Individual Fund

KOTAK MID CAP ADVANTAGE FUND

(ULIF054150923MIDCAPFUND107)

MONTHLY UPDATE MAY 2024

|

AS ON 30th April 2024 |

Aims to maximize opportunity for long-term capital growth, by holding a significant portion in a diversified and flexible mix of medium and

small sized company equities.

Date of Inception

30th September 2023

AUM (in Lakhs)

36,761.13

NAV

13.6934

Fund Manager

Equity : Rohit Agarwal

Debt : Manoj Bharadwaj

Debt : Manoj Bharadwaj

Benchmark Details

Equity - 100% (Nifty Midcap 100)

Modified Duration

Debt & Money

Market Instruments : 0.01

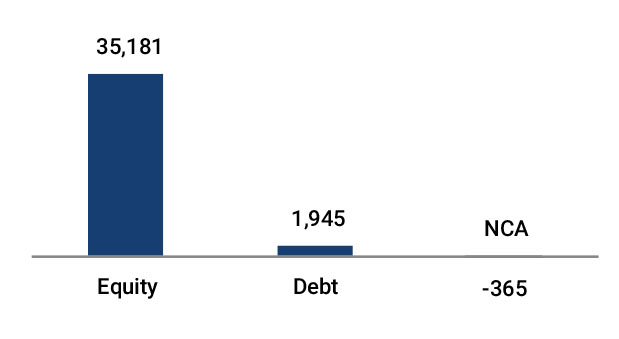

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 75 - 100 | 96 |

| Gsec / Debt | 00 - 25 | 0 |

| MMI / Others | 00 - 25 | 4 |

Performance Meter

| Kotak Mid Cap Advantage Fund (%) | Benchmark (%) | |

| 1 month | 5.5 | 5.8 |

| 3 months | 6.0 | 4.7 |

| 6 months | 36.4 | 30.8 |

| 1 year | n.a. | n.a. |

| 2 years | n.a. | n.a. |

| 3 years | n.a. | n.a. |

| 4 years | n.a. | n.a. |

| 5 years | n.a. | n.a. |

| 6 years | n.a. | n.a. |

| 7 years | n.a. | n.a. |

| 10 years | n.a. | n.a. |

| Inception | 36.9 | 25.5 |

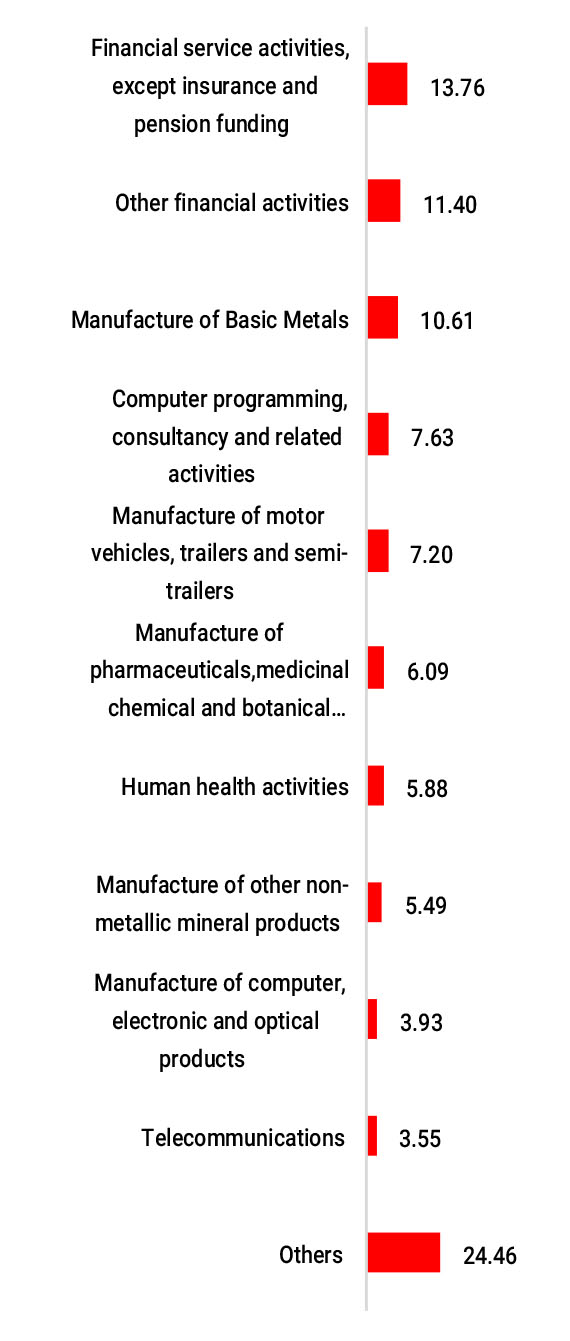

| Holdings | % to Fund |

| Equity | 95.70 |

| Tube Investments Of India Ltd | 3.57 |

| APL Apollo Tubes Ltd | 3.35 |

| Himadri Speciality Chemical Ltd | 3.02 |

| Venus Pipes and Tubes Ltd | 2.93 |

| Indian Hotels Company Ltd | 2.84 |

| Aurobindo Pharma Ltd | 2.62 |

| Shriram Finance Limited | 2.45 |

| Persistent Systems Limited | 2.45 |

| DR. LAL Pathlabs Ltd | 2.33 |

| Narayana Hrudayalaya Ltd | 2.21 |

| Poly Medicure Ltd | 2.13 |

| HDFC Asset Management Co Ltd | 2.12 |

| Angel One Ltd | 2.11 |

| Brigade Enterprises Ltd. | 1.95 |

| Hindustan Petroleum Corporation Ltd | 1.93 |

| PRICOL LIMITED | 1.92 |

| Hitachi Energy India Ltd | 1.90 |

| Indus Towers Ltd | 1.90 |

| NIPPON LIFE INDIA ASSET MANAGEMENT LIMITED | 1.89 |

| Zensar Technologies Limited. | 1.87 |

| Others | 48.21 |

| MMI | 5.29 |

| NCA | -0.99 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.