Group Fund

Kotak Group Gilt Fund

(ULGF-002-27/06/03-GLTFND-107)

MONTHLY UPDATE NOVEMBER 2022

|

AS ON 31st October 2022 |

Returns will be in line with those of fixed interest instruments, and may provide little protection against unexpected inflation increases. Will preserve

capital and minimize downside risk, with investment in debt and government instruments.

Date of Inception

27th June 2003

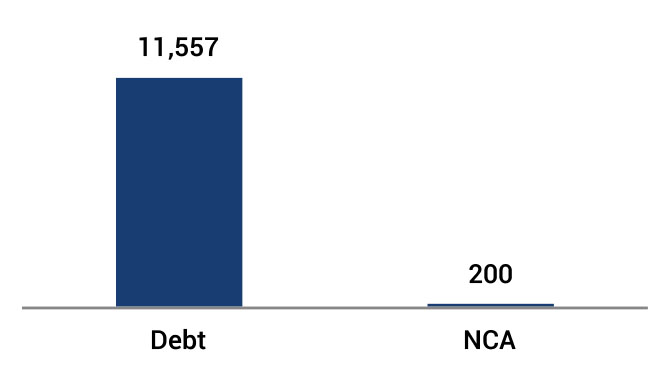

AUM (in Lakhs)

11,756.93

NAV

40.5272

Fund Manager

Debt :Manoj Bharadwaj

Benchmark Details

Equity - 0% (NA)

Debt - 100% (IBEX)

Debt - 100% (IBEX)

Modified Duration

Debt & Money

Market Instruments : 4.58

Asset Allocation

| Approved (%) | Actual (%) | |

| Gsec | 80 - 100 | 90 |

| MMI / Others | 00 - 20 | 10 |

Performance Meter

| Kotak Group Gilt Fund (%) | Benchmark (%) | |

| 1 month | 0.2 | 0.3 |

| 3 months | 1.1 | 1.1 |

| 6 months | 1.2 | 1.5 |

| 1 year | 1.1 | 1.3 |

| 2 years | 2.0 | 2.4 |

| 3 years | 5.0 | 5.3 |

| 4 years | 7.5 | 7.4 |

| 5 years | 6.4 | 6.7 |

| 6 years | 6.3 | 6.6 |

| 7 years | 7.2 | 7.4 |

| 10 years | 7.9 | 8.1 |

| Inception | 7.5 | 7.4 |

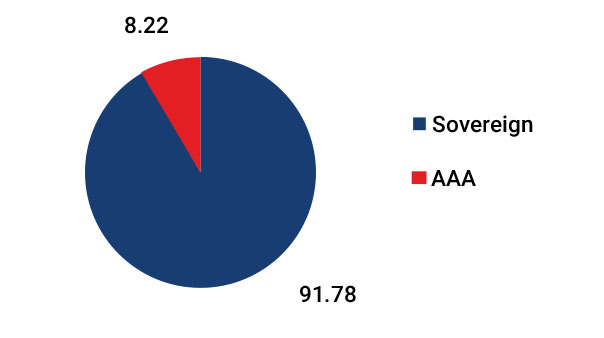

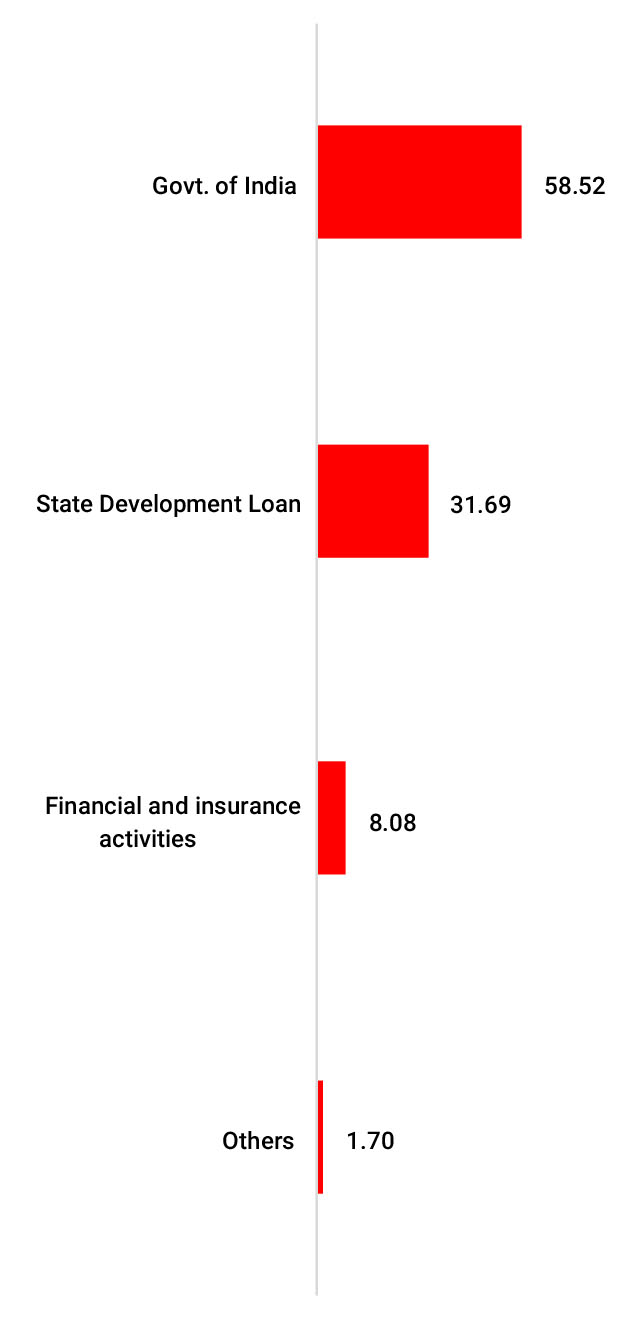

| Holdings | % to Fund |

| G-Sec | 90.22 |

| 7.38% GOI - 20.06.2027 | 13.00 |

| 7.26% GOI - 22.08.2032 | 8.78 |

| 6.54% GOI - 17.01.2032 | 7.31 |

| 6.24% MH SDL - 11.08.2026 | 4.88 |

| 7.08% MP SDL - 09.03.2029 | 4.53 |

| 7.10% GOI - 18.04.2029 | 4.46 |

| 7.69% GOI - 17.06.2043 | 4.33 |

| GOI FRB - 22.09.2033 | 4.30 |

| 7.16% GOI - 20.09.2050 | 3.32 |

| 7.65% TN SDL -06.12.2027 | 3.32 |

| Others | 31.99 |

| MMI | 8.08 |

| NCA | 1.70 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.