● Policy continuity expected:We believe the government focus on capex, manufacturing and infra push would continue. Healthy corporate balance sheet and decent domestic demand is expected to be the driver for capex cycle in India.

● GST collections: India’s goods and services tax collections surged by 9.9% YoY to Rs 1.96 lakh crore crore during March. Central GST collections stood at Rs 38,100 crore while state GST collections were at Rs 49,900 crore. Integrated GST collection was at Rs 95,900 crore while GST cess collections at Rs 12,300 crore in March. Net GST collections in March was at Rs. 1.76 lakh crore, up 7.3% YoY while gross GST collections for FY25 stands Rs 22.08 lakh crore, up 9.4%, YoY. After adjusting refunds, Net GST collections for the FY25 is Rs 19.56 lakh crore, up 8.6%.

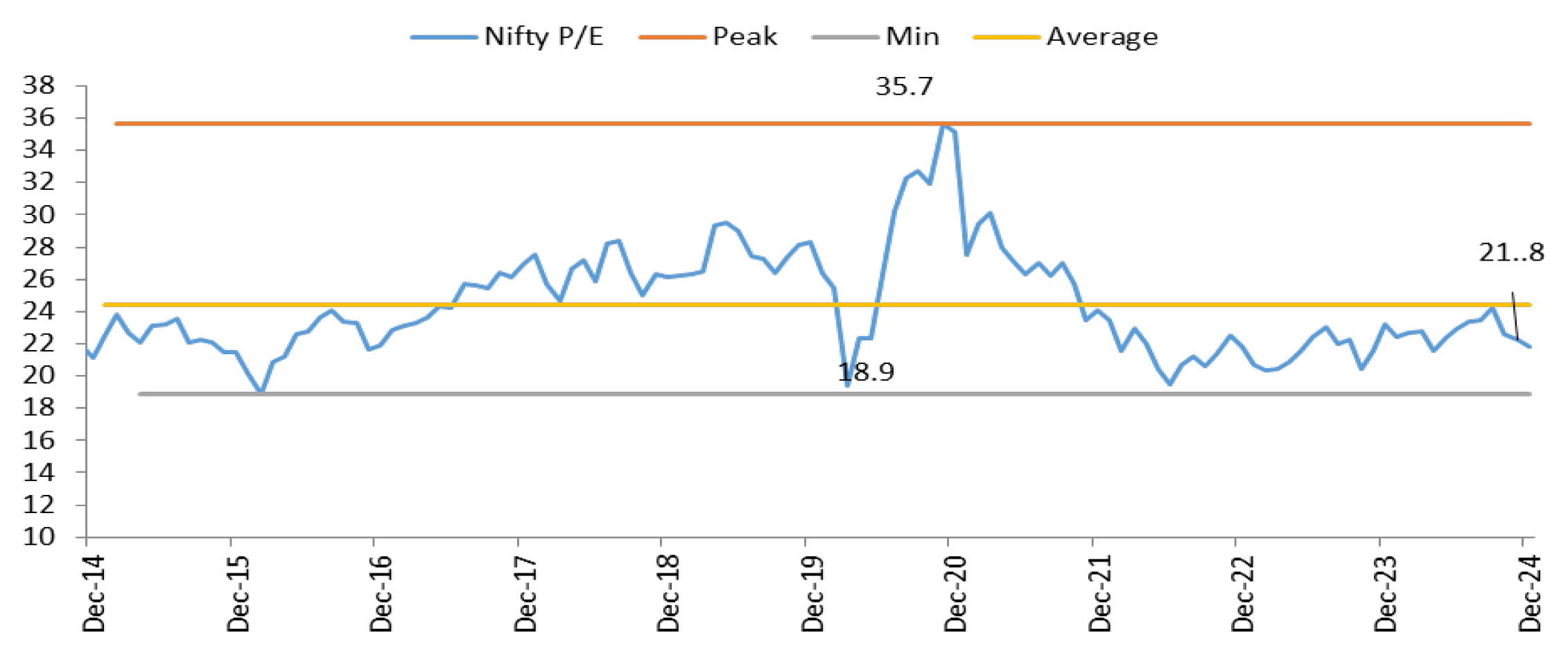

● Outlook: India’s economic recovery continues with GDP improving to and moving towards an average of 6.5%. Macros remain strong amidst moderating inflation prints, range-bound crude prices, easing 10-year G-sec yield, stable currency, and resilient corporate earnings. A healthy domestic macro and micro environment and strong retail participation would continue to keep market sentiments positive, even as risks continue to emanate from geopolitics and tariffs.