Group Fund

Kotak Group Short Term Bond Fund

(ULGF-018-18/12/13-SHTRMBND-107)

MONTHLY UPDATE OCTOBER 2023

|

AS ON 30th September 2023 |

Will generate stable returns through investments in a suitable mix of debt and money market instruments.

Date of Inception

19th October 2015

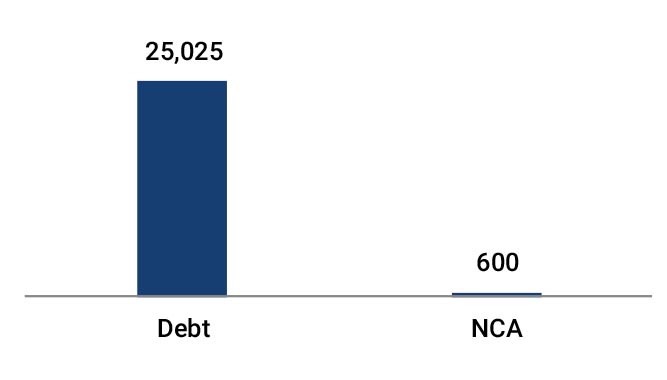

AUM (in Lakhs)

25,625.79

NAV

16.1286

Fund Manager

Debt : Manoj Bharadwaj

Benchmark Details

100%-CRISIL Short Term Bond Fund Index

Modified Duration

Debt & Money

Market Instruments : 1.25

Asset Allocation

| Approved (%) | Actual (%) | |

| Gsec | 00 - 50 | 37 |

| Debt | 25 - 75 | 42 |

| MMI / Others | 10 - 75 | 21 |

Performance Meter

| Kotak Group Short Term Bond Fund (%) | Benchmark (%) | |

| 1 month | 0.5 | 0.5 |

| 3 months | 1.5 | 1.7 |

| 6 months | 3.2 | 3.8 |

| 1 year | 6.3 | 7.4 |

| 2 years | 3.9 | 5.0 |

| 3 years | 4.1 | 5.3 |

| 4 years | 5.1 | 6.5 |

| 5 years | 6.1 | 7.3 |

| 6 years | 5.6 | 6.8 |

| 7 years | 5.9 | 6.9 |

| 10 years | n.a. | n.a. |

| Inception | 6.2 | 7.2 |

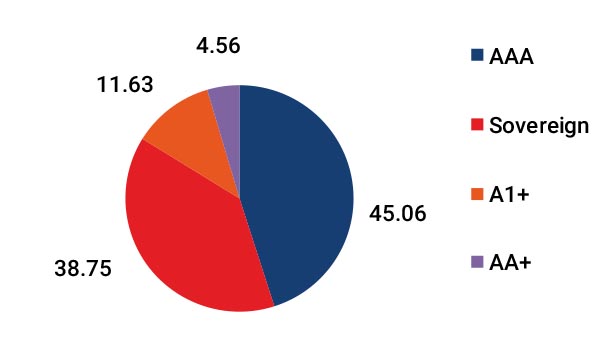

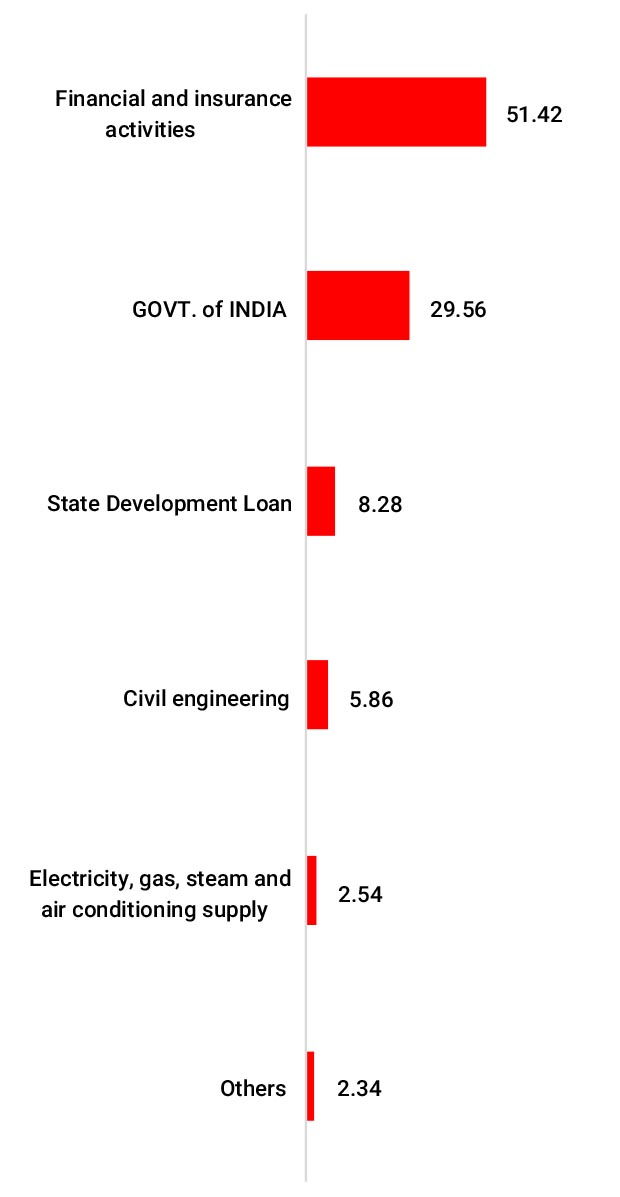

| Holdings | % to Fund |

| G-Sec | 37.07 |

| 7.06% GOI - 10.04.2028 | 10.18 |

| 7.32% GOI - 28.01.2024 | 9.76 |

| 8.22% TN SDL - 13.05.2025 | 5.93 |

| 7.38% GOI - 20.06.2027 | 3.92 |

| GOI FRB - 22.09.2033 | 3.51 |

| 9.37% MAH SDL - 04.12.2023 | 1.57 |

| 7.59% GOI - 11.01.2026 | 0.79 |

| 5.74% GOI - 15.11.2026 | 0.64 |

| 9.69% PN SDL - 12.02.2024 | 0.39 |

| 9.25% RJ SDL - 09.10.2023 | 0.29 |

| Others | 0.10 |

| Corporate Debt | 41.95 |

| 5.14% NABARD - 31.01.2024 | 7.74 |

| 7.70% L&T Ltd. - 28.04.2025 | 5.86 |

| 7.64% PFC - 25.08.2026 | 3.90 |

| 6.25% LIC Housing Finance - 20.06.2025 | 3.69 |

| 7.38% Cholamandalam Invest and Fin co Ltd - 31.07.2024 | 3.48 |

| 5.10% Sundaram Finance - 01.12.2023 | 3.07 |

| 5.45% NTPC - 15.10.2025 | 2.54 |

| 7.85% PFC - 03.04.2028 | 2.39 |

| 7.58% PFC - 15.01.2026 | 2.34 |

| 5.78% HDFC BANK - 25.11.2025 | 2.23 |

| Others | 4.71 |

| MMI | 18.64 |

| NCA | 2.34 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.