Individual Fund

Kotak Pension Opportunities Fund

(ULIF-032-17/07/09-PNOPPFND-107)

MONTHLY UPDATE SEPTEMBER 2024

|

AS ON 30TH August 2024 |

Aims to maximize opportunity for long term capital growth by holding significant portions in a diversified and flexible mix of large/medium sized

stocks

Date of Inception

17th July 2009

AUM (in Lakhs)

151.22

NAV

58.3346

Fund Manager

Equity : Hemant Kanawala

Debt :Manoj Bharadwaj

Debt :Manoj Bharadwaj

Benchmark Details

Equity - 100% (BSE 200)

Modified Duration

Debt & Money Market Instruments : 0.01

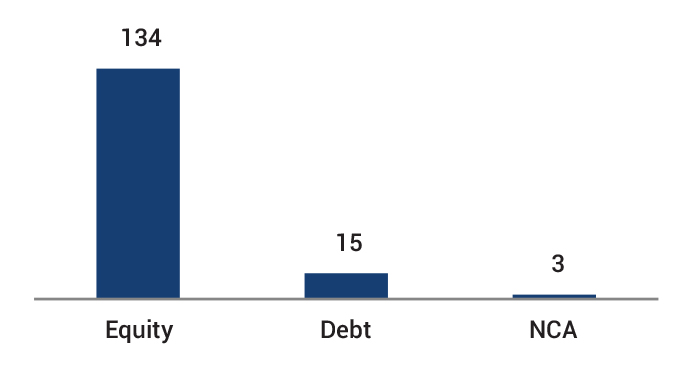

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 75 - 100 | 88 |

| Gsec / Debt | 00 - 25 | 0 |

| MMI / Others | 00 - 25 | 12 |

Performance Meter

| Pension Opportunities Fund (%) | Benchmark (%) | |

| 1 month | 1.0 | 0.9 |

| 3 months | 9.8 | 12.0 |

| 6 months | 13.2 | 17.3 |

| 1 year | 28.3 | 38.5 |

| 2 years | 18.2 | 22.4 |

| 3 years | 13.1 | 16.5 |

| 4 years | 19.2 | 24.9 |

| 5 years | 16.4 | 20.4 |

| 6 years | 12.2 | 15.0 |

| 7 years | 11.9 | 15.2 |

| 10 years | 12.6 | 13.7 |

| Inception | 12.4 | 13.0 |

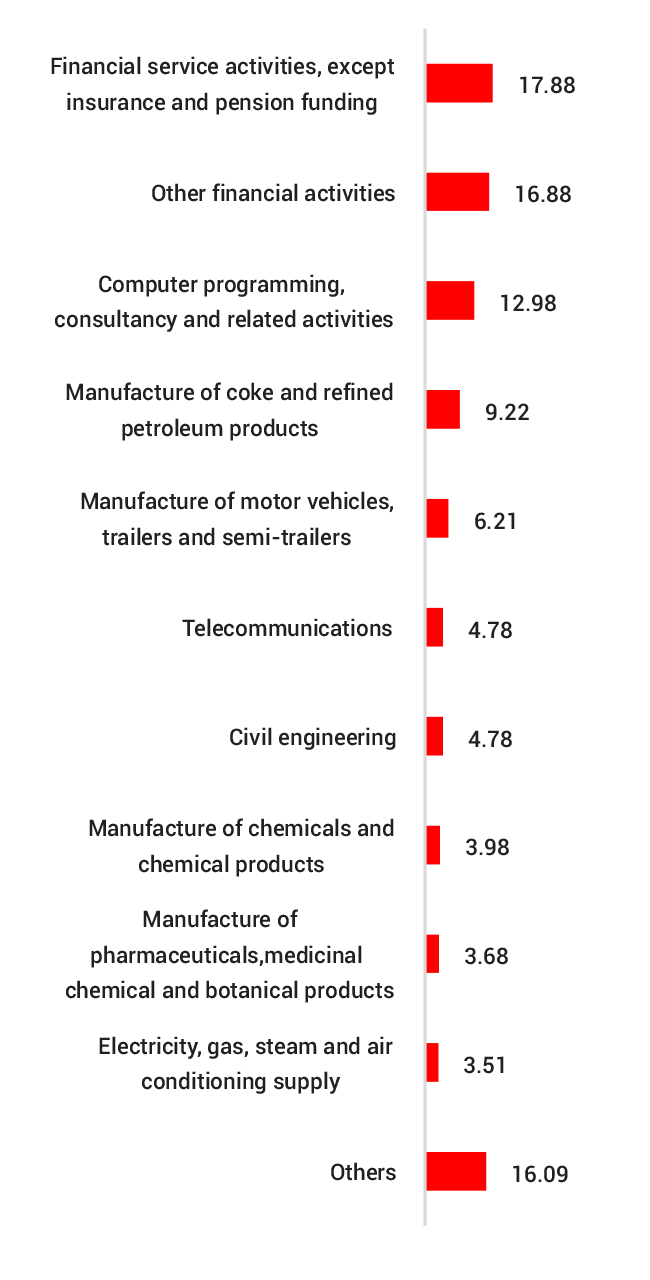

| Holdings | % to Fund |

| Equity | 88.39 |

| Reliance Industries Ltd | 8.01 |

| ICICI Bank Ltd. | 7.58 |

| Infosys Ltd. | 6.31 |

| HDFC Bank Ltd. | 5.16 |

| Bharti Airtel Ltd. | 4.78 |

| Larsen And Toubro Ltd. | 4.78 |

| Tata Consultancy Services Ltd. | 4.13 |

| National Thermal Power Corporation Ltd | 3.51 |

| Mahindra & Mahindra Ltd | 3.51 |

| SBI ETF Nifty Bank | 3.47 |

| Maruti Suzuki India Ltd | 2.71 |

| Hindustan Unilever Ltd | 2.68 |

| UltraTech Cement Ltd. | 2.54 |

| ICICI Prudential Bank ETF Nifty Bank Index | 2.45 |

| Titan Industries Ltd | 2.19 |

| Hindalco Industries Ltd. | 2.05 |

| Axis Bank Ltd. | 2.02 |

| State Bank of India. | 1.93 |

| Cipla Ltd. | 1.92 |

| Dr Reddys Laboratories Ltd. | 1.77 |

| Others | 14.90 |

| MMI | 9.92 |

| NCA | 1.69 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.