Global equities declined, primarily driven by growth concerns and a momentum slowdown in the United States, with

the MSCI World Index dropping 4.1% month-on-month. Among the major regions, India and South Africa emerged

as the top performers, gaining 9.4% and 7.0%, respectively, while the US saw the weakest performance, down 6.0%.

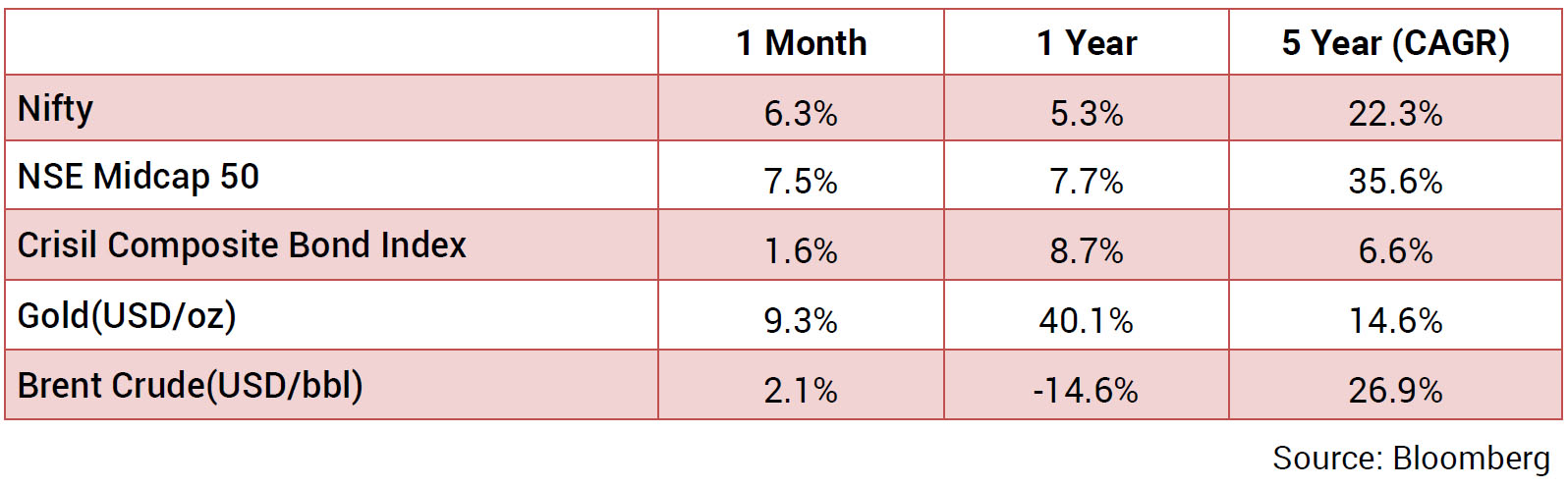

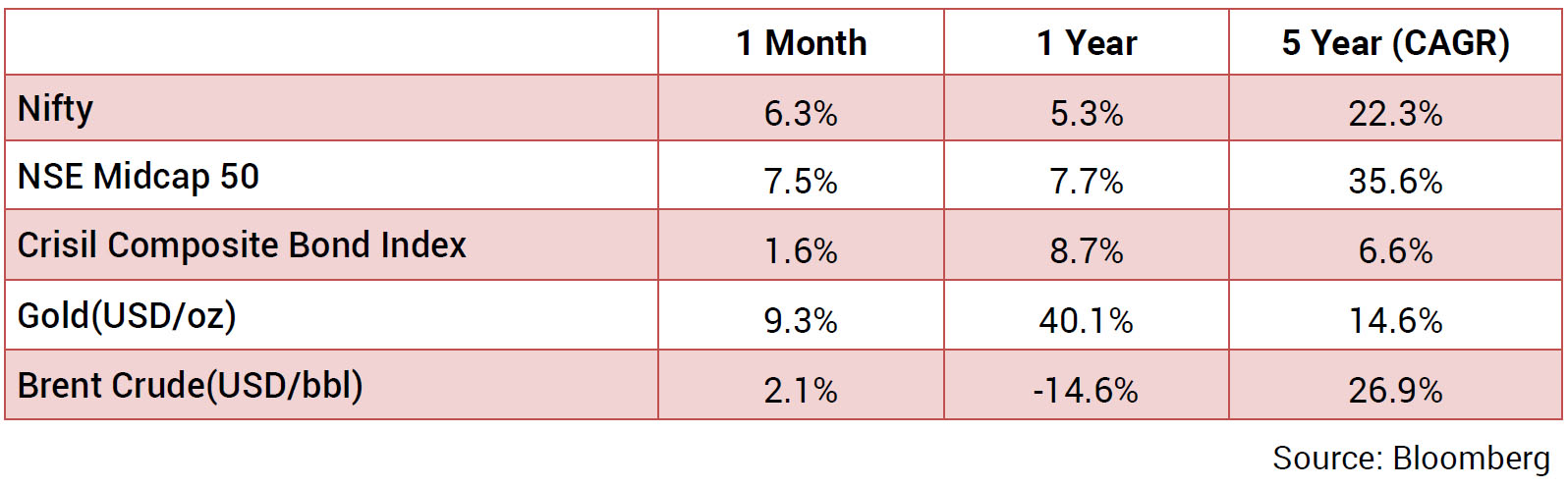

Nifty 50 was up 6.3% and ended a five-month losing spree, closing the month at 23,519 (YTD -0.5%). This rebound

was supported by some green shoots in high frequency indicators, RBI’s proactive approach to augmenting banking

system liquidity, easing regulatory pressure through the deferral of LCR norms, revised guidelines on Priority Sector

Lending to enhance credit access, and a reduction in risk weights for microfinance loans, bank loans to NBFCs, INR

appreciation and strong FII buying. Large-caps rose by 6.8%, while small/mid-caps rose by 8.8%/7.0%, respectively.

All sectors finished the month in positive territory, except for Information Technology.

Benchmark 10-year treasury yields averaged 6.67% in March (a tad lower than the Feb average of 6.70%). On month-end values, the 10Y yield was a bit lower and ended the month at 6.58% (down 15bps MoM). The U.S. 10Y yield is at 4.21% (flat MoM, +1bp YoY). INR appreciated 2.4% over the month and ended the month at 85.46/USD, with one-year depreciation at 2.4% now. Oil prices were up by 5.1% in Mar, following a decline of 4.6% in Feb. Brent currently trades at $77.2, having ended at $73.4 as of end-Feb.

The global economy’s resilience is being challenged by rising trade tensions and increasing uncertainty regarding the scope, timing, and intensity of tariffs. While contributing to greater volatility in global financial markets, these factors have also sparked concerns about a potential slowdown in global growth. Emerging economies are particularly susceptible to the spillover effects of these developments, primarily through trade, capital flows, and currency depreciation. Additionally, divergent domestic macroeconomic conditions are leading to differing policy responses among central banks.

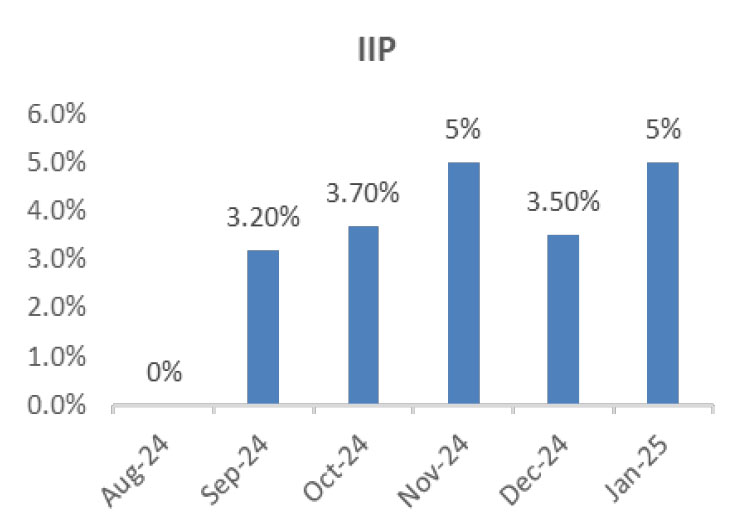

The Indian economy continues to show resilience amid global challenges, supported by strong sectoral performance and improving consumption trends. The Second Advance Estimates (SAE) from the National Statistics Office (NSO) project a steady 6.5% growth for 2024-25. Recent quarterly data highlights this strength, with real GDP growing 6.2% in Q3:2024-25, recovering from the previous quarter’s slowdown. Private consumption is rising, reflecting strong consumer confidence and sustained demand, while increased government spending is further boosting growth. Government spending has picked up significantly in recent months, providing a further fillip to growth. Key sectors, including construction, financial services, and trade, continue to thrive as pillars of economic resilience. Various high-frequency indicators of economic activity point towards a sustained momentum in growth during Q4 as well.

Benchmark 10-year treasury yields averaged 6.67% in March (a tad lower than the Feb average of 6.70%). On month-end values, the 10Y yield was a bit lower and ended the month at 6.58% (down 15bps MoM). The U.S. 10Y yield is at 4.21% (flat MoM, +1bp YoY). INR appreciated 2.4% over the month and ended the month at 85.46/USD, with one-year depreciation at 2.4% now. Oil prices were up by 5.1% in Mar, following a decline of 4.6% in Feb. Brent currently trades at $77.2, having ended at $73.4 as of end-Feb.

The global economy’s resilience is being challenged by rising trade tensions and increasing uncertainty regarding the scope, timing, and intensity of tariffs. While contributing to greater volatility in global financial markets, these factors have also sparked concerns about a potential slowdown in global growth. Emerging economies are particularly susceptible to the spillover effects of these developments, primarily through trade, capital flows, and currency depreciation. Additionally, divergent domestic macroeconomic conditions are leading to differing policy responses among central banks.

The Indian economy continues to show resilience amid global challenges, supported by strong sectoral performance and improving consumption trends. The Second Advance Estimates (SAE) from the National Statistics Office (NSO) project a steady 6.5% growth for 2024-25. Recent quarterly data highlights this strength, with real GDP growing 6.2% in Q3:2024-25, recovering from the previous quarter’s slowdown. Private consumption is rising, reflecting strong consumer confidence and sustained demand, while increased government spending is further boosting growth. Government spending has picked up significantly in recent months, providing a further fillip to growth. Key sectors, including construction, financial services, and trade, continue to thrive as pillars of economic resilience. Various high-frequency indicators of economic activity point towards a sustained momentum in growth during Q4 as well.

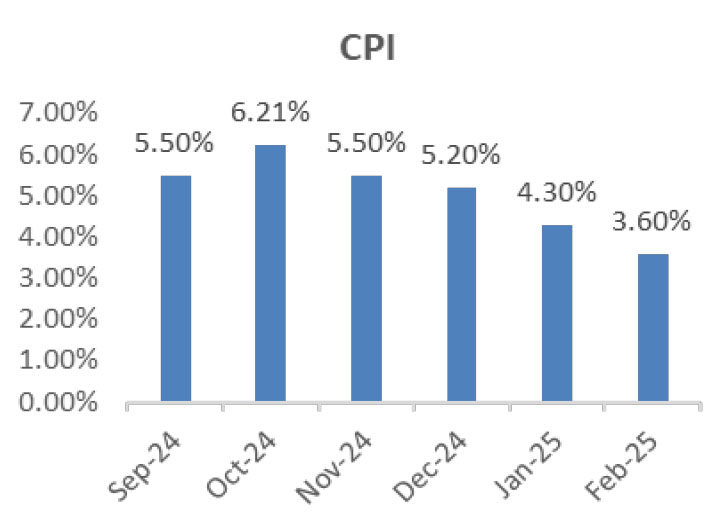

CPI: CPI inflation came in lower than expected at 3.6% YoY in February, down from 4.3% in January. This was primarily due to a

sharp decline in food and beverage inflation, which eased to 3.8% YoY from 5.7% in January, driven by lower vegetable prices.

Other food categories, such as spices, pulses, and eggs, also saw a decline. The moderation in food inflation was broad-based,

with only 35% of food items seeing inflation above 6%. Excluding vegetables, headline inflation remained stable at 3.5% in

FYTD25. Meanwhile, core inflation rose to 4.0% YoY in February, up from 3.8% in January, driven by higher gold prices.

Trade: The merchandise trade deficit narrowed unexpectedly to US$14.1bn in February, down from US$23bn in January, driven by a US$8.5bn decrease in imports. The decline was led by lower imports of electronic goods (US$1.8bn), crude oil (US$1.5bn), and ores and minerals (-US$1.0bn). While electronic goods imports typically declined in February, the drop was larger than usual. Exports were stable, up by US$0.5bn, with a fall in non-oil exports offset by a rise in oil exports.

On a FYTD basis, the trade deficit in FY25 widened to US$261bn (Apr-Feb) from US$226bn in FY24, reflecting a 15% increase, primarily due to higher crude oil imports. Net crude oil imports rose to US$106.5bn, up from US$83.6bn in FY24, driven by higher volumes and reduced discounts on Russian oil. The services surplus remained strong at US$18.5bn in February, up from US$18bn in January (revised). Notably, the combined trade and services balance turned positive in February, reaching US$4.4bn. For FYTD25, the services surplus increased to US$171.7bn, compared to US$149.3bn in FYTD24.

BOP: The Balance of Payments (BOP) deficit surged to a historical high of US$37.7bn in Q3, driven by significant capital outflows. Net capital flows turned negative at -US$26.8bn, with outflows in Foreign Portfolio Investments (FPI) and Foreign Direct Investments (FDI), banking capital, and other capital. FPI outflows were primarily in equities due to rising UST yields and risk-off sentiment following the change in the US government. Banking capital outflows were linked to NOSTRO accounts, foreign currency loans to residents and non-residents, and related assets. Other capital outflows, amounting to US$11.7bn, included export receipt timing, India’s subscription to international institutions, and SDR allocations. FDI flows, usually stable, turned negative due to higher repatriation and Indian investments abroad. This sharp rise in outflows contributed to pressure on the INR, despite the current account deficit remaining low.

Trade: The merchandise trade deficit narrowed unexpectedly to US$14.1bn in February, down from US$23bn in January, driven by a US$8.5bn decrease in imports. The decline was led by lower imports of electronic goods (US$1.8bn), crude oil (US$1.5bn), and ores and minerals (-US$1.0bn). While electronic goods imports typically declined in February, the drop was larger than usual. Exports were stable, up by US$0.5bn, with a fall in non-oil exports offset by a rise in oil exports.

On a FYTD basis, the trade deficit in FY25 widened to US$261bn (Apr-Feb) from US$226bn in FY24, reflecting a 15% increase, primarily due to higher crude oil imports. Net crude oil imports rose to US$106.5bn, up from US$83.6bn in FY24, driven by higher volumes and reduced discounts on Russian oil. The services surplus remained strong at US$18.5bn in February, up from US$18bn in January (revised). Notably, the combined trade and services balance turned positive in February, reaching US$4.4bn. For FYTD25, the services surplus increased to US$171.7bn, compared to US$149.3bn in FYTD24.

BOP: The Balance of Payments (BOP) deficit surged to a historical high of US$37.7bn in Q3, driven by significant capital outflows. Net capital flows turned negative at -US$26.8bn, with outflows in Foreign Portfolio Investments (FPI) and Foreign Direct Investments (FDI), banking capital, and other capital. FPI outflows were primarily in equities due to rising UST yields and risk-off sentiment following the change in the US government. Banking capital outflows were linked to NOSTRO accounts, foreign currency loans to residents and non-residents, and related assets. Other capital outflows, amounting to US$11.7bn, included export receipt timing, India’s subscription to international institutions, and SDR allocations. FDI flows, usually stable, turned negative due to higher repatriation and Indian investments abroad. This sharp rise in outflows contributed to pressure on the INR, despite the current account deficit remaining low.

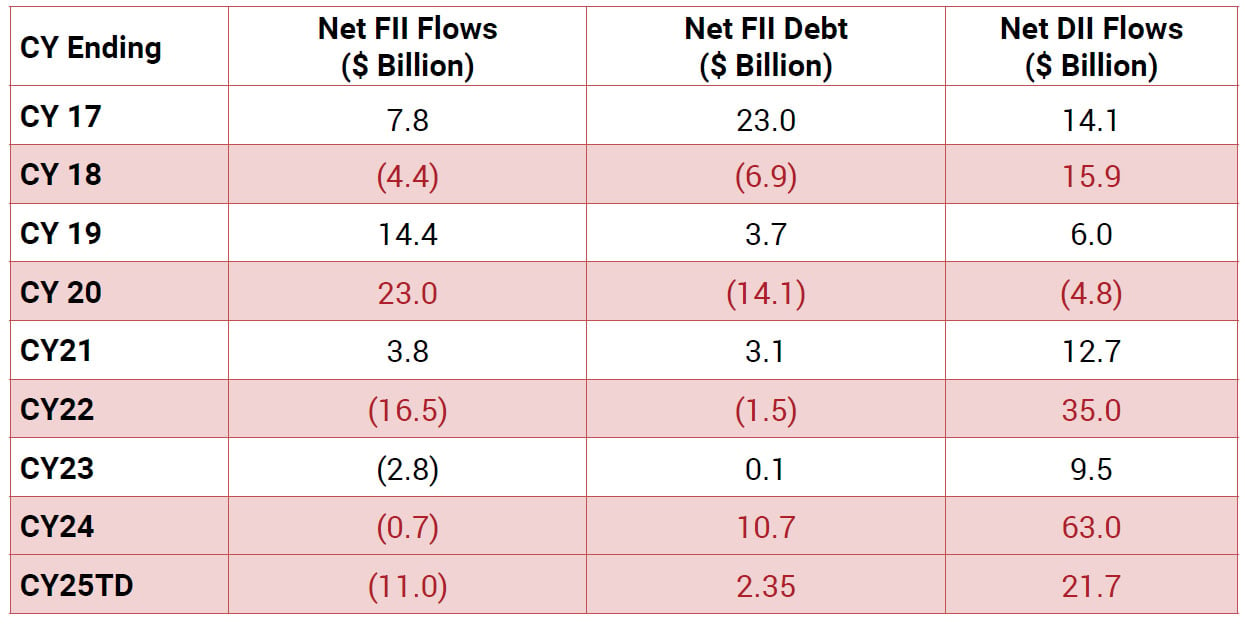

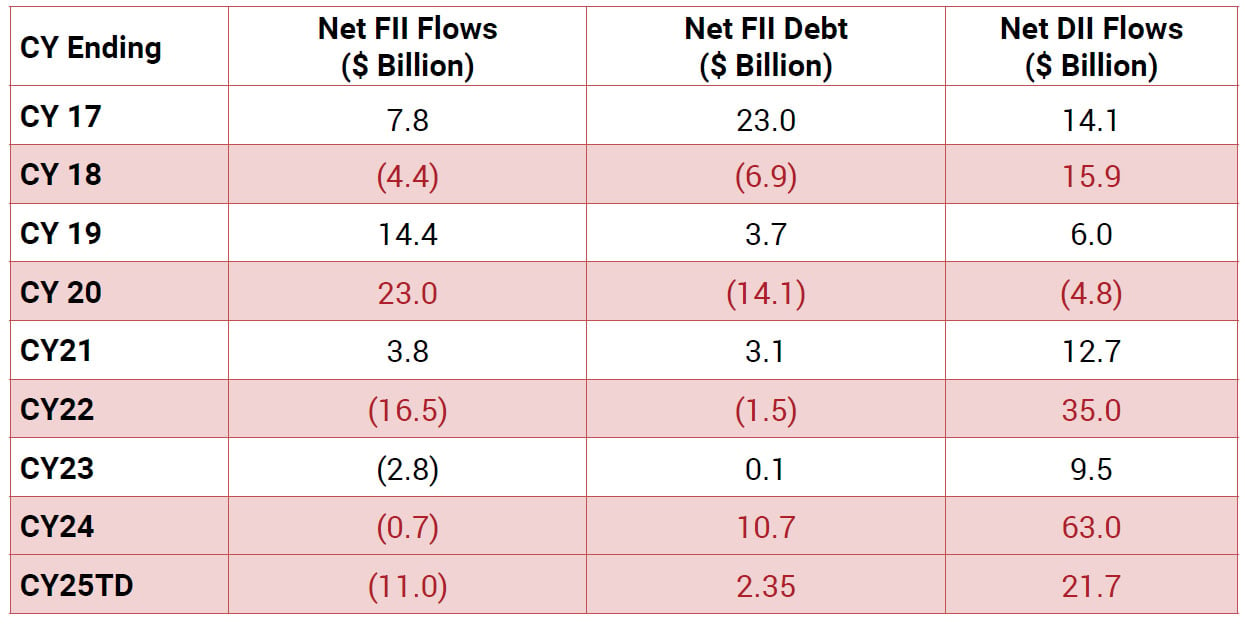

FIIs turned buyers and bought $1.0bn of equities in Mar (after selling $5.4bn in Feb) – with a selling of $2.2bn in

the first half and a buying of $3.2bn in the second half. DIIs remained net buyers for the 20th consecutive month,

with strong inflows of $4.3bn in Mar (vs. inflows of $7.4bn in Feb). Mutual funds were net buyers in Mar, with inflows

of +$1.1bn (vs. +$5.5bn in Feb). Insurance funds were also net buyers in the month, with inflows of +$3.3bn

(vs.+$1.9bn in Feb).