Individual Fund

Kotak Dynamic Floating Rate Fund

(ULIF-020-07/12/04-DYFLTRFND-107)

MONTHLY UPDATE APRIL 2025

|

AS ON 31ST MARCH 2025 |

Aims to preserve capital and minimize downside risk, with investment in debt and government instruments.

Date of Inception

07th December 2004

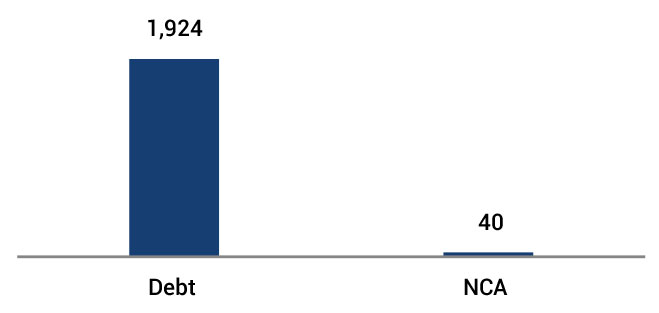

AUM (in Lakhs)

1,964.21

NAV

37.5044

Fund Manager

Debt : Manoj Bharadwaj

Benchmark Details

Debt - 100% (CRISIL Liquid)

Modified Duration

Debt & Money

Market Instruments : 0.30

Asset Allocation

| Approved (%) | Actual (%) | |

| Gsec | 00 - 75 | 7 |

| Debt | 25 - 100 | 79 |

| MMI / Others | 00 - 19 | 14 |

Performance Meter

| Dynamic Floating Rate Fund (%) | Benchmark (%) | |

| 1 month | 0.5 | 0.6 |

| 3 months | 1.6 | 1.8 |

| 6 months | 3.0 | 3.5 |

| 1 year | 6.6 | 7.3 |

| 2 years | 6.4 | 7.3 |

| 3 years | 5.5 | 6.8 |

| 4 years | 4.9 | 6.0 |

| 5 years | 4.8 | 5.6 |

| 6 years | 5.2 | 5.7 |

| 7 years | 5.4 | 6.0 |

| 10 years | 5.8 | 6.4 |

| Inception | 6.7 | 6.8 |

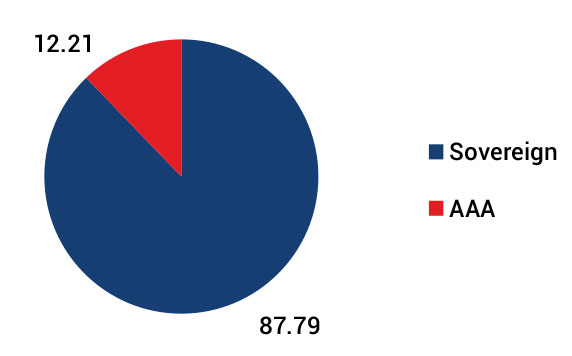

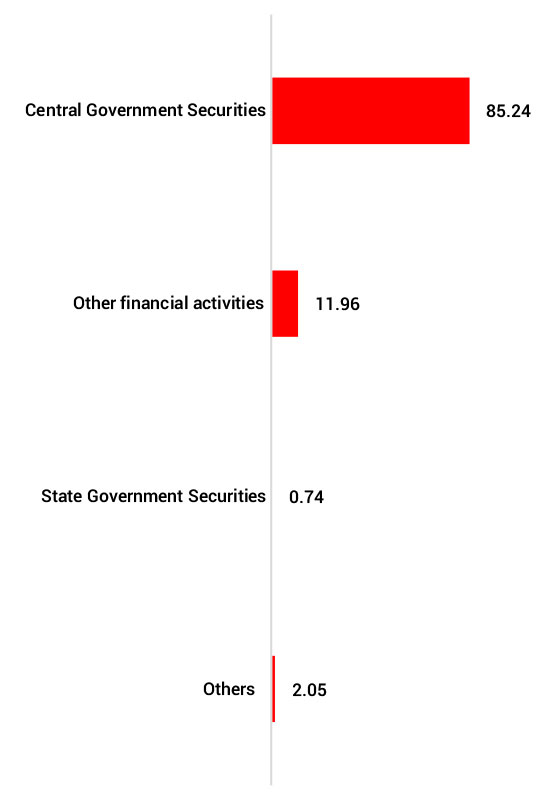

| Holdings | % to Fund |

| G-Sec | 7.46 |

| 7.38% GOI - 20.06.2027 | 5.65 |

| 6.13% GOI - 04.06.2028 | 1.05 |

| 8.14% TN SDL - 27.05.2025 | 0.74 |

| 7.72% GOI - 26.10.2055 | 0.01 |

| Corporate Debt | 78.53 |

| GOI FRB - 04.10.2028 | 37.12 |

| GOI FRB - 22.09.2033 | 30.73 |

| GOI FRB - 30.10.2034 | 10.67 |

| MMI | 11.96 |

| NCA | 2.05 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.