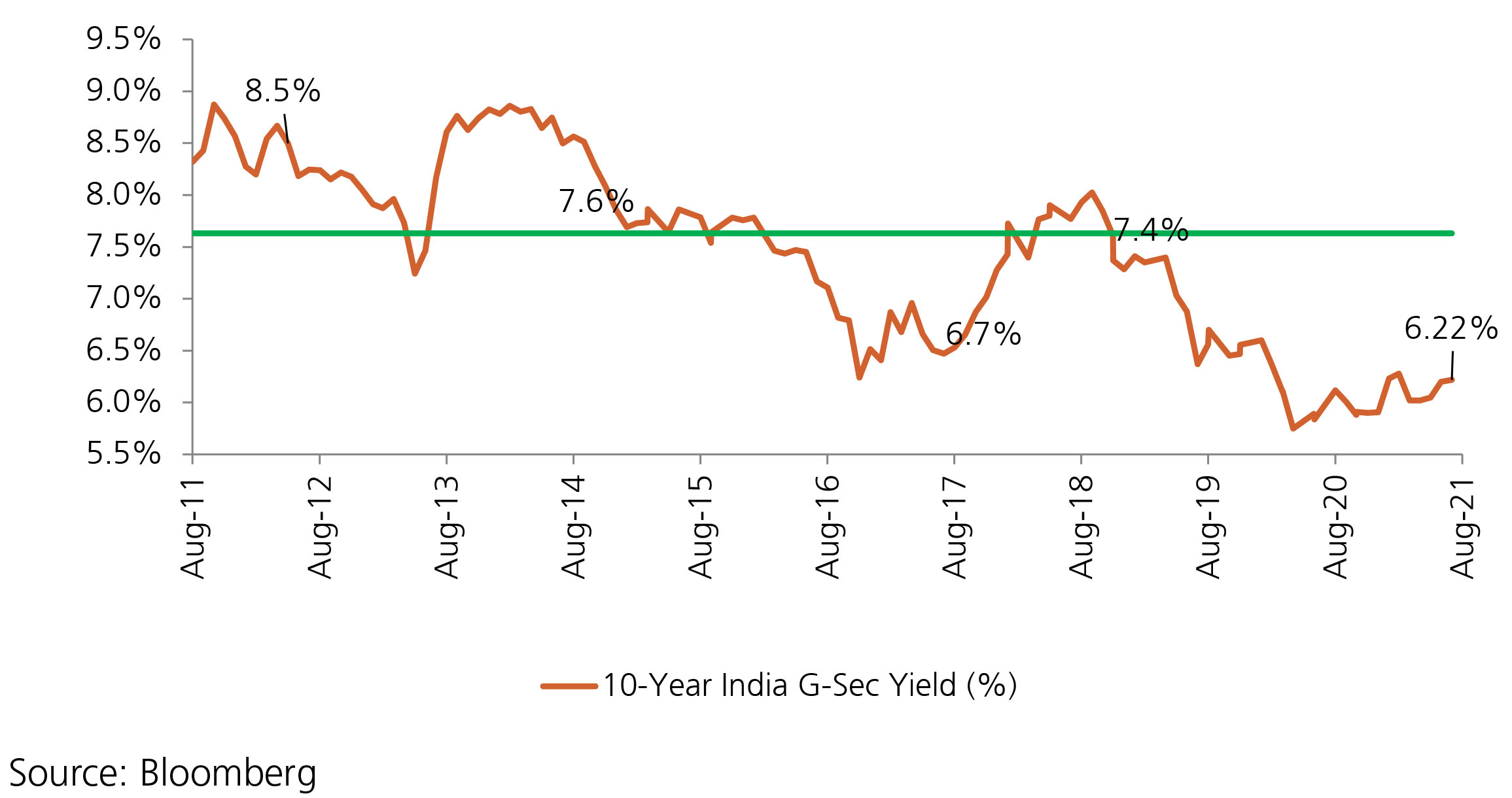

The 10y benchmark traded in a narrow range of 6.20-6.25% with yields across most points on the curve easing, some points more than others. With major events such as the RBI MPC and US Fed’s Jackson Hole meeting out of the way without creating much sway on yields, it now falls upon more high frequency datapoints such as CPI Inflation print, G-Sec auction dynamics and Crude prices to guide the trajectory of yields. However, expectations are that CPI Inflation has passed its peak and it will moderate to levels that the RBI is more comfortable with. As such, we do not see any immediate upside pressure on yields and expect it to trade in a range with a dovish bias. In the medium term, it will be important to observe the actions of the Fed and its repercussions on the actions of the RBI and also how the domestic growth story continues to evolve.