● Market continues to scale new peaks: India market remained strong and continued its upward journey, led by domestic liquidity and positive FII flows. India market cap touched an all-time high of USD5.5t (INR466t). Concerns build around unexpected election verdict, budget announcements by the Government, weak global growth and geopolitical concerns, could not disturb the structural growth opportunity that India provides.

● Fed seen poised for September rate cut as inflation cools: Fed Chair Jerome Powell said last week that “the time has come” to cut rates, after a battle with decades-high inflation that saw the U.S. central bank raising rates aggressively in 2022 and 2023. It has kept its policy rate in the 5.25%-5.50% range since last July. The further cooling of inflation could give the Fed leeway to be more aggressive with rate declines at coming meetings, especially if the labor market shows a steep deterioration.

● Capex, manufacturing and infra themes continue to remain under focus: The Government once again refrained populism and continued on the path of fiscal consolidation and capex push. Government returning to power for the third consecutive term and no major change in spending stance, the underlying themes/sector that had remained under focus earlier would continue going ahead as well. Hence, Infrastructure development, defence, manufacturing push and capex will remain under focus.

● GST collections grew 10% YoY in Aug’24: Goods and Services Tax (GST) collections in Aug’24 went up by 10% from the same period last year to INR1.74t vs. INR1.59t in the same period last year. Overall, the government has collected GST of INR9.1t (10.1% YoY) in FY25YTD. It means that GST collections have averaged INR1.82t per month in FY25YTD, compared to the budgeted estimate of INR1.88t per month.

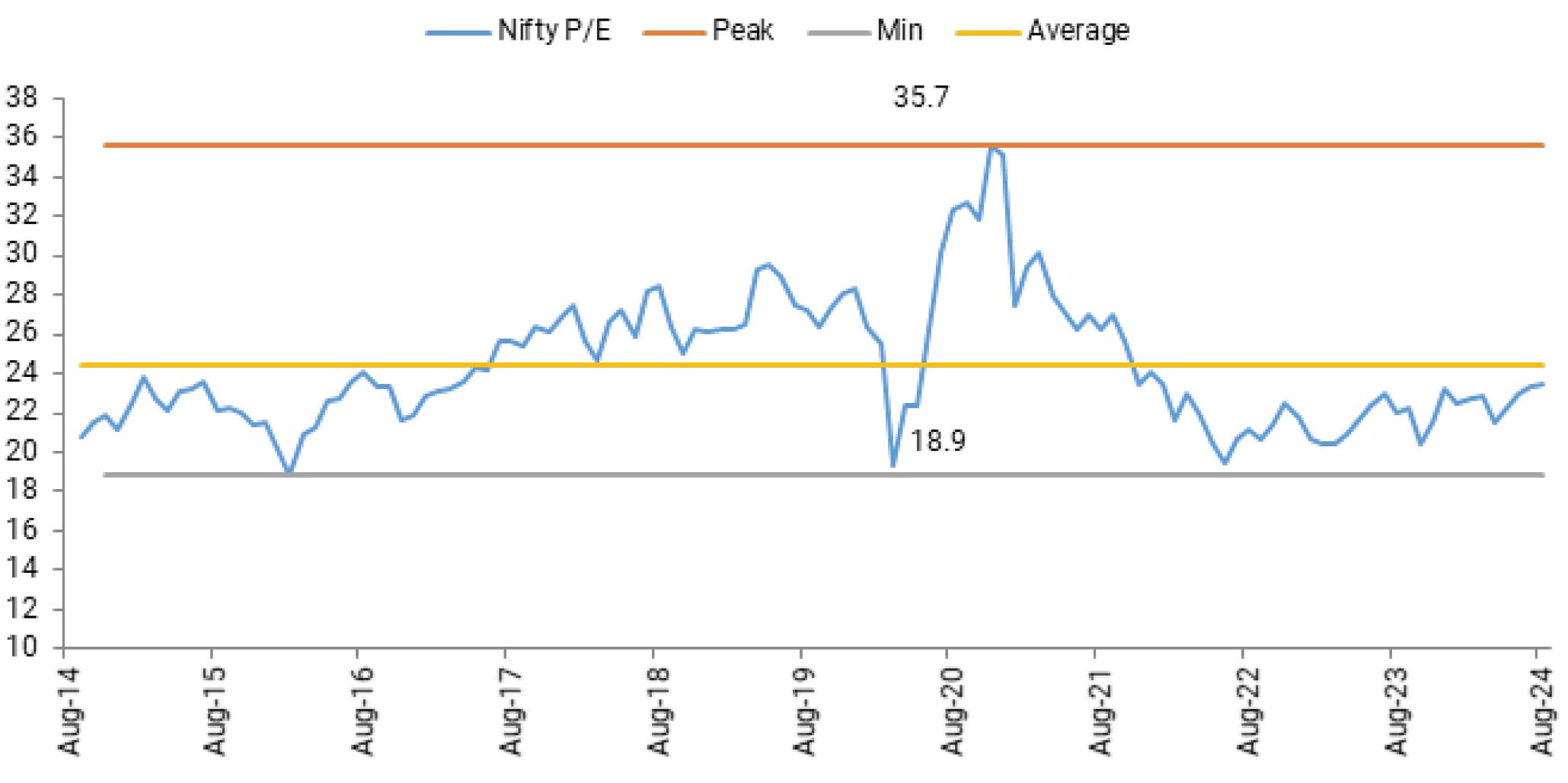

● Outlook: Government stability and the recent Union budget further bolsters India’s strong macro-micro positioning amid concern on the global economy growth. The combination of ~7%+ GDP growth and mid teen Nifty earnings CAGR in FY24-26, stable currency, moderating inflation, both current account and fiscal deficits well within tolerance band, stable currency, and buoyant retail participation should continue to keep capital markets strong. We maintain our positive stance for Indian equities.