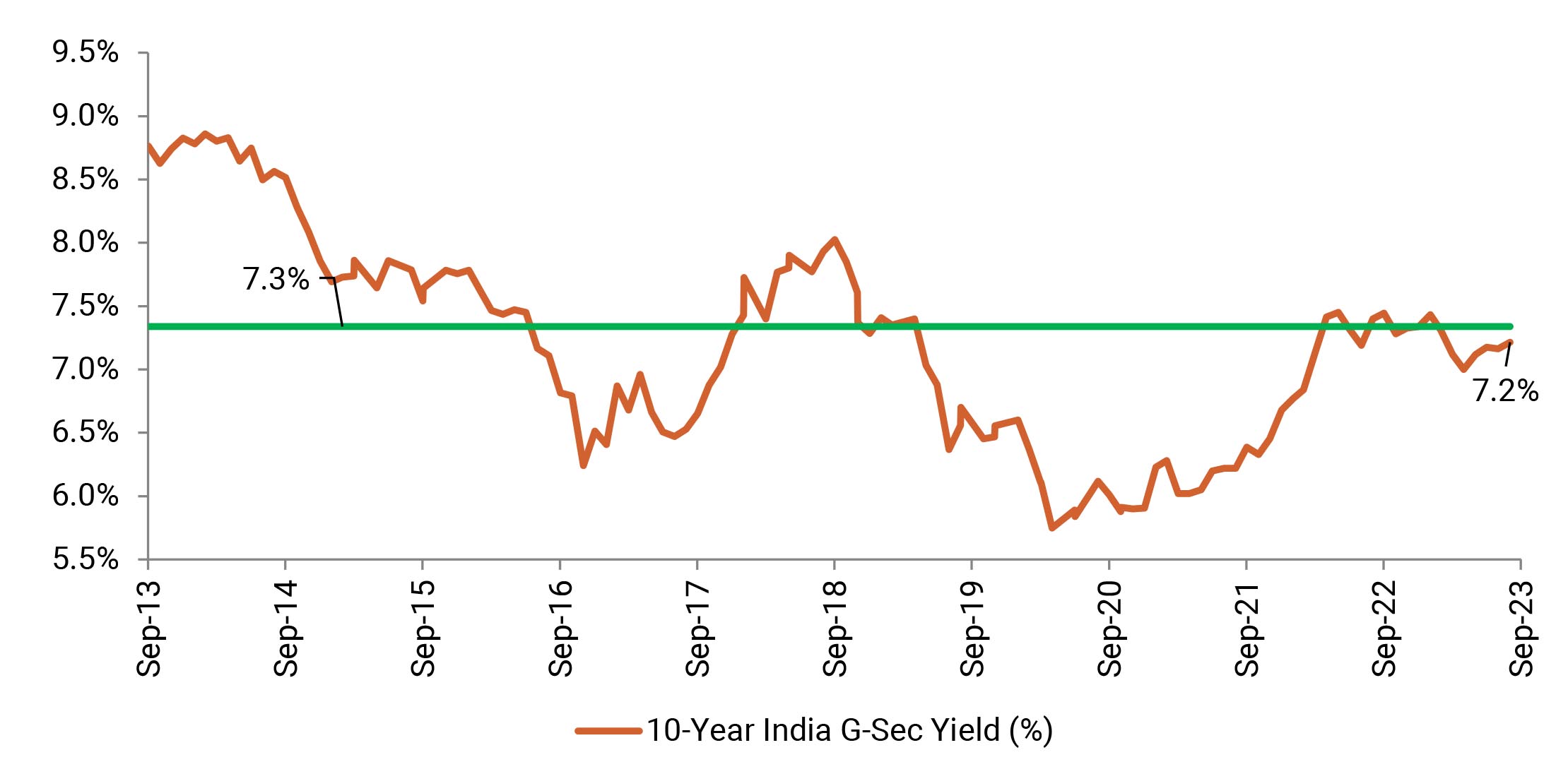

Yields have traded with an upward bias over the month and even the much awaited news of India’s inclusion into the JP Morgan Emerging Market Bond Index could not break the trend. 10yr benchmark yields traded in the range of 7.13%-7.25% and eventually ended the month 5bps higher sequentially at 7.22%. The 10y benchmark averaged 7.19% in September.

Lack of certainty on continued threat from inflation and pressure arising from volatility in global yields have prevented yields from moving south with conviction. The RBI MPC meeting in the first week of October will be crucial as there are quite a few moving parts that the central bank would have to reckon with.