Month Gone By – Markets (period ended December 31, 2020)

Equity indices globally and domestically recorded new highs in response to sharp moderation in

Coronavirus cases, emergency approvals provided to vaccines and stimulus approval of USD900bn

in USA. The passage of ever looming Brexit deal also provided a closure to the markets.The

optimism reflected in the rising crude oil prices which crossed USD50/bbl for the first time since

March 2020 due to greenshoots of recovery and rising demand as reflected by a steady fall in US

jobless claims in the month of December.

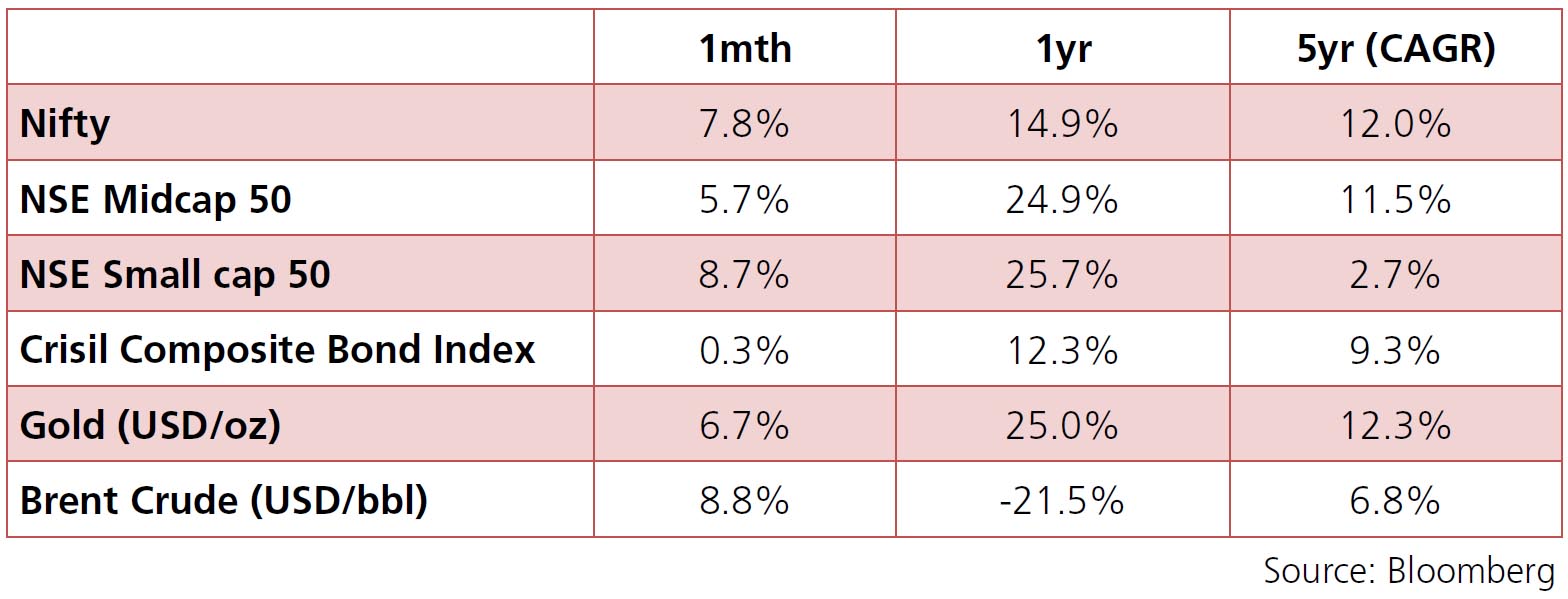

In line with global equities, Indian equities also saw a sharp rally in December (Nifty up 7.8%). The primary driver for the rally was huge FPI inflows amounting to USD8.4bn, however the rise has been pretty uneven as analyzed by a further breakup analysis of sectoral indices. While BSE Realty bolstered by cheaper home loans and stamp duty discount rose by 20.2% for the month, followed by BSE Metals at 13.5%; BSE Auto and BSE Power remain laggards at 3.4% and 3.1% rise respectively.

INR gained much lost ground owing to strong dollar inflows and weakening DXY and ended the month at 73.04/USD in December.

In line with global equities, Indian equities also saw a sharp rally in December (Nifty up 7.8%). The primary driver for the rally was huge FPI inflows amounting to USD8.4bn, however the rise has been pretty uneven as analyzed by a further breakup analysis of sectoral indices. While BSE Realty bolstered by cheaper home loans and stamp duty discount rose by 20.2% for the month, followed by BSE Metals at 13.5%; BSE Auto and BSE Power remain laggards at 3.4% and 3.1% rise respectively.

INR gained much lost ground owing to strong dollar inflows and weakening DXY and ended the month at 73.04/USD in December.

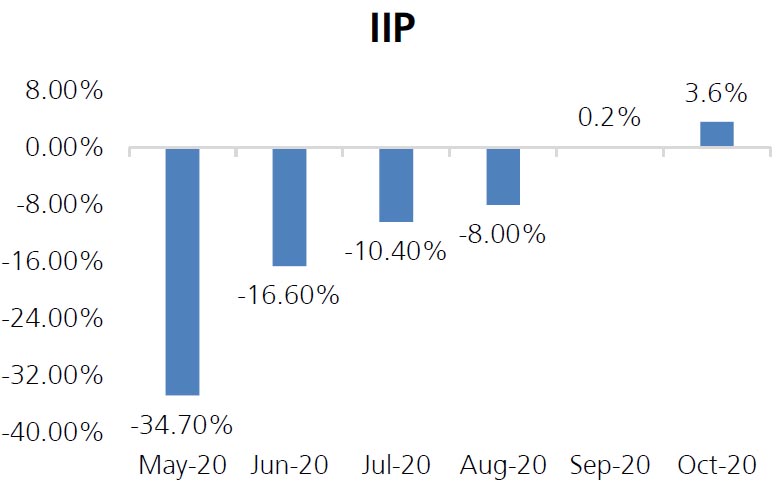

IIP: Index for Industrial Production for October gained 3.6% YoY (vs. 0.2% in August) and came

in ahead of the consensus forecast (consensus: 1.1%) thereby registering a sharp recovery

betraying the market consensus. Consumer durables recorded a sharp rise at 17.6% compared

to a rise of 3.4% in the previous month, followed by growth in consumer non-durables output

at 7.5% in October compared to an increase of 2.4% in September 2020.

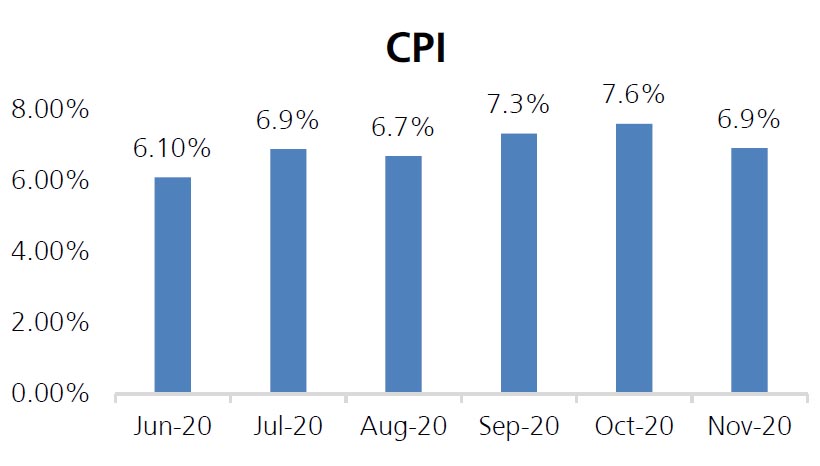

CPI: Headline CPI moderated to 6.9% for the month of November compared to 7.6% in October. The easing was led by moderation in food basket to 9.4% against previous month figure of 11%.

Trade Deficit: India recorded a trade deficit of USD 15.5bn for December, against a trade deficit recorded at USD 9.87bn recorded in November. Merchandise exports were down by 0.8% in December (vs. 9% fall in November) while imports were up 7% mainly fuelled by a spike in Gold imports which shot up by 82% y-o-y.

Fiscal Deficit: As of November end, India’s fiscal deficit widened to over Rs10.8 trn, ~135% of the annual target as the fall in revenue collections (40% of annual target vs 50% same time last year) only acted as a catalyst to burgeouning expenditure on account of social commitments in the face of a pandemic.

CPI: Headline CPI moderated to 6.9% for the month of November compared to 7.6% in October. The easing was led by moderation in food basket to 9.4% against previous month figure of 11%.

Trade Deficit: India recorded a trade deficit of USD 15.5bn for December, against a trade deficit recorded at USD 9.87bn recorded in November. Merchandise exports were down by 0.8% in December (vs. 9% fall in November) while imports were up 7% mainly fuelled by a spike in Gold imports which shot up by 82% y-o-y.

Fiscal Deficit: As of November end, India’s fiscal deficit widened to over Rs10.8 trn, ~135% of the annual target as the fall in revenue collections (40% of annual target vs 50% same time last year) only acted as a catalyst to burgeouning expenditure on account of social commitments in the face of a pandemic.

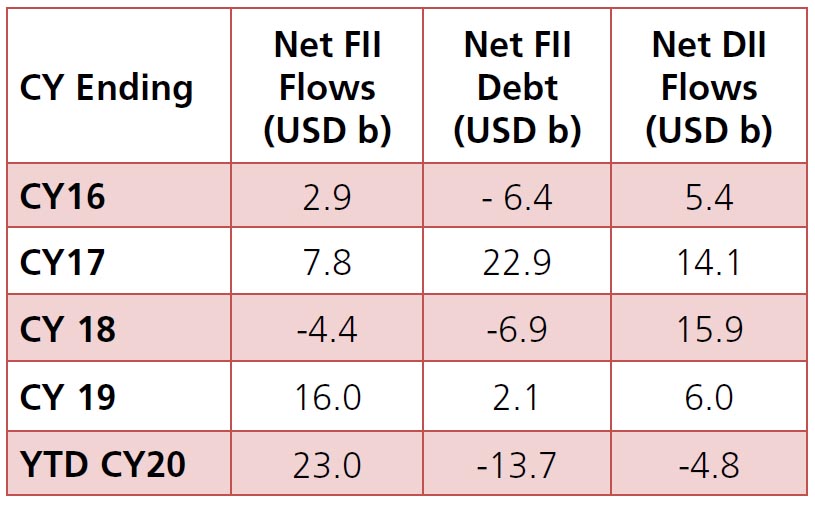

FII buying accelerated sharply in December

to USD8.4bn, highest monthly net FII inflow

(vs net buy of USD8.1bn in November)

taking their YTD inflows to USD 23bn. DIIs

continued to be on the sell side to the tune of

USD 5.03bn (YTD USD -4.8bn) split between

Domestic MFs USD 2.63bn and Other DIIs

USD 2.40bn.