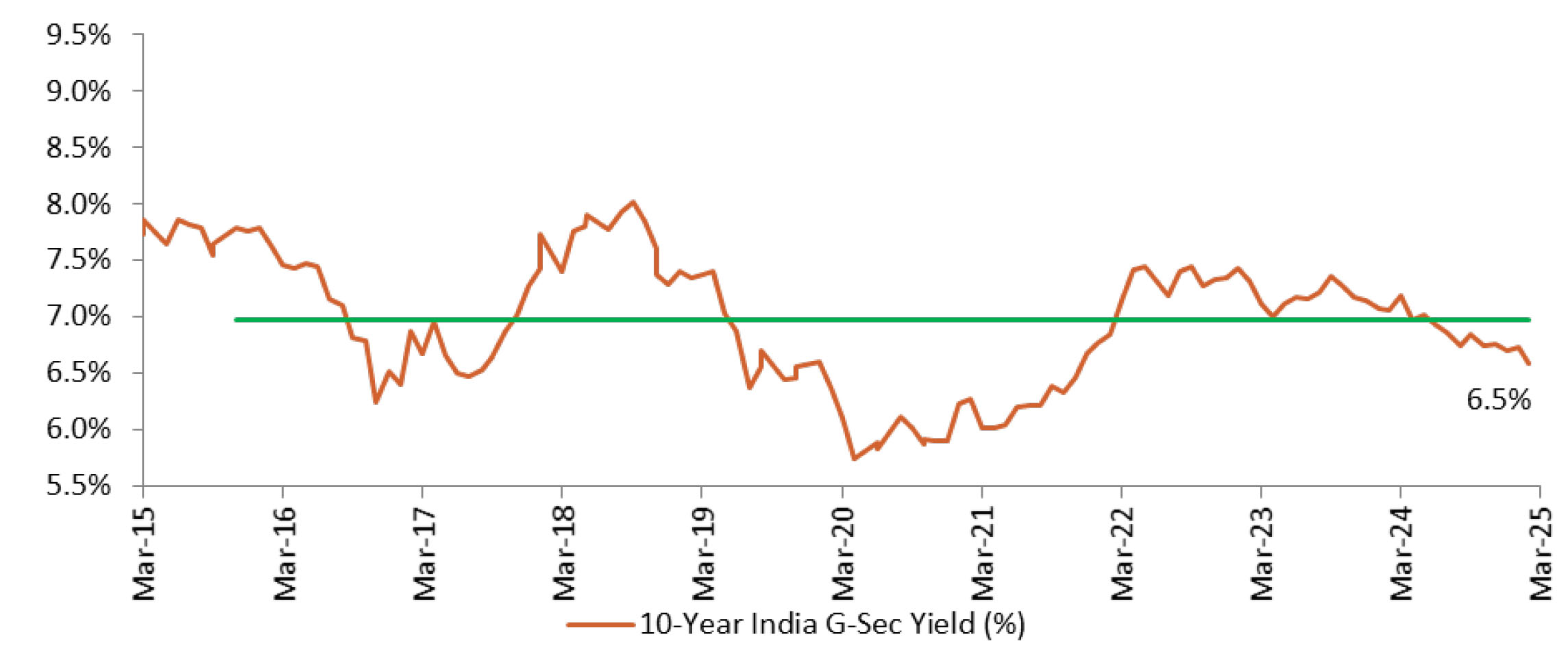

The RBI’s aggressive liquidity easing measures suggest a strong intent on ensuring smooth monetary transmission as it continues on its rate easing path. Based on our estimates of muted FY2026 growth and a comfortable inflation trajectory, we continue to expect 25 bps of rate cuts each in the April policy, accompanied by a possible shift in stance to accommodative. However, uncertainties related to tariff measures announced by the Trump-led US administration (and consequently repricing of the Fed’s rate cut cycle) along with geopolitics-led supply-side disruptions pose headwinds to the outlook. We expect the yields to move lower amidst (1) easing of liquidity conditions, rate cuts along with expected FPI demand providing support to the shorter end of the curve, and (2) the lower supply in the longer end, which is expected to offset the heavy debt switch budgeted at Rs 2.5 tn.