Group Fund

Kotak Group Dynamic Floor Fund

(ULGF-015-07/01/10-DYFLRFND-107)

MONTHLY UPDATE MAY 2024

|

AS ON 30th April 2024 |

Aims to provide stable long term inflation beating growth over the medium to longer term and defend capital against short term capital shocks.

Is likely to out-perform traditional balanced or equity funds during sideways or falling markets and shadow the rising equity markets.

Date of Inception

07th January 2010

AUM (in Lakhs)

473.12

NAV

36.8431

Fund Manager

Equity : Hemant Kanawala

Debt : Manoj Bharadwaj

Debt : Manoj Bharadwaj

Benchmark Details

Equity - 30% (Nifty)

Debt - 70% (Crisil Composite Bond)

Debt - 70% (Crisil Composite Bond)

Modified Duration

Debt & Money

Market Instruments : 2.38

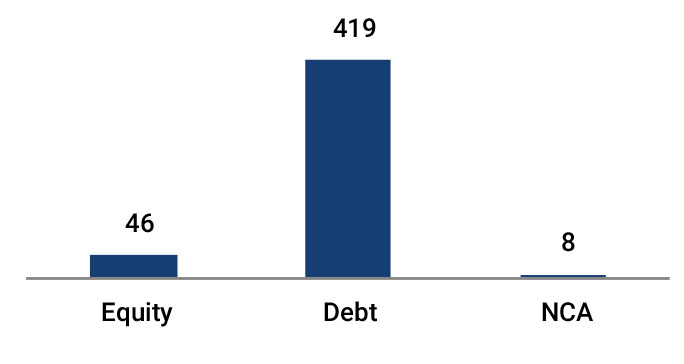

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 00 - 60 | 10 |

| Gsec / Debt | 00 - 100 | 60 |

| MMI / Others | 00 - 40 | 30 |

Performance Meter

| Kotak Group Dynamic Floor Fund (%) | Benchmark (%) | |

| 1 month | 0.3 | 0.3 |

| 3 months | 1.6 | 2.4 |

| 6 months | 4.7 | 8.4 |

| 1 year | 7.2 | 12.1 |

| 2 years | 5.9 | 9.1 |

| 3 years | 5.0 | 8.4 |

| 4 years | 5.1 | 11.0 |

| 5 years | 3.9 | 9.7 |

| 6 years | 4.5 | 9.5 |

| 7 years | 4.7 | 9.2 |

| 10 years | 6.4 | 9.8 |

| Inception | 5.9 | 8.9 |

| Holdings | % to Fund |

| Equity | 9.64 |

| HDFC Bank Ltd. | 0.65 |

| Reliance Industries Ltd | 0.60 |

| ICICI Bank Ltd. | 0.59 |

| Larsen And Toubro Ltd. | 0.56 |

| I T C Ltd. | 0.46 |

| SBI ETF Nifty Bank | 0.42 |

| Bharti Airtel Ltd. | 0.41 |

| Infosys Ltd. | 0.40 |

| Tata Consultancy Services Ltd. | 0.31 |

| ICICI Prudential Bank ETF Nifty Bank Index | 0.30 |

| Kotak Banking ETF - Dividend Payout Option | 0.26 |

| Maruti Suzuki India Ltd | 0.24 |

| Sun Pharmaceuticals Ltd | 0.24 |

| Axis Bank Ltd. | 0.24 |

| Mahindra & Mahindra Ltd | 0.24 |

| Oil & Natural Gas Corporation Ltd | 0.23 |

| National Thermal Power Corporation Ltd | 0.23 |

| Hindustan Unilever Ltd | 0.22 |

| Tata Motors Ltd. | 0.20 |

| Power Grid Corporation of India Ltd | 0.18 |

| Others | 2.68 |

| G-Sec | 49.29 |

| 5.74% GOI - 15.11.2026 | 16.36 |

| 6.18% GOI - 04.11.2024 | 10.52 |

| 7.41% GOI - 19.12.2036 | 6.51 |

| 7.38% GOI - 20.06.2027 | 5.41 |

| 9.20% GOI - 30.09.2030 | 2.33 |

| 7.25% GOI - 12.06.2063 | 2.10 |

| 7.17% GOI - 17.04.2030 | 1.43 |

| 7.06% GOI - 10.04.2028 | 0.84 |

| 7.18% GOI - 24.07.2037 | 0.84 |

| 7.36% GOI - 12.09.2052 | 0.66 |

| Others | 2.28 |

| Corporate Debt | 10.76 |

| 8.90% PFC - 18.03.2028 | 2.19 |

| 8.63% REC - 25.08.2028 | 2.18 |

| 8.65% Cholamandalam Invest and Fin co ltd - 28.02.2029 | 2.16 |

| 7.85% PFC - 03.04.2028 | 2.12 |

| 7.62% EXIM- 01.09.2026 | 2.11 |

| MMI | 28.53 |

| NCA | 1.79 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.