Month Gone By – Markets (period ended February 26, 2021)

Equity markets finished February with modest gains recording a close of 3811 despite making

new all-time highs earlier in the month witnessing a all-time high of 3950.43 on February 16th.

While primarily, promises of fiscal stimulus from the White House, more vaccines getting into

arms, and a pledge by Federal Reserve Chairman Powell to keep interest rate lows to help support

the economic recovery gave investors the confidence they needed to invest in the stock market,

the sell off in yields on back of weaker auctions in the US, rising yield environment globally and

the convexity hedging phenomenon witnessed at the month end lead to a sell of in the equities.

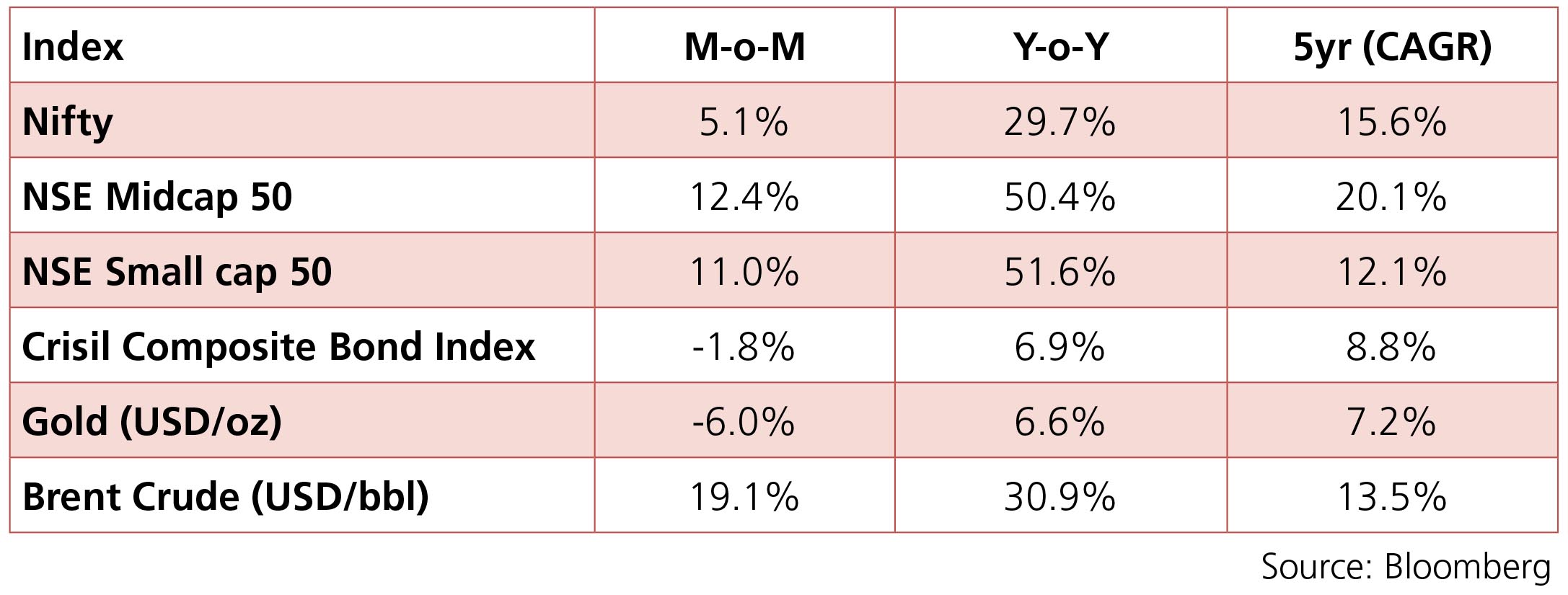

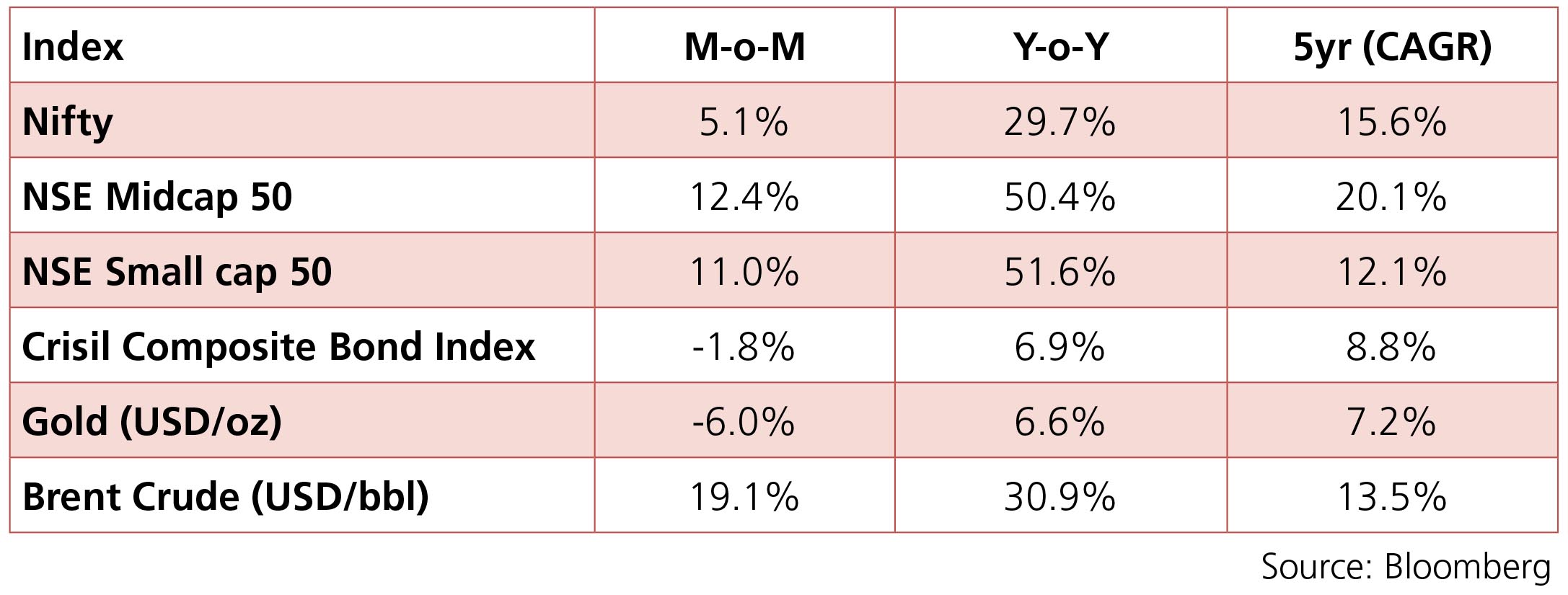

In line with global equities, Indian equities also saw a sharp rally in February, with Nifty recording ever highest ever levels of 15431 on February 16th eventually closing at 14529 at the close of the month. Amid volatile sessions, the BSE-30 and Nifty-50 indices gained 6.1% and 6.6%. The BSE Mid-cap. and BSE Small-cap. indices gained 10.5% and 12%. Among sector indices, the BSE metal index gained 24%, followed by power (+21%) and realty (-15%). SBI (+38%), ONGC (+26%) and IndusInd Bank (+26%) were the top gainers in the BSE-30 index while TCS (-7%), Hindustan Unilever (-6%) and Nestle India (-6%) were the top laggards. The month started on a positive note with the announcement of the Union Budget. Key benchmark indices gained 5% on February 1 as there was no change in tax rates, focus was on growth and increase in spending. Better-than-expected 3QFY21 results season also boosted investor sentiment. However, the market remained concerned about the sharp rise in bond yields and a sudden increase in Covid-19 cases in a few Indian states.

INR on an average traded at 72.70 against the dollar, while slipping at the month end and closed at 73.92 against the dollar on back of spike in US yields

In line with global equities, Indian equities also saw a sharp rally in February, with Nifty recording ever highest ever levels of 15431 on February 16th eventually closing at 14529 at the close of the month. Amid volatile sessions, the BSE-30 and Nifty-50 indices gained 6.1% and 6.6%. The BSE Mid-cap. and BSE Small-cap. indices gained 10.5% and 12%. Among sector indices, the BSE metal index gained 24%, followed by power (+21%) and realty (-15%). SBI (+38%), ONGC (+26%) and IndusInd Bank (+26%) were the top gainers in the BSE-30 index while TCS (-7%), Hindustan Unilever (-6%) and Nestle India (-6%) were the top laggards. The month started on a positive note with the announcement of the Union Budget. Key benchmark indices gained 5% on February 1 as there was no change in tax rates, focus was on growth and increase in spending. Better-than-expected 3QFY21 results season also boosted investor sentiment. However, the market remained concerned about the sharp rise in bond yields and a sudden increase in Covid-19 cases in a few Indian states.

INR on an average traded at 72.70 against the dollar, while slipping at the month end and closed at 73.92 against the dollar on back of spike in US yields

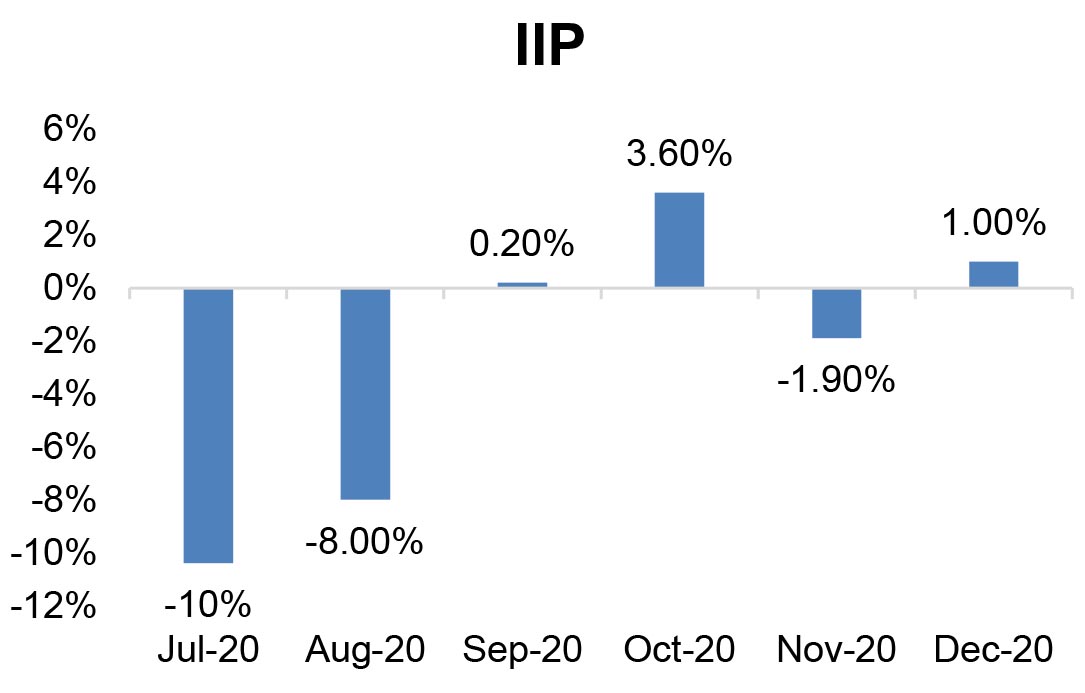

IIP: India’s factory output, which is measured in IIP witnessed a growth of 1% y-o-y (vs 0.4% in

December 2019) to 135.9 during the month of December 2020. The growth in IIP during December

last year is primarily on account of the electricity and manufacturing sectors. The mining sector saw

a contraction of -4.8% y-o-y to 115.1 in December. However, the manufacturing sector witnessed a

growth of 1.6% to 137.5 and the electricity sector rose 5.1% to 158.0, the MoSPI data showed.

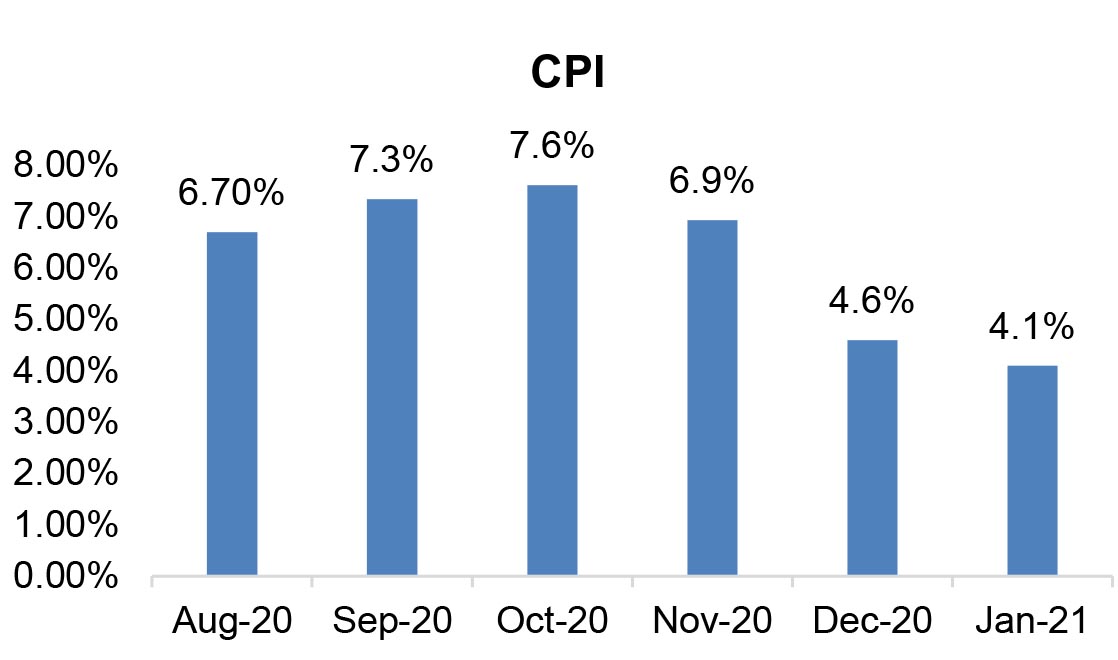

CPI: Headline CPI saw a decline at 4.06% compared to 4.59% for the month of December and 6.9% in November. The decline in retail inflation last month was mainly due to easing food prices. The Consumer Food Price Index (CFPI) eased to 1.89 per cent in the month of January, down from 3.41% in December 2020. The easing of the food basket was due to a fall in vegetable prices that slipped -15.84% y-o-y in January. Apart from vegetables, other key segments were however positive.

Trade Deficit: February trade deficit moderated to US$12.9Bn (US$14.5 bn in January). For 11MFY21, trade deficit stands at US$85Bn against US$151 bn in 11MFY20. Exports fell marginally by 0.3% in February to US$27.7Bn as against a growth of 6.2% in January; While imports rose 7% (2% in January) to US$40.6 bn, they fell by 3.4% on a sequential basis. Oil imports fell 17%, while non-oil imports rose 16% ((-)3.2% mom). Non-oil non-gold imports rose 6.1% (-8% m-o-m) to US$26.3Bn.

Fiscal Deficit: As of January end, India’s fiscal deficit widened to over Rs12.34Tn, ~67% of the revised annual target. The total receipts amounted to Rs12.83Tn at 80% of the estimated for the year vs 66% for the previous year. The ependiture recorded was at Rs25.2Tn at 73% of the annual estimatevs previous year recorded at 84% of the estimate recorded previous year.

GDP: India’s GDP growth moved back into positive territory, rising 0.4% y-o-y in Q4, from an upwardly revised -7.3% in Q3 (previously: -7.5%) and marginally below consensus of 0.6%. The improvement was broad-based and reflected the fast pace of normalization due to falling pandemic cases. In level terms, it is estimated that GDP is now back to its pre-pandemic level of Q4 2019, although this was depressed due to the cyclical slowdown prior to the pandemic.

CPI: Headline CPI saw a decline at 4.06% compared to 4.59% for the month of December and 6.9% in November. The decline in retail inflation last month was mainly due to easing food prices. The Consumer Food Price Index (CFPI) eased to 1.89 per cent in the month of January, down from 3.41% in December 2020. The easing of the food basket was due to a fall in vegetable prices that slipped -15.84% y-o-y in January. Apart from vegetables, other key segments were however positive.

Trade Deficit: February trade deficit moderated to US$12.9Bn (US$14.5 bn in January). For 11MFY21, trade deficit stands at US$85Bn against US$151 bn in 11MFY20. Exports fell marginally by 0.3% in February to US$27.7Bn as against a growth of 6.2% in January; While imports rose 7% (2% in January) to US$40.6 bn, they fell by 3.4% on a sequential basis. Oil imports fell 17%, while non-oil imports rose 16% ((-)3.2% mom). Non-oil non-gold imports rose 6.1% (-8% m-o-m) to US$26.3Bn.

Fiscal Deficit: As of January end, India’s fiscal deficit widened to over Rs12.34Tn, ~67% of the revised annual target. The total receipts amounted to Rs12.83Tn at 80% of the estimated for the year vs 66% for the previous year. The ependiture recorded was at Rs25.2Tn at 73% of the annual estimatevs previous year recorded at 84% of the estimate recorded previous year.

GDP: India’s GDP growth moved back into positive territory, rising 0.4% y-o-y in Q4, from an upwardly revised -7.3% in Q3 (previously: -7.5%) and marginally below consensus of 0.6%. The improvement was broad-based and reflected the fast pace of normalization due to falling pandemic cases. In level terms, it is estimated that GDP is now back to its pre-pandemic level of Q4 2019, although this was depressed due to the cyclical slowdown prior to the pandemic.

Deal activity picked up in February with 11

deals worth ~$1.7bn being executed (vs 8 deals

worth ~$1.5bn in January), key deals being

Brookfield REIT’s IPO (~$523mn), Advent’s stake

sale in Crompton (~$205mn) and Indiamart’s

QIP ($148mn).

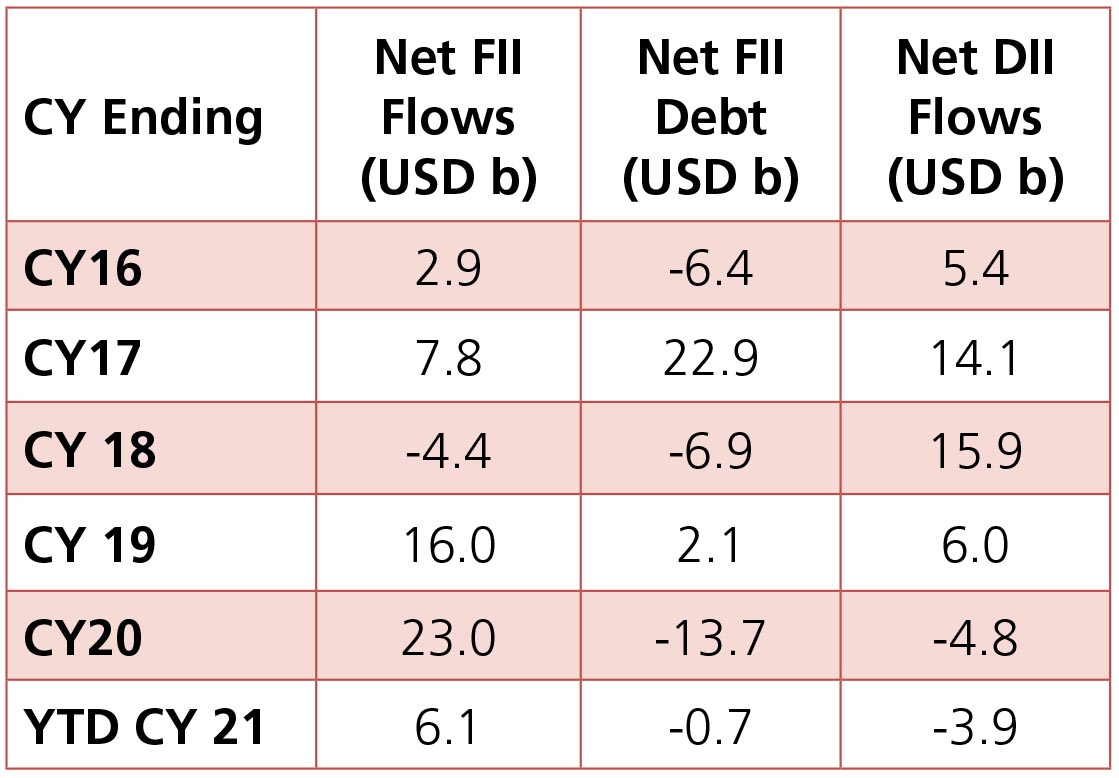

FII buying accelerated post the budget with net inflows of ~$3bn seen in February (vs net inflows of ~$2bn in Jan). DIIs continued to remain net sellers to the tune of ~$2.3bn, with a large part of it coming from the Domestic Mutual Funds

FII buying accelerated post the budget with net inflows of ~$3bn seen in February (vs net inflows of ~$2bn in Jan). DIIs continued to remain net sellers to the tune of ~$2.3bn, with a large part of it coming from the Domestic Mutual Funds