● Economy: Broder economy growth continues to remain strong, even IMF now has predicated Indian economy to grow at strongly during 2024. However, if we break down the growth, consumption continues to remain weak highlighting the challenges of low income household, on the other hand investments especially high end residential real state is doing well.

● GST collection: January month reported GST collection were 2nd highest ever, it grew 10.4% YoY to Rs1.72tn. With this, overall GST collection reached Rs16.7tn during 10month FY24, registering strong 11.6% growth. Robust collection clearly reflects the strong market environment.

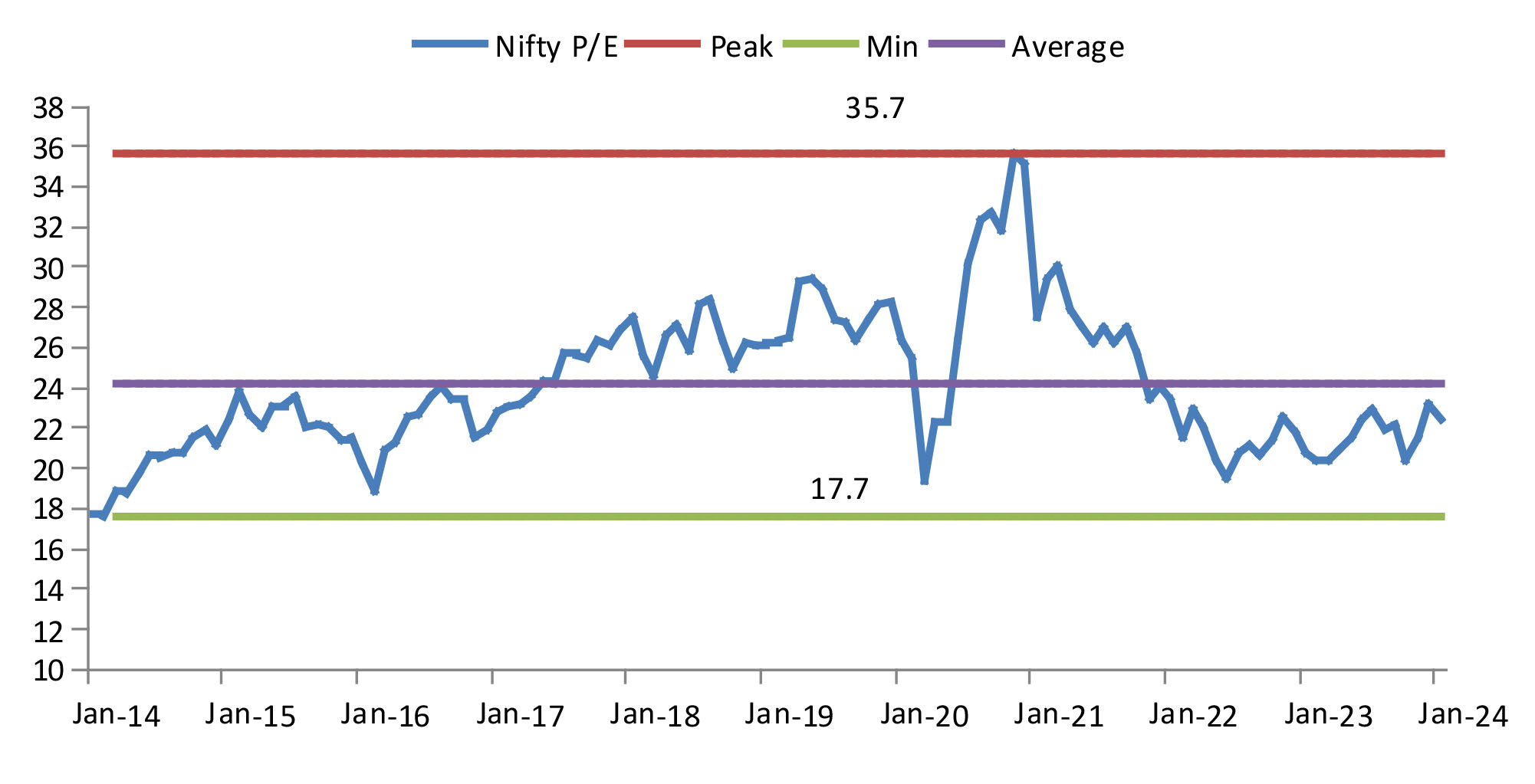

● Resilient earnings: Q3FY23 earnings reported so far has been in-line with broad market expectations with positive outlook given by most of the management. Nifty index companies on aggregate level has reported marginal beat, however their valuation has de-rated in anticipation of slowing loan growth due to deposit growth issue.

● Outlook: A healthy domestic macro and micro environment, expected political continuity post 2024 General Elections, strong retail participation, global interest rates at its peak and expectation of rate cuts would continue to keep market sentiments positive. However, ongoing consumption slowdown, weakness in rural markets, fluctuating FII flows and geopolitical uncertainties may keep the markets volatile in near term.