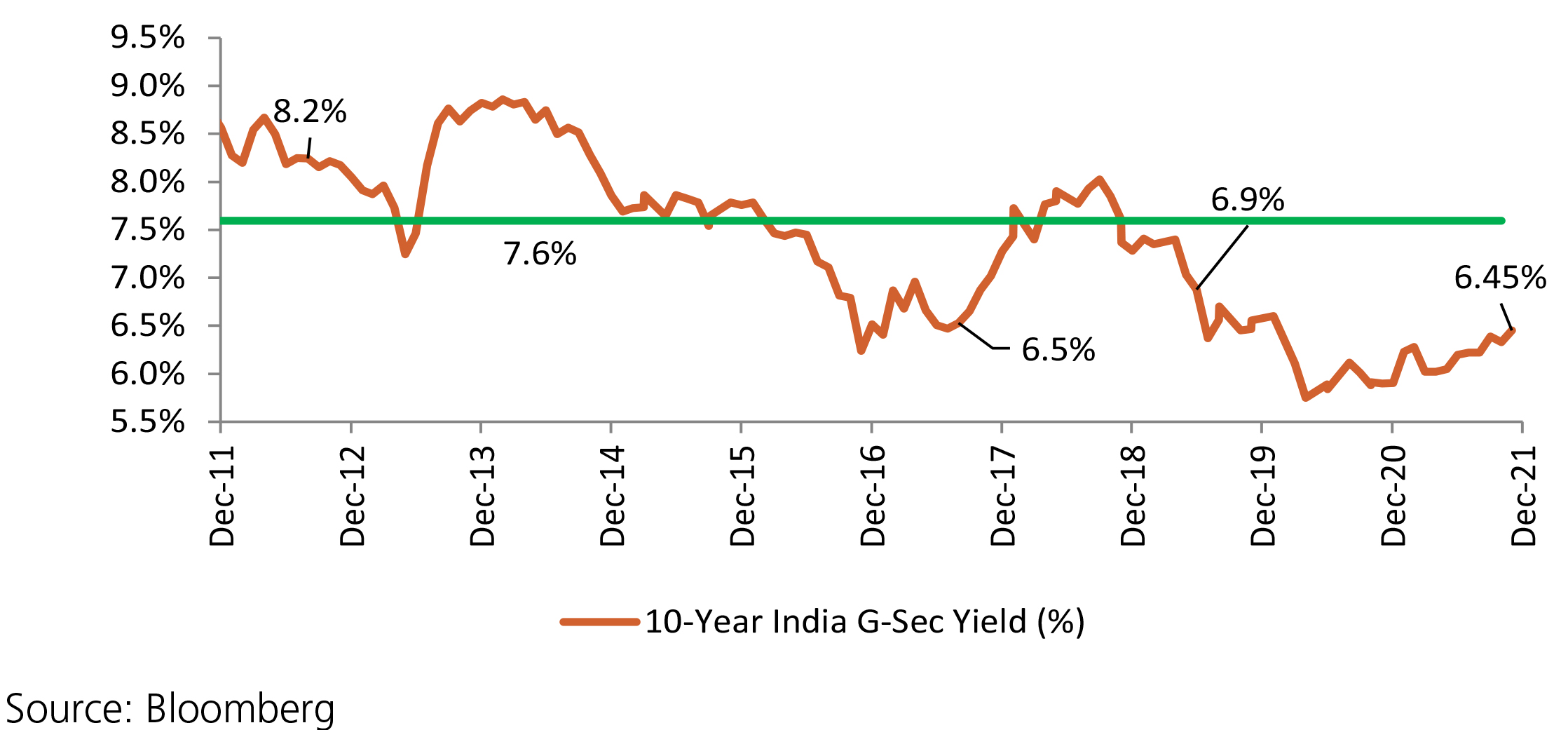

Yields were on an unidirectional trend upwards in December till they stabilized in the band of 6.46-6.47% later in the month before ending at 6.45%. Despite the RBI staying put on rates, yields have been pushing higher as the market tries to price in the “stealth tightening”. The RBI gave a clear signal of its intent to balance the excess liquidity still prevailing in market and this pushed up yields on the shorter-end while supply continues to weigh on the longer-end. In particular, it was the announcement of the 3Day Variable Rate Reverse Repo auction (VRRR) that the market drew strong inferences from. Governor Das had stated in the MPC meeting that the RBI seeks to rebalance the liquidity surplus by shifting it from the fixed rate reverse repo window to the variable rate reverse repo (VRRR) with the 14-day VRRR auction as the main liquidity management tool. As more liquidity is absorbed via the auction at rates higher than the revere repo rate the weighted average rate will move even closer to the repo rate, at which point the adjustment in the fixed rate reverse repo may just be a technicality. On the last day of the month and calendar year, the RBI also indicated its discomfort on existing yield levels in the market as it cancelled INR 170bn of the auction, of which INR 130bn was of the 10y benchmark, against the total amount of INR 240bn. The market is also expecting the announcement of a new 10y benchmark shortly as the current benchmark is close to its optimal outstanding issuance. The Union Budget is the next big event and the market would attempt to price the event in coming weeks. On the whole, the month of December saw the 10y benchmark continue its uptrend trading in a range of 6.35%-6.48% and eventually ending the month 12bps higher m-o-m at 6.45%. The 10y benchmark averaged 6.41% over the month of December.