Group Fund

Kotak Group Dynamic Floor Fund

(ULGF-015-07/01/10-DYFLRFND-107)

MONTHLY UPDATE APRIL 2022

|

AS ON 31st March 2022 |

Aims to provide stable long term inflation beating growth over the medium to longer term and defend capital against short term capital shocks.

Is likely to out-perform traditional balanced or equity funds during sideways or falling markets and shadow the rising equity markets.

Date of Inception

07th January 2010

AUM (in Lakhs)

427.24

NAV

33.0538

Fund Manager

Equity : Hemant Kanawala

Debt : Gajendra Manavalan

Debt : Gajendra Manavalan

Benchmark Details

Equity - 30% (Nifty)

Debt - 70% (Crisil Composite Bond)

Debt - 70% (Crisil Composite Bond)

Modified Duration

Debt & Money

Market Instruments : 2.09

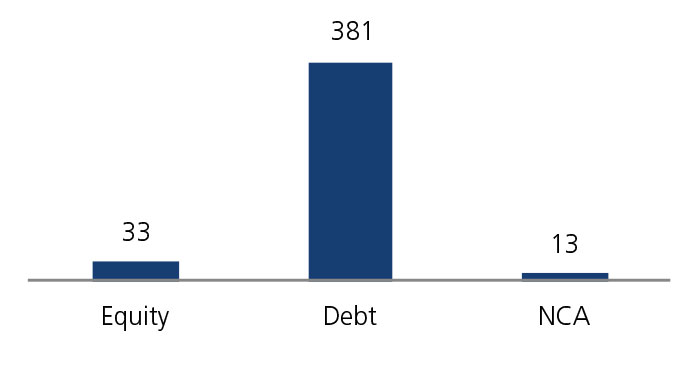

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 00 - 60 | 8 |

| Gsec / Debt | 00 - 100 | 74 |

| MMI / Others | 00 - 40 | 18 |

Performance Meter

| Kotak Group Dynamic Floor Fund (%) | Benchmark (%) | |

| 1 month | 0.4 | 1.4 |

| 3 months | 0.6 | 0.6 |

| 6 months | 0.9 | 0.7 |

| 1 year | 4.3 | 8.9 |

| 2 years | 5.1 | 16.4 |

| 3 years | 2.7 | 10.6 |

| 4 years | 4.2 | 10.3 |

| 5 years | 4.5 | 9.6 |

| 6 years | 6.0 | 10.2 |

| 7 years | 5.0 | 9.2 |

| 10 years | 6.7 | 10.0 |

| Inception | 6.0 | 9.0 |

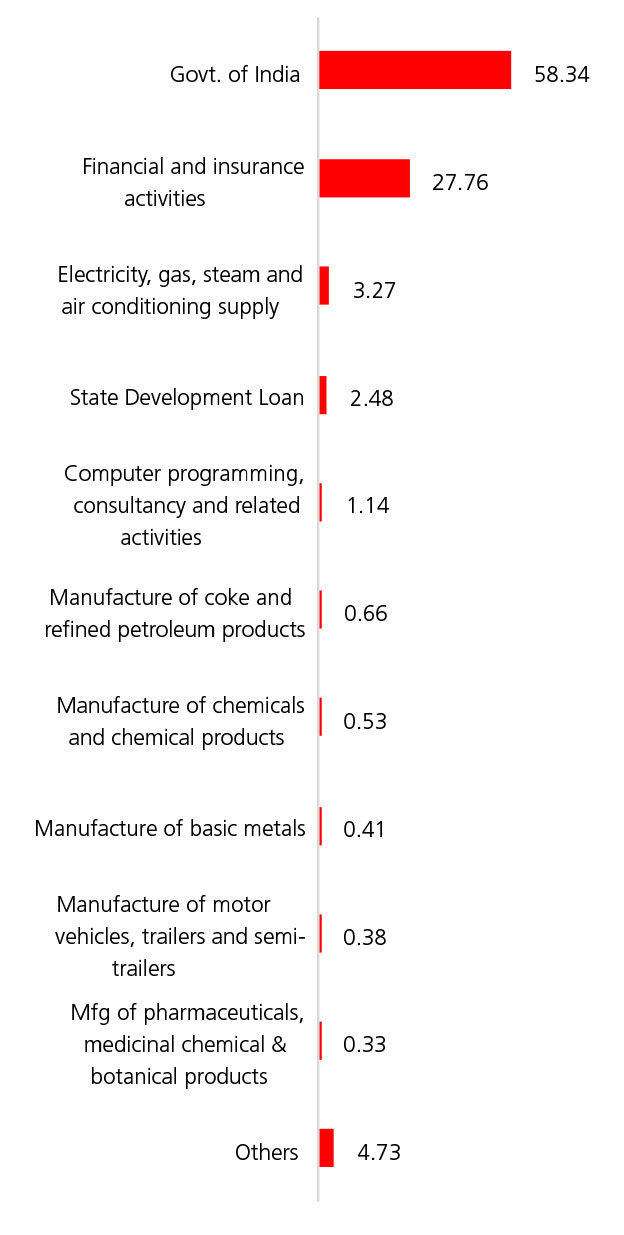

| Holdings | % to Fund |

| Equity | 7.80 |

| Reliance Industries Ltd | 0.60 |

| Infosys Ltd | 0.60 |

| ICICI Bank Ltd | 0.42 |

| Housing Development Finance Corp. Ltd | 0.35 |

| SBI ETF Nifty Bank | 0.33 |

| HDFC Bank Ltd | 0.33 |

| Tata Consultancy Services Ltd | 0.33 |

| Larsen And Toubro Ltd | 0.31 |

| I T C Ltd | 0.29 |

| Bharti Airtel Ltd | 0.26 |

| ICICI Prudential Bank ETF Nifty Bank Index | 0.24 |

| Hindustan Unilever Ltd | 0.22 |

| Kotak Banking ETF - Dividend Payout Option | 0.21 |

| Asian Paints Ltd | 0.17 |

| Axis Bank Ltd | 0.17 |

| Sun Pharmaceuticals Ltd | 0.16 |

| Maruti Suzuki India Ltd | 0.16 |

| Hindalco Industries Ltd | 0.16 |

| Bajaj Finance Ltd | 0.15 |

| Oil & Natural Gas Corporation Ltd | 0.15 |

| Others | 2.18 |

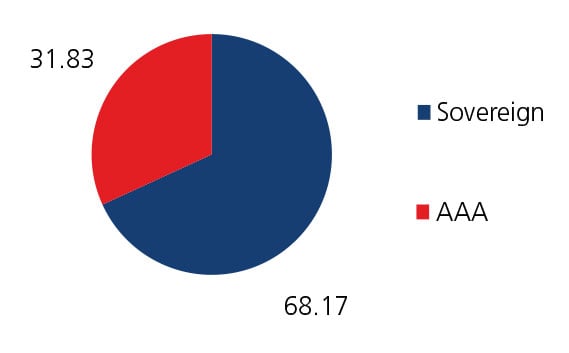

| G-Sec | 60.81 |

| 7.37% GOI - 16.04.2023 | 24.05 |

| 6.79% GOI - 15.05.2027 | 11.94 |

| 6.18% GOI - 04.11.2024 | 11.93 |

| 8.15% GOI FCI Bonds - 16.10.22 | 4.77 |

| 9.20% GOI - 30.09.2030 | 2.67 |

| 1.44% INFLATION INDEX GS 2023 | 1.48 |

| 7.65% RJ SDL - 29.11.2027 | 0.43 |

| 6.67% GOI - 17.12.2050 | 0.37 |

| 6.45% GOI - 07.10.2029 | 0.29 |

| 7.62% KA SDL - 01.11.2027 | 0.27 |

| Others | 2.62 |

| Corporate Debt | 13.18 |

| 9.30% PGC - 28.06.2023 | 3.07 |

| 8.90% PFC - 18.03.2028 | 2.59 |

| 8.63% REC - 25.08.2028 | 2.58 |

| 7.85% PFC - 03.04.2028 | 2.48 |

| 7.62% EXIM- 01.09.2026 | 2.46 |

| MMI | 15.21 |

| NCA | 3.00 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.