Individual Fund

Pension Balanced Fund II

(ULIF-046-24/01/10-PNBALFND2-107)

Monthly Update March 2021

|

AS ON 26th February 2021 |

Aims for moderate growth by holding a diversified mix of equities and fixed interest instruments.

Date of Inception

24th January 2010

AUM (in Lakhs)

46.64

NAV

28.1816

Fund Manager

Equity : Hemant Kanawala

Debt : Gajendra Manavalan

Debt : Gajendra Manavalan

Benchmark Details

Equity - 60% (BSE 100);

Debt - 40% (Crisil Composite Bond)

Modified Duration

Debt & Money

Market Instruments : 1.30

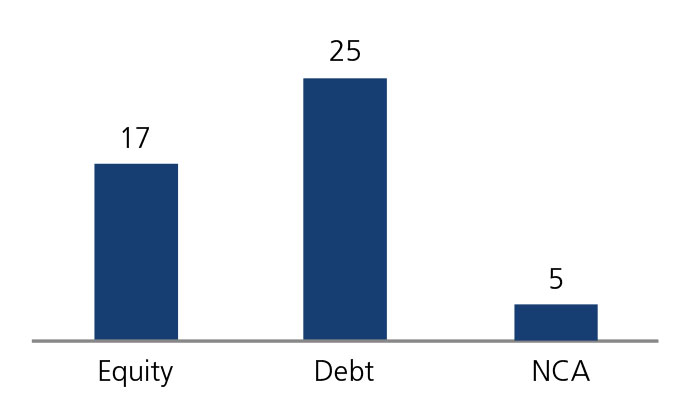

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 30 - 60 | 36 |

| Gsec / Debt | 20 - 70 | 32 |

| MMI / Others | 00 - 40 | 32 |

Performance Meter

| Pension Balanced Fund II (%) | Benchmark (%) | |

| 1 month | 2.0 | 3.3 |

| 3 months | 4.5 | 6.9 |

| 6 months | 10.9 | 17.0 |

| 1 year | 15.4 | 21.8 |

| 2 years | 12.1 | 14.3 |

| 3 years | 9.1 | 10.7 |

| 4 years | 9.5 | 11.1 |

| 5 years | 12.0 | 13.3 |

| 6 years | 8.4 | 8.9 |

| 7 years | 12.0 | 12.0 |

| 10 years | 10.4 | 10.1 |

| Inception | 9.8 | 9.5 |

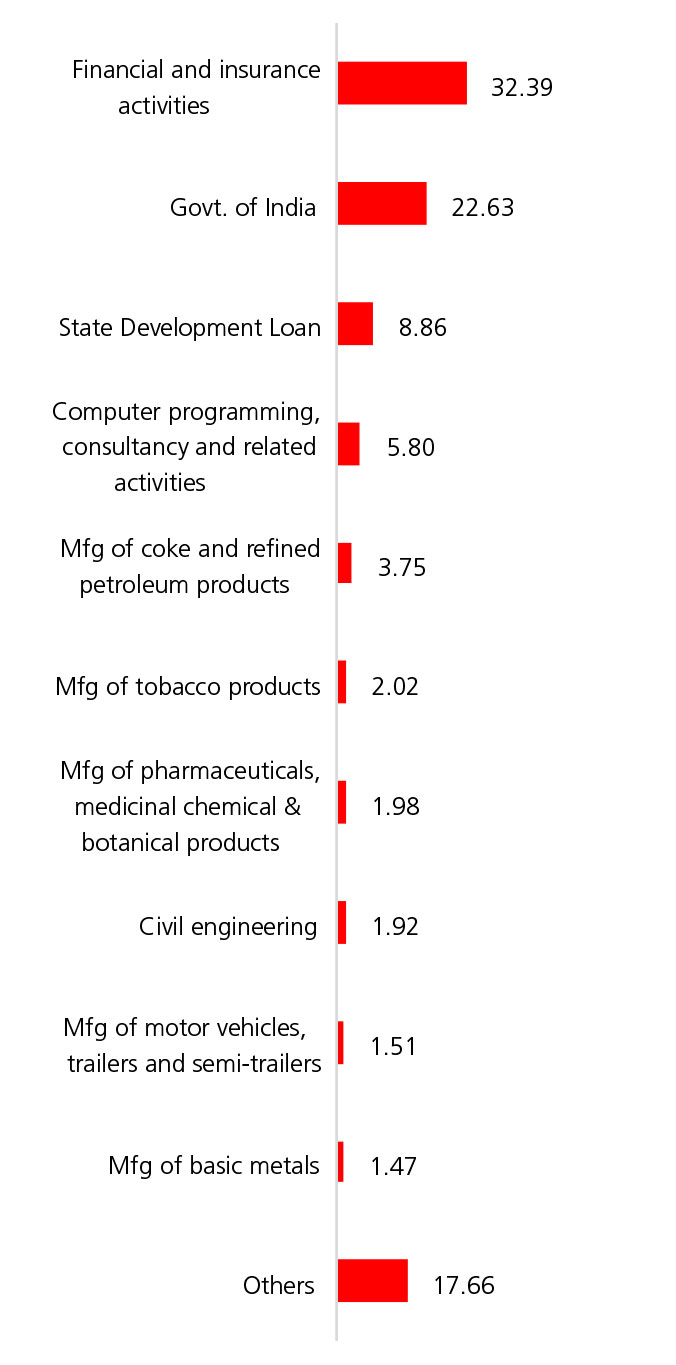

| Holdings | % to Fund |

| Equity | 36.37 |

| Infosys Ltd | 3.14 |

| Reliance Industries Ltd | 3.00 |

| HDFC Bank Ltd | 2.73 |

| Kotak Banking ETF - Dividend Payout Option | 2.61 |

| ICICI Bank Ltd | 2.54 |

| Tata Consultancy Services Ltd | 2.11 |

| I T C Ltd | 2.02 |

| Larsen And Toubro Ltd | 1.92 |

| Axis Bank Ltd | 1.86 |

| UltraTech Cement Ltd | 1.44 |

| Bharti Airtel Ltd | 1.25 |

| Titan Industries Ltd | 1.15 |

| Dr Reddys Laboratories Ltd | 1.14 |

| Bajaj Finance Ltd | 1.13 |

| Asian Paints Ltd | 1.12 |

| Maruti Suzuki India Ltd | 1.03 |

| Hindalco Industries Ltd | 1.00 |

| Cipla Ltd | 0.84 |

| Britannia Industries Ltd | 0.79 |

| HCL Technologies Ltd | 0.55 |

| Others | 2.99 |

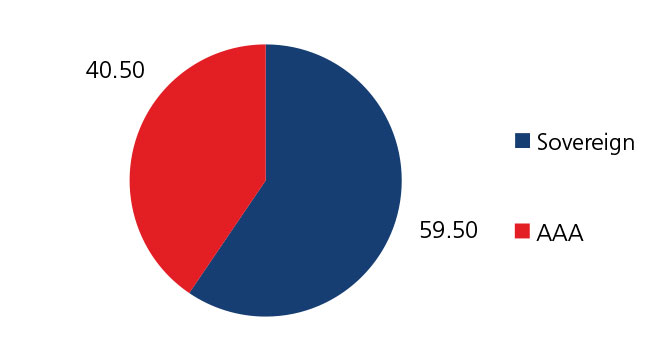

| G-Sec | 31.49 |

| 8.15% GOI FCI Bonds - 16.10.22 | 11.29 |

| 1.44% INFLATION INDEX GS 2023 | 7.44 |

| 8.30% Fertilizer Co GOI - 07.12.23 | 0.83 |

| 8.68% TN SDL - 26.05.2021 | 0.50 |

| 9.72% PN SDL - 28.08.2023 | 0.49 |

| 9.39% GJ SDL - 20.11.2023 | 0.47 |

| 8.72% TN SDL -19.09.2026 | 0.40 |

| 6.65% Fertilizer Co GOI - 29.01.2 | 0.38 |

| 8.84% PN SDL - 11.06.2024 | 0.37 |

| 9.69% PN SDL - 12.02.2024 | 0.36 |

| Others | 8.95 |

| Corporate Debt | 0.08 |

| 4.25% HDFC Bank FD NSE - 09.08.2021 | 0.08 |

| MMI | 21.44 |

| NCA | 10.62 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.