Individual Fund

Pension Frontline Equity Fund

(ULIF-044-11/01/10-PNFRLEQFND-107)

Monthly Update September 2020

|

AS ON 31st August 2020 |

Aims for a high level of capital growth by holding a significant portion in large sized company equities.

Date of Inception

11th January 2010

AUM (in Lakhs)

677.65

NAV

28.4402

Fund Manager

Equity : Rohit Agarwal

Debt :Gajendra Manavalan

Debt :Gajendra Manavalan

Benchmark Details

Equity - 100% (BSE 100)

Modified Duration

Debt & Money Market Instruments : 0.01

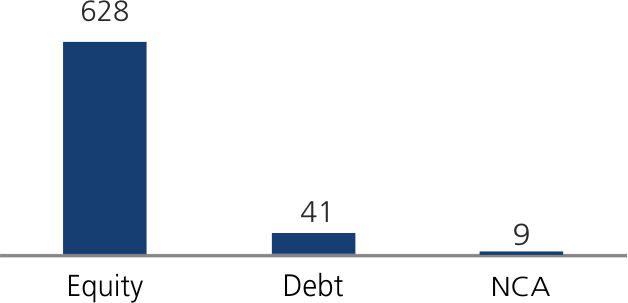

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 60 - 100 | 93 |

| Gsec / Debt | 00 - 40 | 0 |

| MMI / Others | 00 - 40 | 7 |

Performance Meter

| Pension Frontline Equity Fund (%) | Benchmark (%) | |

| 1 month | 2.6 | 2.9 |

| 3 months | 19.0 | 18.4 |

| 6 months | 1.4 | 1.7 |

| 1 year | 6.6 | 3.1 |

| 2 years | -0.1 | -2.3 |

| 3 years | 4.2 | 3.6 |

| 4 years | 6.2 | 6.2 |

| 5 years | 7.9 | 7.2 |

| 6 years | 8.7 | 6.2 |

| 7 years | 13.6 | 11.2 |

| 10 years | 9.4 | 7.5 |

| Inception | 10.3 | 7.3 |

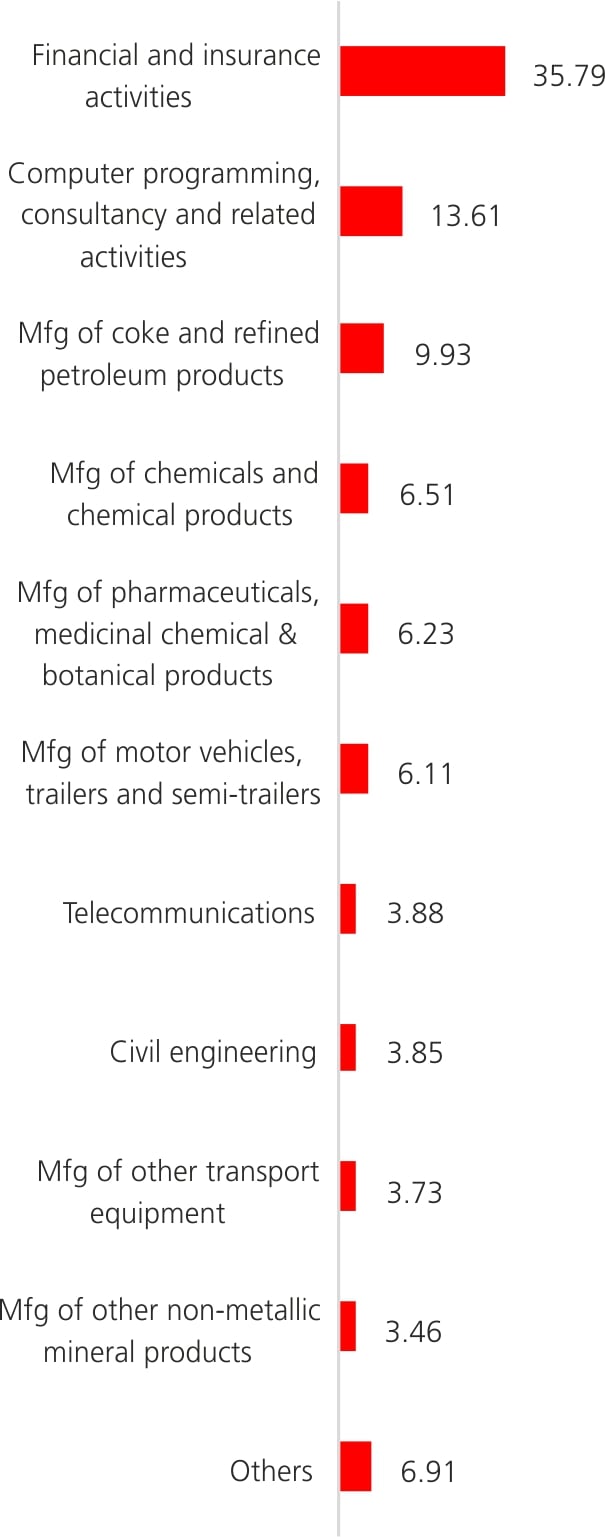

| Holdings | % to Fund |

| Equity | 92.73 |

| HDFC Bank Ltd | 8.48 |

| Reliance Industries Ltd | 8.08 |

| SBI ETF Nifty Bank | 6.17 |

| Infosys Ltd | 5.67 |

| ICICI Bank Ltd | 5.53 |

| Tata Consultancy Services Ltd | 4.82 |

| Hindustan Unilever Ltd | 3.96 |

| Bharti Airtel Ltd | 3.88 |

| Larsen And Toubro Ltd | 3.85 |

| Maruti Suzuki India Ltd | 3.47 |

| Axis Bank Ltd | 3.43 |

| HCL Technologies Ltd | 3.12 |

| Dr Reddys Laboratories Ltd | 2.92 |

| Bajaj Finance Ltd | 2.84 |

| Kotak Banking ETF - Dividend Payout Option | 2.73 |

| Mahindra & Mahindra Ltd | 2.63 |

| Asian Paints Ltd | 2.56 |

| Hero Honda Motors Ltd | 2.34 |

| UltraTech Cement Ltd | 2.26 |

| Sun Pharmaceuticals Ltd | 2.02 |

| Others | 11.99 |

| Corporate Debt | 0.08 |

| 4.25% HDFC Bank FD NSE - 09.08.2021 | 0.08 |

| MMI | 5.90 |

| NCA | 1.28 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.