Month Gone By – Markets (period ended October 31, 2022)

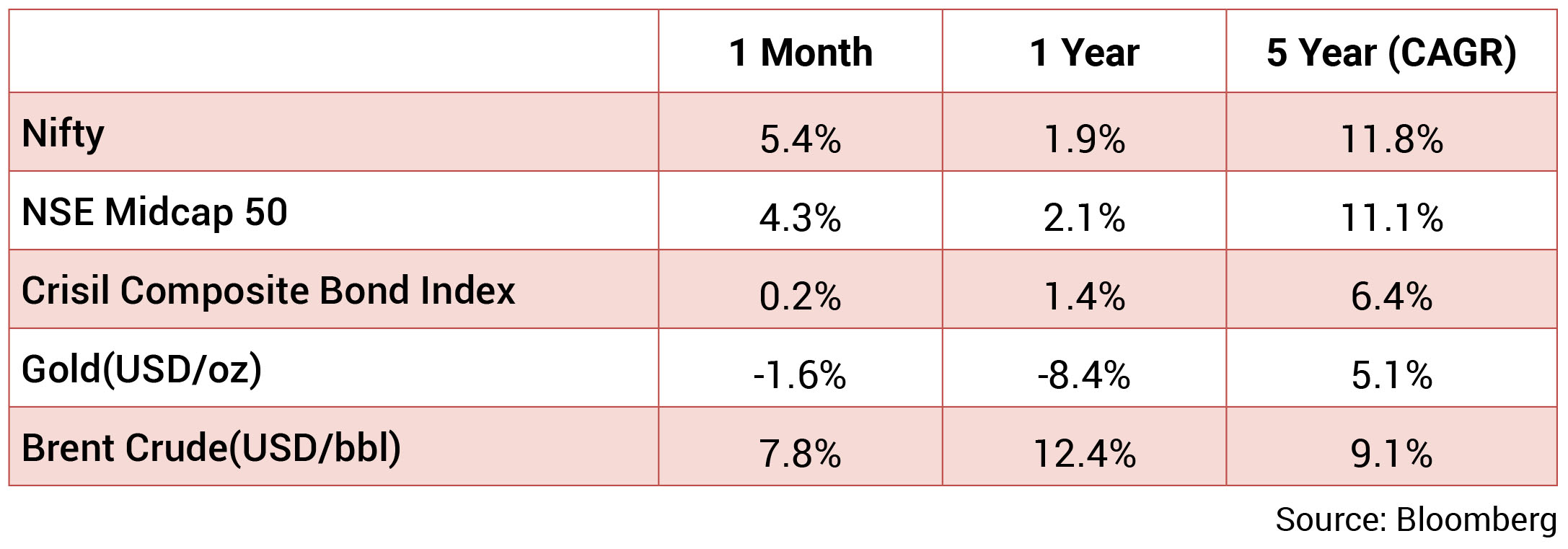

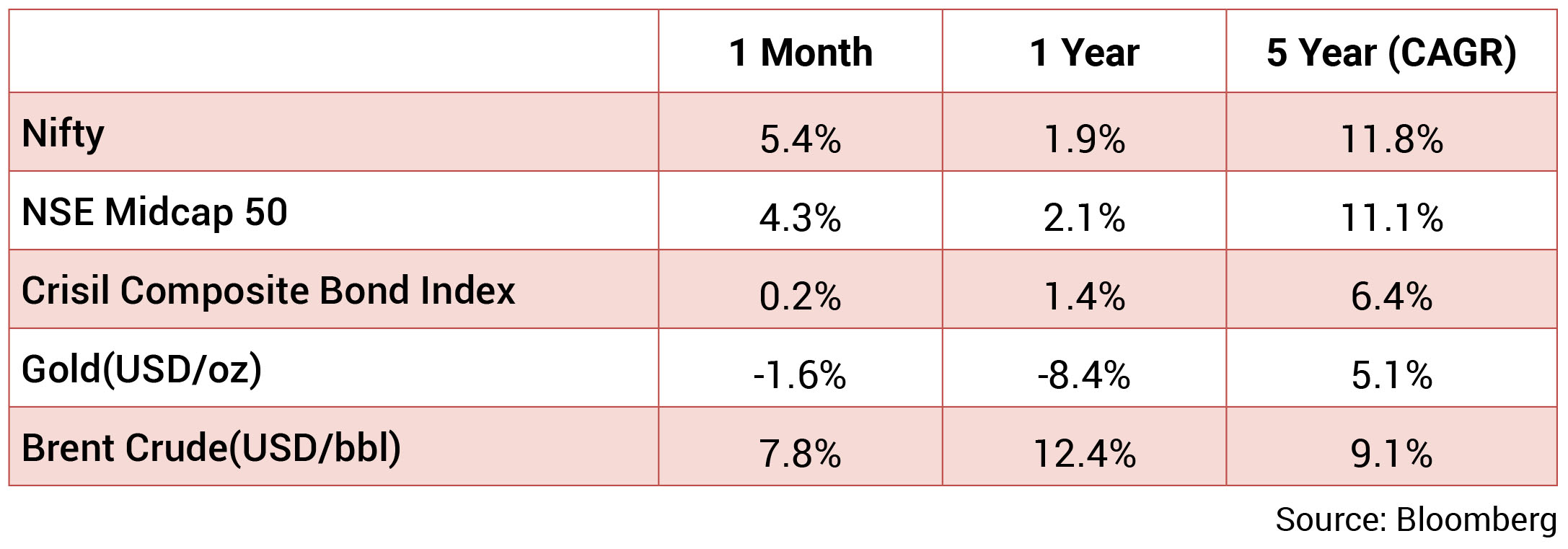

Indian markets gained by 5.4% m-o-m as FIIs turned buyers again. Banks and Infra were the

best performing sectors while FMCG was the laggard over the month. The INR continued

to depreciate against the USD due to aggressive rate hikes in the US. INR depreciated by

1.7% m-o-m, reaching 82.7/USD in October. The 10y benchmark traded in a range of 7.4%-

7.5% and eventually ending the month 5ps higher m-o-m at 7.5%. The 10y benchmark

averaged 7.44% in October.

Inflation in US and UK remained elevated at 8.2% and 10.1% respectively in September, while EU registered 10% inflation in September. The US Fed undertook another 75bps rate hike on 2nd Nov’22 taking the fed fund rate range between 3.75-4% currently. This was the fourth consecutive 75bps rate hike and sixth rate increase in 2022. While the US economy did enter into a technical recession with two consecutive quarters of contraction in GDP growth, its labour market continues to remain tight with lowest unemployment in 50 years. As of 2nd Nov’22, the ratio of job vacancies to unemployed came in lower at 1.87x in Sep’22, higher than 1.65x in Aug’22 (which had seen a drop from 1.95x in Jul’22). Hence the Fed would continue to prioritize price stability.

On the domestic front, the RBI had raised rates by 50bps at its September meeting, with the repo rate now at 5.9%. GDP forecast had been revised downwards by 20bps to 7% for FY23 while the MPC retained its average FY23 headline inflation projection at 6.7%.

OPEC+ cut output by 2million barrels/day to support and put a floor on crude prices. Brent crude was up around 7.8% to around USD 94.8/bbl. Gold ended October slightly lower by 2% at USD 1,641/oz.

Inflation in US and UK remained elevated at 8.2% and 10.1% respectively in September, while EU registered 10% inflation in September. The US Fed undertook another 75bps rate hike on 2nd Nov’22 taking the fed fund rate range between 3.75-4% currently. This was the fourth consecutive 75bps rate hike and sixth rate increase in 2022. While the US economy did enter into a technical recession with two consecutive quarters of contraction in GDP growth, its labour market continues to remain tight with lowest unemployment in 50 years. As of 2nd Nov’22, the ratio of job vacancies to unemployed came in lower at 1.87x in Sep’22, higher than 1.65x in Aug’22 (which had seen a drop from 1.95x in Jul’22). Hence the Fed would continue to prioritize price stability.

On the domestic front, the RBI had raised rates by 50bps at its September meeting, with the repo rate now at 5.9%. GDP forecast had been revised downwards by 20bps to 7% for FY23 while the MPC retained its average FY23 headline inflation projection at 6.7%.

OPEC+ cut output by 2million barrels/day to support and put a floor on crude prices. Brent crude was up around 7.8% to around USD 94.8/bbl. Gold ended October slightly lower by 2% at USD 1,641/oz.

Source: Bloomberg

Source: Bloomberg

MPC Minutes: The minutes of the September MPC meeting displayed differences in the

tone of internal and external committee members. Although five members (except Dr Goyal)

voted for a 50 bps hike, differing views emerged regarding future rate hikes. Internal MPC

members Governor Das, Dr Patra and Dr Ranjan remained hawkish, and expressed the need

to continue with aggressive rate actions, citing (1) the need to keep inflation expectations

anchored, and (2) comfort provided by resilience in domestic growth. Governor Das and Dr

Patra also highlighted the need to remain watchful for the second-order effects of inflation.

On the other hand, Dr Goyal and Dr Varma were wary of the lagged impact of monetary

tightening. Dr Goyal pointed to an absence of second-order effects of inflation from wages

rising, reflecting slack in the labor market. Additionally, Dr Varma explicitly called for a

pause in the next meeting.

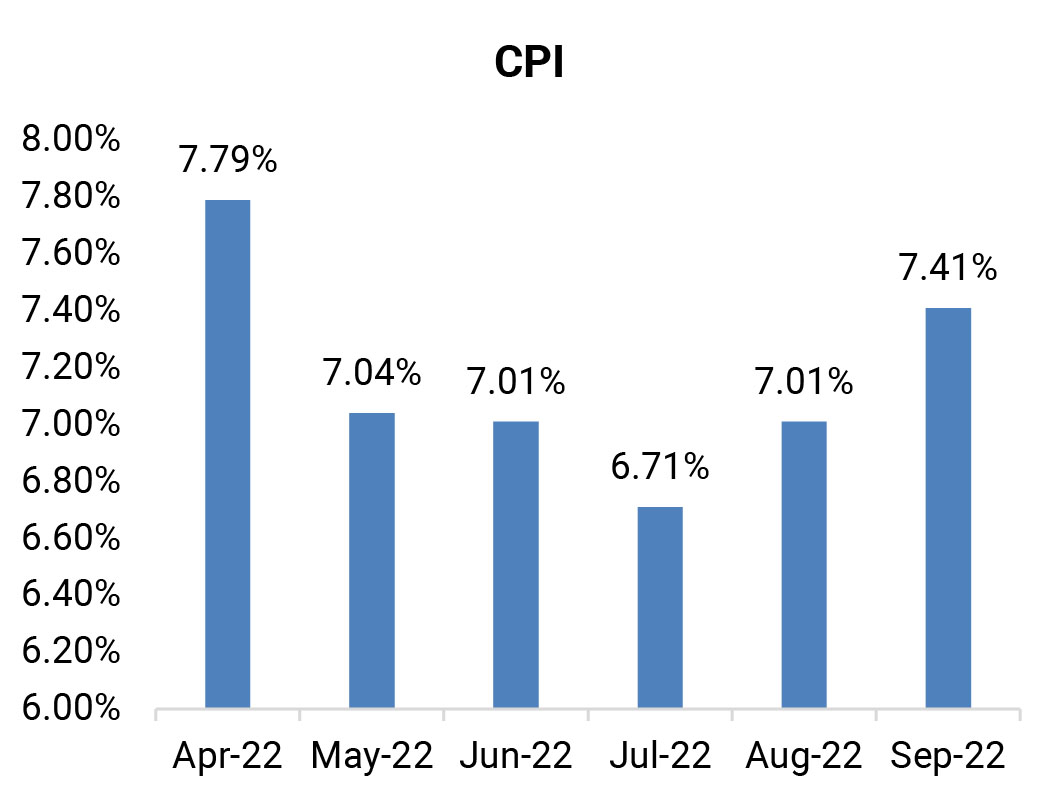

CPI: September CPI inflation rose to 7.41% (August: 7%) led by rising food prices. Sequentially, headline inflation rose by 0.6% (August: 0.5% mom) led by food and beverages inflation (0.9% mom). The sequential pickup was largely due to vegetables, cereals, spices, meat and fish, and pulses. Meanwhile, fuel and light inflation moderated to 10.4% (August: 10.8%) but increased sharply by 0.4% mom (August: (-)0.4% mom). September core inflation (CPI excluding food, fuel, pan, and tobacco) increased by 9 bps to 6.26%. Sequentially, core inflation moderated to 0.32% (August: 0.46%). Clothing and footwear increased to 10.2% (August: 9.9%) followed by household goods and services at 7.68% (7.53%), while moderation was visible in recreation, and personal care and effects.

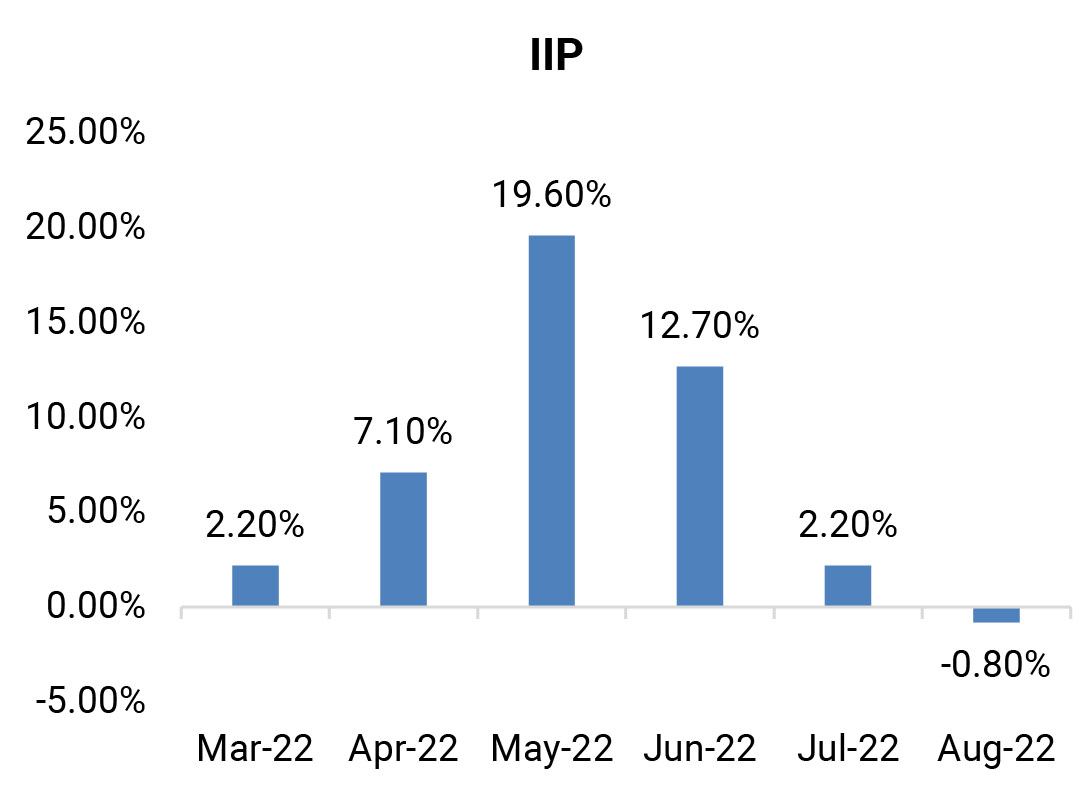

IIP: August IIP surprised on the downside, contracting by 0.8% (July 2.2%) while also declining sequentially by 2.3% (July: (-)2.9% mom). On a sectoral basis, only electricity production registered a positive growth of 1.4% while manufacturing activity fell by 0.7% (July: +3%), and mining activity fell by 3.9% ((-)3.3%). As per the use-based classification, most categories registered positive growths (but slower than in July) led by capital goods increasing by 5%, and infrastructure and primary goods increasing by 1.7%, each. Only consumer goods declined in August.

Trade: India’s trade deficit at USD 25.7bn in September 2022 was marginally lower on a sequential basis but was about 14.4% higher than a year ago. India’s merchandise exports at USD 35.4bn recorded growth of 4.8%, despite a sequential decline of 3.8% in September, reflecting the knock-on effects of slowing external demand. Non-oil exports contracted for the second consecutive month in September 2022. India’s merchandise imports remained above USD 60bn for the fifth consecutive month in September 2022, however import growth moderated to 8.7% on a yoy basis and declined sequentially by 3.8%.

Fiscal deficit: The fiscal deficit stood at 37.3% of the Budget Estimates, as compared to 35% in the same period last year. In absolute terms, the fiscal deficit was at Rs 6.2tn at the end of September. The main contributors to the somewhat higher fiscal deficit were lower net tax revenues at 52.3% of BE vs 59.6% in the corresponding period previous year and non-tax revenues at 58.4% vs 66% in the same period last year. At the same time, total expenditure was marginally lower at 46.2% for the period vs 46.7% in the same period last year.

CPI: September CPI inflation rose to 7.41% (August: 7%) led by rising food prices. Sequentially, headline inflation rose by 0.6% (August: 0.5% mom) led by food and beverages inflation (0.9% mom). The sequential pickup was largely due to vegetables, cereals, spices, meat and fish, and pulses. Meanwhile, fuel and light inflation moderated to 10.4% (August: 10.8%) but increased sharply by 0.4% mom (August: (-)0.4% mom). September core inflation (CPI excluding food, fuel, pan, and tobacco) increased by 9 bps to 6.26%. Sequentially, core inflation moderated to 0.32% (August: 0.46%). Clothing and footwear increased to 10.2% (August: 9.9%) followed by household goods and services at 7.68% (7.53%), while moderation was visible in recreation, and personal care and effects.

IIP: August IIP surprised on the downside, contracting by 0.8% (July 2.2%) while also declining sequentially by 2.3% (July: (-)2.9% mom). On a sectoral basis, only electricity production registered a positive growth of 1.4% while manufacturing activity fell by 0.7% (July: +3%), and mining activity fell by 3.9% ((-)3.3%). As per the use-based classification, most categories registered positive growths (but slower than in July) led by capital goods increasing by 5%, and infrastructure and primary goods increasing by 1.7%, each. Only consumer goods declined in August.

Trade: India’s trade deficit at USD 25.7bn in September 2022 was marginally lower on a sequential basis but was about 14.4% higher than a year ago. India’s merchandise exports at USD 35.4bn recorded growth of 4.8%, despite a sequential decline of 3.8% in September, reflecting the knock-on effects of slowing external demand. Non-oil exports contracted for the second consecutive month in September 2022. India’s merchandise imports remained above USD 60bn for the fifth consecutive month in September 2022, however import growth moderated to 8.7% on a yoy basis and declined sequentially by 3.8%.

Fiscal deficit: The fiscal deficit stood at 37.3% of the Budget Estimates, as compared to 35% in the same period last year. In absolute terms, the fiscal deficit was at Rs 6.2tn at the end of September. The main contributors to the somewhat higher fiscal deficit were lower net tax revenues at 52.3% of BE vs 59.6% in the corresponding period previous year and non-tax revenues at 58.4% vs 66% in the same period last year. At the same time, total expenditure was marginally lower at 46.2% for the period vs 46.7% in the same period last year.

Deal flow dropped in October with 15 deals worth ~USD 655mn executed. Key deals

included Zee Entertainment (USD 169mn) and Suzlon Energy (USD 147mn).

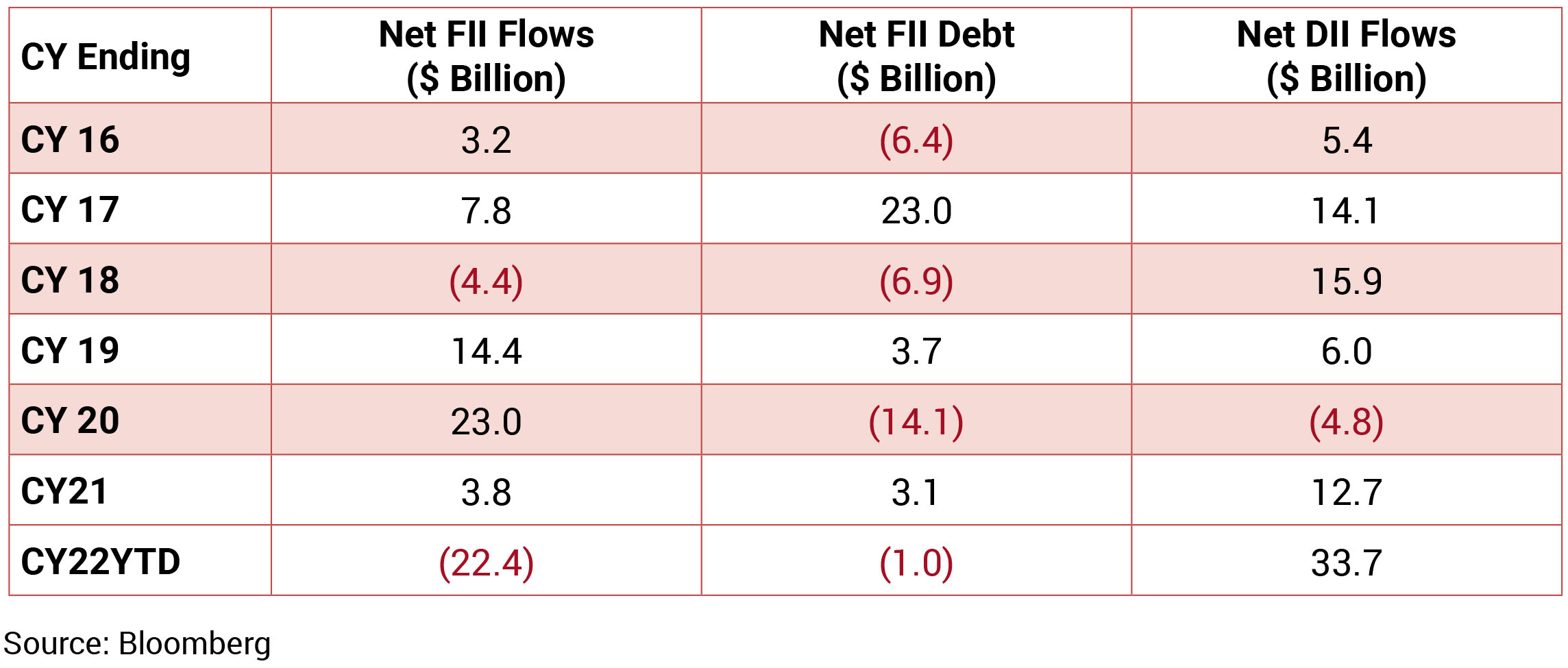

FIIs were net buyers in the month of October 2022 to the tune of USD 690mn and DIIs bought to the tune of USD 1.1bn.

FIIs were net buyers in the month of October 2022 to the tune of USD 690mn and DIIs bought to the tune of USD 1.1bn.