MPC in its monetary policy scheduled in August did not reduce the policy rates citing higher CPI reading in recent months. Debt market turned bearish post monetary policy as expection of increase in HTM limits of banks or cut atleast in the reverse repo rates to supports the fragile economic growth amid Covid 19 crisis were not met. Market participants continued to sell bonds after July CPI data which came it at 6.93% and MPC minutes were also hawkish as fears of generalization of high food and fuel inflation into core and headline inflation emerged.

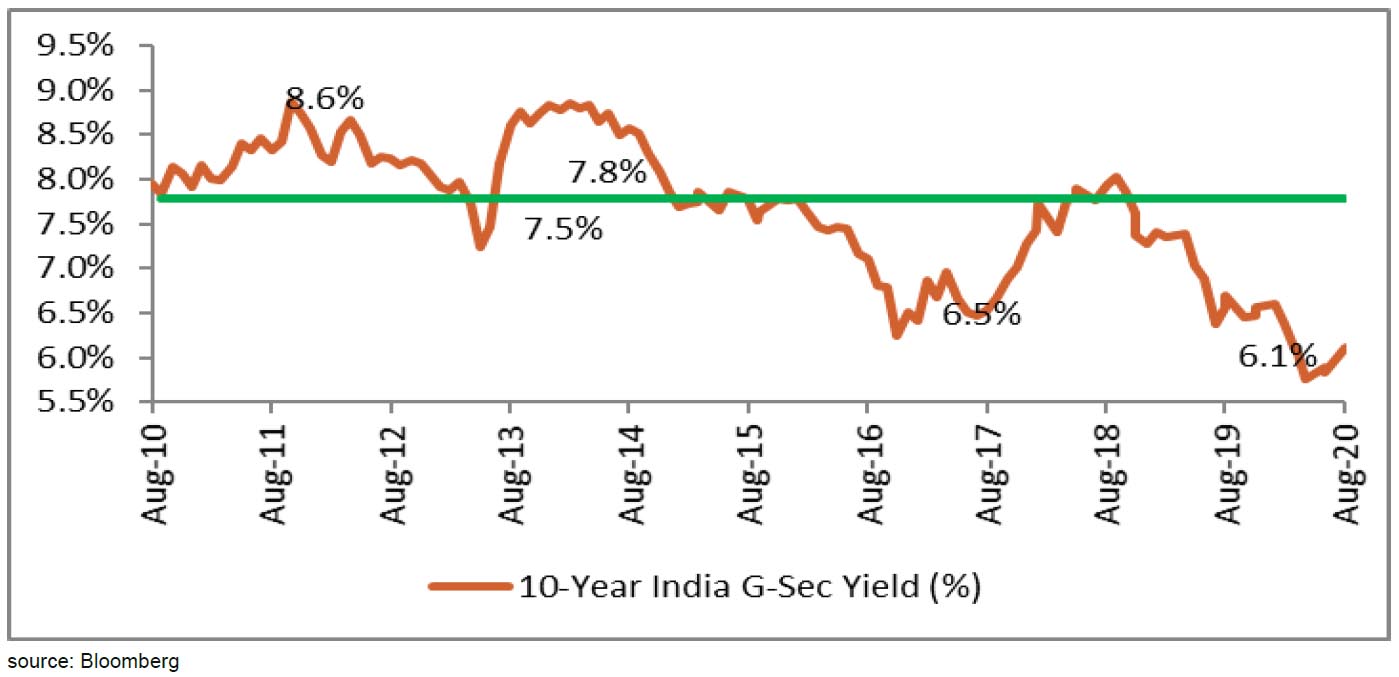

10-year benchmark G-sec rose from 5.77% to 6.19% in August and closed at 6.11% on 31st Aug due to value buying. Short term G-sec yield rose more compared to 10 year Gsec as yield curve flattened. For example, 5 year benchmark Gsec yields rose from 4.98% to 5.47% during the month.

On 31st Aug, RBI surprised the markets by announcing a hike in HTM limits of Banks from 19.5% to 22% of NDTL. This will enable banks to buy around INR3.5tn of SLR securities. RBI also announced INR40,000 cr of operation twist to support the bonds markets and also indicated that CPI would moderate from Q3 and RBI would do needful to ensure orderly market functioning.

Going forward, supply chain disruptions might persist, with implications for both food and non-food prices. Higher domestic taxes on petroleum products have resulted in elevated domestic prices and will impart broad-based cost-push pressures going forward. Headline inflation may remain elevated in Q2 FY21, but may moderate in H2 FY21 aided by large favourable base effects.

Turning to the growth outlook, the recovery in the rural economy is expected to be robust, buoyed by the progress in kharif sowing. Domestic demand conditions might recover gradually from Q2 and to sustain through Q1FY22. External demand is expected to remain anaemic under the weight of the global recession and contraction in global trade. Taking into consideration the above factors, real GDP growth is expected to be negative for FY21.

It is expected that RBI will continue its accomodative stance on growth concerns and support the huge borrowing calender of centre and states (including GST compensation) through open market operations. On this backdrop, the 10 year benchmark G-sec could trade in the range of 5.65%-6.35% in the near future.