Group Fund

Kotak Group Bond Fund

(ULGF-004-15/04/04-BNDFND-107)

MONTHLY UPDATE NOVEMBER 2022

|

AS ON 31st October 2022 |

Returns will be in line with those of fixed interest instruments, and may provide little protection against unexpected inflation increases. Will preserve

capital and minimize downside risk, with investment in debt and government instruments.

Date of Inception

15th April 2004

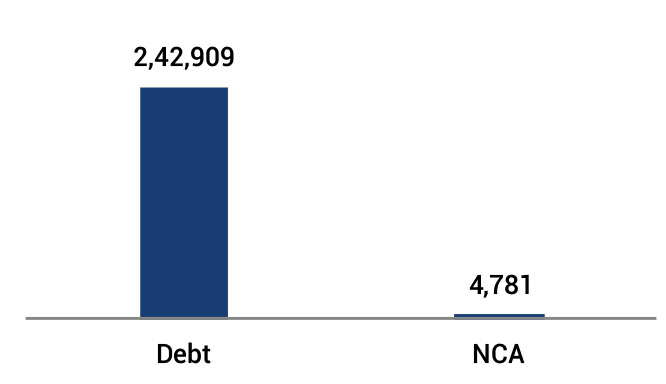

AUM (in Lakhs)

2,47,690.55

NAV

45.9582

Fund Manager

Debt : Manoj Bharadwaj

Benchmark Details

Equity - 0% (NA)

Debt - 100% (Crisil Composite Bond))

Debt - 100% (Crisil Composite Bond))

Modified Duration

Debt & Money

Market Instruments : 3.84

Asset Allocation

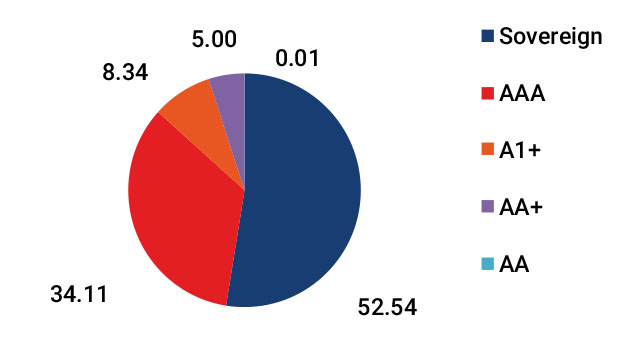

| Approved (%) | Actual (%) | |

| Gsec | 00 - 75 | 56 |

| Debt | 25 - 100 | 27 |

| MMI / Others | 00 - 40 | 17 |

Performance Meter

| Kotak Group Bond Fund (%) | Benchmark (%) | |

| 1 month | 0.3 | 0.2 |

| 3 months | 0.9 | 1.2 |

| 6 months | 1.1 | 1.2 |

| 1 year | 0.9 | 1.4 |

| 2 years | 2.3 | 2.6 |

| 3 years | 5.6 | 5.7 |

| 4 years | 8.0 | 7.6 |

| 5 years | 6.7 | 6.4 |

| 6 years | 6.7 | 6.5 |

| 7 years | 7.5 | 7.2 |

| 10 years | 8.1 | 7.8 |

| Inception | 8.6 | 6.7 |

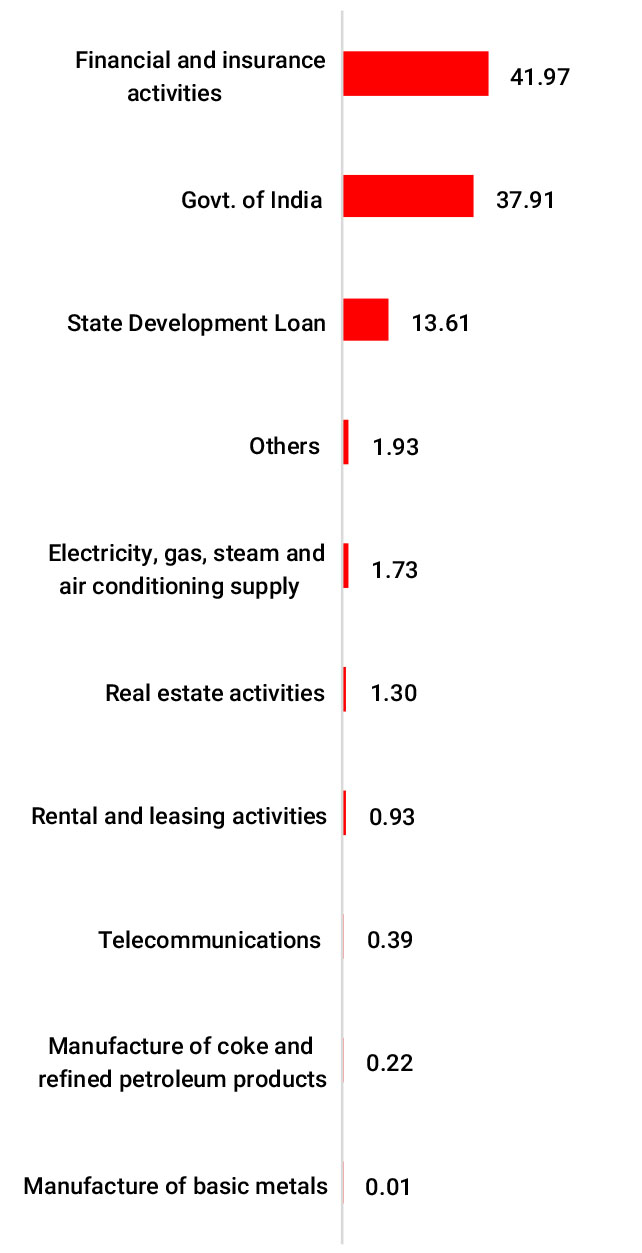

| Holdings | % to Fund |

| G-Sec | 56.39 |

| 7.26% GOI - 22.08.2032 | 10.81 |

| 6.54% GOI - 17.01.2032 | 7.66 |

| 7.38% GOI - 20.06.2027 | 7.49 |

| 7.10% GOI - 18.04.2029 | 5.50 |

| 7.54% GOI - 23.05.2036 | 2.36 |

| 6.24% MH SDL - 11.08.2026 | 2.33 |

| 8.64% MP SDL - 03.09.2033 | 1.66 |

| 8.54% REC - 15.11.2028 | 1.62 |

| 6.45% REC - 07.01.2031 | 1.47 |

| 7.08% MP SDL - 09.03.2029 | 1.40 |

| Others | 14.10 |

| Corporate Debt | 26.92 |

| 7.38% Cholamandalam Invest and Fin co Ltd - 31.07.2024 | 2.20 |

| 8.55% HDFC - 27.03.2029 | 1.55 |

| 7.09% HDB Financial services Ltd - 17.04.2023 | 1.53 |

| 8.56% REC - 29.11.2028 | 1.50 |

| 7.34% NHB - 07.08.2025 | 1.49 |

| 5.65% Bajaj Finance Ltd - 10.05.2024 | 1.46 |

| 6.25% Cholamandalam Invest and Fin co ltd - 21.02.2024 | 1.45 |

| 7.05% Embassy Office Parks REIT - 18.10.2026 | 1.30 |

| 5.10% Sundaram Finance - 01.12.2023 | 1.09 |

| 7.40% Muthoot Finance Ltd - 05.01.2024 | 0.90 |

| Others | 12.46 |

| MMI | 14.76 |

| NCA | 1.93 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.