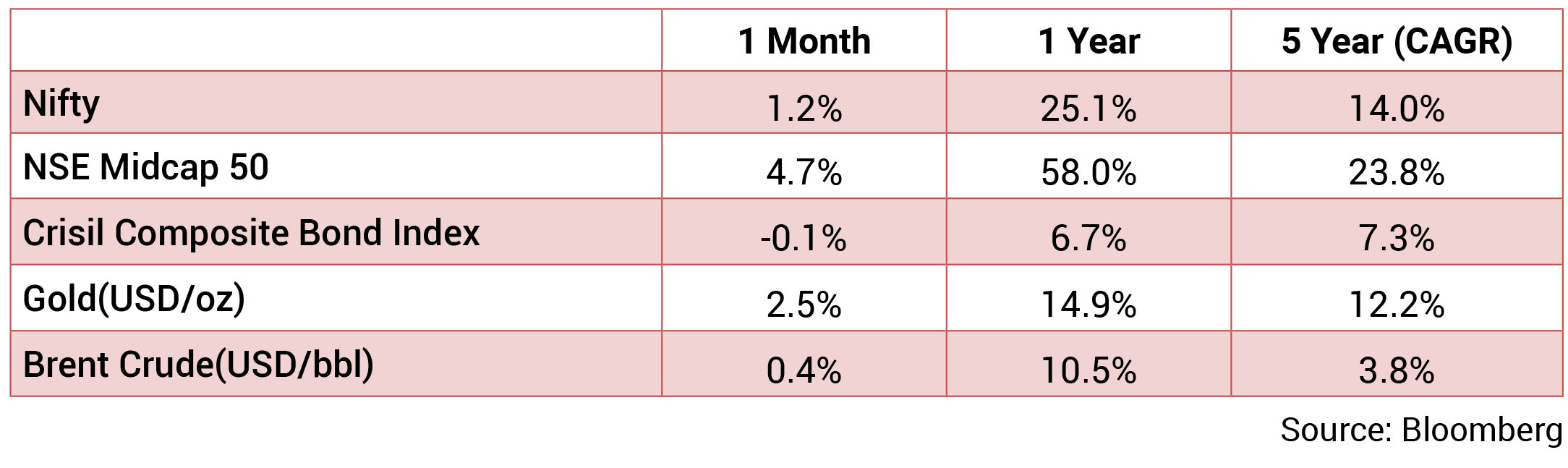

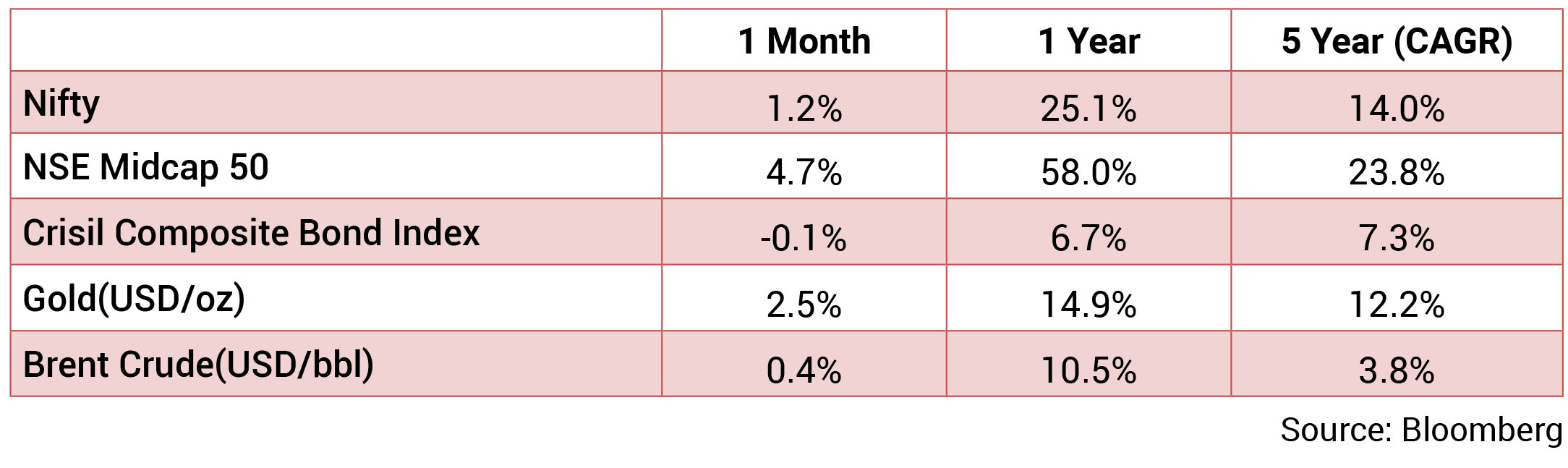

Market sentiments continue to remain buoyant amidst strong economic growth. Nifty gained 1.2% in

April and ended the month at 22,605 after touching its lifetime high of 22,785 on the last trading day of the

month. Small-caps and mid-caps rose by 9.1% and 3.6% respectively, significantly ahead of large-caps’

performance over the month (+2.1%). The next big event to watch out for are India’s national elections

which commenced on April 19 and are to be conducted in seven phases till 1 June. INR remained flattish

over the month and ended the month at 83.44/USD. DXY gained 1.7% over the month, ending at 106.2.

Among major regions, MSCI China was the best performer last month (6.5%) followed by India (2.3%)

while MSCI Japan/Brazil/US were the weakest (-4.9%/-4.8%/-4.2% respectively). India benchmark 10-year

G-Sec yield averaged at 7.17% in April (higher than the March average of 7.06%). On month-end values,

the 10Y yield was higher and ended the month at 7.19% (higher by 13 bps over last month). The US 10Y

yield is at 4.68% (48 bps higher over last month). Oil prices moved higher by 1.0% in April, following a rise

of 2.9% in March.

Global growth remains resilient, with easing inflationary pressures, albeit at a slower pace, and tight employment conditions in spite of geopolitical and extreme weather event risks. The International Monetary Fund in its latest world economic outlook raised global growth forecast for 2024 to 3.2%, 10 bps higher than its January Update. Globally, headline inflation receded significantly from levels recorded a year ago in most economies, although it still remains above targets and has turned sticky recently. In the US, CPI inflation rose to 3.5% in March from 3.2% in February. Euro area inflation moderated to 2.4% in March from 2.6% in February. In the UK, CPI inflation softened to 3.2% in March. Japan’s inflation (CPI excluding fresh food) eased to 2.6% in March from 2.8% in February. In such context, global central banks are staying cautious and pushing back against any premature easing thereby delaying the prospects of any immediate rate cuts, at least in the US.

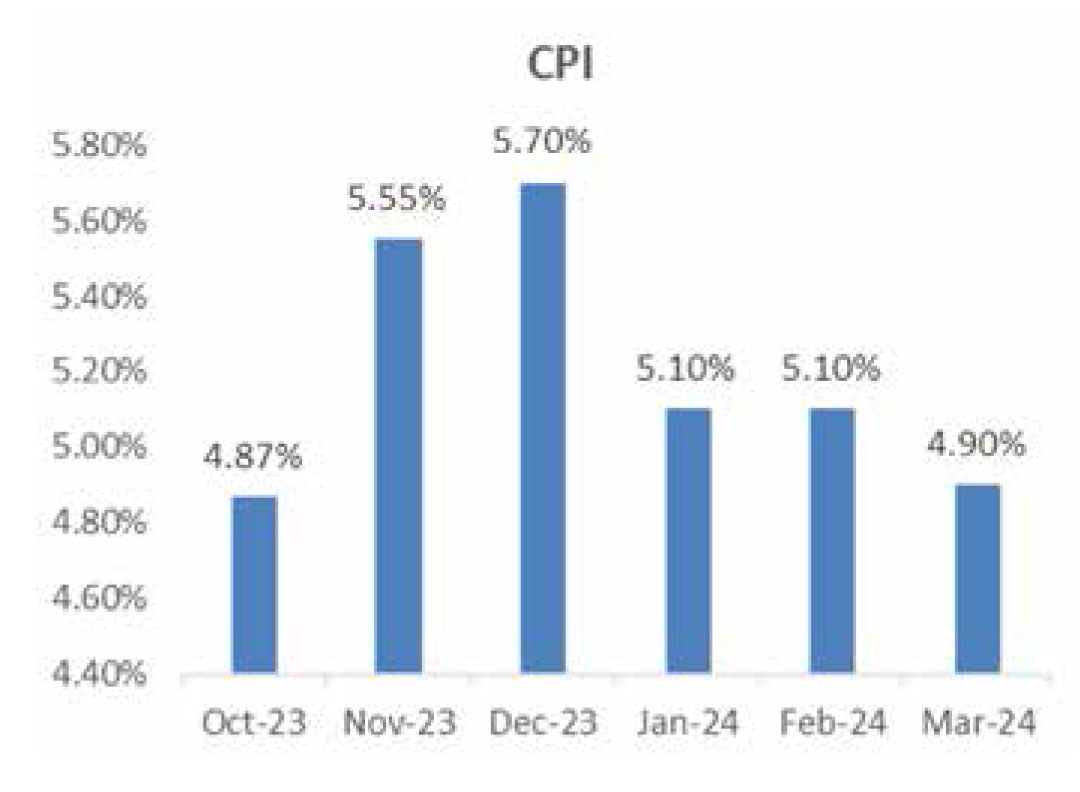

On the domestic front, the Indian economy continues to remain resilient, and continues to record strong PMI readings. FY2025 GDP growth is expected to be around 7%. The next few quarters will however be crucial given the multitude of risks from the lagged impact of monetary tightening and slowing global growth. On the inflation front, while headline CPI inflation has moderated to below 5% recently, MPC continues to emphasize the importance of bringing it back to 4%. Major positive remains that the underlying momentum for core inflation remains soft, with core inflation comfortably below 4%. While liquidity conditions have started to normalize with average call rate now around repo, the MPC may formally announce a shift in stance to neutral either when growth concerns arise or when RBI feels confident that inflation will sustainably revert towards 4%.

Global growth remains resilient, with easing inflationary pressures, albeit at a slower pace, and tight employment conditions in spite of geopolitical and extreme weather event risks. The International Monetary Fund in its latest world economic outlook raised global growth forecast for 2024 to 3.2%, 10 bps higher than its January Update. Globally, headline inflation receded significantly from levels recorded a year ago in most economies, although it still remains above targets and has turned sticky recently. In the US, CPI inflation rose to 3.5% in March from 3.2% in February. Euro area inflation moderated to 2.4% in March from 2.6% in February. In the UK, CPI inflation softened to 3.2% in March. Japan’s inflation (CPI excluding fresh food) eased to 2.6% in March from 2.8% in February. In such context, global central banks are staying cautious and pushing back against any premature easing thereby delaying the prospects of any immediate rate cuts, at least in the US.

On the domestic front, the Indian economy continues to remain resilient, and continues to record strong PMI readings. FY2025 GDP growth is expected to be around 7%. The next few quarters will however be crucial given the multitude of risks from the lagged impact of monetary tightening and slowing global growth. On the inflation front, while headline CPI inflation has moderated to below 5% recently, MPC continues to emphasize the importance of bringing it back to 4%. Major positive remains that the underlying momentum for core inflation remains soft, with core inflation comfortably below 4%. While liquidity conditions have started to normalize with average call rate now around repo, the MPC may formally announce a shift in stance to neutral either when growth concerns arise or when RBI feels confident that inflation will sustainably revert towards 4%.

CPI: March CPI inflation at 4.9% moderated from February’s 5.1% (Kotak: 4.9%). Food inflation fell to 8.5%

(8.7% in February). Sequentially, food inflation increased 0.2% (0.1% mom in February), led mainly by meat

and fish, cereals, vegetables, and fruits. Core CPI inflation (CPI, excluding food and beverages, and fuel)

moderated marginally to 3.3% (February: 3.4%). Sequentially, core CPI increased 0.2% (0.3% in February),

led by personal care and effects (mainly gold and silver), and health (doctor’s fee and medicine).

IIP: IIP growth in February improved to 5.7% (January: 4.1%), led by a favorable base effect. Sequentially, IIP contracted 3.1% (January: 3.3 % mom). According to the sectoral classification, manufacturing activity increased 5% (January: 3.6%), mining increased 8% (5.9%) and electricity production increased 7.5% (5.6%). According to the use-based classification, all categories registered positive growths, except for consumer non-durables.

MPC Meeting: The RBI MPC voted with a 5-1 majority to hold the repo rate at 6.5% and remain focused on the withdrawal of accommodation (Dr Varma voted for a 25 bps cut and a change in stance to neutral). The tone was fairly balanced, with continued comfort on growth, and emphasis on returning inflation to the 4% target. The MPC retained its real GDP growth projection of 7% in FY2025 (7.6% in FY2024), with some marginal tweaks to the quarterly profile. The MPC also retained its FY2025 headline inflation projection at 4.5% (Kotak: 4.5%), taking into consideration: (1) an expected record rabi wheat production in 2023-24 and (2) early indications of a normal monsoon, auguring well for kharif sowing. However, they noted upside risks from (1) climate shocks impacting food inflation, (2) low reservoir levels, especially in the southern states and (3) above-normal temperatures expected in April-June 2024.

Trade: Exports in March were steady at US$41.7 bn (February: US$41.4 bn), aided by a rise in non-oil exports to US$36.3 bn (US$33.2 bn), which offset a fall in oil exports to US$5.4 bn (US$8.2 bn). Imports in March fell to US$57.3 bn (February: US$60.1 bn), mainly due to a fall in non-oil imports to US$40.1 bn (US$43.2 bn). This was mainly due to a sharp fall in imports of gold to US$1.5 bn (February: US$6.2 bn) and silver to US$0.8 bn (US$1.7 bn). The goods trade deficit in FY2024 was at US$240.8 bn (FY2023: US$265 bn).

IIP: IIP growth in February improved to 5.7% (January: 4.1%), led by a favorable base effect. Sequentially, IIP contracted 3.1% (January: 3.3 % mom). According to the sectoral classification, manufacturing activity increased 5% (January: 3.6%), mining increased 8% (5.9%) and electricity production increased 7.5% (5.6%). According to the use-based classification, all categories registered positive growths, except for consumer non-durables.

MPC Meeting: The RBI MPC voted with a 5-1 majority to hold the repo rate at 6.5% and remain focused on the withdrawal of accommodation (Dr Varma voted for a 25 bps cut and a change in stance to neutral). The tone was fairly balanced, with continued comfort on growth, and emphasis on returning inflation to the 4% target. The MPC retained its real GDP growth projection of 7% in FY2025 (7.6% in FY2024), with some marginal tweaks to the quarterly profile. The MPC also retained its FY2025 headline inflation projection at 4.5% (Kotak: 4.5%), taking into consideration: (1) an expected record rabi wheat production in 2023-24 and (2) early indications of a normal monsoon, auguring well for kharif sowing. However, they noted upside risks from (1) climate shocks impacting food inflation, (2) low reservoir levels, especially in the southern states and (3) above-normal temperatures expected in April-June 2024.

Trade: Exports in March were steady at US$41.7 bn (February: US$41.4 bn), aided by a rise in non-oil exports to US$36.3 bn (US$33.2 bn), which offset a fall in oil exports to US$5.4 bn (US$8.2 bn). Imports in March fell to US$57.3 bn (February: US$60.1 bn), mainly due to a fall in non-oil imports to US$40.1 bn (US$43.2 bn). This was mainly due to a sharp fall in imports of gold to US$1.5 bn (February: US$6.2 bn) and silver to US$0.8 bn (US$1.7 bn). The goods trade deficit in FY2024 was at US$240.8 bn (FY2023: US$265 bn).

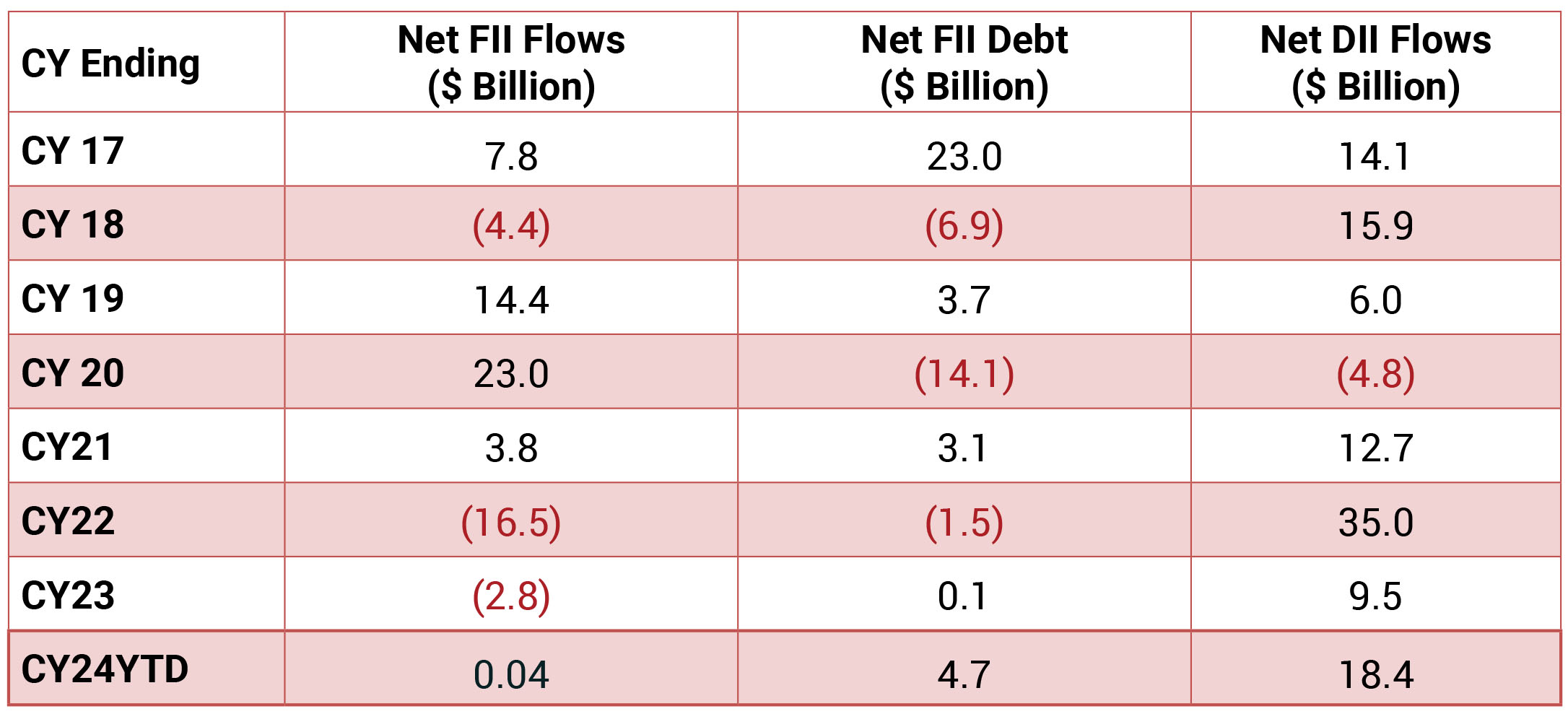

FIIs ended the month with a net selling of $1.3 bn (after a net buying of $4.0 bn in March), with

most of the net selling happening in the second half of the month. DIIs continued to remain net

buyers for the 9th consecutive month with strong inflows of $5.3 bn in April ($6.8 bn in March).