Global equity markets were volatile after negative news around yen carry trade unwinding, US recession

and geopolitical tensions rattled sentiment in early August. However, risky assets made a comeback

post BOJ Deputy Governor Uchida’s commentary and the Fed’s dovish commentary at the Jackson Hole

address. Nifty 50 ended the volatile month at 25,236 (+1.1%), while it touched a record high of 25,270.

India 10-year G-Sec yield averaged at 6.87% in August (lower than the July average of 6.97%). On monthend

values, the 10Y yield was lower and ended the month at 6.86% (down 6 bps). The US 10Y yield is at

3.90% (lower by 13 bps from last month). INR depreciated marginally by 0.2% over the month and ended

the month at 83.87/USD. Oil prices moved down by 1.9% in August, following a dip of 6.0% in July. Brent

currently trades at ~$75 per barrel having ended at ~$81.5/barrel in July.

Financial market volatility on account of monetary policy divergence remains a threat to global economic growth. While the Fed has signaled its willingness to normalize policy from September, Bank of Japan hiked interest rates last month in response to a weaker yen. Incoming data from the US has been soft and has sparked fears of a recession in the US, stoking a widespread sell-off and unleashing a global unwinding of high risk trade. On the macro front so far, the manufacturing sector is experiencing a slowdown, but services activity continues to hold up. Prices are also starting to moderate for services even though inflation still remains above central bank targets across major economies.

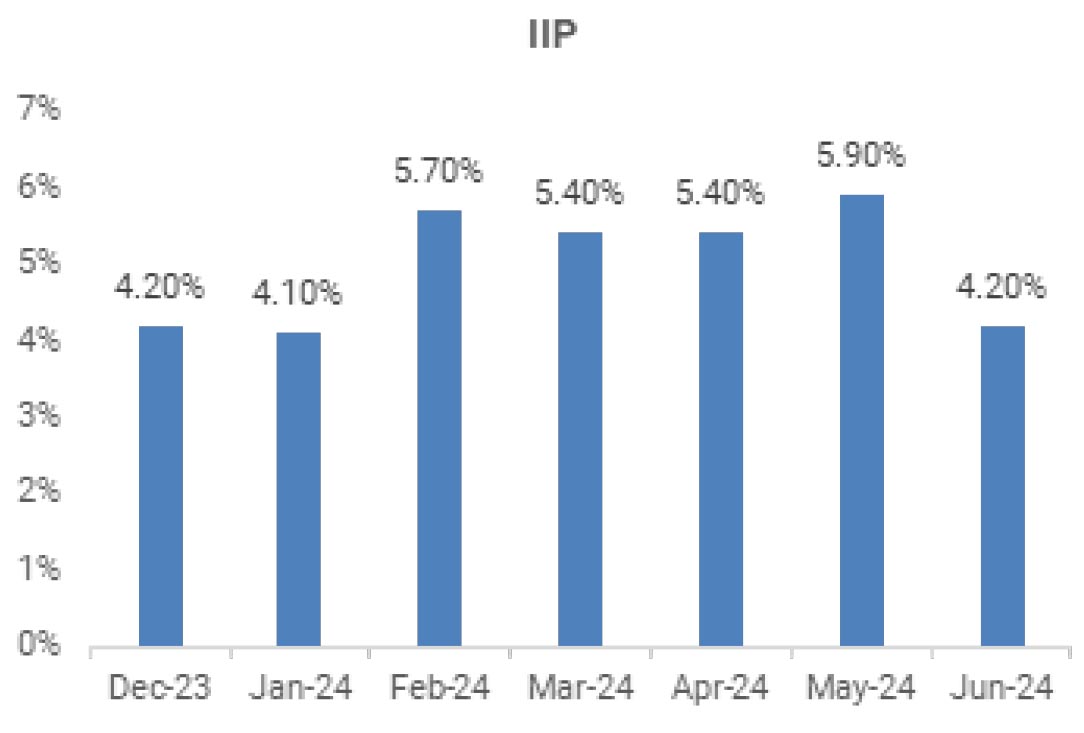

The Indian economy continues to continues to record strong PMI readings. While high-frequency indicators show stable growth in the near term, adverse base effects and continued consumption weakness are likely to weigh on growth. Investment will remain the key growth driver, though the impetus from the government will moderate. An above-normal monsoon and modest improvement in rural demand could add to the growth prospects. With solid support from growth prospects, the RBI will continue to have space to focus on pushing inflation toward the 4% target.

Financial market volatility on account of monetary policy divergence remains a threat to global economic growth. While the Fed has signaled its willingness to normalize policy from September, Bank of Japan hiked interest rates last month in response to a weaker yen. Incoming data from the US has been soft and has sparked fears of a recession in the US, stoking a widespread sell-off and unleashing a global unwinding of high risk trade. On the macro front so far, the manufacturing sector is experiencing a slowdown, but services activity continues to hold up. Prices are also starting to moderate for services even though inflation still remains above central bank targets across major economies.

The Indian economy continues to continues to record strong PMI readings. While high-frequency indicators show stable growth in the near term, adverse base effects and continued consumption weakness are likely to weigh on growth. Investment will remain the key growth driver, though the impetus from the government will moderate. An above-normal monsoon and modest improvement in rural demand could add to the growth prospects. With solid support from growth prospects, the RBI will continue to have space to focus on pushing inflation toward the 4% target.

MPC: The RBI MPC continued to vote with a 4-2 majority to hold the repo rate at 6.5% and retained stance

at withdrawal of accommodation (Dr Varma and Dr Goyal voted for a 25-bps cut and a change in stance

to neutral). The RBI continued to focus on the primary task of inflation management even as expectations

built up for some response to the recent global financial market volatility. The tone was slightly more

hawkish than the June policy, with food inflation risks dominating the outlook. The MPC retained its

FY2025 real GDP growth estimate at 7.2% while reducing its 1QFY25 growth estimate by 20 bps to 7.1%.

The MPC retained its FY2025 headline inflation projection at 4.5% while increasing the 2QFY25 inflation

estimate by 60 bps to 4.4% and making some changes to the rest of the year profile.

GDP: In Q1FY25, GDP growth was recorded at 6.7% YoY, compared to 7.8% in Q4FY24. The moderation in the pace of growth concealed positive internal developments, with private consumption showing signs of recovery following a lackluster FY24. Private consumption growth improved to 7.4% YoY in Q1FY25 from 4.0% in Q4FY24. This improvement is believed to have been driven by both rural and urban demand. Investment also experienced a pickup in Q1FY25, despite a substantial slowdown in government capital expenditure. The softer headline GDP growth was attributed to a negative contribution from discrepancies.

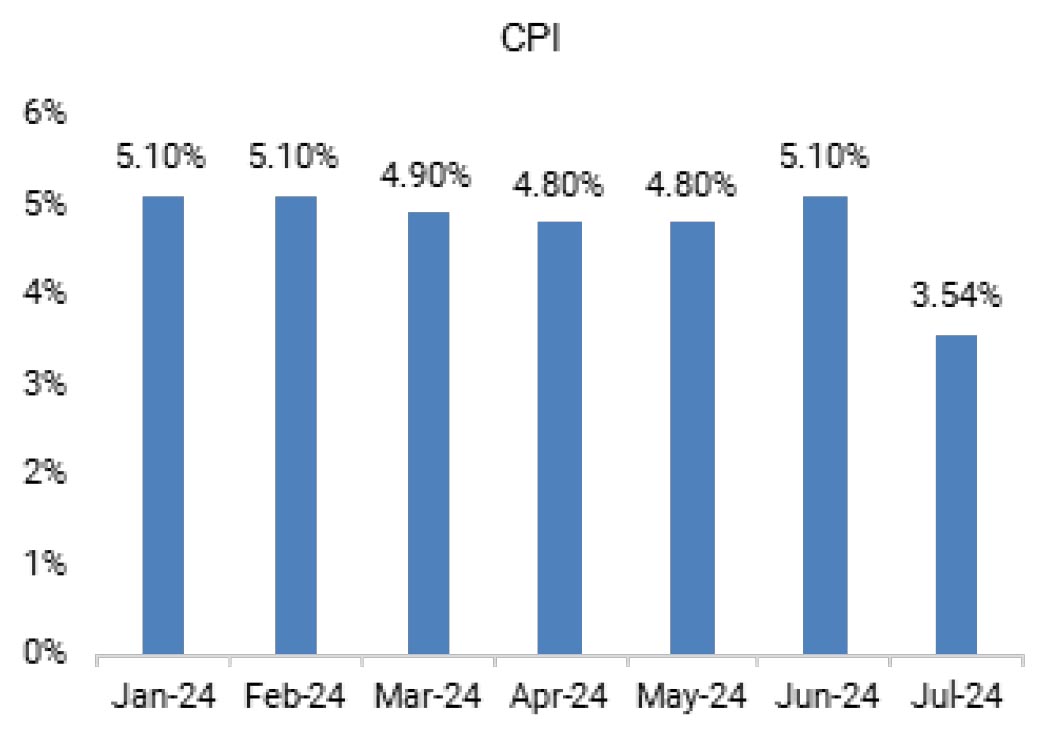

CPI: India’s CPI inflation in July dropped to 3.54% YoY from 5.08% in June, driven by favorable base effects. However, on a month-on-month basis, headline inflation rose by 1.42%, the highest increase in a year, largely due to a 2.47% MoM rise in food and beverages inflation, which was significantly influenced by a 14.1% MoM increase in the prices of vegetables. Core CPI inflation, excluding tobacco, reversed its downtrend, rising to 3.4% YoY in July compared to the last three-month average of 3.16%, reflecting the impact of increased telecom tariff hikes.

Trade: Merchandise trade deficit rose to a nine-month high in July to US$23.5bn from US$21bn deficit in June, led by decline in exports (-US$1.2bn M-o-M) and rise in non-oil non-gold imports (US$2.4bn M-o-M). The decline in exports was led by engineering goods, gems and jewellery and crude oil. Meanwhile, the rise in non-oil non-gold imports was led by electronic goods imports. Crude oil imports were lower by US$1.2bn M-o-M, reflecting lower volumes and lower crude oil prices (in June). On a FYTD basis, trade deficit has widened to US$85.6bn in FYTD25 (Apr-July) v/s US$75bn deficit in FYTD24 (Apr-July).

GDP: In Q1FY25, GDP growth was recorded at 6.7% YoY, compared to 7.8% in Q4FY24. The moderation in the pace of growth concealed positive internal developments, with private consumption showing signs of recovery following a lackluster FY24. Private consumption growth improved to 7.4% YoY in Q1FY25 from 4.0% in Q4FY24. This improvement is believed to have been driven by both rural and urban demand. Investment also experienced a pickup in Q1FY25, despite a substantial slowdown in government capital expenditure. The softer headline GDP growth was attributed to a negative contribution from discrepancies.

CPI: India’s CPI inflation in July dropped to 3.54% YoY from 5.08% in June, driven by favorable base effects. However, on a month-on-month basis, headline inflation rose by 1.42%, the highest increase in a year, largely due to a 2.47% MoM rise in food and beverages inflation, which was significantly influenced by a 14.1% MoM increase in the prices of vegetables. Core CPI inflation, excluding tobacco, reversed its downtrend, rising to 3.4% YoY in July compared to the last three-month average of 3.16%, reflecting the impact of increased telecom tariff hikes.

Trade: Merchandise trade deficit rose to a nine-month high in July to US$23.5bn from US$21bn deficit in June, led by decline in exports (-US$1.2bn M-o-M) and rise in non-oil non-gold imports (US$2.4bn M-o-M). The decline in exports was led by engineering goods, gems and jewellery and crude oil. Meanwhile, the rise in non-oil non-gold imports was led by electronic goods imports. Crude oil imports were lower by US$1.2bn M-o-M, reflecting lower volumes and lower crude oil prices (in June). On a FYTD basis, trade deficit has widened to US$85.6bn in FYTD25 (Apr-July) v/s US$75bn deficit in FYTD24 (Apr-July).

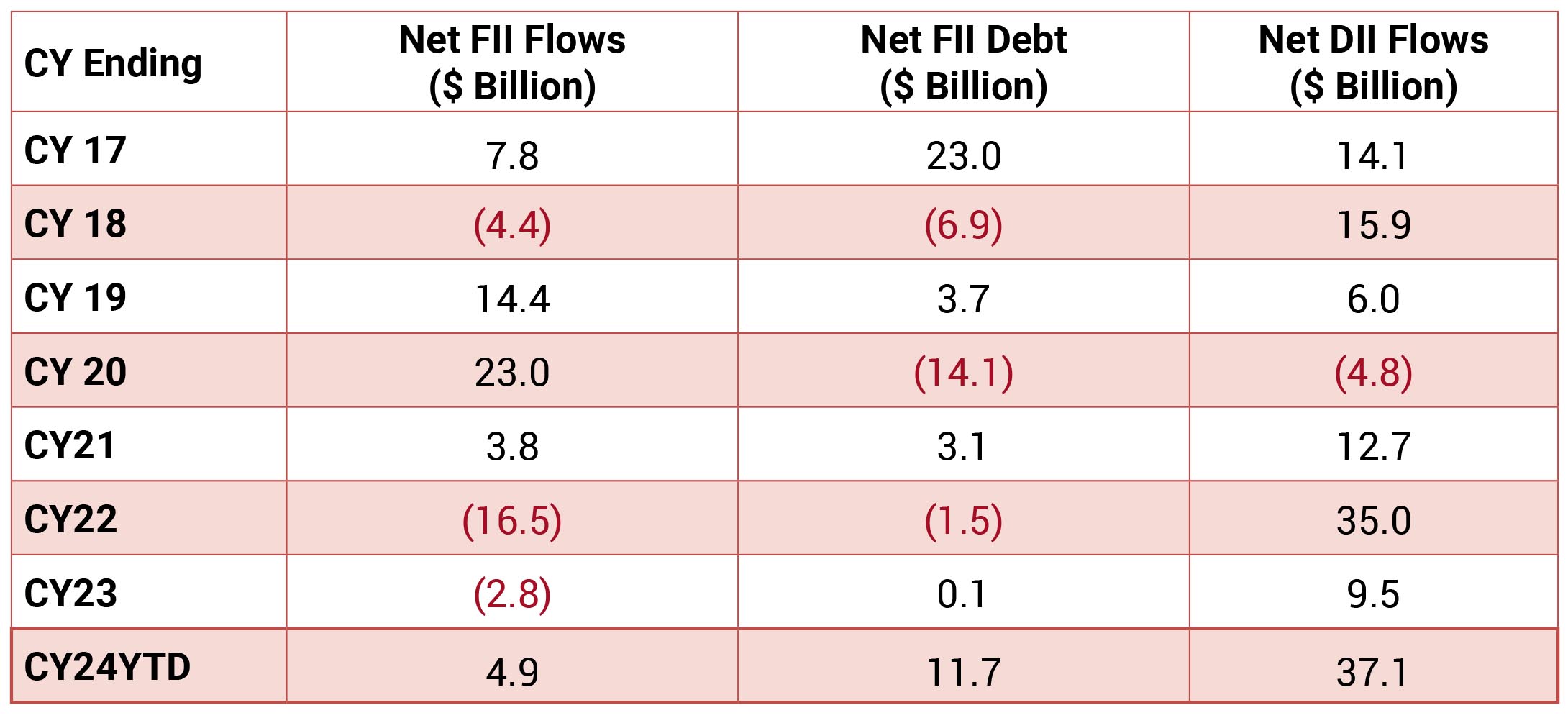

FIIs ended the month with a net buying of $1.2bn (after a net buying of $3.3 bn in July).

We now stand at ~$4.9bn of FII inflows YTD. FIIs were buyers in the debt market at $1.9bn

(following a buying of $2.6bn in Jul).

Deal flow was strong in August with reported 68 deals worth ~$6.7 billion executed. Key deals included Adani Energy Solutions Limited ($ 996mn) and OLA Electric Mobility Ltd ($731mn).

FIIs brought in the month of August 2024 to the tune of $2.2bn and DIIs remained net buyers to the tune of $5.7bn.

Deal flow was strong in August with reported 68 deals worth ~$6.7 billion executed. Key deals included Adani Energy Solutions Limited ($ 996mn) and OLA Electric Mobility Ltd ($731mn).

FIIs brought in the month of August 2024 to the tune of $2.2bn and DIIs remained net buyers to the tune of $5.7bn.