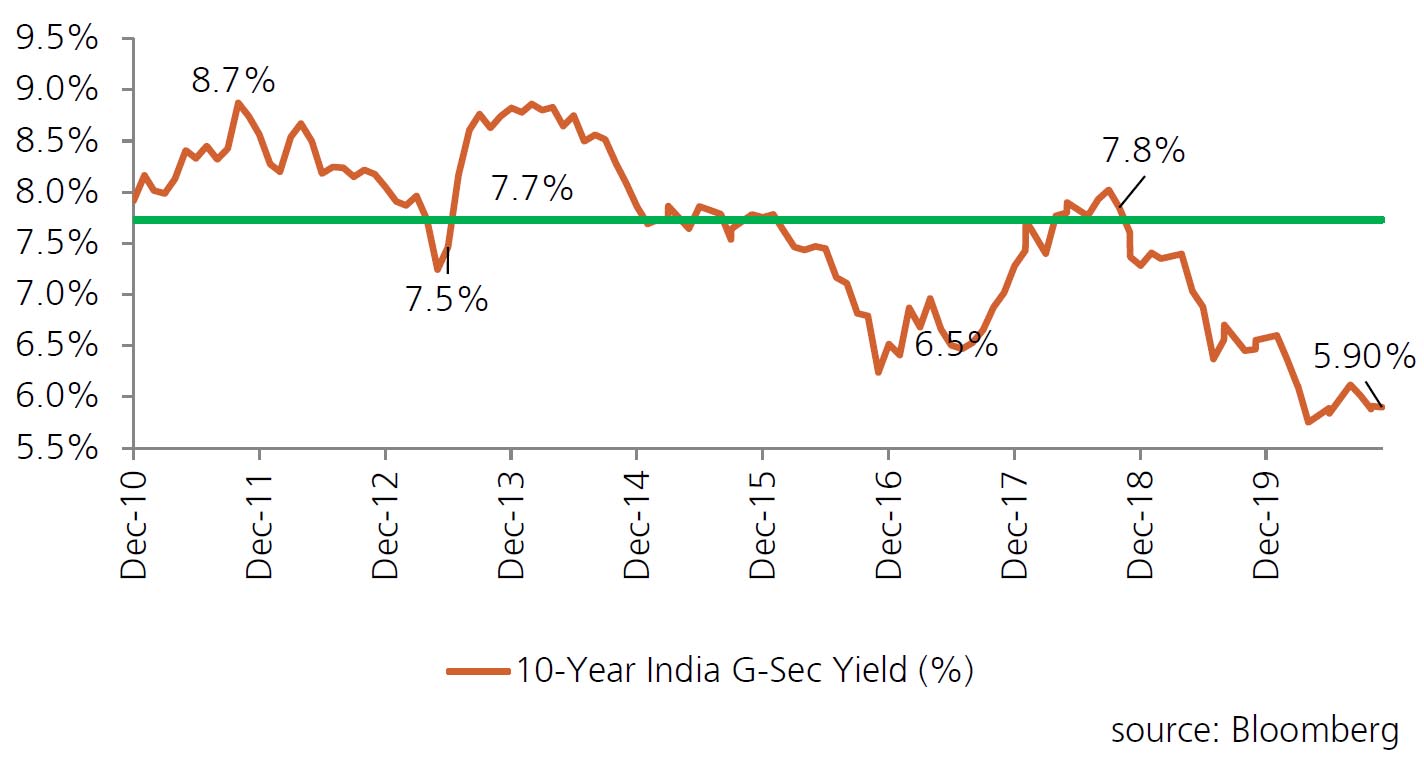

10-year benchmark G-sec traded in a range of 5.89% to 5.96% in December. Though the volumes remained lacklustre, the Central Bank supportive actions in form of Operation Twists has managed to keep the yield curve contained in the face of never ending supply and rising inflation. What mandates a special remark here is a special report published by RBI which justified the inflation targetting mechanism at a target rate of 4%. This paper is to be deemed important as the Monetary Policy Framework is due for review in March 2021.

While, the December Monetory Policy outcome was as per expectations with no slashing of repo rates, what remained noteworthy was the revision of GDP forecast for FY 2020-21 to -7.5% from -9.5% stated in October Policy. This combined with the statements in the minutes which clearly state that RBI should regain control of overnight rates to peg it close to benchamrk rate and elevated inflation setting in pose a risk of eventual withdrawal of liquidity which in itself has been a contentious issue for a while.

On the supply front, State Borrowing calendar for Q4 2020-21 at 3.16tn combined with expetected EBR borrowings by Public Sector Undertakings while ensure a widening of spreads between Government of India Securities vs SDL/ AAA PSUs.

Given this backdrop, the 10 year benchmark G-sec could trade in the range of 5.80%-6.00% in the near future.