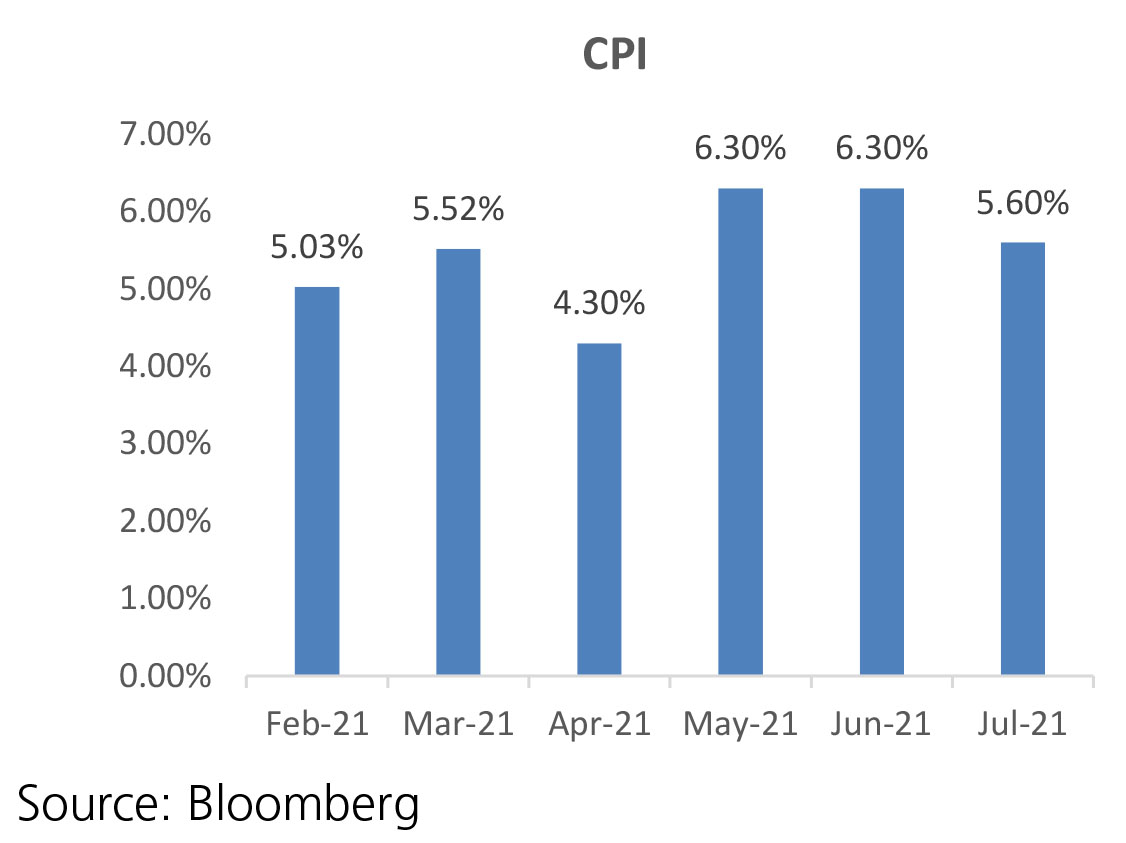

CPI: CPI inflation for July came in at 5.7%, down from 6.3% in June amidst favourable base effects despite increasing momentum. Food and beverages inflation moderated to 4.5% from 5.6% in June, coming from a softening of inflation in oils and fats, fruits, and pulses. Fuel inflation remained in double digits in July at 12.4%, though it was a tad lower by around 20 bps from 12.6% in June 2021. Core CPI inflation moderated to 5.8% in July 2021 from 6.1% in June.

Trade Deficit: The trade deficit for July aggregated to $10.97 Bn vs a deficit of $9.3 Bn in June 2021. The trade deficit in July 2020 was $4.8 Bn. The country’s exports came in at $35.4 Bn vs $32.5 Bn in June 2020. Imports for the month increased by 63% over July 2020 to US$46.4 Bn due to lower base and gaining momentum. Oil imports for the month rose to $12.9 Bn, as compared to $10.6 Bn in July 2020.

Fiscal Deficit: The fiscal deficit stood at 21.3% of the Budget Estimates, as compared to 103.1% in the same period last year. In absolute terms, the fiscal deficit was at Rs. 3,21,143 crore at the end of July. The main contributors to the lower fiscal deficit were higher net tax revenues at 34.2% of BE vs 12.4% in the corresponding period previous year and non-tax revenues at 57.6% vs 6.4% in the same period last year. At the same time, total expenditure was lower at 28.8% for the period vs 34.7% in the same period last year.

GDP: Q1 FY22 GDP expanded by 20.1% YoY (GVA growth of 18.8%). GDP growth was in line with estimates and primarily driven by low base of the Covid impacted quarter of the previous year. On a QoQ basis, GDP has declined 16.9% and by 9.2% when compared with June-2019 quarter. In comparison to the pre-Covid base, only government expenditure and exports are faring better, growing at 7.4% and 8.7% respectively, while the rest of the components such as private consumption, investments and imports are still in negative.

CPI: CPI inflation for July came in at 5.7%, down from 6.3% in June amidst favourable base effects despite increasing momentum. Food and beverages inflation moderated to 4.5% from 5.6% in June, coming from a softening of inflation in oils and fats, fruits, and pulses. Fuel inflation remained in double digits in July at 12.4%, though it was a tad lower by around 20 bps from 12.6% in June 2021. Core CPI inflation moderated to 5.8% in July 2021 from 6.1% in June.

Trade Deficit: The trade deficit for July aggregated to $10.97 Bn vs a deficit of $9.3 Bn in June 2021. The trade deficit in July 2020 was $4.8 Bn. The country’s exports came in at $35.4 Bn vs $32.5 Bn in June 2020. Imports for the month increased by 63% over July 2020 to US$46.4 Bn due to lower base and gaining momentum. Oil imports for the month rose to $12.9 Bn, as compared to $10.6 Bn in July 2020.

Fiscal Deficit: The fiscal deficit stood at 21.3% of the Budget Estimates, as compared to 103.1% in the same period last year. In absolute terms, the fiscal deficit was at Rs. 3,21,143 crore at the end of July. The main contributors to the lower fiscal deficit were higher net tax revenues at 34.2% of BE vs 12.4% in the corresponding period previous year and non-tax revenues at 57.6% vs 6.4% in the same period last year. At the same time, total expenditure was lower at 28.8% for the period vs 34.7% in the same period last year.

GDP: Q1 FY22 GDP expanded by 20.1% YoY (GVA growth of 18.8%). GDP growth was in line with estimates and primarily driven by low base of the Covid impacted quarter of the previous year. On a QoQ basis, GDP has declined 16.9% and by 9.2% when compared with June-2019 quarter. In comparison to the pre-Covid base, only government expenditure and exports are faring better, growing at 7.4% and 8.7% respectively, while the rest of the components such as private consumption, investments and imports are still in negative.

Deal flow accelerated in August with 18 deals worth ~$3 Bn executed (vs 11 deals

worth ~$1.9 Bn in July). Notable deals included a slew of IPOs - Nuvoco Vistas

(~$0.7 Bn), Chemplast (~$0.5 Bn), Cartrade (~$0.4 Bn) and Aptus (~$0.4 Bn).

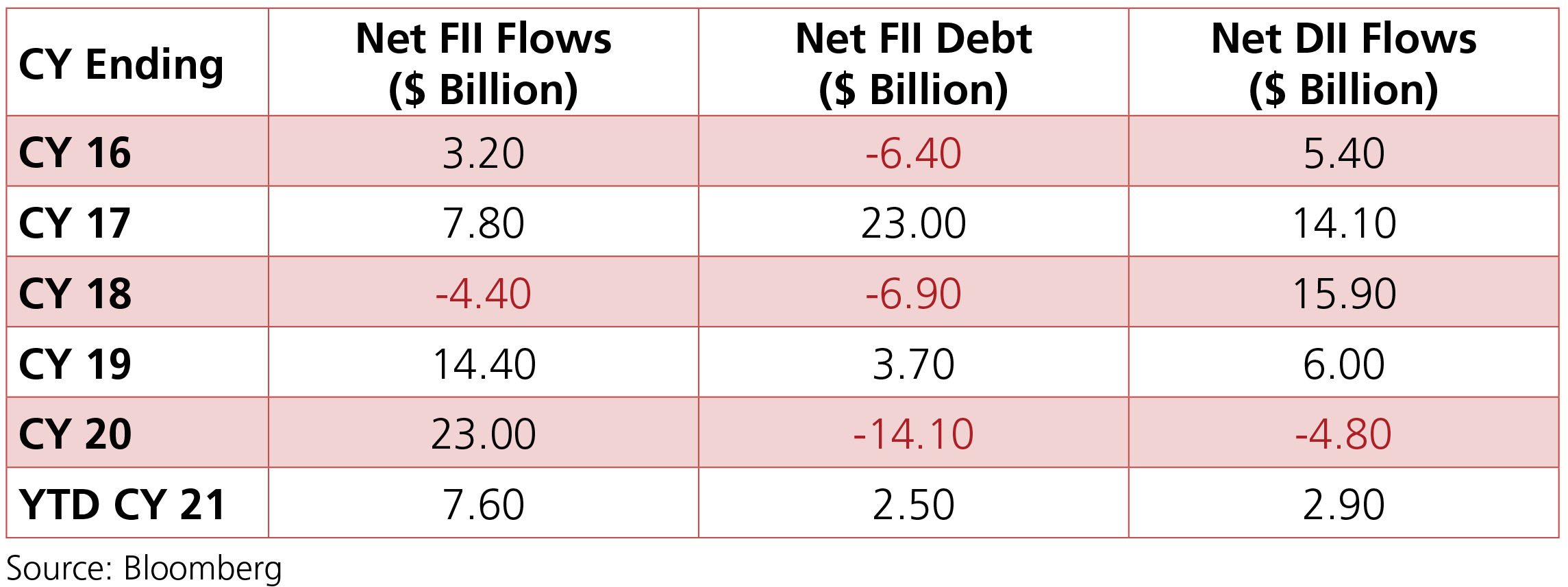

FIIs were net buyers to the tune of +$1.2 Bn in August (YTD +$7.5 Bn) vs –$1.7 Bn in July while DII buying moderated to +$0.9 Bn (YTD +$2.9 Bn) vs +$2.5 Bn in July. DII buying was largely driven by Domestic MFs who bought +$1.4 Bn (YTD +$2 Bn), fueled by NFO related inflows.

FIIs were net buyers to the tune of +$1.2 Bn in August (YTD +$7.5 Bn) vs –$1.7 Bn in July while DII buying moderated to +$0.9 Bn (YTD +$2.9 Bn) vs +$2.5 Bn in July. DII buying was largely driven by Domestic MFs who bought +$1.4 Bn (YTD +$2 Bn), fueled by NFO related inflows.