Group Fund

Kotak Group Short Term Bond Fund

(ULGF-018-18/12/13-SHTRMBND-107)

Monthly Update January 2022

|

AS ON 31st December 2021 |

Will generate stable returns through investments in a suitable mix of debt and money market instruments.

Date of Inception

19th October 2015

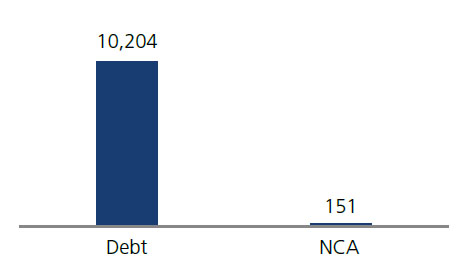

AUM (in Lakhs)

10,355.16

NAV

14.9700

Fund Manager

Debt : Gajendra Manavalan

Benchmark Details

100%-CRISIL Short Term Bond Fund Index

Modified Duration

Debt & Money

Market Instruments : 1.71

Asset Allocation

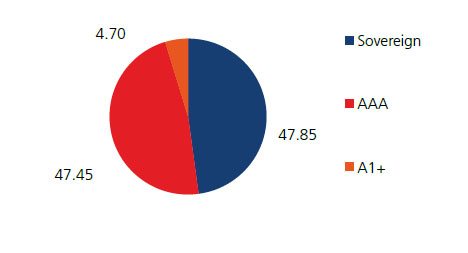

| Approved (%) | Actual (%) | |

| Gsec | 00 - 50 | 47 |

| Debt | 25 - 75 | 37 |

| MMI / Others | 10 - 75 | 15 |

Performance Meter

| Kotak Group Short Term Bond Fund (%) | Benchmark (%) | |

| 1 month | -0.1 | 0.2 |

| 3 months | 0.2 | 0.9 |

| 6 months | 1.9 | 2.5 |

| 1 year | 2.6 | 4.4 |

| 2 years | 5.4 | 7.4 |

| 3 years | 6.5 | 8.1 |

| 4 years | 6.4 | 7.7 |

| 5 years | 6.3 | 7.4 |

| 6 years | 6.8 | 7.8 |

| 7 years | n.a | n.a |

| 10 years | n.a | n.a |

| Inception | 6.7 | 7.7 |

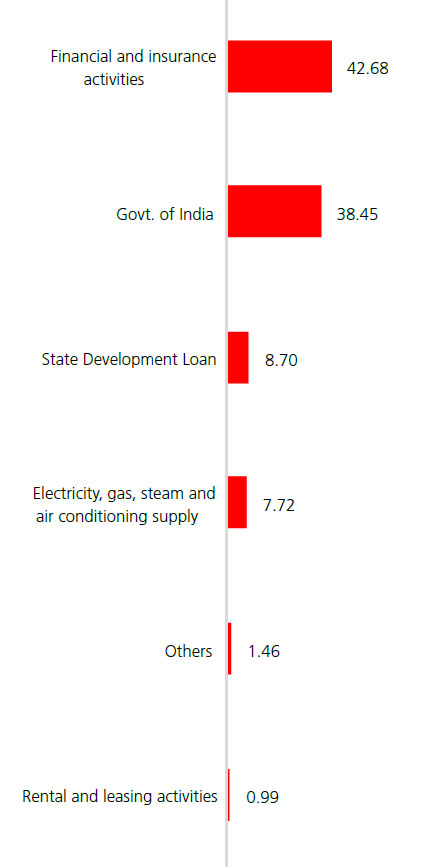

| Holdings | % to Fund |

| G-Sec | 47.15 |

| GOI FRB - 22.09.2033 | 20.62 |

| 5.63% GOI - 12.04.2026 | 7.20 |

| 7.17% GOI - 08.01.2028 | 5.04 |

| 7.59% GOI - 11.01.2026 | 4.11 |

| 9.50% GJ SDL - 11.09.2023 | 2.07 |

| 6.65% Fertilizer Co GOI - 29.01.23 | 1.48 |

| 9.69% PN SDL - 12.02.2024 | 1.05 |

| 8.90% KA SDL - 19.12.2022 | 1.00 |

| 9.17% PN SDL - 11.04.2022 | 0.98 |

| 7.20% MH SDL -09.08.2027 | 0.96 |

| Others | 2.64 |

| Corporate Debt | 37.44 |

| 7.35% Bajaj Finance Ltd - 10.11.2022 | 7.93 |

| 5.45% NTPC - 15.10.2025 | 7.72 |

| 9.05% HDFC - 20.11.2023 | 5.13 |

| 5.32% NHB - 01.09.2023 | 4.88 |

| 5.10% Sundaram Finance - 01.12.2023 | 2.90 |

| 5.78% HDFC - 25.11.2025 | 1.92 |

| 7.25% HDFC - 17.06.2030 | 1.72 |

| 9.25% LIC Housing Finance - 12.11.2022 | 1.20 |

| 7.70% REC - 10.12.2027 | 1.03 |

| 10.08% IOT Utkal Energy Services Limited - 20.03.2022 | 0.99 |

| Others | 2.02 |

| MMI | 13.95 |

| NCA | 1.46 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.