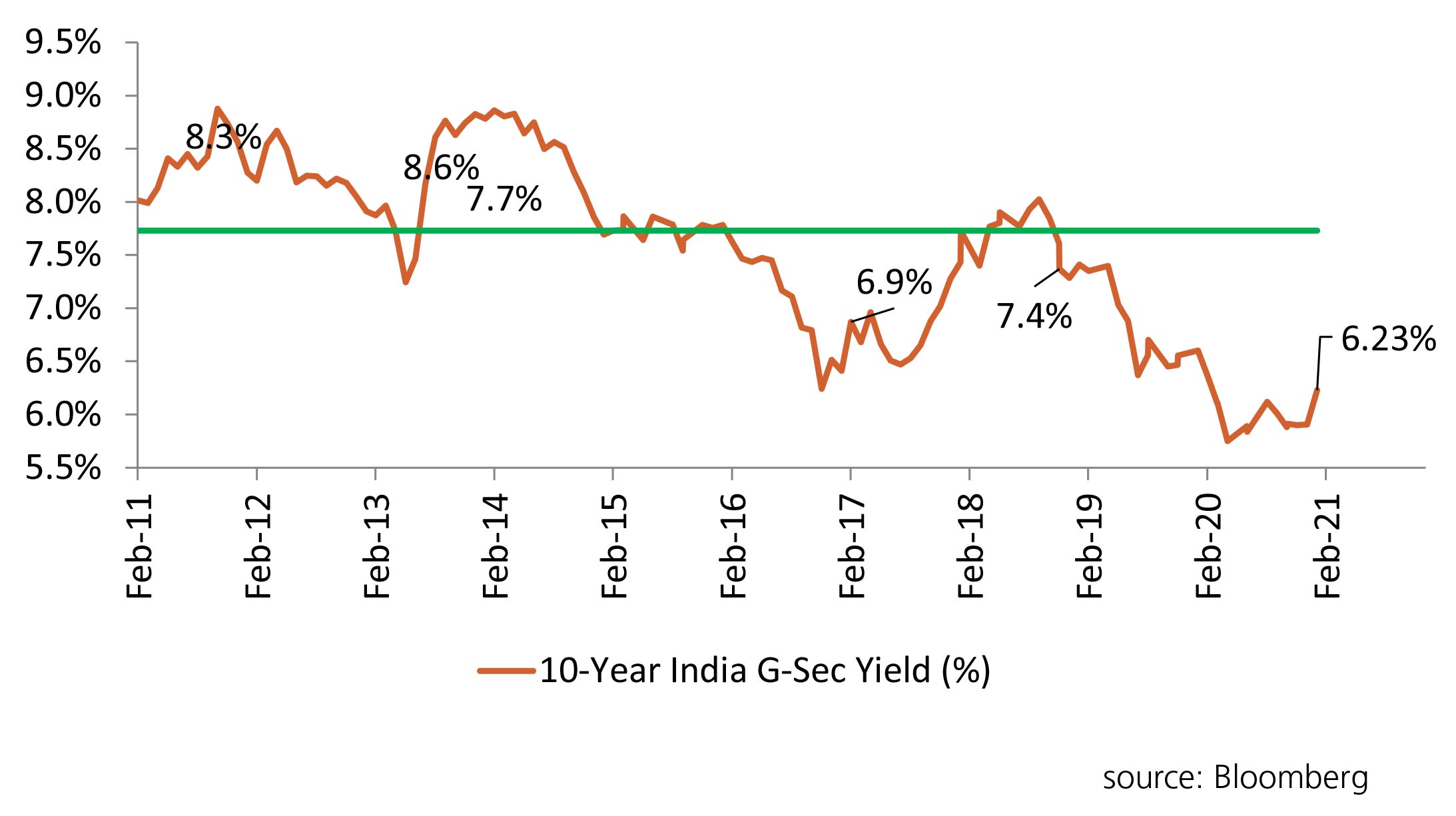

It has been a slippery ride for yields post budget with yields on 10Y Benchmark spiking from 5.91% as on January 29th to 6.23% on February 26th. The expansionary nature of the budget, borrowing for FY 2021-22 at Rs9.1Tn and an overall increase in the yields globally on the back of covid vaccines and positive economic outlook sent the yields spiralling downwards. The weak demand in the auctions as investors demanded an increase in yield leading to a bout of cancelled auctions and devolvement on Primary Dealers only aggravated the situation as the Central Bank sought a cooperative solution from the market to meet the government’s fiscal expansion.

The spreads of AAA PSUs widened to an almost 90 bps vs the benchmark in annualized terms, whereas AAA NBFCs traded at almost 100-105 bps vs the benchmark. The spread has witnessed a widening by almost 30-40 bps over the month as the overall atmosphere towards the yields remained skeptical.

Given this backdrop, the 10 year benchmark G-sec could trade in the range of 6.20%-6.30% in the near future, with a slightly bullish outlook as the yields should broadly stabilize at current levels given softening inflation outlook and year end valuations phenomenon kicking in towards end of March.