Group Fund

Kotak Group Prudent Fund

(ULGF-019-04/07/17-KGPFFND-107)

MONTHLY UPDATE JUNE 2022

|

AS ON 31st May 2022 |

Aims to provide enhanced long term returns by taking a moderate exposure to equity and equity related securities and active management of a

fixed income portfolio.

Date of Inception

1st June 2018

AUM (in Lakhs)

22,753.74

NAV

14.0805

Fund Manager

Equity : Rohit Agarwal

Debt : Manoj Bharadwaj

Debt : Manoj Bharadwaj

Benchmark Details

20% BSE 100 & 80% Crisil Composite Bond

Modified Duration

Debt & Money

Market Instruments : 3.06

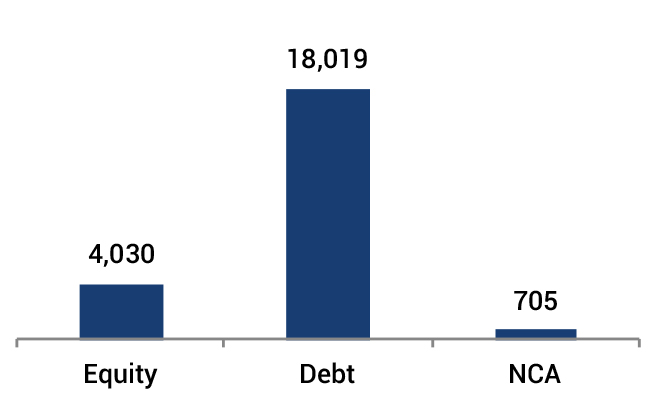

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 00 - 20 | 18 |

| Gsec / Debt | 40 - 100 | 52 |

| MMI / Others | 00 - 40 | 30 |

Performance Meter

| Kotak Group Prudent Fund (%) | Benchmark (%) | |

| 1 month | -1.1 | -1.8 |

| 3 months | -1.2 | -1.8 |

| 6 months | -1.9 | -2.0 |

| 1 year | 1.7 | 2.1 |

| 2 years | 7.3 | 8.8 |

| 3 years | 7.5 | 8.0 |

| 4 years | 8.9 | 8.7 |

| 5 years | n.a | n.a |

| 6 years | n.a | n.a |

| 7 years | n.a | n.a |

| 10 years | n.a | n.a |

| Inception | 8.9 | 8.7 |

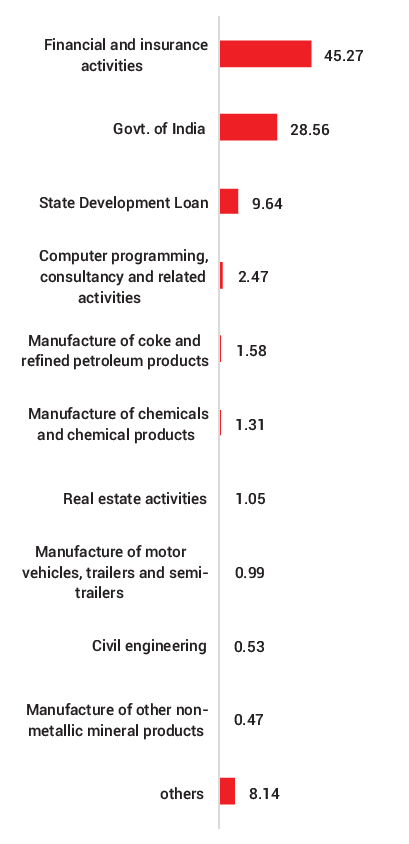

| Holdings | % to Fund |

| Equity | 17.71 |

| Reliance Industries Ltd | 1.58 |

| Infosys Ltd | 1.33 |

| ICICI Bank Ltd | 1.24 |

| SBI ETF Nifty Bank | 0.66 |

| ICICI Prudential Bank ETF Nifty Bank Index | 0.64 |

| Axis Bank Ltd | 0.57 |

| Kotak Banking ETF - Dividend Payout Option | 0.56 |

| State Bank of India | 0.56 |

| Maruti Suzuki India Ltd | 0.51 |

| Tata Consultancy Services Ltd | 0.49 |

| Larsen And Toubro Ltd | 0.49 |

| Hindustan Unilever Ltd | 0.45 |

| Mahindra & Mahindra Ltd | 0.40 |

| UltraTech Cement Ltd | 0.38 |

| SBI Life Insurance Company Ltd | 0.35 |

| HDFC Bank Ltd | 0.34 |

| Bajaj Finance Ltd | 0.32 |

| S R F Ltd | 0.32 |

| Bharti Airtel Ltd | 0.31 |

| Housing Development Finance Corp. Ltd | 0.26 |

| Others | 5.95 |

| G-Sec | 40.25 |

| 6.54% GOI - 17.01.2032 | 9.73 |

| 6.24% MH SDL - 11.08.2026 | 3.77 |

| GOI FRB - 22.09.2033 | 3.72 |

| 6.79% GOI - 26.12.2029 | 3.20 |

| 5.74% GOI - 15.11.2026 | 2.55 |

| 7.17% GOI - 08.01.2028 | 1.81 |

| GOI FRB - 04.10.2028 | 1.70 |

| 6.99% UP SDL - 27.10.2031 | 1.42 |

| 9.50% GJ SDL - 11.09.2023 | 1.36 |

| 6.67% GOI - 15.12.2035 | 1.33 |

| Others | 9.65 |

| Corporate Debt | 11.57 |

| 6.99% IRFC - 04.06.2041 | 3.23 |

| 7.05% Embassy Office Parks REIT - 18.10.2026 | 1.05 |

| 5.65% Bajaj Finance Ltd - 10.05.2024 | 1.02 |

| 7.40% Muthoot Finance Ltd - 05.01.2024 | 0.70 |

| 9.24% LIC Housing Finance - 30.09.2024 | 0.55 |

| 5.78% HDFC - 25.11.2025 | 0.46 |

| 8.56% REC - 29.11.2028 | 0.46 |

| 7.85% PFC - 03.04.2028 | 0.45 |

| 10.08% IOT Utkal Energy Services Limited - 20.03.2027 | 0.41 |

| 7.35% Bajaj Finance Ltd - 10.11.2022 | 0.40 |

| Others | 2.84 |

| MMI | 27.37 |

| NCA | 3.10 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.