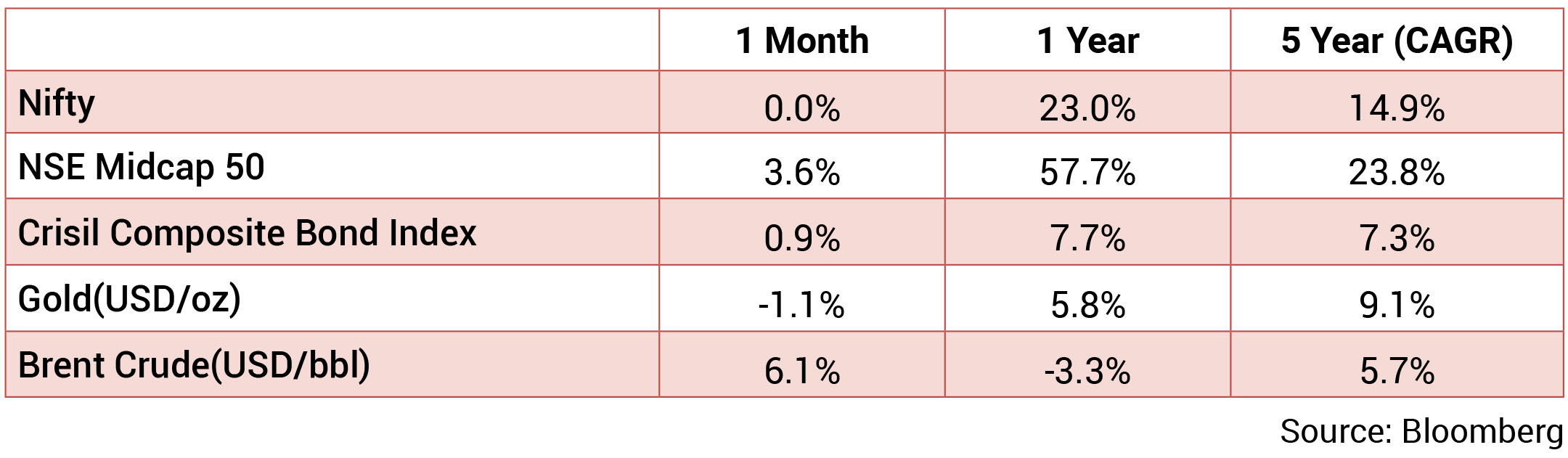

Market was flat (but volatile) in January 2024, primarily due to mixed earnings results and FII/DII flows.

Nifty reached an all-time high of 22,100 by mid-January but corrected by 1.7% from its all-time high by

month-end. Energy and IT have been the frontrunners, while financials have been the laggards. The INR

saw slight appreciation against USD and averaged 83.12, with a monthly best and worst of 82.9 and 83.3,

respectively, in January. 10yr benchmark yields traded in the range of 7.14%-7.24% and eventually ended

the month 3bps lower sequentially at 7.14%. The 10y benchmark averaged 7.18% in January.

With stubborn inflation in the major advanced economies, geopolitical tensions, and its impact on logistics and energy prices, global central banks continue their fight against inflation. The Fed continued with its status quo on rates in the January meeting while introducing substantial changes to the statement. The statement acknowledged the solid pace of economic growth and a better balance of risks to achieve employment and inflation goals. Also, language regarding “any additional policy firming” was replaced with “any adjustments to target range.” While there is some dovishness regarding the change in statement language, there was no guidance on the timing of the rate cuts, and the Fed chair hinted that the committee would not be confident enough to cut rates in the March meeting. A continued increase in shelter prices and pressure from energy prices hiked the US inflation rate to 3.4% in December 2023. The US economy added 216k jobs in December, much more than the 105k/173k jobs in October and November. Inflation in the EU continued to ease, but the ECB kept the rates unchanged at record high levels, and the President stated that it was premature to engage in discussion regarding the interest rate cuts. In their most recent meetings, the Bank of Canada and the Bank of England likewise decided to keep interest rates unchanged.

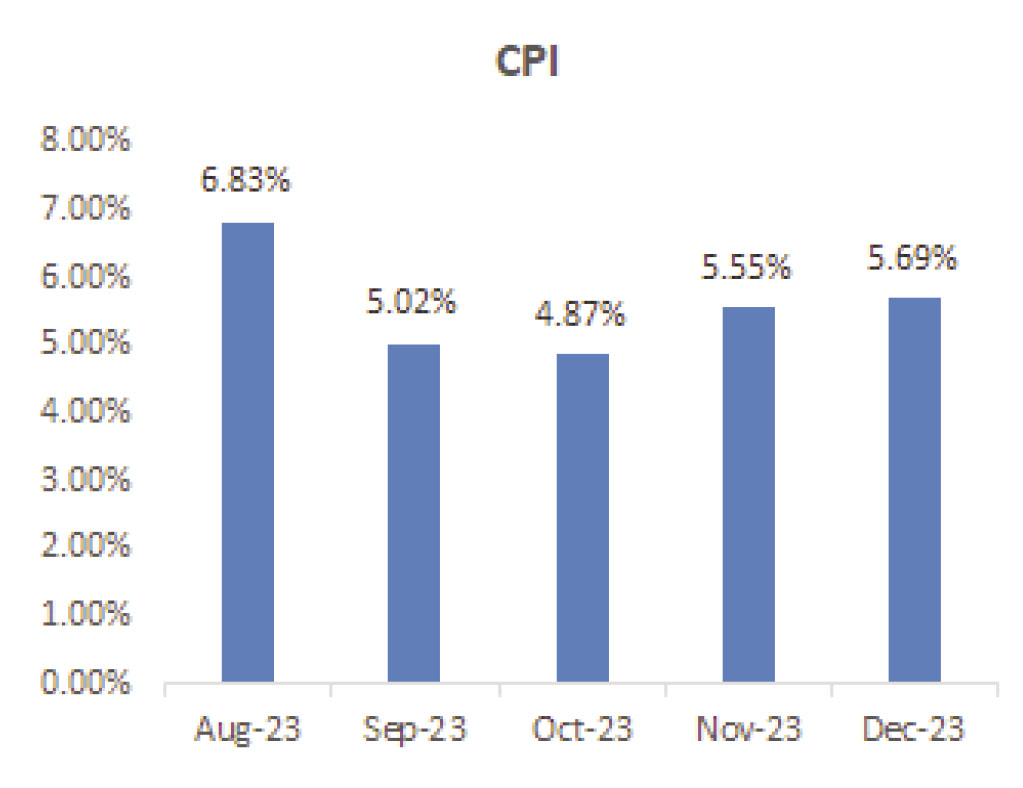

Inflation remained nearly steady, at 5.7% in December. Sequential inflation eased by 32 bps, largely driven by a 530 bps correction in vegetable prices. Positively, core CPI sustained the downward trend for the sixth month, at 3.8% yoy. Rabi sowing has overshot the normal area and is at levels seen in the previous year. However, rice and pulses sown were slightly lower than last year. Other high-frequency indicators suggest robust macroeconomic activity. Recent prints of energy consumption, vehicle registrations, strong credit growth, and E-way bill collections all pointed to robustness in Indian macros. GST collections in January were the second highest yet, and manufacturing PMI for January improved, indicating an advancement in the health of the manufacturing sector. The CSO published its initial advance estimate of the country’s income for FY24, projecting GDP at 7.3%, helped by robust investments and respectable private and government consumption spending. The industries anticipated to contribute the most are manufacturing, financial and real estate services, and construction. As of December, the government’s fiscal deficit was controlled at 55%, indicating sound financial standing. The strong corporate and income tax receipts were a major factor in this.

Brent crude prices rose to an average of USD79/bbl in January from USD77/bbl in December, as they ranged between USD76-USD84/bbl. OPEC+ maintaining current production cuts and extended geopolitical tension continue to exert pressure on oil prices. The gold price saw a dip as it ended at USD 2,048/oz in January from USD 2,072/oz in December. Steel price trended lower as HRC prices ended the month at USD963/Tn compared to USD1,135/Tn in December.

With stubborn inflation in the major advanced economies, geopolitical tensions, and its impact on logistics and energy prices, global central banks continue their fight against inflation. The Fed continued with its status quo on rates in the January meeting while introducing substantial changes to the statement. The statement acknowledged the solid pace of economic growth and a better balance of risks to achieve employment and inflation goals. Also, language regarding “any additional policy firming” was replaced with “any adjustments to target range.” While there is some dovishness regarding the change in statement language, there was no guidance on the timing of the rate cuts, and the Fed chair hinted that the committee would not be confident enough to cut rates in the March meeting. A continued increase in shelter prices and pressure from energy prices hiked the US inflation rate to 3.4% in December 2023. The US economy added 216k jobs in December, much more than the 105k/173k jobs in October and November. Inflation in the EU continued to ease, but the ECB kept the rates unchanged at record high levels, and the President stated that it was premature to engage in discussion regarding the interest rate cuts. In their most recent meetings, the Bank of Canada and the Bank of England likewise decided to keep interest rates unchanged.

Inflation remained nearly steady, at 5.7% in December. Sequential inflation eased by 32 bps, largely driven by a 530 bps correction in vegetable prices. Positively, core CPI sustained the downward trend for the sixth month, at 3.8% yoy. Rabi sowing has overshot the normal area and is at levels seen in the previous year. However, rice and pulses sown were slightly lower than last year. Other high-frequency indicators suggest robust macroeconomic activity. Recent prints of energy consumption, vehicle registrations, strong credit growth, and E-way bill collections all pointed to robustness in Indian macros. GST collections in January were the second highest yet, and manufacturing PMI for January improved, indicating an advancement in the health of the manufacturing sector. The CSO published its initial advance estimate of the country’s income for FY24, projecting GDP at 7.3%, helped by robust investments and respectable private and government consumption spending. The industries anticipated to contribute the most are manufacturing, financial and real estate services, and construction. As of December, the government’s fiscal deficit was controlled at 55%, indicating sound financial standing. The strong corporate and income tax receipts were a major factor in this.

Brent crude prices rose to an average of USD79/bbl in January from USD77/bbl in December, as they ranged between USD76-USD84/bbl. OPEC+ maintaining current production cuts and extended geopolitical tension continue to exert pressure on oil prices. The gold price saw a dip as it ended at USD 2,048/oz in January from USD 2,072/oz in December. Steel price trended lower as HRC prices ended the month at USD963/Tn compared to USD1,135/Tn in December.

CPI: CPI inflation in December, while increasing marginally, surprised on the downside at 5.7% (November:

5.6%). On a sequential basis, headline CPI inflation contracted by 0.3% (+0.5% mom in November) led by

vegetables, fruits, meat and fish, and spices. Food inflation increased to 9.5% (November: 8.7%). December

core inflation moderated to 3.8% (November: 4.1%) led by sequential contraction in house rent, tuition

fees, bus fares, etc. Sequentially, the core inflation momentum was unchanged in December compared

to +0.2% mom in November.

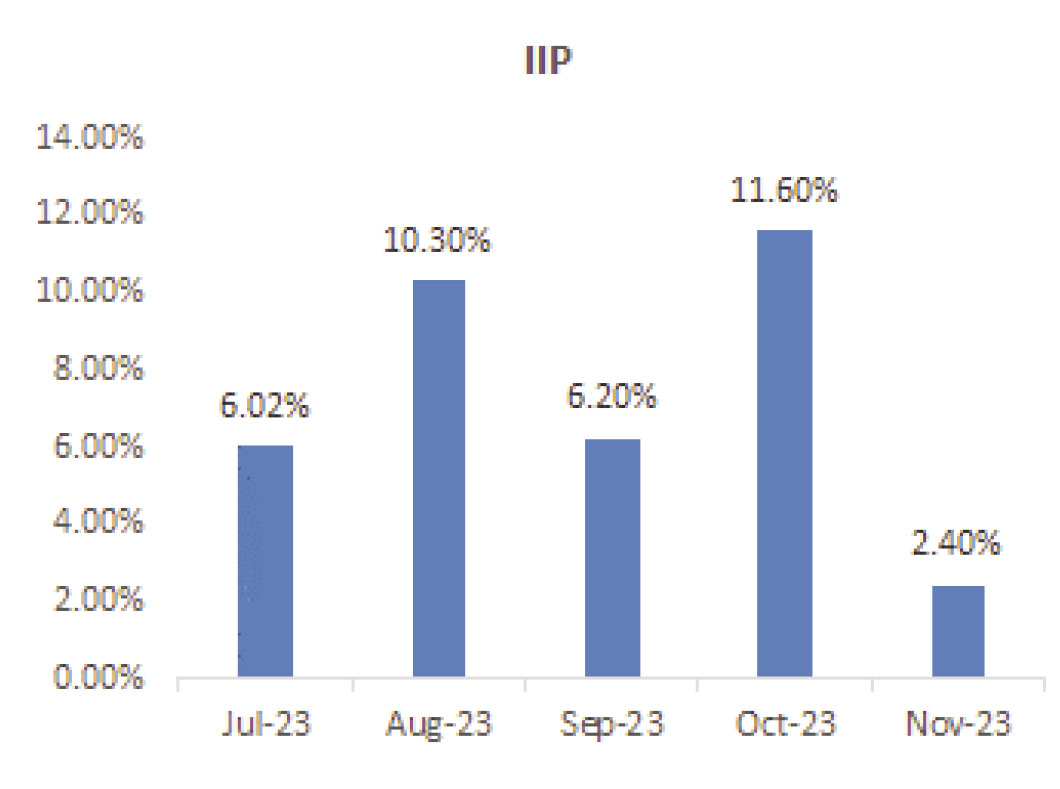

IIP: Industrial production in November moderated sharply to 2.4% (October: 11.6%) due to an adverse base effect and a holiday impacted month. As per the sectoral classification, manufacturing sector growth was at 1.2% (October: 10.2%), mining sector growth was at 6.8% (13.1%), and electricity production growth was at 5.8% (20.4%). As per the use-based classification, primary goods production grew by 8.4% (October: 11.4%), intermediate goods by 3.5% (9.4%), and infrastructure goods by 1.5% (11.3%). On the other hand, capital goods production contracted by 1.1% (October: +21.3%), consumer non-durables production contracted by 3.6% (+8.7%), and consumer durables production contracted by 5.4% (+15.9%).

Trade: Goods trade deficit in December narrowed marginally to US$19.8 bn (November: US$20.6 bn) with exports at US$38.5 bn (US$33.9 bn) and imports at US$58.3 bn (US$54.5 bn). Non-oil exports was at US$31.6 bn (November: US$26.4 bn) while non-oil imports was at US$43.3 bn (US$39.5 bn). Services trade surplus was at US$14.6 bn, with exports at US$27.9 bn and imports at US$13.3 bn.

Budget: Nominal GDP in FY25E is estimated to grow at 10.5% over FY24 revised. Gross tax revenue is expected to grow in line with nominal GDP growth to Rs 38.3tn in FY25E. Budgeted Capital Expenditure for FY25E at Rs 11.11trn (3.4% of GDP). The government has assumed an increase in total expenditure of ~6.1% YoY in FY25, lower than historical years. Gross and net borrowing for FY25 are estimated at Rs14.13trn and Rs 11.75trn respectively lower than FY24 numbers. Fiscal Deficit in FY24E is estimated at 5.8% and FY25E is estimated at 5.1% of GDP, each lower by 10 bps based on last year’s Budget estimate. Government aims to bring Fiscal Deficit below 4.5% of GDP by FY26E.

IIP: Industrial production in November moderated sharply to 2.4% (October: 11.6%) due to an adverse base effect and a holiday impacted month. As per the sectoral classification, manufacturing sector growth was at 1.2% (October: 10.2%), mining sector growth was at 6.8% (13.1%), and electricity production growth was at 5.8% (20.4%). As per the use-based classification, primary goods production grew by 8.4% (October: 11.4%), intermediate goods by 3.5% (9.4%), and infrastructure goods by 1.5% (11.3%). On the other hand, capital goods production contracted by 1.1% (October: +21.3%), consumer non-durables production contracted by 3.6% (+8.7%), and consumer durables production contracted by 5.4% (+15.9%).

Trade: Goods trade deficit in December narrowed marginally to US$19.8 bn (November: US$20.6 bn) with exports at US$38.5 bn (US$33.9 bn) and imports at US$58.3 bn (US$54.5 bn). Non-oil exports was at US$31.6 bn (November: US$26.4 bn) while non-oil imports was at US$43.3 bn (US$39.5 bn). Services trade surplus was at US$14.6 bn, with exports at US$27.9 bn and imports at US$13.3 bn.

Budget: Nominal GDP in FY25E is estimated to grow at 10.5% over FY24 revised. Gross tax revenue is expected to grow in line with nominal GDP growth to Rs 38.3tn in FY25E. Budgeted Capital Expenditure for FY25E at Rs 11.11trn (3.4% of GDP). The government has assumed an increase in total expenditure of ~6.1% YoY in FY25, lower than historical years. Gross and net borrowing for FY25 are estimated at Rs14.13trn and Rs 11.75trn respectively lower than FY24 numbers. Fiscal Deficit in FY24E is estimated at 5.8% and FY25E is estimated at 5.1% of GDP, each lower by 10 bps based on last year’s Budget estimate. Government aims to bring Fiscal Deficit below 4.5% of GDP by FY26E.

Deal flow slowed Q-o-Q in January 2024 with reported 35 deals worth ~$5.6 billion executed. Key

deals included Grasim Industries ($481mn) and NHPC Ltd. ($208mn).

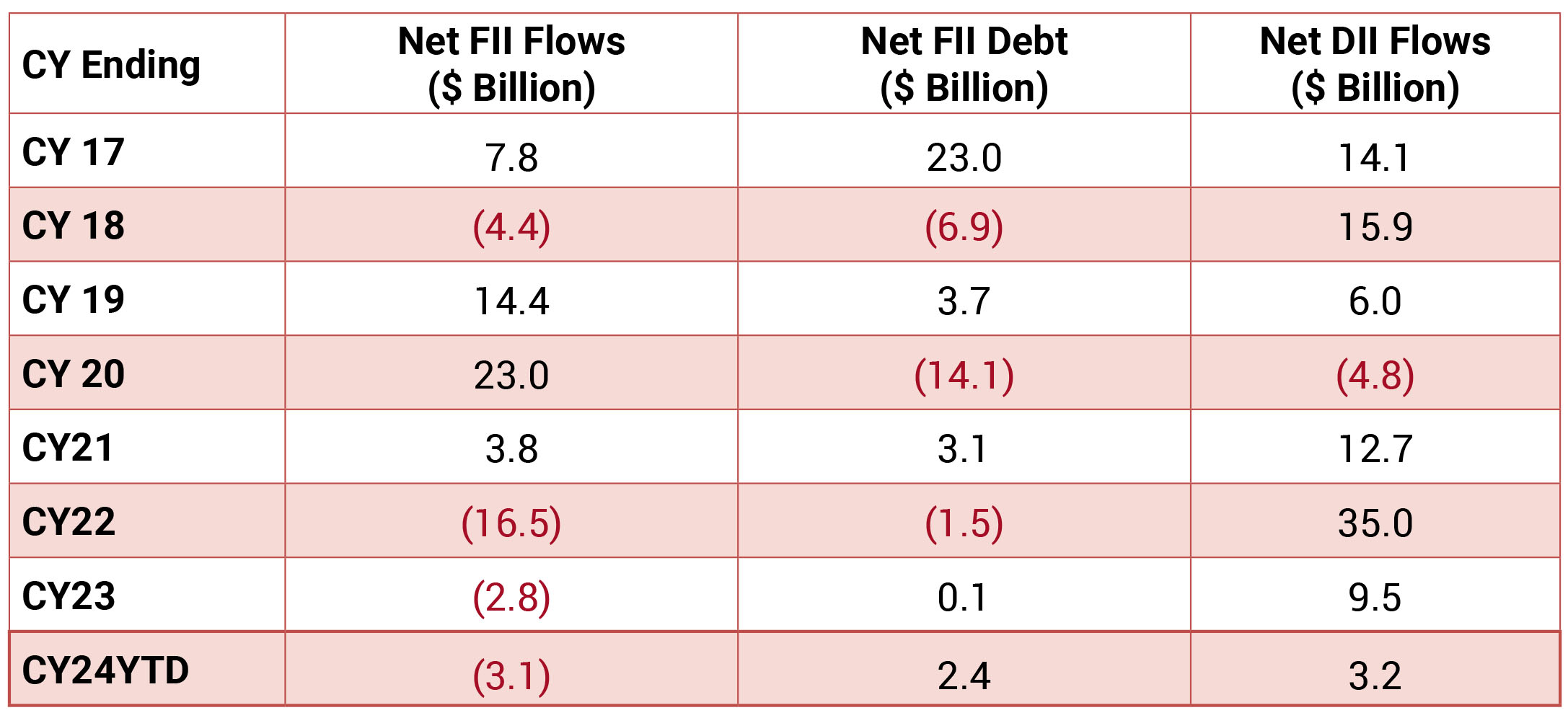

FIIs sold in the month of Jan 2024 to the tune of $3.1bn and DIIs remained net buyers to the tune of $3.2bn.

FIIs sold in the month of Jan 2024 to the tune of $3.1bn and DIIs remained net buyers to the tune of $3.2bn.