Individual Fund

Classic Opportunities Fund

(ULIF-033-16/12/09-CLAOPPFND-107)

Monthly Update April 2021

|

AS ON 31st March 2021 |

Aims to maximize opportunity for you through long-term capital growth, by holding a significant portion in a diversified and flexible mix of large /

medium sized company equities

Date of Inception

16th December 2009

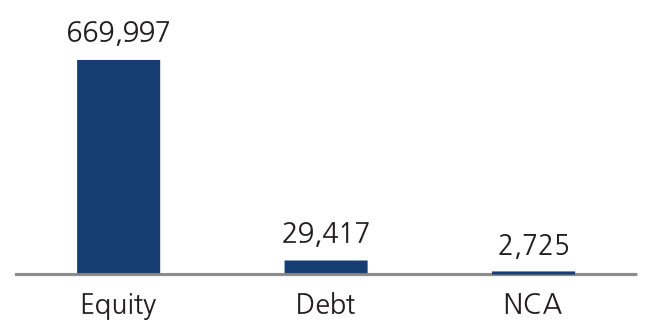

AUM (in Lakhs)

7,02,138.60

NAV

37.6360

Fund Manager

Equity : Hemant Kanawala

Debt : Gajendra Manavalan

Debt : Gajendra Manavalan

Benchmark Details

Equity - 100% (BSE 200)

Modified Duration

Debt & Money

Market Instruments : 0.02

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 75 - 100 | 95 |

| Gsec / Debt | 00 - 25 | 0 |

| MMI / Others | 00 - 25 | 5 |

Performance Meter

| Classic Opportunities Fund (%) | Benchmark (%) | |

| 1 month | 0.5 | 1.2 |

| 3 months | 7.8 | 6.5 |

| 6 months | 30.1 | 31.5 |

| 1 year | 70.4 | 74.3 |

| 2 years | 14.5 | 13.2 |

| 3 years | 12.0 | 12.4 |

| 4 years | 11.7 | 12.0 |

| 5 years | 14.2 | 14.1 |

| 6 years | 10.6 | 10.1 |

| 7 years | 15.1 | 13.0 |

| 10 years | 12.4 | 10.2 |

| Inception | 12.4 | 10.1 |

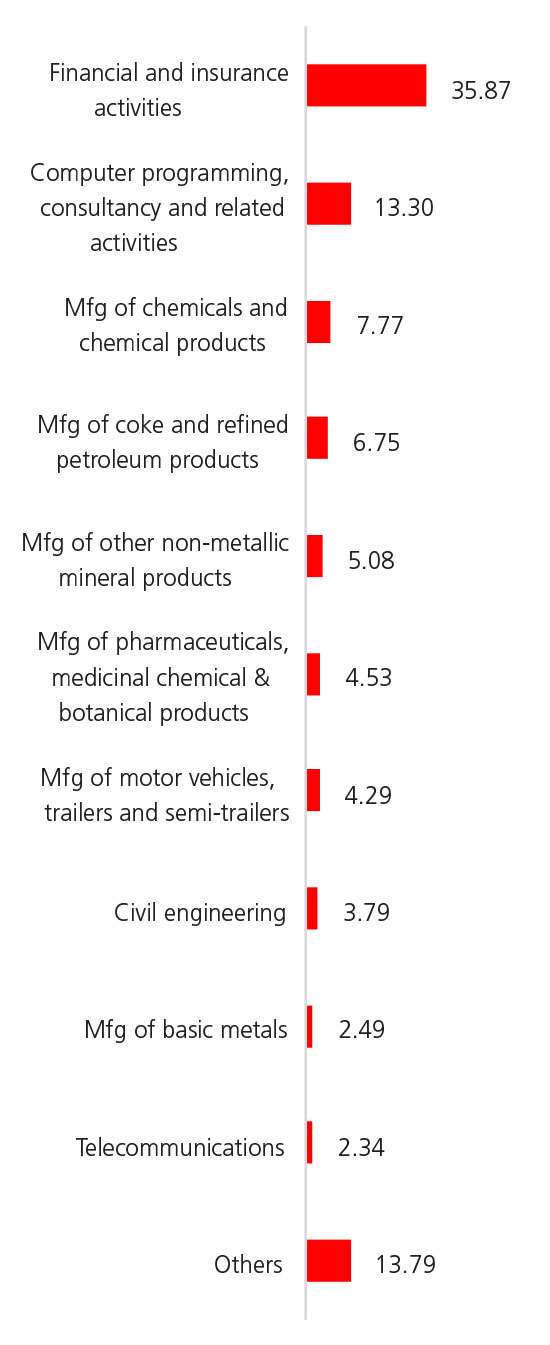

| Holdings | % to Fund |

| Equity | 95.42 |

| Infosys Ltd | 7.36 |

| Reliance Industries Ltd | 5.78 |

| HDFC Bank Ltd | 5.07 |

| ICICI Bank Ltd | 4.93 |

| SBI ETF Nifty Bank | 4.33 |

| Tata Consultancy Services Ltd | 3.65 |

| Kotak Banking ETF - Dividend Payout Option | 3.60 |

| Larsen And Toubro Ltd | 3.17 |

| Hindustan Unilever Ltd | 2.40 |

| Bharti Airtel Ltd | 2.34 |

| Housing Development Finance Corp. Ltd | 2.00 |

| UltraTech Cement Ltd | 2.00 |

| Mahindra & Mahindra Ltd | 1.86 |

| Axis Bank Ltd | 1.63 |

| State Bank of India | 1.59 |

| ICICI Prudential Bank ETF Nifty Bank Index | 1.49 |

| Shree Cement Ltd | 1.38 |

| Bajaj Finance Ltd | 1.35 |

| Hindalco Industries Ltd | 1.33 |

| Asian Paints Ltd | 1.26 |

| Others | 36.91 |

| Corporate Debt | 0.05 |

| 4.25% HDFC Bank FD NSE - 09.08.2021 | 0.05 |

| MMI | 4.14 |

| NCA | 0.39 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.