Individual Fund

Kotak Dynamic Growth Fund

(ULIF-012-27/06/03-DYGWTFND-107)

MONTHLY UPDATE MAY 2024

|

AS ON 30th April 2024 |

Aims for a high level of capital growth by holding a significant portion in large sized company equities.

Date of Inception

27th June 2003

AUM (in Lakhs)

5,836.93

NAV

161.9142

Fund Manager

Equity : Rohit Agarwal

Debt :Manoj Bharadwaj

Debt :Manoj Bharadwaj

Benchmark Details

Equity - 80% (BSE 100);

Debt - 20% (Crisil Composite Bond)

Modified Duration

Debt & Money

Market Instruments : 4.67

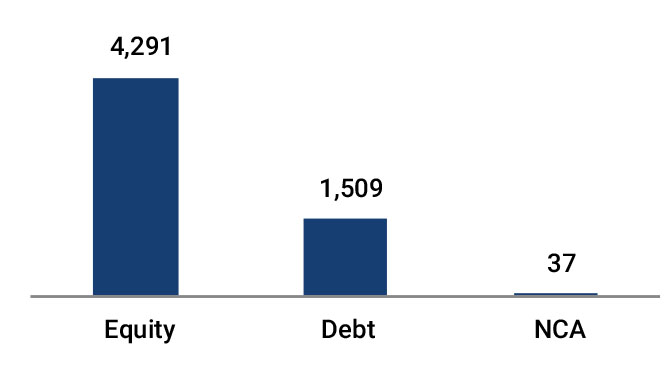

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 40 - 80 | 74 |

| Gsec / Debt | 20 - 60 | 22 |

| MMI / Others | 00 - 40 | 4 |

Performance Meter

| Kotak Dynamic Growth Fund (%) | Benchmark (%) | |

| 1 month | 3.0 | 1.6 |

| 3 months | 6.2 | 4.8 |

| 6 months | 19.5 | 17.9 |

| 1 year | 30.5 | 24.8 |

| 2 years | 17.0 | 14.4 |

| 3 years | 16.4 | 14.7 |

| 4 years | 21.5 | 20.6 |

| 5 years | 14.8 | 13.7 |

| 6 years | 13.1 | 12.5 |

| 7 years | 12.8 | 12.6 |

| 10 years | 14.0 | 12.6 |

| Inception | 14.3 | 13.3 |

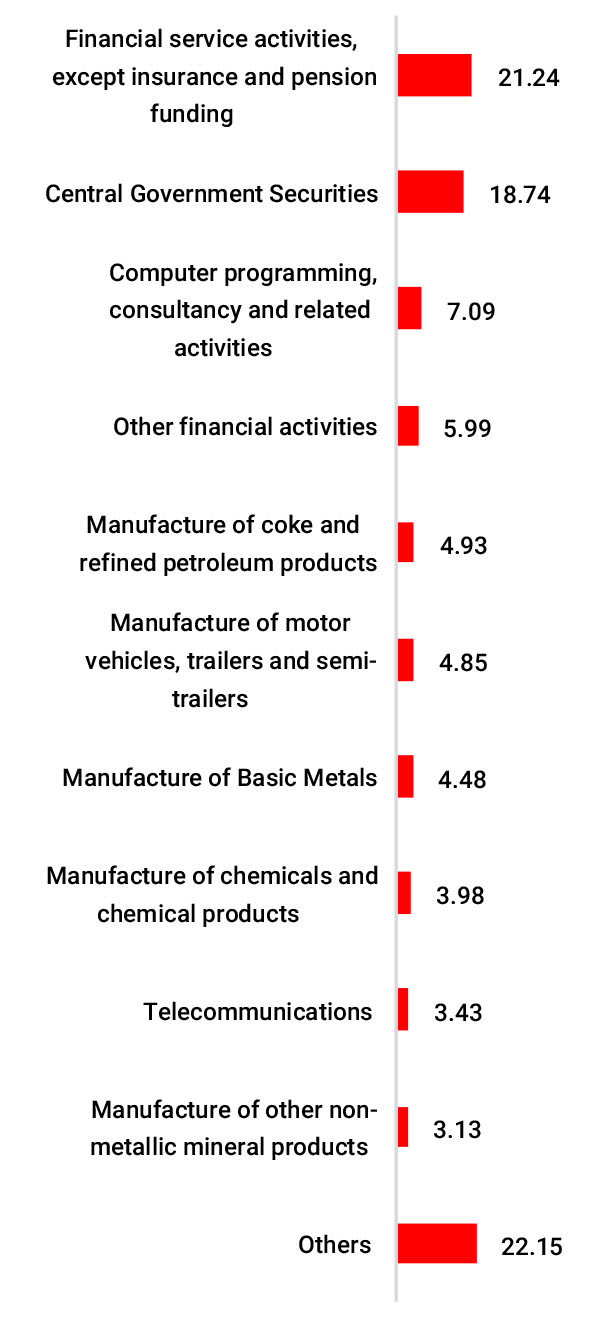

| Holdings | % to Fund |

| Equity | 73.51 |

| ICICI Bank Ltd. | 4.89 |

| Reliance Industries Ltd | 3.88 |

| HDFC Bank Ltd. | 3.40 |

| Bharti Airtel Ltd. | 3.09 |

| Infosys Ltd. | 2.93 |

| Axis Bank Ltd. | 2.41 |

| Larsen And Toubro Ltd. | 2.20 |

| Maruti Suzuki India Ltd | 2.06 |

| Venus Pipes and Tubes Ltd | 1.93 |

| State Bank of India. | 1.82 |

| I T C Ltd. | 1.81 |

| Tech Mahindra Ltd. | 1.54 |

| Zomato Ltd | 1.34 |

| Shriram Finance Limited | 1.27 |

| Interglobe Aviation Ltd. | 1.25 |

| National Thermal Power Corporation Ltd | 1.24 |

| Anant Raj Ltd | 1.23 |

| Bharat Electronics Ltd. | 1.23 |

| UltraTech Cement Ltd. | 1.15 |

| Titan Industries Ltd | 1.12 |

| Others | 31.71 |

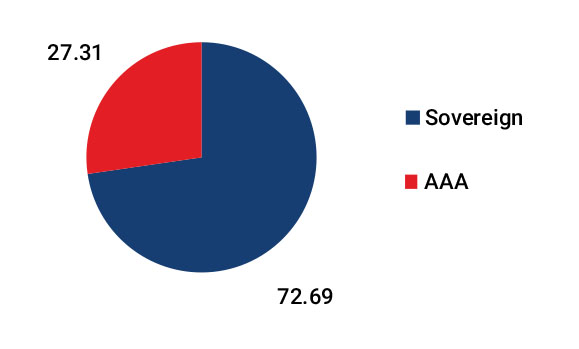

| G-Sec | 18.79 |

| 5.74% GOI - 15.11.2026 | 4.06 |

| 7.26% GOI - 06.02.2033 | 1.83 |

| 7.18% GOI - 24.07.2037 | 1.76 |

| 7.59% GOI - 11.01.2026 | 1.72 |

| 6.67% GOI - 15.12.2035 | 1.64 |

| 8.17% GOI - 01.12.2044 | 1.02 |

| 6.79% GOI - 15.05.2027 | 0.91 |

| 7.41% GOI - 19.12.2036 | 0.84 |

| 8.30% GOI - 02.07.2040 | 0.75 |

| 7.72% GOI - 26.10.2055 | 0.70 |

| Others | 3.55 |

| Corporate Debt | 3.12 |

| 7.80% HDFC BANK - 03.05.2033 | 1.36 |

| 8.70% REC - 28.09.2028 | 0.71 |

| 8.56% REC - 29.11.2028 | 0.53 |

| 8.65% PFC - 28.12.2024 | 0.52 |

| MMI | 3.94 |

| NCA | 0.64 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.