Individual Fund

Kotak Dynamic Growth Fund

(ULIF-012-27/06/03-DYGWTFND-107)

MONTHLY UPDATE JULY 2025

|

AS ON 30TH JUNE 2025 |

The portfolio will consist of a professionally managed portfolio primarily invested in listed equity and equity related investments. Security

will be enhanced through holdings in Government and other debt securities, infrastructure assets as defined in the IRDAI regulations

together with short-term investments.

Date of Inception

27th June 2003

AUM (in Lakhs)

5,499.72

NAV

180.4110

Fund Manager

Equity : Rohit Agarwal

Debt :Manoj Bharadwaj

Debt :Manoj Bharadwaj

Benchmark Details

Equity - 80% (BSE 100);

Debt - 20% (Crisil Composite Bond)

Modified Duration

Debt & Money

Market Instruments : 5.45

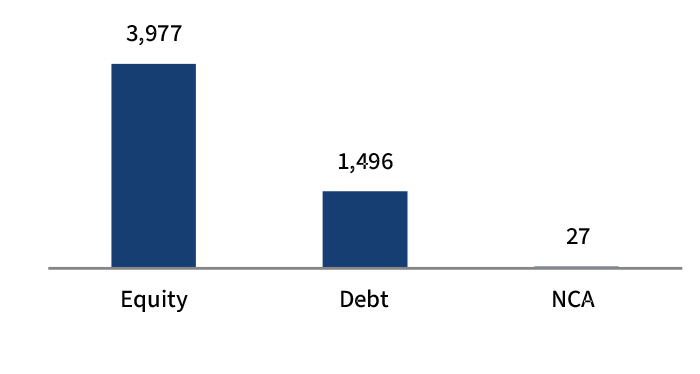

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 40 - 80 | 72 |

| Gsec / Debt | 20 - 60 | 23 |

| MMI / Others | 00 - 40 | 5 |

Performance Meter

| Kotak Dynamic Growth Fund (%) | Benchmark (%) | |

| 1 month | 1.9 | 2.4 |

| 3 months | 7.0 | 7.6 |

| 6 months | 2.4 | 6.5 |

| 1 year | 5.2 | 6.3 |

| 2 years | 16.3 | 15.3 |

| 3 years | 17.8 | 16.7 |

| 4 years | 13.2 | 12.4 |

| 5 years | 18.5 | 17.9 |

| 6 years | 13.9 | 13.3 |

| 7 years | 13.2 | 12.7 |

| 10 years | 12.0 | 11.5 |

| Inception | 14.0 | 13.1 |

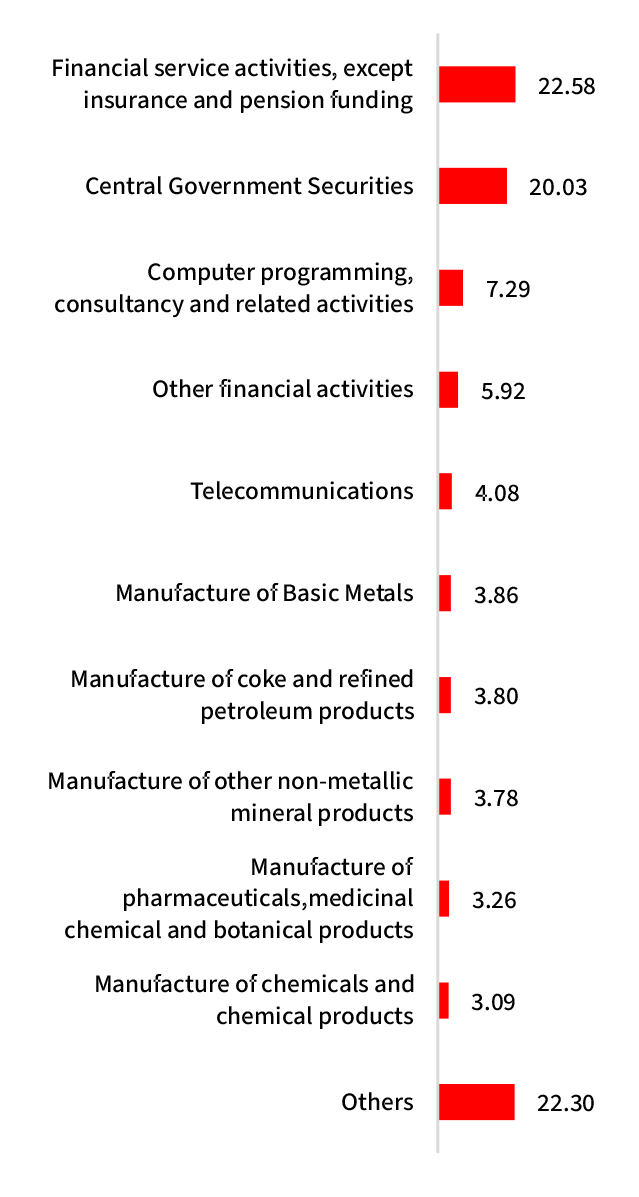

| Holdings | % to Fund |

| Equity | 72.32 |

| ICICI Bank Ltd. | 5.16 |

| HDFC Bank Ltd. | 4.64 |

| Bharti Airtel Ltd. | 3.69 |

| Infosys Ltd. | 3.21 |

| Reliance Industries Ltd | 2.81 |

| Larsen And Toubro Ltd. | 2.38 |

| State Bank of India. | 2.18 |

| Axis Bank Ltd. | 2.11 |

| Shriram Finance Limited | 1.87 |

| I T C Ltd. | 1.84 |

| Others | 42.43 |

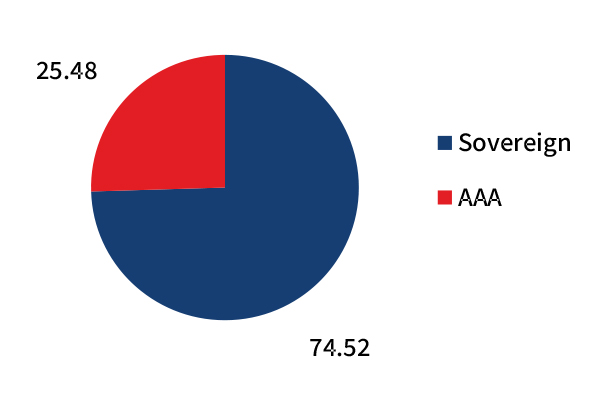

| G-Sec | 20.27 |

| 7.10% GOI - 08.04.2034 | 4.07 |

| 7.37% GOI - 23.10.2028 | 4.01 |

| 7.26% GOI - 06.02.2033 | 2.04 |

| 6.67% GOI - 15.12.2035 | 1.85 |

| 8.17% GOI - 01.12.2044 | 1.17 |

| 7.18% GOI - 24.07.2037 | 1.10 |

| 6.92% GOI - 18.11.2039 | 0.97 |

| 8.30% GOI - 02.07.2040 | 0.83 |

| 7.72% GOI - 26.10.2055 | 0.76 |

| 7.41% GOI - 19.12.2036 | 0.71 |

| Others | 2.75 |

| Corporate Debt | 2.84 |

| 8.06% Bajaj Finance Ltd - 15.05.2029 | 0.93 |

| 8.70% REC - 28.09.2028 | 0.77 |

| 8.56% REC - 29.11.2028 | 0.58 |

| 7.80% HDFC BANK - 03.05.2033 | 0.56 |

| MMI | 4.09 |

| NCA | 0.48 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.