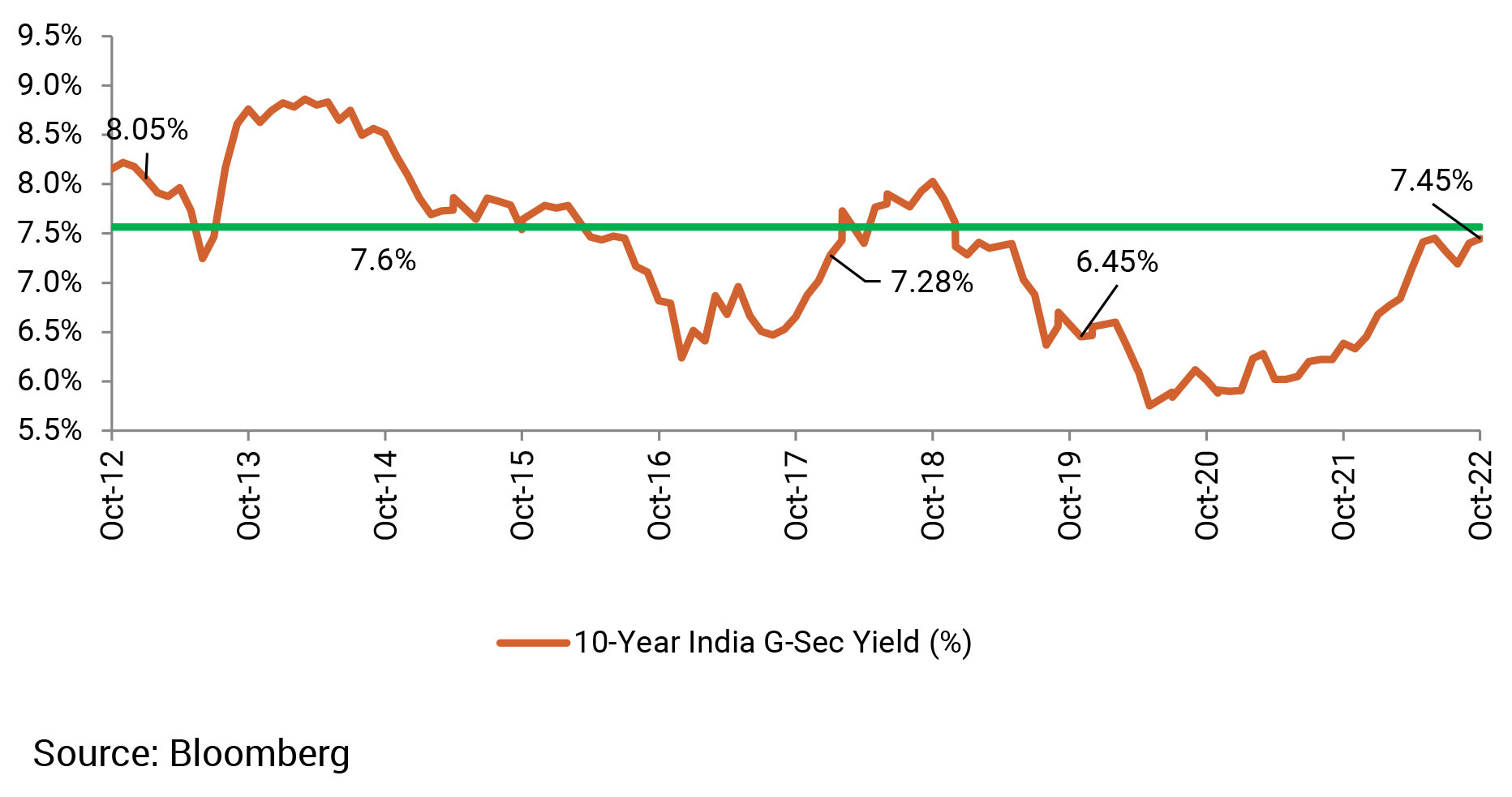

Yields stuck to a range of 10bps, in between 7.40-7.50%, for most of the month of October. Market optimism on yield trajectory came to an abrupt end as the index inclusion story faded this year too. Confirmation came in early into the month that India would not be considered for global bond index conclusion at this point in time.

Market found itself short of positive cues as another major development was OPEC+ cutting output by 2million barrels/day to support and put a floor on crude prices. It appears that the group is attempting to create a virtual floor for crude around USD 90/bbl.

The next relief trigger for markets would be the Fed shifting to a slower pace of tightening as it would be the first glimmer of hope for an eventual and much anticipated pivot. The market is also eagerly looking forward to the RBI taking its foot off the pedal but the actions of the RBI too are to an extent hinged on the actions of the Fed. Factors to watch out for would be global and domestic inflation conditions, crude prices, evolving domestic fiscal situation and geopolitical escalations.