Overall, the debt markets have stayed volatile during the month of January. The announcement for normalisation of liquidity operations by RBI resulted in upshooting of the yields in the shorter end of the curve by upto 10-12 bps.

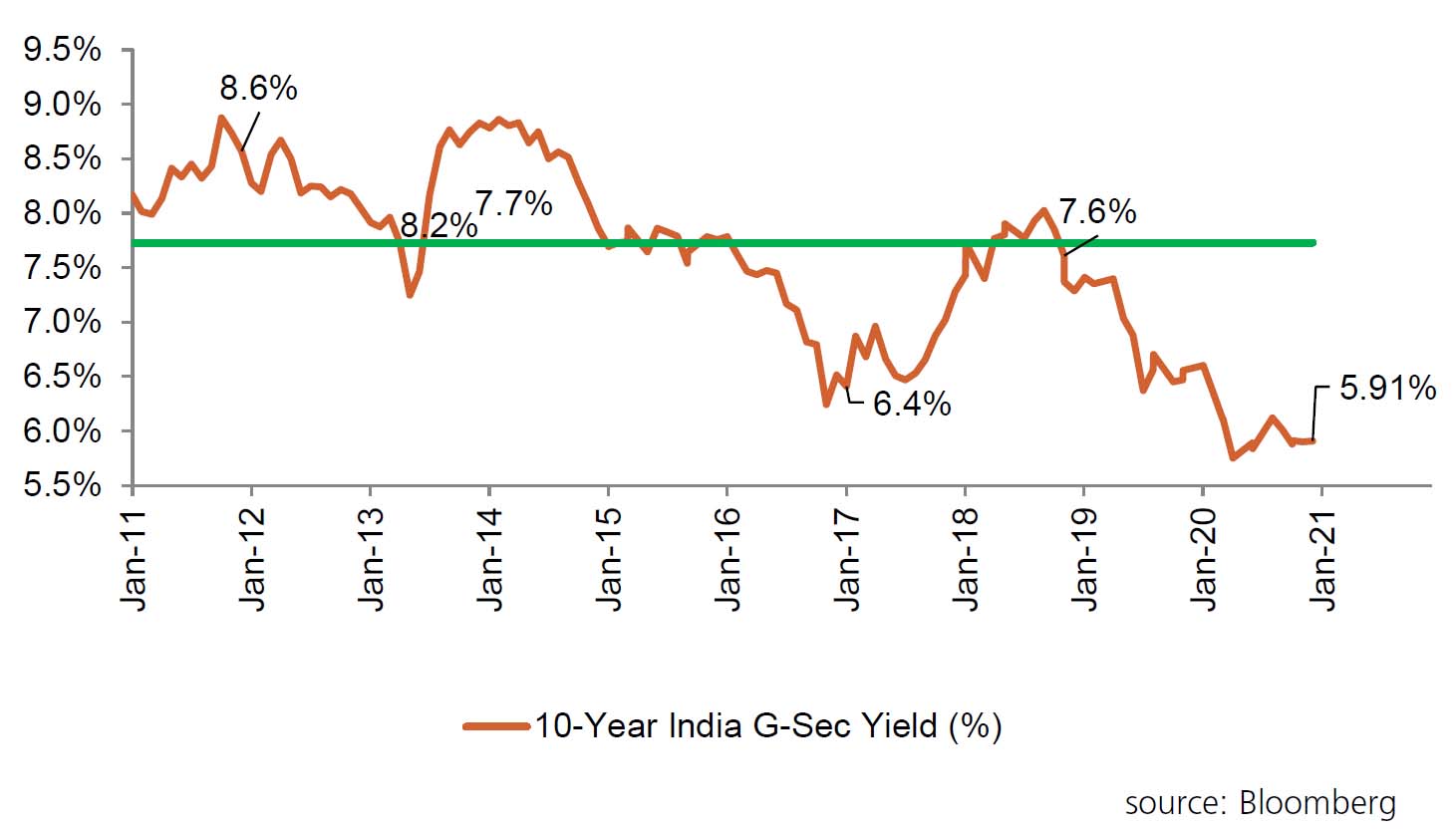

While 10-year benchmark G-sec traded in a range of 5.85% to 5.99% in January, the Union Budget presented on February 1st sent the yields rocketing to 6.06% at end of February 1st and 6.13% on February 2nd. The fiscal deficit for the fiscal 2021-22 pegged at 6.8% somersaulted the broad concensus of 5.5%. The fiscal deficit target for the FY 2020-21 has only been revised from 3.5% to 9.5% vs the market expectations of 7.5%. The Monetary Policy outcome on February 5th is eagerly awaited by the market, as hopes are pinned on Central Bank actions to clear the waters with respect to what lies ahead for the yields.

The annualized spread for ‘AAA’ PSUs have jumped from 62 bps as on 29th January to 68 bps on February 2nd.

Given this backdrop, the 10 year benchmark G-sec could trade in the range of 6.10%-6.25% in the near future.