Month Gone By – Markets (period ended August 31, 2020)

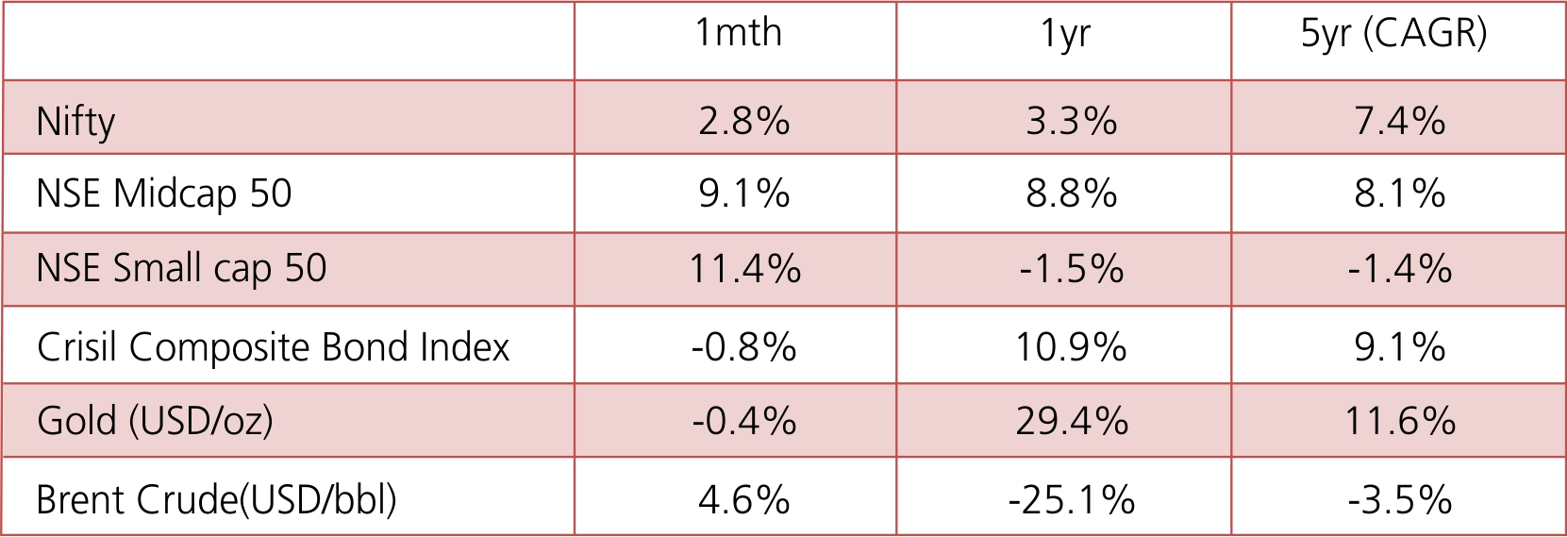

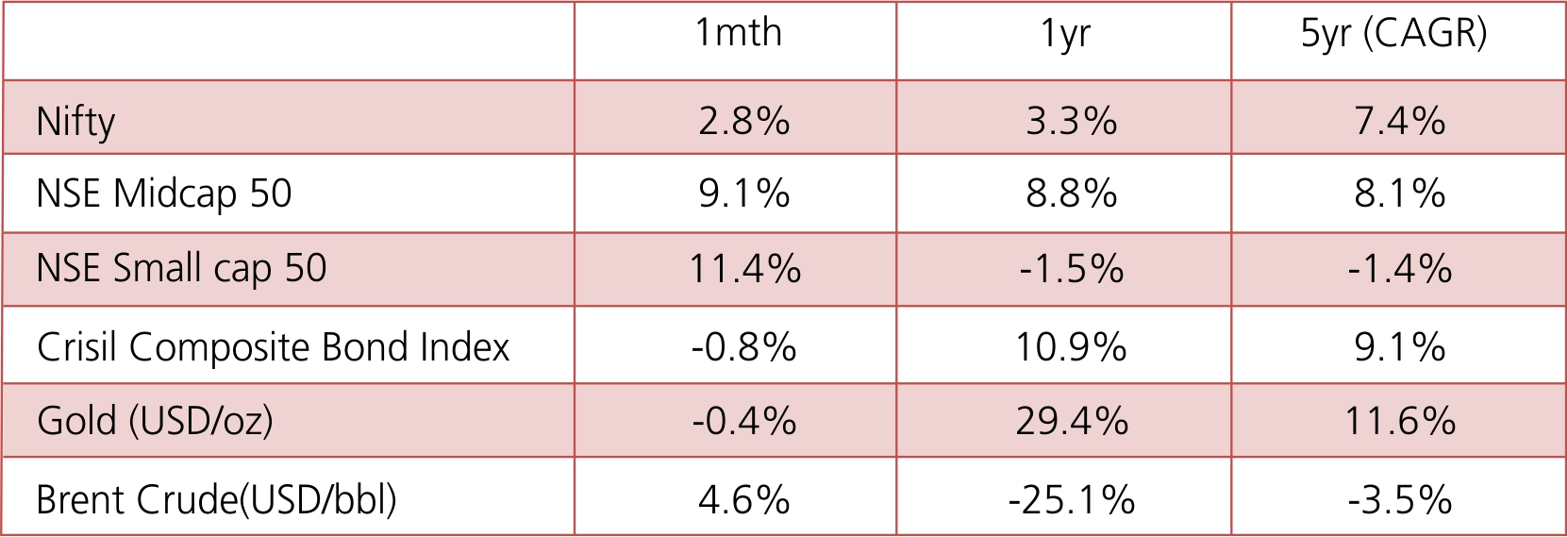

Indian Equities moved slightly higher (Nifty +2.8%) in August, in line with the region and S&P 500 (US) which touched new highs during the month. Dollar weakness, gradual re-opening of the economy and hopes of a vaccine supported sentiments. While the growth rate / doubling rate of virus spread in India moderated over August, absolute daily cases touched new highs. Geopolitical tensions flared up once again along the India-China border spooking the markets. Market Regulator SEBI disallowed extension of new higher margin norms taking effect from 1 September, potentially reducing the retail activity going forward. Breadth of the market improved substantially. Nifty Midcap50 and Nifty SmallCap50 outperformed Nifty50 by 6.3% and 8.6% respectively.

Brent oil price gained 4.6% in August to end the month at USD45.3/bbl, this being third consecutive month of gain. However, YTD oil prices are still down 25.1% down. INR appreciated by 1.6% against USD and ended the month at 73.6/$. YTD, INR has depreciated 3.1% against USD. India’s FX reserves are close to their all-time peak at USD537.5bn as of 21stAugust. FX reserves have increased by USD14.9bn in the last four weeks

Brent oil price gained 4.6% in August to end the month at USD45.3/bbl, this being third consecutive month of gain. However, YTD oil prices are still down 25.1% down. INR appreciated by 1.6% against USD and ended the month at 73.6/$. YTD, INR has depreciated 3.1% against USD. India’s FX reserves are close to their all-time peak at USD537.5bn as of 21stAugust. FX reserves have increased by USD14.9bn in the last four weeks

GDP : 1Q FY21 Real GDP growth contracted by 23.9% yoy, coming in worse than expectations. The contractions was led by a strict lockdown and labor migration, Construction was the worst hit, followed by trade, hotels, transport and communication. Agriculture grew 3.4%. On the production side, public administration contracted 10.3%. However, government consumption on the expenditure side grew meaningfully at 16.4%.

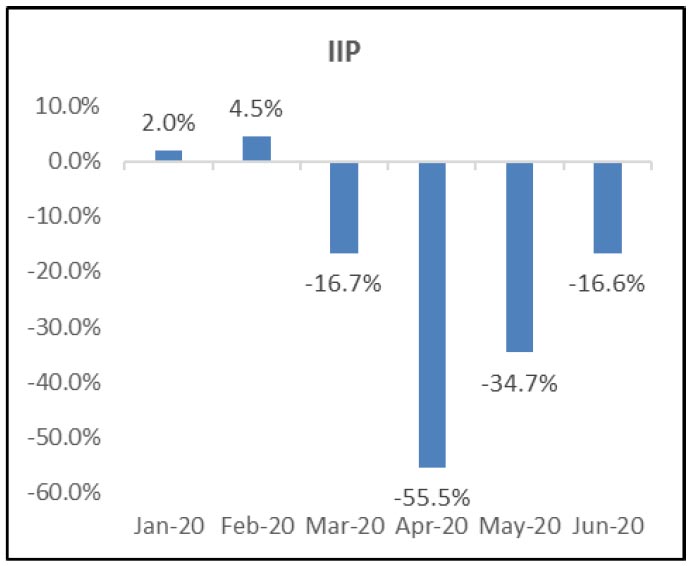

IP :Index for Industrial Production for Jun contracted 16.6% (vs. 34.7% contraction in May). While the (seasonally-adjusted) output of consumer durables doubled between May and June, it was still at just 68% of its pre-pandemic levels. However the non-durable production jumped to 115% of its pre-pandemic levels and registered a healthy 14% YoY growth. In this context, next month’s print will be important to see how much of the growth in non-durables was driven by pent up demand.

CPI : Headline CPI for July came in at 6.9% ahead of the consensus. Bulk of the upside surprise was on account of jump in food inflation which printed at 9.6% (vs. 8.7% in June). Moreover, core inflation continued to accelerate and came at a 17-month high of 5.6% in July (vs. 5.3% in June)

Trade Deficit : India’s trade balance turned to a deficit of ~USD4.8bn in July after a rare surplus of ~USD0.8bn in June, as gold and other imports started to pick-up. Exports in July were down ~10% in July at USD23.6bn while imports were down 28% at USD28.4bn. Imports ex Oil and Gold declined 29%oya (vs. 41% decline in June), the 18th consecutive month of YoY declines. Within imports, consumer goods imports were at 92% of pre-pandemic levels in July while capital goods were at just 62%

Fiscal Deficit: : India’s fiscal deficit stood at Rs8.2trn at the end of July, at ~103% of the budgeted target for the current fiscal year. Sharp fall in tax receipts coupled with resilient government expenditure led to the high deficit in the period.

IP :Index for Industrial Production for Jun contracted 16.6% (vs. 34.7% contraction in May). While the (seasonally-adjusted) output of consumer durables doubled between May and June, it was still at just 68% of its pre-pandemic levels. However the non-durable production jumped to 115% of its pre-pandemic levels and registered a healthy 14% YoY growth. In this context, next month’s print will be important to see how much of the growth in non-durables was driven by pent up demand.

CPI : Headline CPI for July came in at 6.9% ahead of the consensus. Bulk of the upside surprise was on account of jump in food inflation which printed at 9.6% (vs. 8.7% in June). Moreover, core inflation continued to accelerate and came at a 17-month high of 5.6% in July (vs. 5.3% in June)

Trade Deficit : India’s trade balance turned to a deficit of ~USD4.8bn in July after a rare surplus of ~USD0.8bn in June, as gold and other imports started to pick-up. Exports in July were down ~10% in July at USD23.6bn while imports were down 28% at USD28.4bn. Imports ex Oil and Gold declined 29%oya (vs. 41% decline in June), the 18th consecutive month of YoY declines. Within imports, consumer goods imports were at 92% of pre-pandemic levels in July while capital goods were at just 62%

Fiscal Deficit: : India’s fiscal deficit stood at Rs8.2trn at the end of July, at ~103% of the budgeted target for the current fiscal year. Sharp fall in tax receipts coupled with resilient government expenditure led to the high deficit in the period.

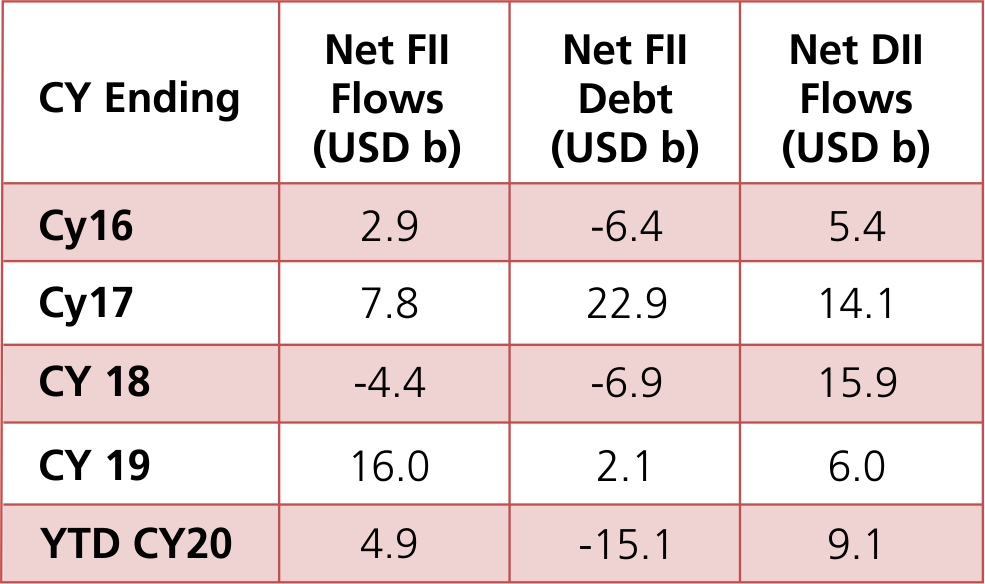

In flow trends, slew of primary capital raises by financials led to a strong FII net inflow of ~USD6.3bn in August taking YTD inflows to USD 4.9bn.DIIs continued to remain net sellers, at USD 1.5bn largely contributed by Domestic Mutual Funds that saw their first redemption in net equity flows (-Rs38.5bn in July) since March’16. Both Mutual Funds and Other DIIs were net sellers to the tune of USD1.2bn and USD0.3bn respectively in August. YTD, DIIs have bought USD USD9.1bn split into USD 2.9bn by Mutual Funds and USD 6.1bn by other DIIs. FIIs recorded net outflows from debt markets at USD 0.4bn in August. YTD, FIIs have sold USD 15.1bn in the debt markets.