Individual Fund

Kotak Pension Bond Fund

(ULIF-017-15/04/04-PNBNDFND-107)

MONTHLY UPDATE OCTOBER 2023

|

AS ON 30th September 2023 |

Aims to preserve capital and minimize downside risk, with investment in debt and government instruments.

Date of Inception

15th April 2004

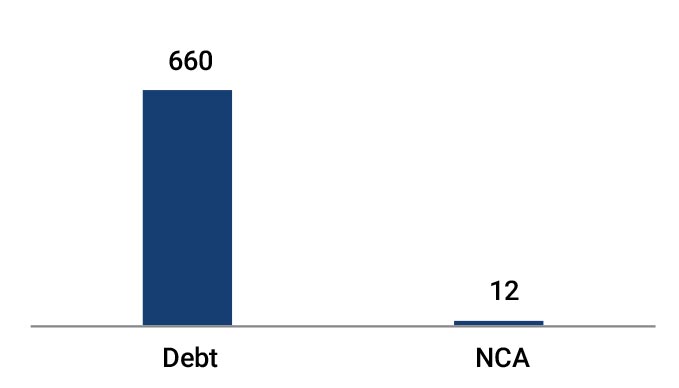

AUM (in Lakhs)

672.01

NAV

44.8056

Fund Manager

Debt : Manoj Bharadwaj

Benchmark Details

Equity - 0% (NA);

Debt - 100% (Crisil Composite Bond)

Modified Duration

Debt & Money

Market Instruments : 2.13

Asset Allocation

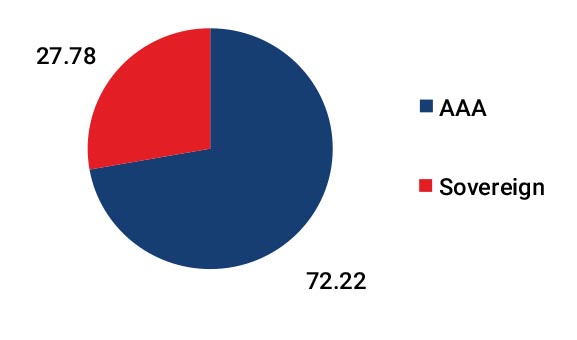

| Approved (%) | Actual (%) | |

| Gsec | 00 - 75 | 27 |

| Debt | 25 - 100 | 42 |

| MMI / Others | 00 - 40 | 31 |

Performance Meter

| Pension Bond Fund (%) | Benchmark (%) | |

| 1 month | 0.4 | 0.3 |

| 3 months | 1.1 | 1.3 |

| 6 months | 2.8 | 3.8 |

| 1 year | 5.4 | 7.7 |

| 2 years | 3.2 | 4.3 |

| 3 years | 4.1 | 4.8 |

| 4 years | 5.7 | 6.4 |

| 5 years | 7.6 | 7.8 |

| 6 years | 6.2 | 6.6 |

| 7 years | 6.3 | 6.8 |

| 10 years | 8.0 | 8.3 |

| Inception | 8.0 | 6.7 |

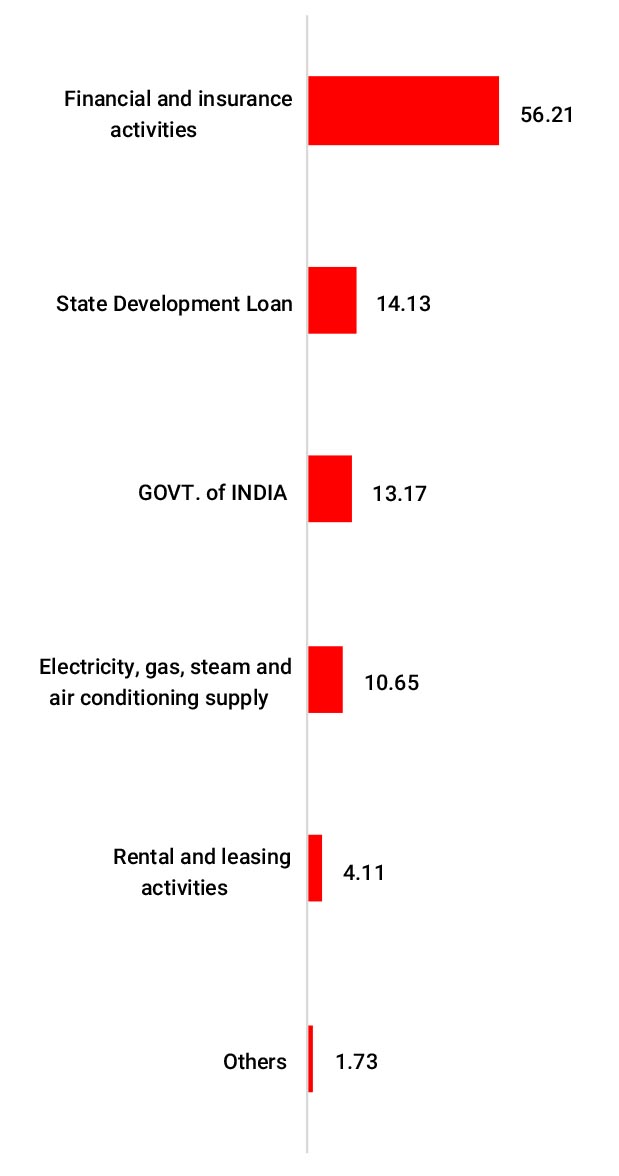

| Holdings | % to Fund |

| G-Sec | 34.95 |

| 7.38% GOI - 20.06.2027 | 3.99 |

| 8.80% REC - 22.01.2029 | 3.10 |

| 8.29% NABARD - 24.01.2029 | 1.54 |

| 8.09% REC - 21.03.2028 | 1.52 |

| 7.54% GOI - 23.05.2036 | 1.51 |

| 8.01% REC - 24.03.2028 | 1.50 |

| 9.39% GJ SDL - 20.11.2023 | 0.94 |

| 9.50% MAH SDL - 18.12.2023 | 0.92 |

| 8.72% TN SDL -19.09.2026 | 0.92 |

| 7.17% GOI - 17.04.2030 | 0.84 |

| Others | 18.17 |

| Corporate Debt | 34.31 |

| 6.25% LIC Housing Finance - 20.06.2025 | 2.90 |

| 10.08% IOT Utkal Energy Services Limited - 20.03.2027 | 2.82 |

| 8.90% PFC - 18.03.2028 | 1.55 |

| 9.33% IRFC - 10.05.2026 | 1.55 |

| 8.63% REC - 25.08.2028 | 1.54 |

| 8.54% NHPC - 26.11.2028 | 1.54 |

| 9.35% PGC - 29.08.2025 | 1.53 |

| 8.13% PGC - 25.04.2031 | 1.53 |

| 8.78% NHPC - 11.02.2026 | 1.52 |

| 8.15% EXIM- 21.01.2030 | 1.52 |

| Others | 16.30 |

| MMI | 29.01 |

| NCA | 1.73 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.