Individual Fund

Kotak Pension Floating Rate Fund

(ULIF-022-07/12/04-PNFLTRFND-107)

MONTHLY UPDATE APRIL 2022

|

AS ON 31st March 2022 |

Aims to preserve capital and minimize downside risk, with investment in debt and government instruments.

Date of Inception

07th December 2004

AUM (in Lakhs)

68.43

NAV

32.1455

Fund Manager

Debt : Gajendra Manavalan

Benchmark Details

Equity - 0% (NA);

Debt - 100% (CRISIL Liquid)

Modified Duration

Debt & Money Market Instruments : 0.82

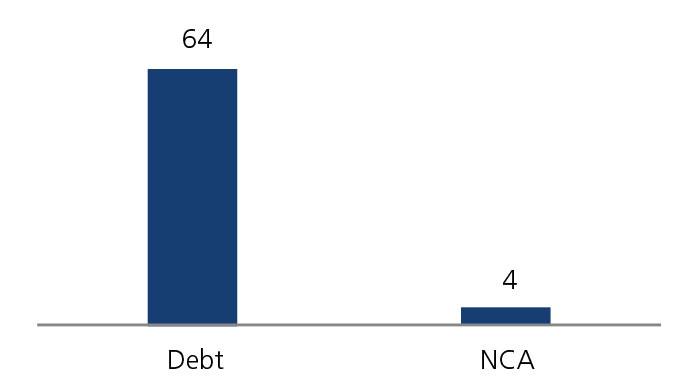

Asset Allocation

| Approved (%) | Actual (%) | |

| Gsec | 00 - 75 | 49 |

| Debt | 25 - 100 | 38 |

| MMI / Others | 00 - 40 | 13 |

Performance Meter

| Pension Floating Rate Fund (%) | Benchmark (%) | |

| 1 month | 0.2 | 0.3 |

| 3 months | 0.7 | 0.9 |

| 6 months | 1.1 | 1.9 |

| 1 year | 3.0 | 3.7 |

| 2 years | 3.8 | 3.9 |

| 3 years | 4.9 | 4.7 |

| 4 years | 5.3 | 5.4 |

| 5 years | 5.3 | 5.7 |

| 6 years | 5.7 | 5.9 |

| 7 years | 5.9 | 6.2 |

| 10 years | 7.1 | 7.0 |

| Inception | 7.0 | 6.8 |

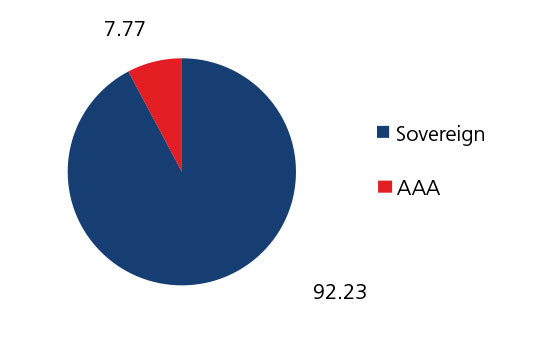

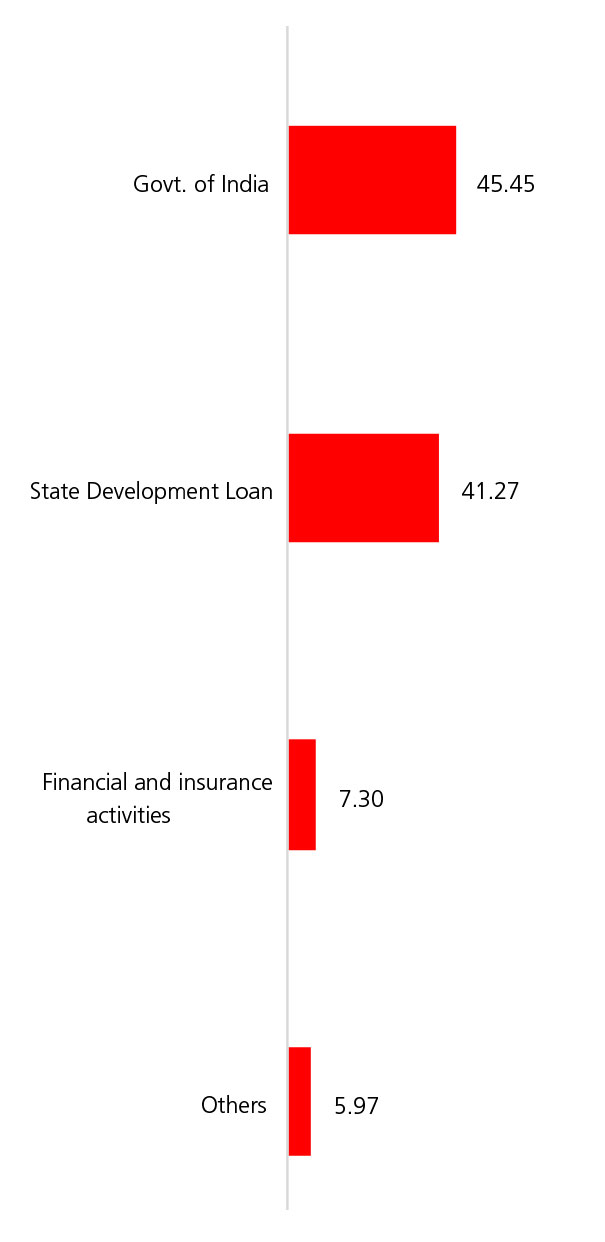

| Holdings | % to Fund |

| G-Sec | 49.09 |

| 9.37% MAH SDL - 04.12.2023 | 21.33 |

| 8.84% PN SDL - 11.06.2024 | 5.90 |

| 8.90% MH SDL -19.12.2022 | 3.01 |

| 8.92% RJ SDL - 21.11.2022 | 3.00 |

| 8.51% PN SDL - 10.04.2023 | 2.97 |

| 8.15% GOI FCI Bonds - 16.10.22 | 2.87 |

| 6.13% GOI - 04.06.2028 | 2.56 |

| 8.30% Fertilizer Co GOI - 07.12.23 | 2.30 |

| 9.25% HR SDL 09.10.2023 | 2.20 |

| 9.65% TN SDL - 12.03.2024 | 1.26 |

| Others | 1.71 |

| Corporate Debt | 37.63 |

| GOI FRB - 07.11.2024 | 37.63 |

| MMI | 7.30 |

| NCA | 5.97 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.