Individual Fund

KOTAK MID CAP ADVANTAGE FUND

(ULIF05415/09/23MIDCAPFUND107)

MONTHLY UPDATE FEBRUARY 2024

|

AS ON 31st January 2024 |

Aims to maximize opportunity for long-term capital growth, by holding a significant portion in a diversified and flexible mix of medium and

small sized company equities.

Date of Inception

30th September 2023

AUM (in Lakhs)

16,273.14

NAV

12.9123

Fund Manager

Equity : Rohit Agarwal

Debt : Manoj Bharadwaj

Debt : Manoj Bharadwaj

Benchmark Details

Equity - 100% (Nifty Midcap 100)

Modified Duration

Debt & Money

Market Instruments : 0.003

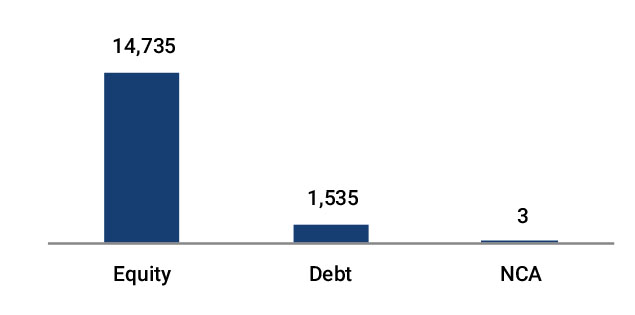

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 75% - 100% | 91 |

| Gsec / Debt | 00% - 25% | 0 |

| MMI / Others | 00% - 25% | 9 |

Performance Meter

| Kotak Mid Cap Advantage Fund (%) | Benchmark (%) | |

| 1 month | 5.3 | 5.2 |

| 3 months | 28.7 | 24.9 |

| 6 months | n.a. | n.a. |

| 1 year | n.a. | n.a. |

| 2 years | n.a. | n.a. |

| 3 years | n.a. | n.a. |

| 4 years | n.a. | n.a. |

| 5 years | n.a. | n.a. |

| 6 years | n.a. | n.a. |

| 7 years | n.a. | n.a. |

| 10 years | n.a. | n.a. |

| Inception | 29.1 | 19.8 |

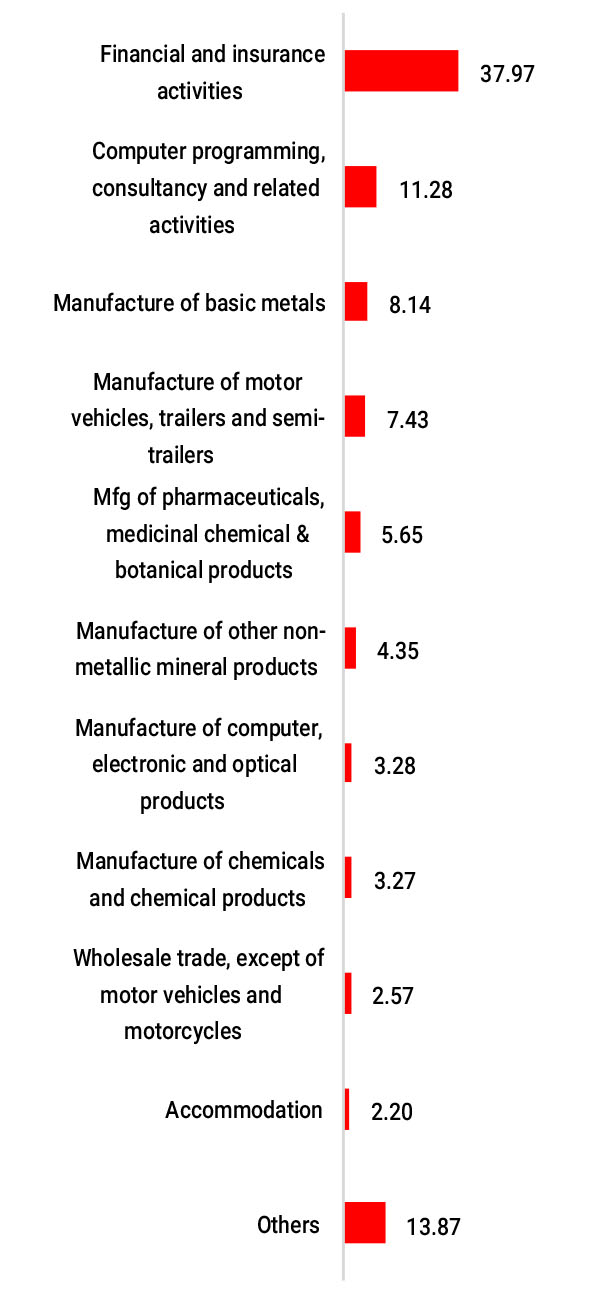

| Holdings | % to Fund |

| Equity | 90.55 |

| Rural Electrification Corporation Ltd. | 3.30 |

| Tube Investments Of India Ltd | 3.23 |

| Shriram Finance Limited | 2.86 |

| Persistent Systems Limited | 2.71 |

| Aurobindo Pharma Ltd | 2.69 |

| Poly Medicure Ltd | 2.57 |

| Zensar Technologies Limited. | 2.49 |

| Power Finance Corporation Ltd | 2.47 |

| P I Industries Ltd | 2.23 |

| Venus Pipes and Tubes Ltd | 2.21 |

| Indian Hotels Company Ltd | 2.20 |

| B S E Ltd | 2.19 |

| Max Financial Services Ltd | 2.14 |

| IndusInd Bank Ltd | 2.01 |

| Narayana Hrudayalaya Ltd | 1.81 |

| APL Apollo Tubes Ltd | 1.80 |

| J B Chemicals & Pharmaceuticals Ltd | 1.80 |

| Rategain Travel Technologies Ltd | 1.80 |

| Hitachi Energy India Ltd | 1.79 |

| HDFC Asset Management Co Ltd | 1.78 |

| Others | 44.45 |

| MMI | 9.43 |

| NCA | 0.02 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.