Month Gone By – Markets (period ended March 31, 2021)

Just a year after the U.S. stock markets tanked in the Covid-19 crash, the S&P 500 ended

the month of March 2021 at record highs of 3972.89 (a gain of 4.24% m-o-m). All said and

done, the U.S. benchmark index has gained more than 77% in the year since the March

2020 abyss.. Nevertheless, March wasn’t exactly a smooth ride. The pace of vaccinations

with about every 3rd American having received the jab, passage of American Rescue Plan

in the Congress and unveiling of American Jobs Plan by Biden were balanced by concerns

about the potential for higher inflation, rising bond yields and the collapse of the investment

fund Archegos Capital drove a fair amount of volatility in stock prices.

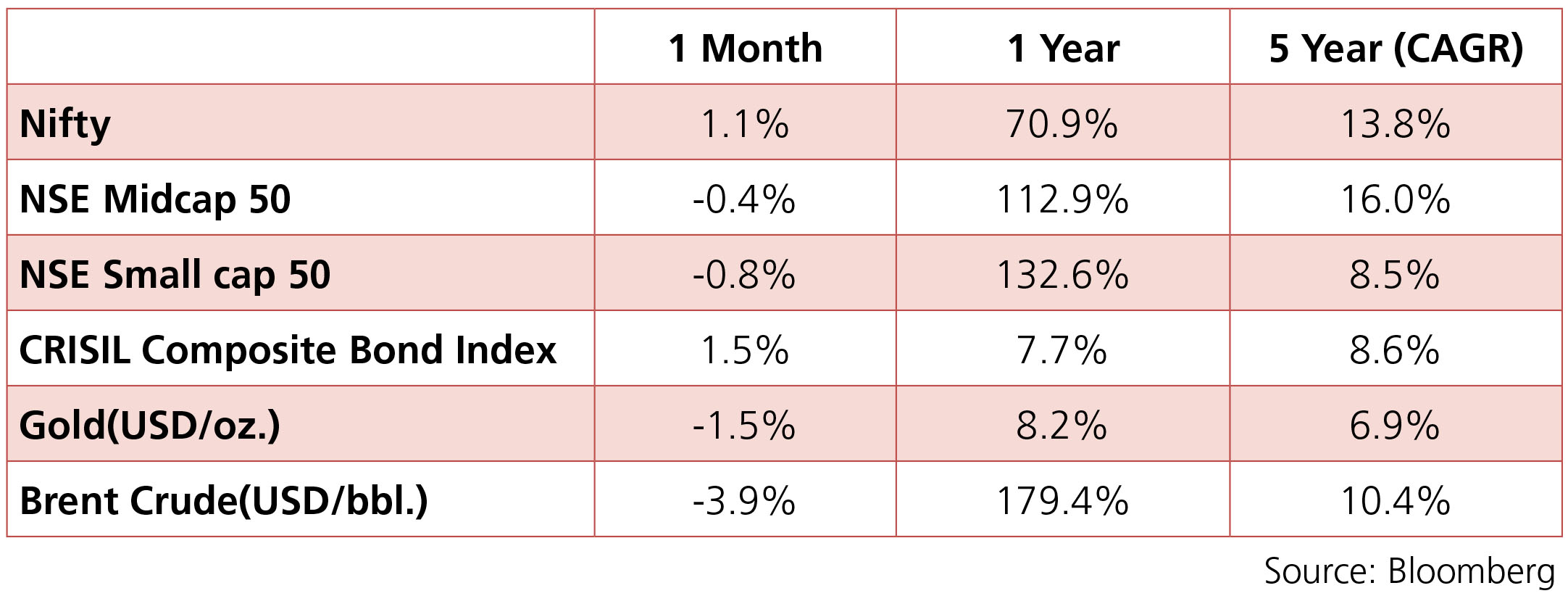

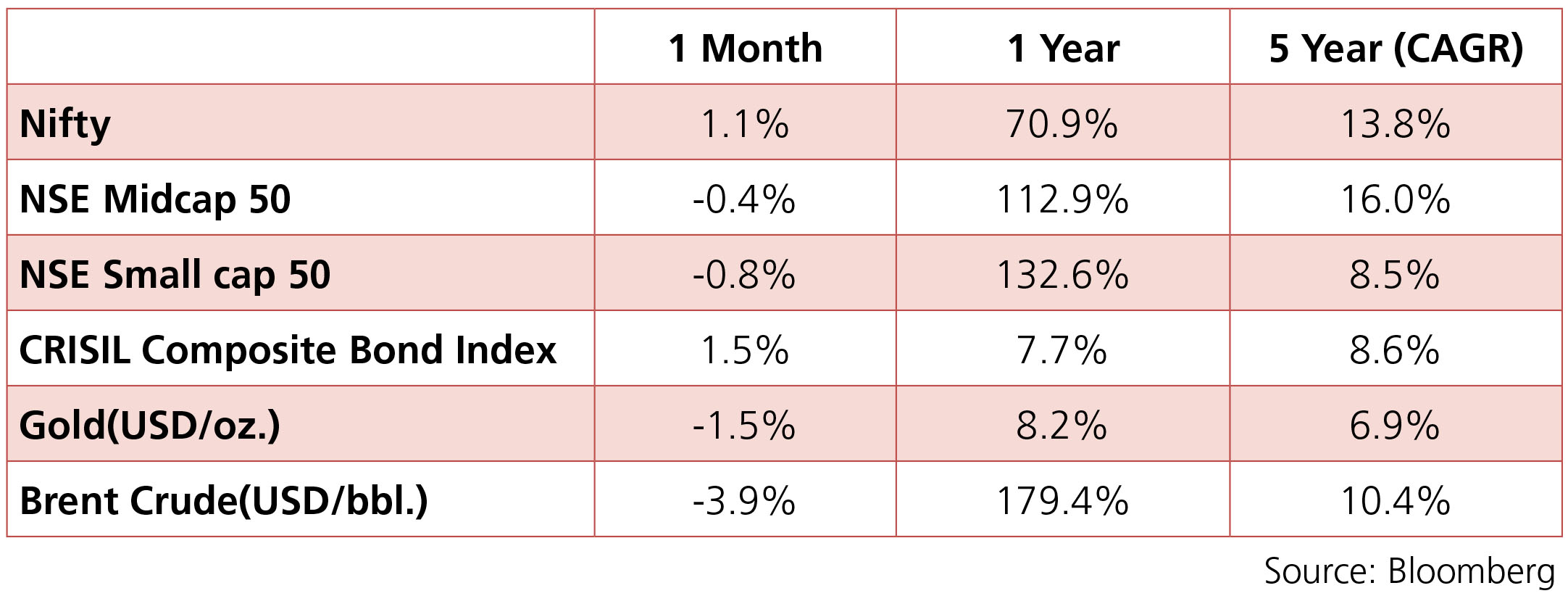

Markets started on an upward trend on supportive global cues, with NIFTY hovering close to 15,000-15,200 levels. However, the markets soon turned volatile in sync with global markets on worries over increasing bond yields and geopolitical worries. The Supreme Court order on lifting the NPL standstill came as a relief too. This is expected to help recoveries in 1Q21 as banks will be able to enforce collections.

The US 10Y continued to be volatile finally ending the journey ay 1.75% on March 31st vs 1.42% on February 26th. The main factors to push the yields higher have been the FOMC quarterly projections and the continued sell off in bond markets on expectations of growth normalization, improving unemployment and consistent inflation beyond 2%.

The INR remained under pressure amid a strong resurgence of Covid cases through out the country and the strengthening of dollar index from 90.88 on February end to 93.23 as on March 31st. INR closed its jouney for the month at 73.13.

Markets started on an upward trend on supportive global cues, with NIFTY hovering close to 15,000-15,200 levels. However, the markets soon turned volatile in sync with global markets on worries over increasing bond yields and geopolitical worries. The Supreme Court order on lifting the NPL standstill came as a relief too. This is expected to help recoveries in 1Q21 as banks will be able to enforce collections.

The US 10Y continued to be volatile finally ending the journey ay 1.75% on March 31st vs 1.42% on February 26th. The main factors to push the yields higher have been the FOMC quarterly projections and the continued sell off in bond markets on expectations of growth normalization, improving unemployment and consistent inflation beyond 2%.

The INR remained under pressure amid a strong resurgence of Covid cases through out the country and the strengthening of dollar index from 90.88 on February end to 93.23 as on March 31st. INR closed its jouney for the month at 73.13.

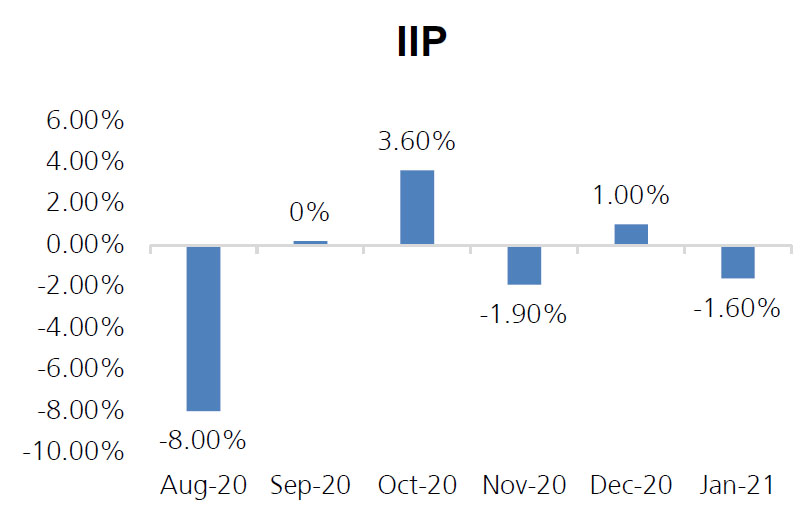

IIP: IIP contracted 1.6% in January 2021 after registering a growth of 1% in December

2020. The slowdown in IIP was led by Mining which contracted 3.7% y-o-y and

Manufacturing which contracted at 2% y-o-y.

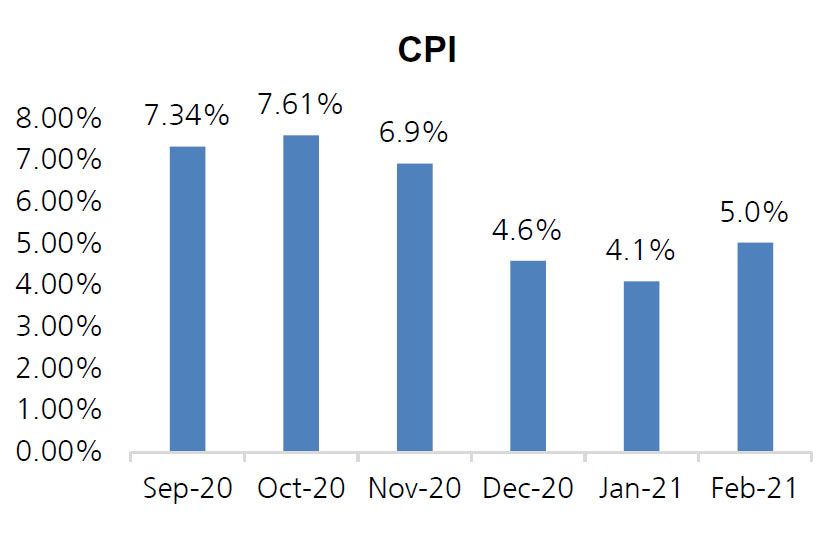

CPI: Retail inflation rose to a three-month high of 5.03% in February vs 4.06% in January, mainly on the back of the rising trend witnessed in food prices, while core CPI came in at 5.70%. The rate of price rise in the food basket accelerated to 3.87 per cent in February, as against 1.89 per cent in the preceding month.

Trade Deficit: March trade deficit spiked to $14.1Bn (US$12.9Bn in February). Preliminary data released by the commerce ministry on Thursday showed that merchandise exports grew 58% to a record $34Bn and imports rose 53% to $48.12Bn (Exports and imports stood at $28Bn and $41Bn respectively in February). Overall, exports in FY21 contracted by 7.4% to $290 billion while imports fell 18.1% to $389 billion.

Fiscal Deficit: The Centre’s fiscal deficit for April-February 2021 came in at 76% of the 2020-21 revised estimates of Rs 18.49Tn, official data showed on March 31. The April- February 2021 fiscal gap stands at 14.06Tn against 10.37Tn on year-on-year basis. The Revenue deficit stood at Rs 10.43Tn versus Rs 7.83Tn y-o-y. The spending during April- February 2021 stood at Rs 28.19Tn against Rs 24.65Tn a year earlier.

CPI: Retail inflation rose to a three-month high of 5.03% in February vs 4.06% in January, mainly on the back of the rising trend witnessed in food prices, while core CPI came in at 5.70%. The rate of price rise in the food basket accelerated to 3.87 per cent in February, as against 1.89 per cent in the preceding month.

Trade Deficit: March trade deficit spiked to $14.1Bn (US$12.9Bn in February). Preliminary data released by the commerce ministry on Thursday showed that merchandise exports grew 58% to a record $34Bn and imports rose 53% to $48.12Bn (Exports and imports stood at $28Bn and $41Bn respectively in February). Overall, exports in FY21 contracted by 7.4% to $290 billion while imports fell 18.1% to $389 billion.

Fiscal Deficit: The Centre’s fiscal deficit for April-February 2021 came in at 76% of the 2020-21 revised estimates of Rs 18.49Tn, official data showed on March 31. The April- February 2021 fiscal gap stands at 14.06Tn against 10.37Tn on year-on-year basis. The Revenue deficit stood at Rs 10.43Tn versus Rs 7.83Tn y-o-y. The spending during April- February 2021 stood at Rs 28.19Tn against Rs 24.65Tn a year earlier.

Deal activity accelerated in March with 27 deals worth ~$4.9bn (vs 11 deals worth

~$1.7bn in February). Notable ones being BPCL Trust Share sale (~$0.8bn), Tata

Communications OFS (~$0.7bn), PE Stake Sale in SBI Cards (~$0.5bn) and a slew of

IPOs – Kalyan Jewellers, Craftsman Automation, Anupam Rasayan, Laxmi Organic,

Nazara Technologies among others.

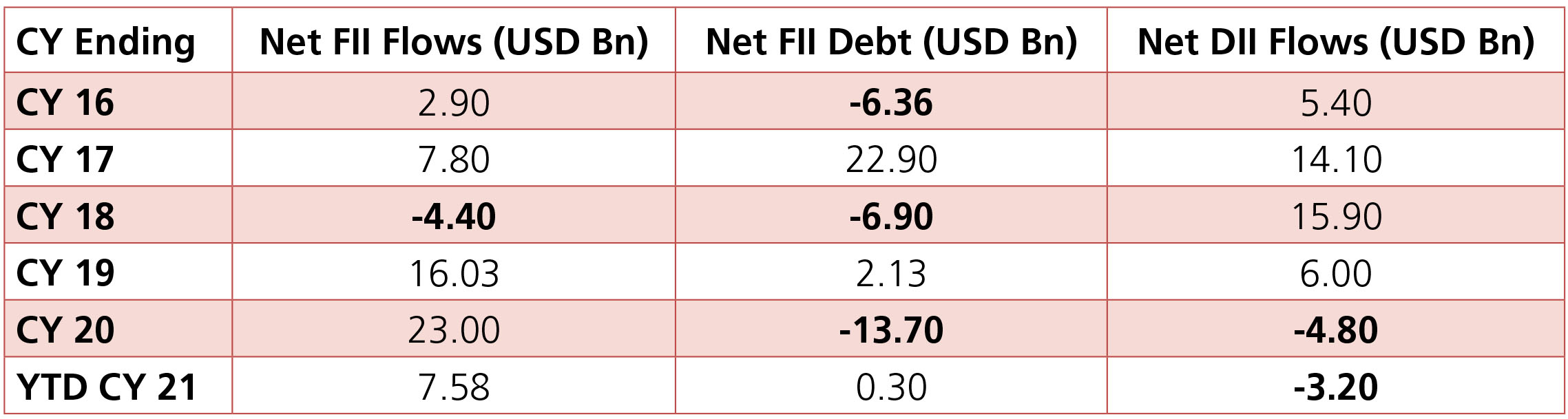

FII buying moderated slightly to ~$2.5bn in March (YTD +$7.5bn) vs net inflows of ~$3bn witnessed in February but it was encouraging to see DIIs turn net buyers for the first time in 2021 with net inflows of ~$0.7bn (YTD -$3.2bn) as the incessant selling by Domestic Mutual Funds paused likely due to reversal in Mutual Fund flow trends.

FII buying moderated slightly to ~$2.5bn in March (YTD +$7.5bn) vs net inflows of ~$3bn witnessed in February but it was encouraging to see DIIs turn net buyers for the first time in 2021 with net inflows of ~$0.7bn (YTD -$3.2bn) as the incessant selling by Domestic Mutual Funds paused likely due to reversal in Mutual Fund flow trends.