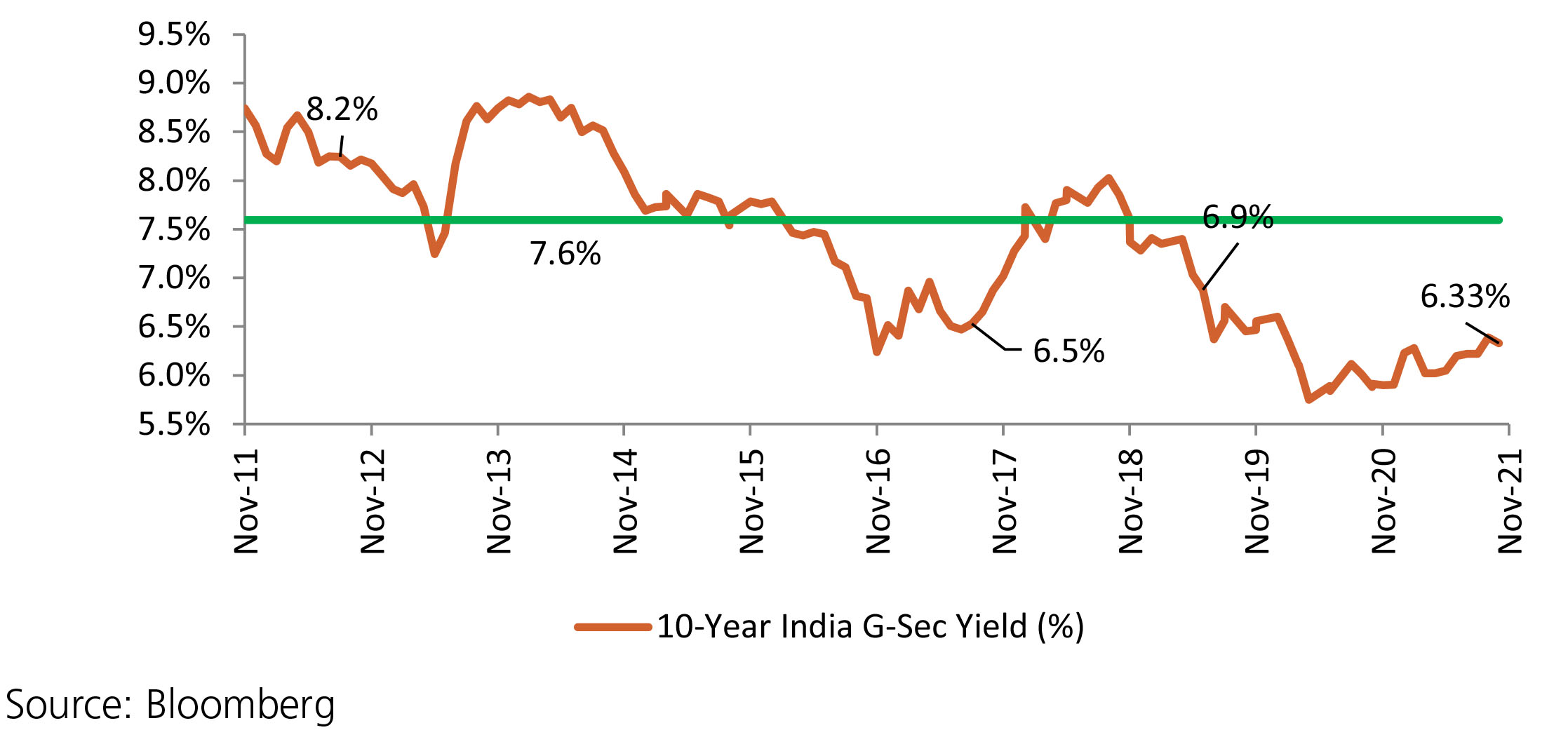

Yields have largely been range-bound over the month although there have been a few developments of note, both global and domestic for the bond markets. The month opened to the FOMC meeting wherein the Fed clearly outlined its roadmap for tapering of asset purchases. However, the commentary of the Fed was construed as more dovish by the market than had been expected. The end of the month would see Fed Chair Powell adopt a more hawkish tone as the emergence of the OMICRON variant runs the risk of prolonged supply chain disruptions leading to entrenching of CPI Inflation. The Fed, as signalled by Powell, would be considering accelerating the pace of tapering which could open up the possibility of rate tightening commencing sooner rather than later. Crude prices continued to be elevated drawing a response from US and other large oilconsuming countries wherein an attempt was made to cool prices through release of strategic oil reserves. However, the respose failed to produce the intended result although the emergence of new COVID variant OMICRON eventually did. The discovery of new variant OMICRON pushed oil prices lower to end the month below USD 70/bbl down 17% m-o-m. The GoI, on its part, to cheer up the public gave a Diwali gift in the form of excise cut on Petrol and Diesel. Although this is something that the market had been expecting and the RBI had been highlighting, the actual cut does come as a relief. It is expected to have a moderating impact on CPI Inflation. Later in the month, as we stand just two months from the Union Budget, concerns over a fiscal slippage or fiscal glide path have already started doing the rounds. Further clarity on the same would be achieved in coming weeks. A range-bound month of November saw the 10y benchmark trading in a range of 6.29%-6.39% and eventually ending the month 6bps lower m-o-m at 6.33%. The 10y benchmark averaged 6.35% over the month of November.