● All time high GST collections: GST collections is strong indicator of economic activity in India. April 2024 GST collection reached all time high of Rs2.1 tn vs. Rs1.8 tn in March 2024. Robust increase in collection is due to both strong economic activity, more formalisation of income and anti-evasion of tax measures by the authority.

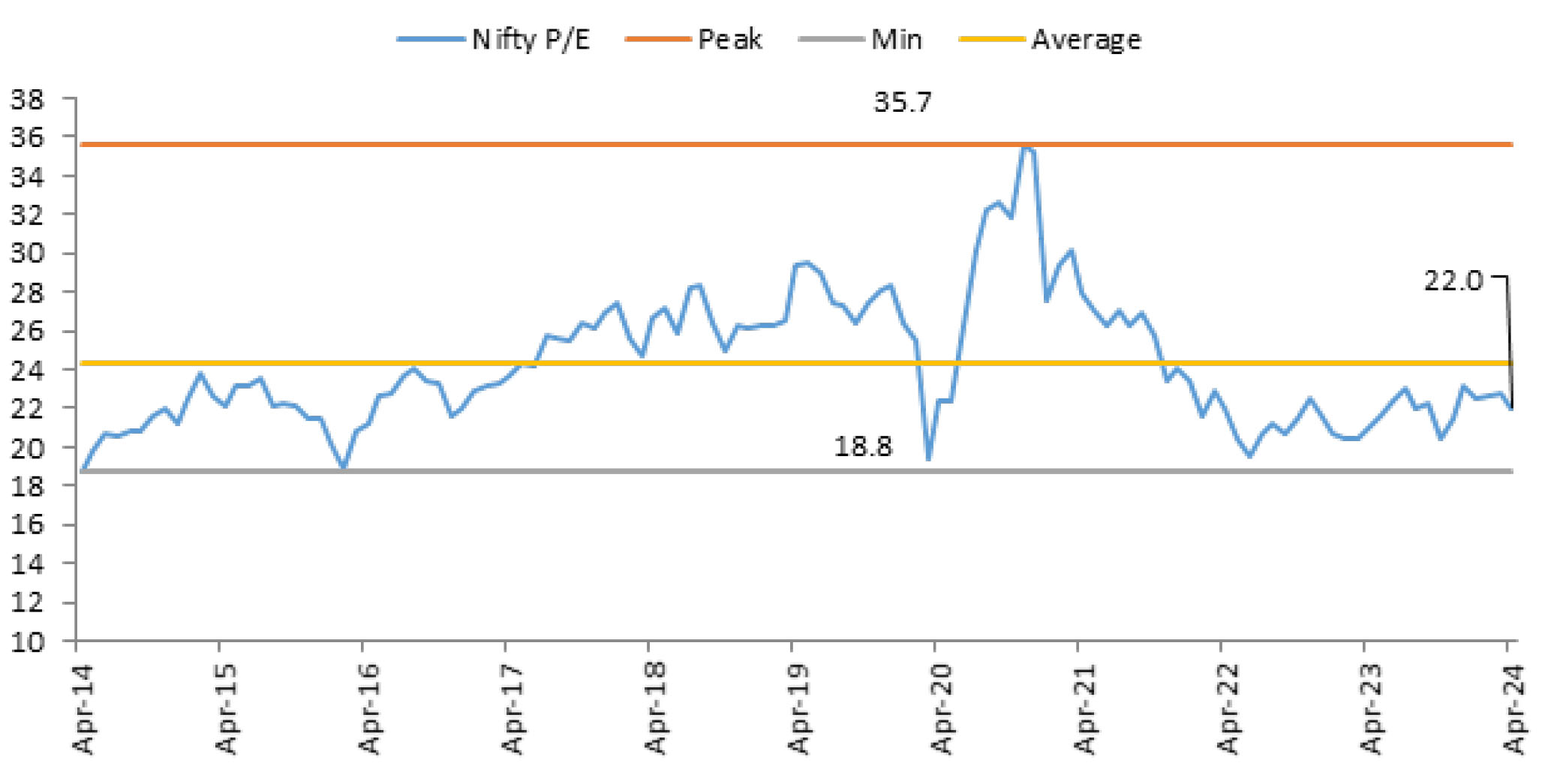

● Mid and small caps rally continue post hitting a bump in Mar’24: After a correction in mid and small caps stocks in the month of March 2024, the broader market recovered back in the following month April 2024. Mid and small cap indices hit all time high again led by strong domestic flows and retail participation during the month. Though the valuation in some pockets of the markets are higher than long term averages, however, optimism led by strong macros and micro, healthy order books, demand outlook and policy continuity is driving continued retail participation.

● Policy continuity expected: Market expectation of continued government is expected to keep the momentum going for capex, manufacturing and infra push. Healthy corporate balance sheet and decent domestic demand is expected to be the driver for capex cycle in India.

● US Fed continues to hold rates, rate cuts not on cards anytime soon: The US Fed rate-setting panel voted unanimously to hold the interest rates steady at a 23-year high mark of 5.25%-5.5% for the sixth straight meeting. This indicates that rate cuts are not on cards anytime soon, until inflation cools down and moves sustainably towards the two per cent target set by the US Fed. Market participants now expect the first rate cut to happen in Dec’24 policy from their earlier expectations in Sep’24 policy.

● Outlook: India is currently enjoying the best macro and micro tailwinds with above ~7% GDP growth, moderating inflation prints, range-bound crude prices, easing 10-year G-sec yield, stable currency, and resilient corporate earnings. A healthy domestic macro and micro environment, expected political continuity post 2024 General Elections, strong retail participation and global interest rates at its peak would continue to keep market sentiments positive.