Month Gone By – Markets (period ended November 30, 2021)

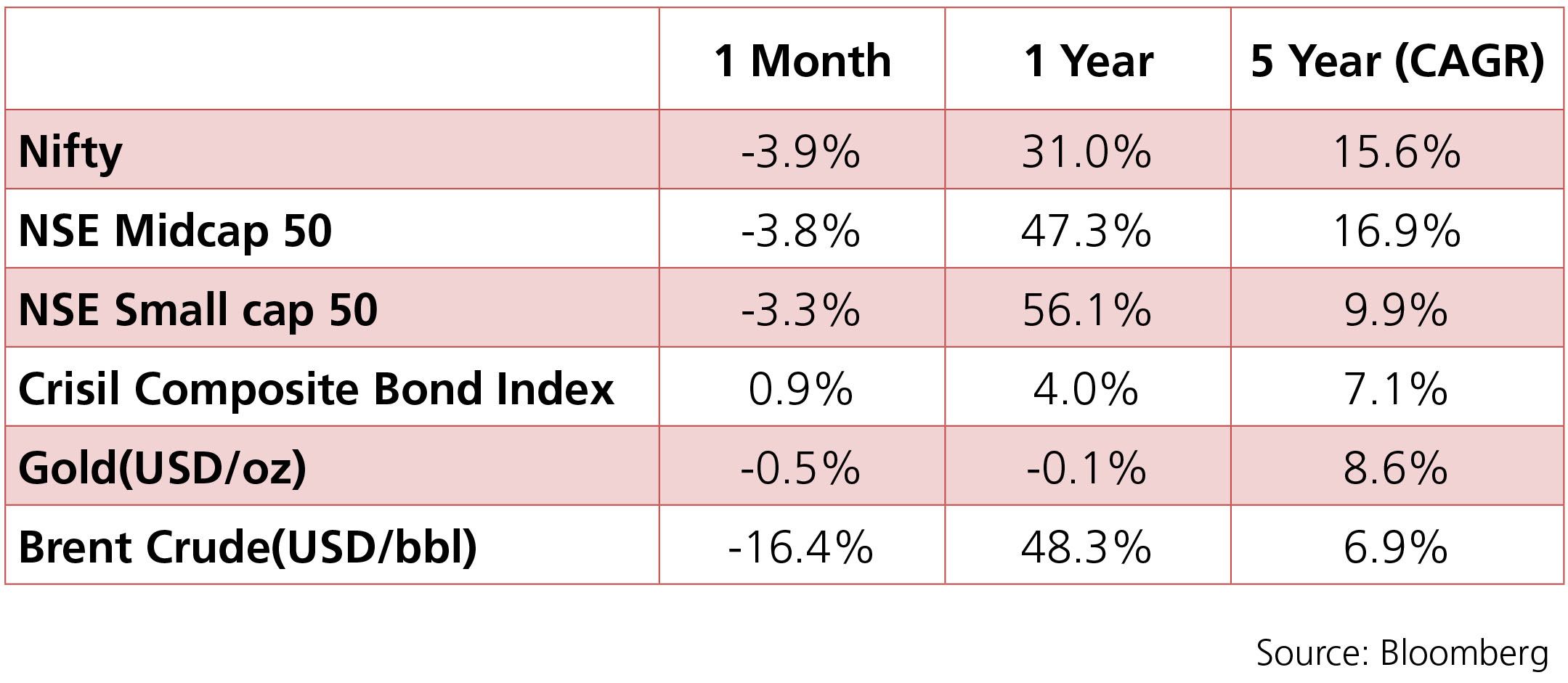

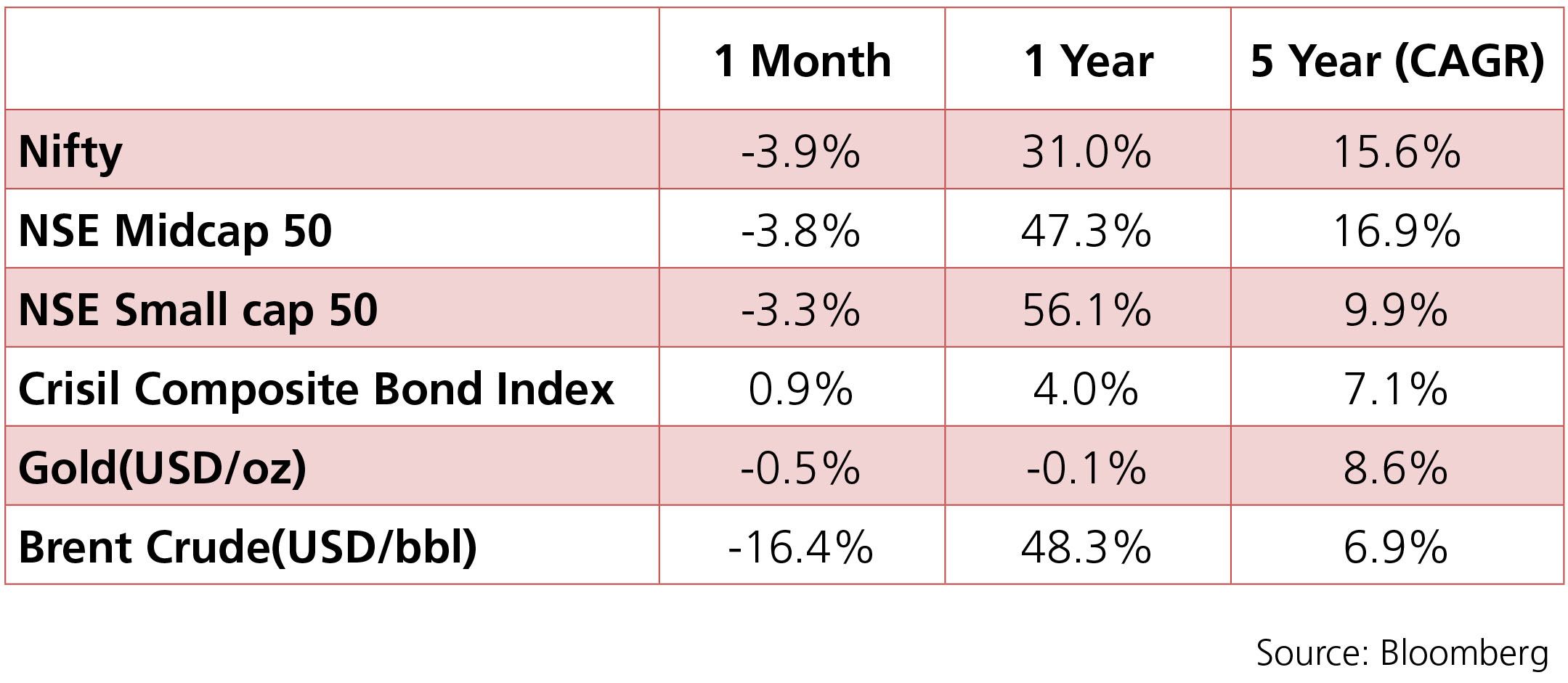

Markets faltered in the month of November as COVID fears resurfaced with the emergence of new variant

OMICRON sending both indices to their biggest monthly loss since March-2020. The Nifty index closed 3.9%

lower for the month of November. Telecom and Utilities have been the frontrunner sectors while Banks and

Metals have been the laggards. The INR has been fairly stable averaging around 74.5 with a monthly best

and worst of 74.3 and 75.0 respectvely. Yields have been on an upward trajectory with the 10y benchmark

trading in a range of 6.29%-6.39% and eventually ending the month 6bps lower m-o-m at 6.33%. The 10y

benchmark averaged 6.35% over the month of November.

One of the major events for the month of November was the FOMC meeting. Global markets were eagerly awaiting the outcome of the FOMC meeting as the Fed was expected to outline its asset purchases tapering roadmap. The Fed announced a USD 15bn/month (USD 10bn Treasuries, USD 5bn agency MBS) reduction in the pace of monthly asset purchases, starting in mid-November. If the Fed were to stick to this pace of tapering, purchases would end by mid-June 2022. The statement also suggests the FOMC could adjust the pace of tapering “if warranted by changes in the economic outlook.” The pace of tapeiring announced by the Fed was in line with market expectations and as such had no shock effect on asset prices. FOMC minutes released later in the month indicated several members were in favor of speeding up the tapering process and raising interest rates sooner rather than later due to rising prices.

On the domestic front, one of the major news was the cut in excise duty by GoI to the tune of Rs 5/litre on Petrol and Rs 10/litre on Diesel. GoI had cumulatively raised excise duty by Rs 15/litre on Petrol and Rs 18/litre on Diesel between March-May’2020 to mitigate the impact of falling indirect tax revenue due to pandemic. This was long anticipated by the markets and something that the RBI had continued to highlight in its asessment of the economy. The cut in excise duty by GoI could have a marginal softening impact on CPI Inflation in coming months.

In commodities, brent crude averaged USD 80.3/bbl as energy prices cooled off over the month. Brent crude was down 17% on a m-o-m basis. Gold edged lower by 0.5% over the month with not much appetite for safe haven assets.

One of the major events for the month of November was the FOMC meeting. Global markets were eagerly awaiting the outcome of the FOMC meeting as the Fed was expected to outline its asset purchases tapering roadmap. The Fed announced a USD 15bn/month (USD 10bn Treasuries, USD 5bn agency MBS) reduction in the pace of monthly asset purchases, starting in mid-November. If the Fed were to stick to this pace of tapering, purchases would end by mid-June 2022. The statement also suggests the FOMC could adjust the pace of tapering “if warranted by changes in the economic outlook.” The pace of tapeiring announced by the Fed was in line with market expectations and as such had no shock effect on asset prices. FOMC minutes released later in the month indicated several members were in favor of speeding up the tapering process and raising interest rates sooner rather than later due to rising prices.

On the domestic front, one of the major news was the cut in excise duty by GoI to the tune of Rs 5/litre on Petrol and Rs 10/litre on Diesel. GoI had cumulatively raised excise duty by Rs 15/litre on Petrol and Rs 18/litre on Diesel between March-May’2020 to mitigate the impact of falling indirect tax revenue due to pandemic. This was long anticipated by the markets and something that the RBI had continued to highlight in its asessment of the economy. The cut in excise duty by GoI could have a marginal softening impact on CPI Inflation in coming months.

In commodities, brent crude averaged USD 80.3/bbl as energy prices cooled off over the month. Brent crude was down 17% on a m-o-m basis. Gold edged lower by 0.5% over the month with not much appetite for safe haven assets.

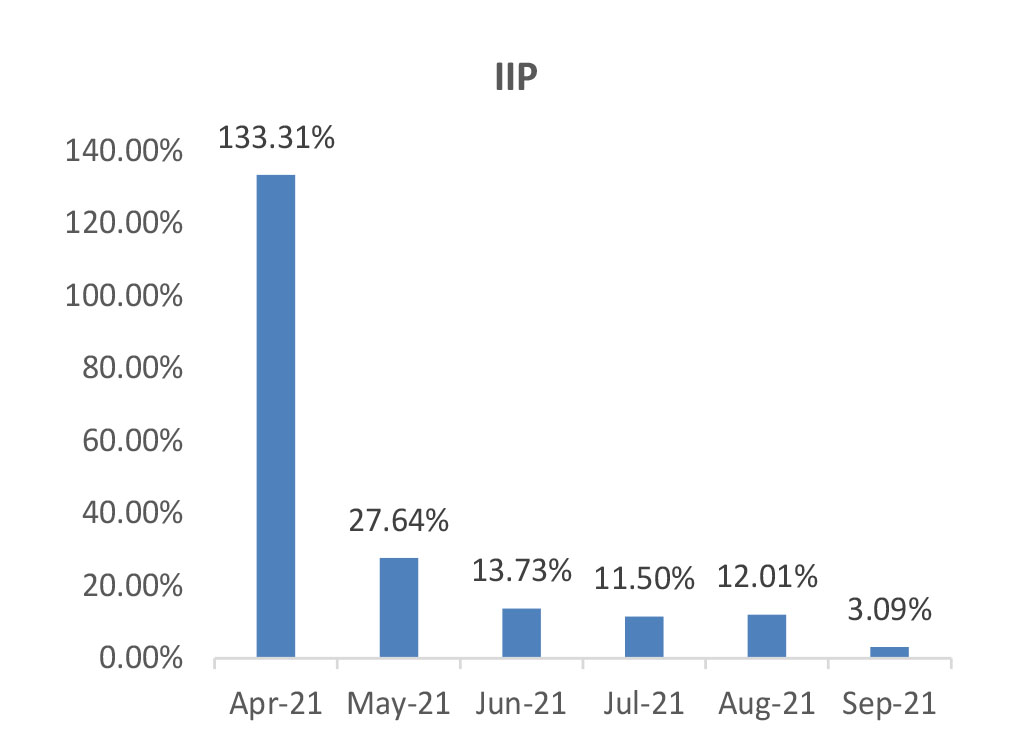

IIP: September IIP grew by 3.1% (August: 12%) on diminishing base effects while declining sequentially by

2.6%. Compared to September 2019, IIP was higher by 4%. On a sectoral basis, mining activity grew by 8.6%

(August: 23.6%), manufacturing by 2.7% (August: 9.9%), and electricity production by 0.9% (August: 16%).

As per the use-based classification, infrastructure/construction goods grew by 7.4% followed by intermediate

goods by 4.9%, primary goods by 4.6%, and capital goods by 1.3%. On the other hand, consumer nondurables

and durables declined by 0.5% and 2%, respectively.

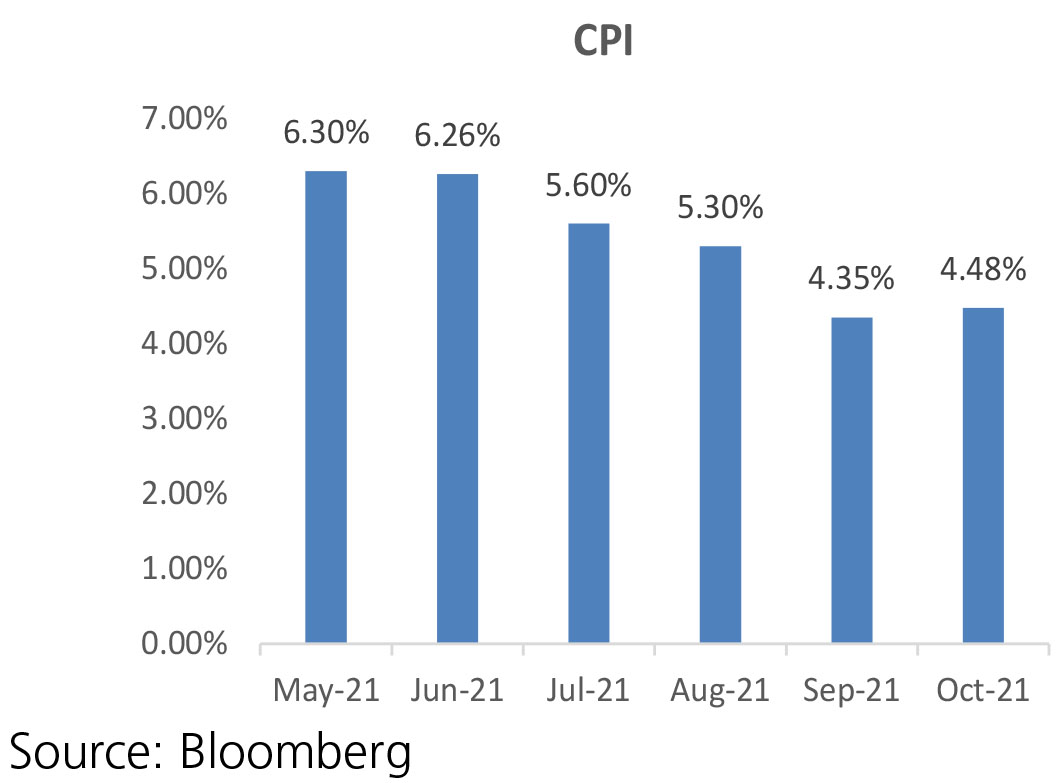

CPI: Headline CPI inflation for the month of October 2021 edged up to 4.5% from 4.3% in September. In spite of favourable base effects, a steep rise in price momentum (month-on-month change in prices) more than offset the favourable base effects, resulting in headline inflation increasing in October. Food and beverages inflation increased to 1.8% (September: 1.6%) primarily led by a pick-up in prices of eggs, oils and fats, fruits and vegetables. Core inflation (CPI excluding food, fuel, pan and tobacco) at 6% remained sticky and elevated from September while increasing sequentially by 0.7% (0.2% mom in September). Prices increased across all categories led by transport, housing and recreation.

Trade Deficit: November trade deficit at USD 23.3bn surpassed the previous high of USD 22.6 bn in September. The deficit widened mainly due to a sharper fall in exports than imports, possibly reflecting rising Covid cases in some of the key markets. Exports in November fell by 16.2% mom (27% growth yoy) to USD 29.9bn. Nonoil exports also fell by 14.4% mom (18.3% growth yoy) at USD 26.1bn. In 8MFY22, exports at USD 263.7bn increased by 52% over 8MFY21. Imports in November increased by 57% to USD 53.2bn. Non-oil imports remained high at USD 38.5bn (October: USD 40.9bn) reflecting strong domestic demand even as the festive season impact has faded away. In 8MFY22, imports at USD 382.9bn increased by 76% over 8MFY21. Trade deficit for 8MFY22 is at USD 119.1bn (USD 43.6bn in 8MFY21).

Fiscal Deficit: The fiscal deficit stood at 36.3% of the Budget Estimates, as compared to 119.7% in the same period last year. In absolute terms, the fiscal deficit was at Rs 5,47,026 crore at the end of October. The main contributors to the lower fiscal deficit were higher net tax revenues at 68.1% of BE vs 35.2% in the corresponding period previous year and non-tax revenues at 85.1% vs 30.2% in the same period last year. At the same time, total expenditure was marginally lower at 52.4% for the period vs 54.6% in the same period last year.

GDP: Q2 FY22 GDP expanded by 8.4% YoY as against 20.1% in Q1 FY22 (GVA growth of 8.5%). As favorable base effects faded, the year on year growth rates declined, but sequentially both GDP and GVA saw a sharp increase. Growth in private consumption expenditure, gross fixed capital formation, exports and imports moderated, but government expenditure grew at a faster pace. While overall GDP was back to Sep 2019 levels in absolute levels, private and government expenditure remained below pre-pandemic levels. On the sector front, while agriculture growth remained unchanged at 4.5%, industry growth slowed down on account of base effects. On the services side, public administration & defense services and financial, real estate & professional services grew by 17.4% and 7.8%, respectively.

CPI: Headline CPI inflation for the month of October 2021 edged up to 4.5% from 4.3% in September. In spite of favourable base effects, a steep rise in price momentum (month-on-month change in prices) more than offset the favourable base effects, resulting in headline inflation increasing in October. Food and beverages inflation increased to 1.8% (September: 1.6%) primarily led by a pick-up in prices of eggs, oils and fats, fruits and vegetables. Core inflation (CPI excluding food, fuel, pan and tobacco) at 6% remained sticky and elevated from September while increasing sequentially by 0.7% (0.2% mom in September). Prices increased across all categories led by transport, housing and recreation.

Trade Deficit: November trade deficit at USD 23.3bn surpassed the previous high of USD 22.6 bn in September. The deficit widened mainly due to a sharper fall in exports than imports, possibly reflecting rising Covid cases in some of the key markets. Exports in November fell by 16.2% mom (27% growth yoy) to USD 29.9bn. Nonoil exports also fell by 14.4% mom (18.3% growth yoy) at USD 26.1bn. In 8MFY22, exports at USD 263.7bn increased by 52% over 8MFY21. Imports in November increased by 57% to USD 53.2bn. Non-oil imports remained high at USD 38.5bn (October: USD 40.9bn) reflecting strong domestic demand even as the festive season impact has faded away. In 8MFY22, imports at USD 382.9bn increased by 76% over 8MFY21. Trade deficit for 8MFY22 is at USD 119.1bn (USD 43.6bn in 8MFY21).

Fiscal Deficit: The fiscal deficit stood at 36.3% of the Budget Estimates, as compared to 119.7% in the same period last year. In absolute terms, the fiscal deficit was at Rs 5,47,026 crore at the end of October. The main contributors to the lower fiscal deficit were higher net tax revenues at 68.1% of BE vs 35.2% in the corresponding period previous year and non-tax revenues at 85.1% vs 30.2% in the same period last year. At the same time, total expenditure was marginally lower at 52.4% for the period vs 54.6% in the same period last year.

GDP: Q2 FY22 GDP expanded by 8.4% YoY as against 20.1% in Q1 FY22 (GVA growth of 8.5%). As favorable base effects faded, the year on year growth rates declined, but sequentially both GDP and GVA saw a sharp increase. Growth in private consumption expenditure, gross fixed capital formation, exports and imports moderated, but government expenditure grew at a faster pace. While overall GDP was back to Sep 2019 levels in absolute levels, private and government expenditure remained below pre-pandemic levels. On the sector front, while agriculture growth remained unchanged at 4.5%, industry growth slowed down on account of base effects. On the services side, public administration & defense services and financial, real estate & professional services grew by 17.4% and 7.8%, respectively.

Deal flow accelerated in November with 13 deals worth ~USD 4.9bn executed (vs 7 deals worth ~USD

4.2bn in October). Key deals included IPOs of Paytm (~USD 2.5bn), Policybazaar (~USD 0.8bn), Nykaa

(~USD 0.6bn) and Sapphire Foods (~USD 0.3bn).

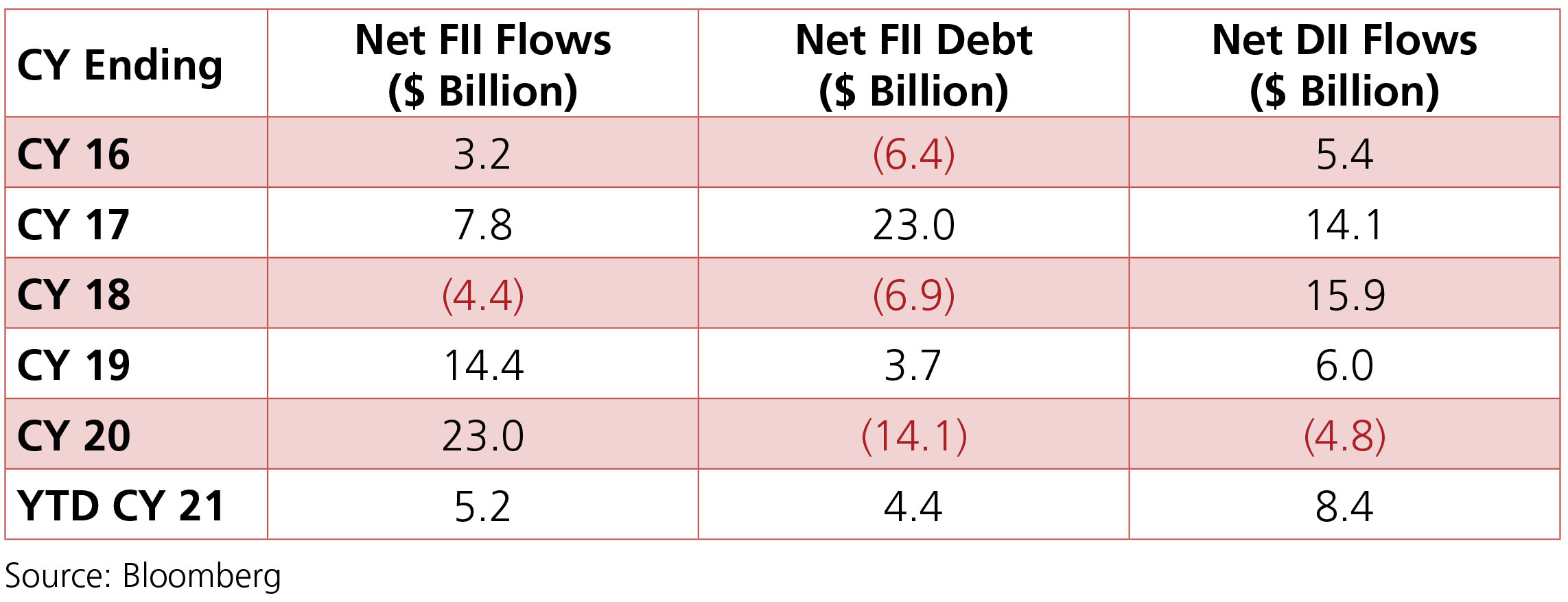

FII selling continued, to the tune of –USD 0.8bn in Nov (YTD +USD 5.5bn), despite healthy participation in IPOs and MSCI rebal inflows while DII buying ramped up to +USD 4.1bn (YTD +USD 8.4bn) driven by both MFs (+USD 1.8bn) and Insurance (+USD 2.3bn).

FII selling continued, to the tune of –USD 0.8bn in Nov (YTD +USD 5.5bn), despite healthy participation in IPOs and MSCI rebal inflows while DII buying ramped up to +USD 4.1bn (YTD +USD 8.4bn) driven by both MFs (+USD 1.8bn) and Insurance (+USD 2.3bn).