Individual Fund

Kotak Dynamic Floating Rate Fund

(ULIF-020-07/12/04-DYFLTRFND-107)

MONTHLY UPDATE AUGUST 2025

|

AS ON 31ST JULY 2025 |

Aims to minimize the downside of interest rate risk by investing in floating rate debt instruments that give returns in line with interest

rate movements.

Date of Inception

07th December 2004

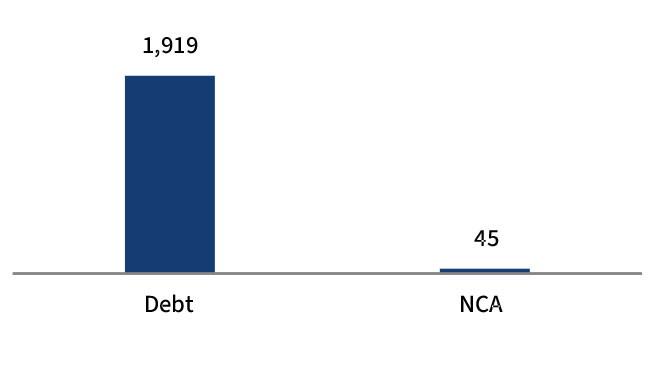

AUM (in Lakhs)

1,963.61

NAV

38.4855

Fund Manager

Debt : Manoj Bharadwaj

Benchmark Details

Debt - 100% (CRISIL Liquid)

Modified Duration

Debt & Money

Market Instruments : 0.18

Asset Allocation

| Approved (%) | Actual (%) | |

| Debt | 60 - 100 | 86 |

| MMI / Others | 00 - 40 | 14 |

Performance Meter

| Dynamic Floating Rate Fund (%) | Benchmark (%) | |

| 1 month | 0.4 | 0.5 |

| 3 months | 1.7 | 1.5 |

| 6 months | 3.8 | 3.3 |

| 1 year | 6.7 | 7.0 |

| 2 years | 6.7 | 7.2 |

| 3 years | 6.3 | 7.0 |

| 4 years | 5.2 | 6.3 |

| 5 years | 4.8 | 5.7 |

| 6 years | 5.1 | 5.7 |

| 7 years | 5.6 | 6.0 |

| 10 years | 5.8 | 6.3 |

| Inception | 6.7 | 6.8 |

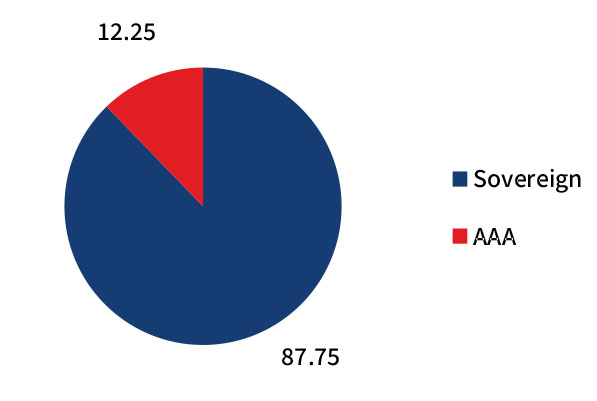

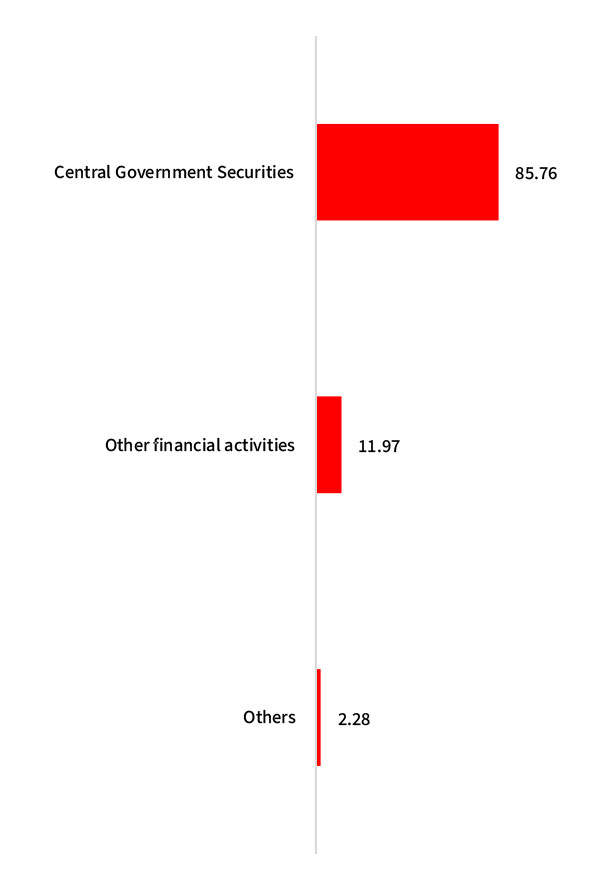

| Holdings | % to Fund |

| G-Sec | 1.08 |

| 6.13% GOI - 04.06.2028 | 1.07 |

| 7.72% GOI - 26.10.2055 | 0.01 |

| Corporate Debt | 84.68 |

| GOI FRB - 04.10.2028 | 37.34 |

| GOI FRB - 22.09.2033 | 36.35 |

| GOI FRB - 30.10.2034 | 10.99 |

| MMI | 11.97 |

| NCA | 2.28 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.