Yields were in for a shock right at the start of the month of May as the RBI announced a 40bps hike in policy rates - an outcome of a three-day monetary policy meeting held off-cycle. This was in addition to a 50bps hike in cash reserve ratio. The RBI continued to retain its stance of accommodative with withdrawal of accommodation. Both the timing and intensity of the MPC action came as a shock to markets resulting in immediate re-pricing in yields.

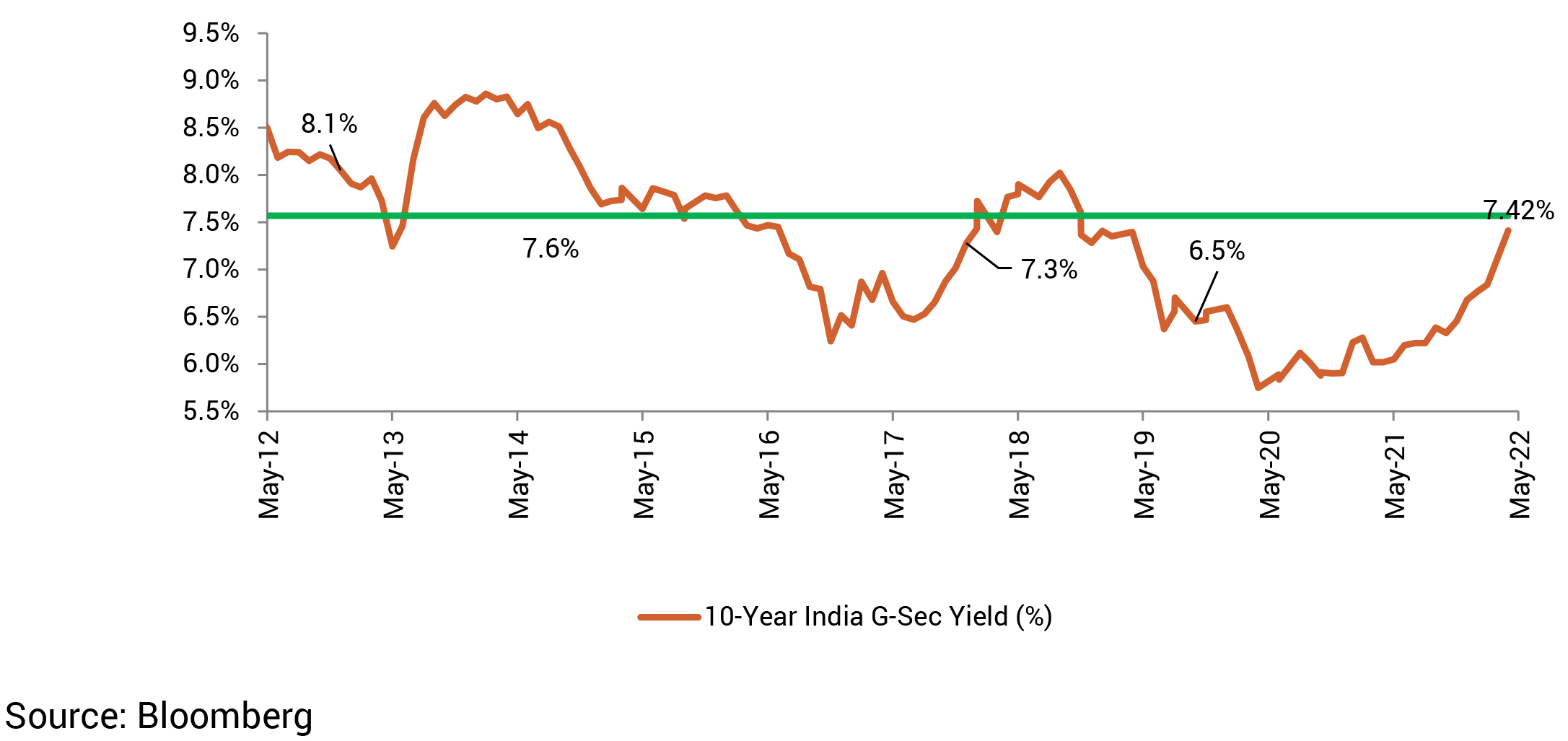

The 10y benchmark shot up by 26bps to 7.38% post the policy decision and kept rising thereafter to a high of 7.46% before pulling back to 7.22%. The pullback could largely be attributed to growing fears of a global downturn restricting the ability of central banks to tighten and eventually leading to unwinding of the tightening measures taken. Light domestic positioning and crude stabilizing, although at elevated levels could also be said to have contributed to the pullback in yields.The southward move in yields however did not last long as the inflation print brought back focus of markets to the risks at hand.

Yields seemed to have found a home in the range of 7.30-7.40% for the near-term till the next policy meeting but that was not to be as a spike in crude prices pushed 10y yields above 7.40% again bringing it close to where it was at the start of the month post the off-cycle MPC meeting. Going forward, we expect the upcoming MPC meeting, SDL supply calendar and global cues (particularly crude prices) to dictate the trajectory of yields.