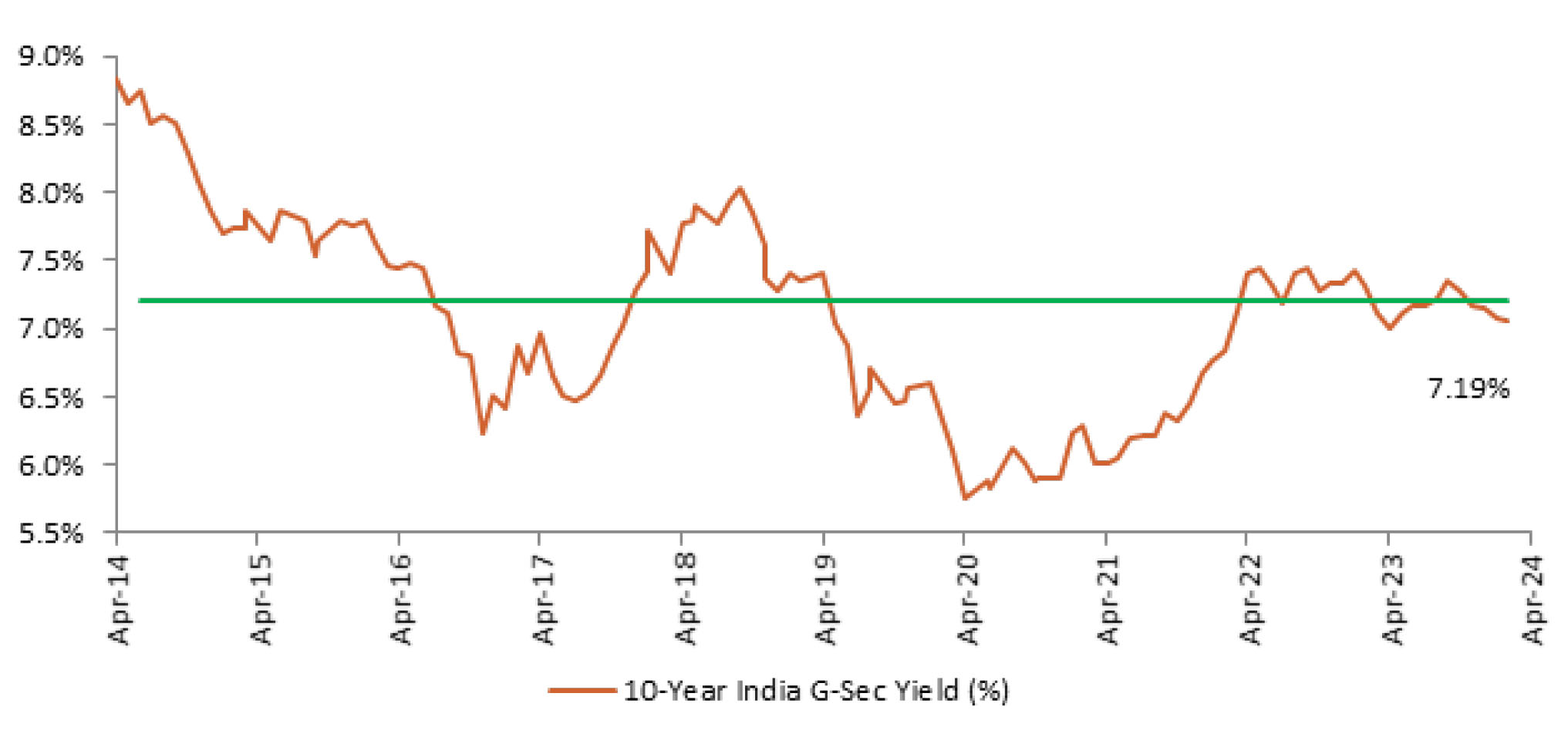

India benchmark 10-year G-Sec yield averaged at 7.17% in April (higher than the March average of 7.06%). On month-end values, the 10Y yield was higher and ended the month at 7.19% (higher by 13 bps over last month).

With global central banks cautious amidst resilient growth and sticky inflation, expectations of monetary easing have been pushed back. On the other hand, favourable demand-supply dynamics domestically and optimism ahead of FPI index flows have been supportive of G-Sec yields. On the inflation front, while headline CPI inflation has moderated to below 5% recently, RBI’s emphasis on bringing inflation back to 4% on a durable basis limits the possibility of monetary easing at least in the near term. Meanwhile, core inflation remains benign and headline inflation is likely to average inflation at 4.5% for FY2025 which should be supportive for sentiments even as risks remain from food prices and from global macro developments.

Going ahead, the outlook for 10-year G-Sec will largely depend on the extent of FPI flows, global macro developments and the evolution of the domestic inflation trajectory.