Global equities posted a strong rebound in June, rising 4.4% for the month, with most gains occurring after the Israel-Iran

ceasefire improved market sentiment. Among key regions, MSCI Brazil (+7.2%) and the U.S. (+5.0%) outperformed, while

Japan (-1.6%) and Europe (-2.0%) lagged. In India, the Nifty 50 gained 3.1% to close at 25,517, supported by an unexpected

RBI rate cut and liquidity boost, easing geopolitical tensions, cooling oil prices, and a modest appreciation in the INR.

Broader markets saw healthy participation, with large-caps up 3.3%, mid-caps up 3.7%, and small-caps leading with a 4.5%

rise—now up over 16% in two months, signaling renewed retail investor interest. All sectors ended the month in the green,

except for Consumer Staples.

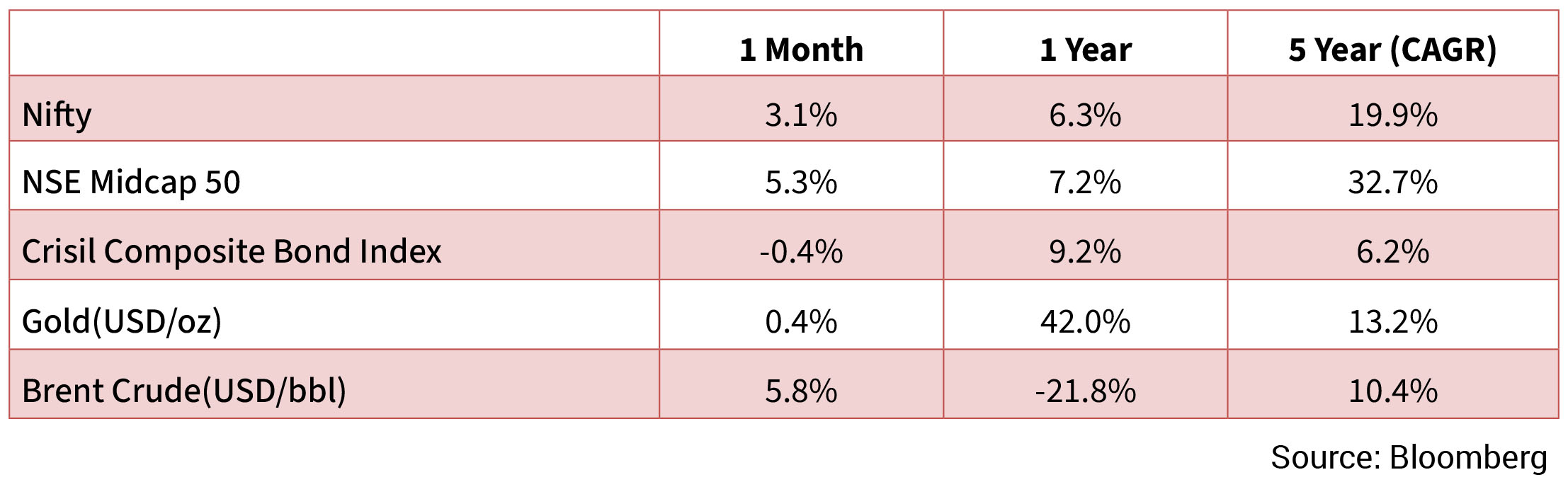

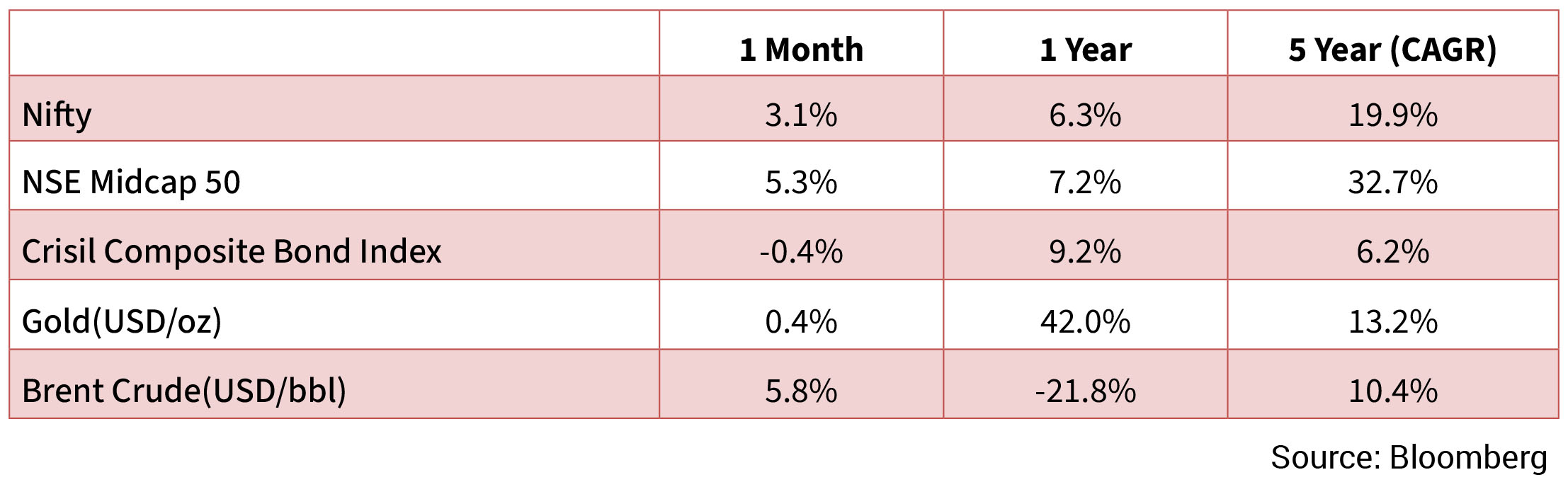

In June, India’s 10-year government bond yields averaged 6.34%, slightly above May’s 6.30%, and closed the month higher at 6.39%, marking a 10-bps increase. Meanwhile, U.S. 10-year yields declined by 17 bps, ending at 4.24%. The INR was largely stable, appreciating by 0.21% over the month to settle at 85.76/USD, with a year-on-year depreciation of 2.85%. Brent crude prices continued their upward trend, rising 6.30% in June after a 2.60% gain in May, and closed the month at $66.50, up from $62.60 in May.

Global markets remained resilient in June, buoyed by improved sentiment following the Israel-Iran ceasefire. Early in the month, the U.S. doubled tariffs on imported steel and aluminum from 25% to 50%, but later progress was seen as high-level negotiations with China resulted in a preliminary trade framework. This agreement, still pending final approval, proposes a layered tariff structure—starting with a 10% reciprocal base tariff and additional duties on specific goods—to stabilize bilateral trade tensions. Despite this, policy uncertainty—especially in the U.S.—continues to weigh on the global economic outlook. Currency markets reflected the volatility, with the U.S. dollar down 10.8% year-to-date, driven by trade policy concerns and President Trump’s calls for Federal Reserve rate cuts. Gold prices remained flat at $3,295 in June, after hitting a record high of $3,500 in April.

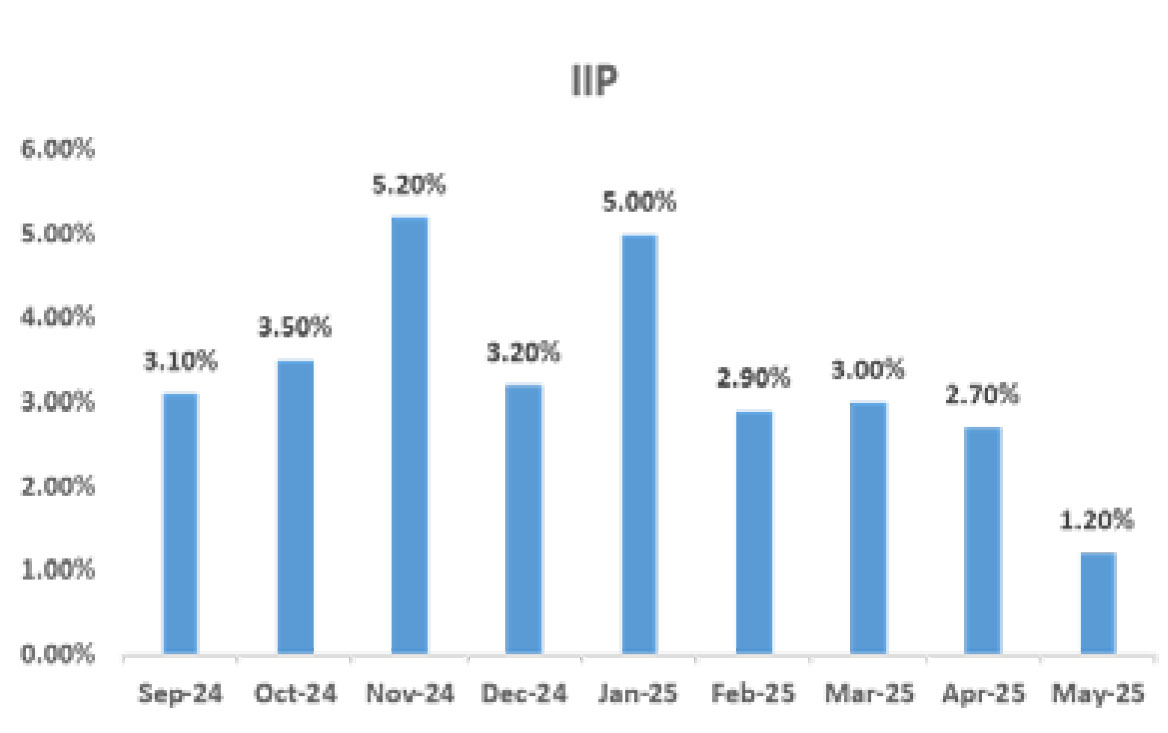

The Indian economy demonstrated resilience in June, supported by a surprise 50 bps rate cut and a 100-bps reduction in the Cash Reserve Ratio (CRR) announced by the RBI, though the CRR cut will take effect later in the year. The RBI also shifted its monetary policy stance from ‘accommodative’ to ‘neutral.’ Improved investor sentiment was bolstered by the easing of tensions between Iran and Israel. After an initial spike of over 20%, crude oil prices fell sharply following the ceasefire, closing the month with a more modest 6% increase. India’s goods trade deficit narrowed to $21.9 billion in May, down from $26.4 billion in April. Industrial production growth slowed, with May’s IIP rising just 1.2%, compared to a revised 2.6% in April, while the composite PMI in June reached a 14-month high of 61, up from 59.3 in May.

In June, India’s 10-year government bond yields averaged 6.34%, slightly above May’s 6.30%, and closed the month higher at 6.39%, marking a 10-bps increase. Meanwhile, U.S. 10-year yields declined by 17 bps, ending at 4.24%. The INR was largely stable, appreciating by 0.21% over the month to settle at 85.76/USD, with a year-on-year depreciation of 2.85%. Brent crude prices continued their upward trend, rising 6.30% in June after a 2.60% gain in May, and closed the month at $66.50, up from $62.60 in May.

Global markets remained resilient in June, buoyed by improved sentiment following the Israel-Iran ceasefire. Early in the month, the U.S. doubled tariffs on imported steel and aluminum from 25% to 50%, but later progress was seen as high-level negotiations with China resulted in a preliminary trade framework. This agreement, still pending final approval, proposes a layered tariff structure—starting with a 10% reciprocal base tariff and additional duties on specific goods—to stabilize bilateral trade tensions. Despite this, policy uncertainty—especially in the U.S.—continues to weigh on the global economic outlook. Currency markets reflected the volatility, with the U.S. dollar down 10.8% year-to-date, driven by trade policy concerns and President Trump’s calls for Federal Reserve rate cuts. Gold prices remained flat at $3,295 in June, after hitting a record high of $3,500 in April.

The Indian economy demonstrated resilience in June, supported by a surprise 50 bps rate cut and a 100-bps reduction in the Cash Reserve Ratio (CRR) announced by the RBI, though the CRR cut will take effect later in the year. The RBI also shifted its monetary policy stance from ‘accommodative’ to ‘neutral.’ Improved investor sentiment was bolstered by the easing of tensions between Iran and Israel. After an initial spike of over 20%, crude oil prices fell sharply following the ceasefire, closing the month with a more modest 6% increase. India’s goods trade deficit narrowed to $21.9 billion in May, down from $26.4 billion in April. Industrial production growth slowed, with May’s IIP rising just 1.2%, compared to a revised 2.6% in April, while the composite PMI in June reached a 14-month high of 61, up from 59.3 in May.

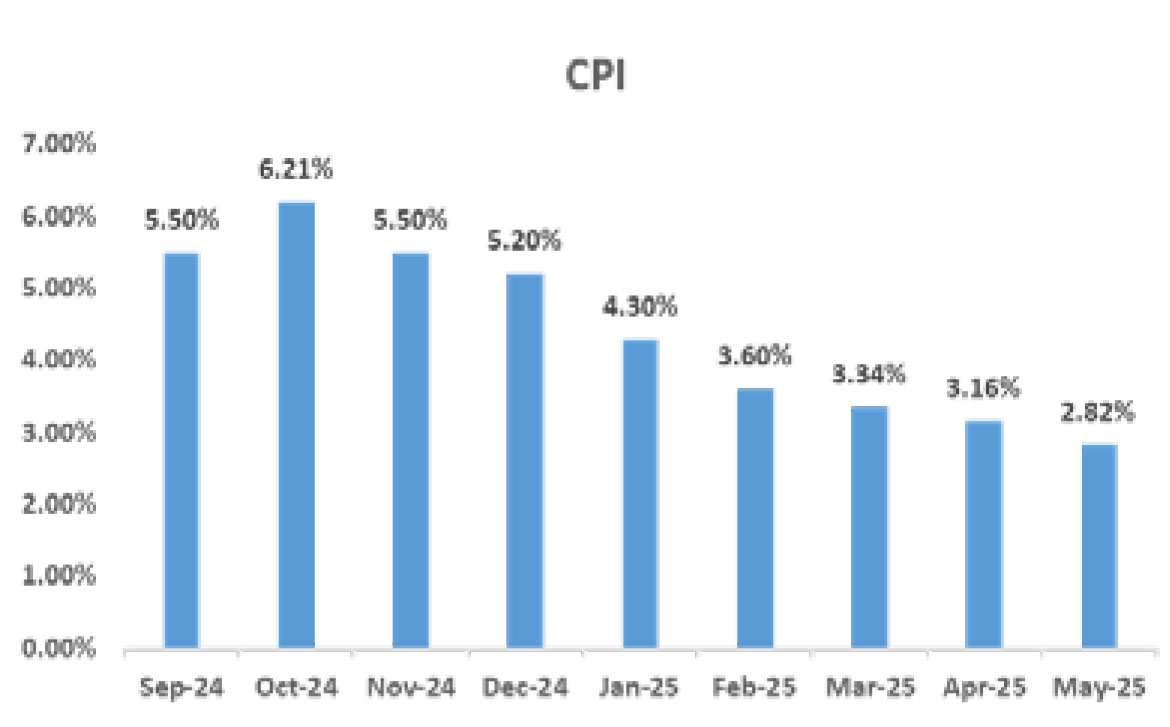

CPI: May’s Consumer Price Index (CPI) came in below expectations at 2.8% year-on-year—the lowest since February 2019—down from

3.2% in April. On a month-on-month basis, headline inflation rose slightly by 0.1%, matching April’s increase. The softer inflation print

was mainly due to food prices, which declined for the fifth straight month, falling 0.1% month-on-month in May, largely driven by lower

vegetable prices. Even food prices excluding vegetables remained subdued, rising just 0.2% month-on-month, with staples like cereals

and pulses seeing price declines. CPI for the third quarter of FY25 is forecasted to average below 3%, lower than the RBI’s 3.4% projection.

However, core inflation remained elevated at around 4.2%, supported by higher gold prices.

Trade: India’s trade data for May showed a strengthening in both merchandise exports and imports, with the merchandise trade deficit narrowing to $21.88 billion from $26.42 billion in April and slightly below the $22.09 billion recorded in May 2024. Merchandise exports dipped 2.17% year-on-year to $38.73 billion, down from $39.59 billion the previous May, while imports also fell 1.7% to $60.61 billion from $61.68 billion. The services sector continued to perform well, posting an estimated trade surplus of $14.65 billion in May, driven by exports of $32.39 billion and imports of $17.14 billion. Notably, India’s exports to the U.S. grew significantly in April- May to $17.25 billion from $14.17 billion a year earlier. However, exporters remain cautious amid ongoing uncertainty surrounding the 90-day pause on reciprocal tariffs for major trading partners, with a 26% tariff on Indian goods set to remain in effect until July 9.

BOP: India recorded a current account deficit (CAD) of $23.3 billion (0.6% of GDP) for FY 2025, an improvement from the $26 billion (0.7% of GDP) deficits in FY 2024. This narrowing was primarily due to higher net invisibles receipts, including services exports and remittances. The January-March 2025 quarter saw a current account surplus of $13.5 billion (1.3% of GDP), a significant turnaround from the $11.3 billion deficit (1.1% of GDP) in Q3 FY25. This surplus was driven by strong services exports and a decline in merchandise imports. Net FDI inflows were $1 billion in FY 2025, a decrease from $10.2 billion in FY 2024. Net FPI inflows stood at $3.6 billion, down from $44.1 billion in the previous fiscal year. India’s external debt increased by $67.5 billion to $736.3 billion by March 2025, with the external debt to GDP ratio rising to 19.1% from 18.5% in March 2024. India’s foreign exchange reserves increased by $8.8 billion on a balance of payments basis in the March quarter, lower than the $30.8 billion accretion in the year-ago period. Meanwhile, forex reserves in FY25 saw a net depletion of $5.0 billion during FY25, as compared to an accretion of $63.7 billion in FY24. Net inflows under external commercial borrowings (ECBs) to India amounted to $7.4 billion in Q4FY25, as compared to $2.6 billion in the corresponding period a year ago. Non-resident deposits (NRI deposits) recorded a net inflow of $2.8 billion in the March quarter, lower than $5.4 billion a year ago.

Trade: India’s trade data for May showed a strengthening in both merchandise exports and imports, with the merchandise trade deficit narrowing to $21.88 billion from $26.42 billion in April and slightly below the $22.09 billion recorded in May 2024. Merchandise exports dipped 2.17% year-on-year to $38.73 billion, down from $39.59 billion the previous May, while imports also fell 1.7% to $60.61 billion from $61.68 billion. The services sector continued to perform well, posting an estimated trade surplus of $14.65 billion in May, driven by exports of $32.39 billion and imports of $17.14 billion. Notably, India’s exports to the U.S. grew significantly in April- May to $17.25 billion from $14.17 billion a year earlier. However, exporters remain cautious amid ongoing uncertainty surrounding the 90-day pause on reciprocal tariffs for major trading partners, with a 26% tariff on Indian goods set to remain in effect until July 9.

BOP: India recorded a current account deficit (CAD) of $23.3 billion (0.6% of GDP) for FY 2025, an improvement from the $26 billion (0.7% of GDP) deficits in FY 2024. This narrowing was primarily due to higher net invisibles receipts, including services exports and remittances. The January-March 2025 quarter saw a current account surplus of $13.5 billion (1.3% of GDP), a significant turnaround from the $11.3 billion deficit (1.1% of GDP) in Q3 FY25. This surplus was driven by strong services exports and a decline in merchandise imports. Net FDI inflows were $1 billion in FY 2025, a decrease from $10.2 billion in FY 2024. Net FPI inflows stood at $3.6 billion, down from $44.1 billion in the previous fiscal year. India’s external debt increased by $67.5 billion to $736.3 billion by March 2025, with the external debt to GDP ratio rising to 19.1% from 18.5% in March 2024. India’s foreign exchange reserves increased by $8.8 billion on a balance of payments basis in the March quarter, lower than the $30.8 billion accretion in the year-ago period. Meanwhile, forex reserves in FY25 saw a net depletion of $5.0 billion during FY25, as compared to an accretion of $63.7 billion in FY24. Net inflows under external commercial borrowings (ECBs) to India amounted to $7.4 billion in Q4FY25, as compared to $2.6 billion in the corresponding period a year ago. Non-resident deposits (NRI deposits) recorded a net inflow of $2.8 billion in the March quarter, lower than $5.4 billion a year ago.

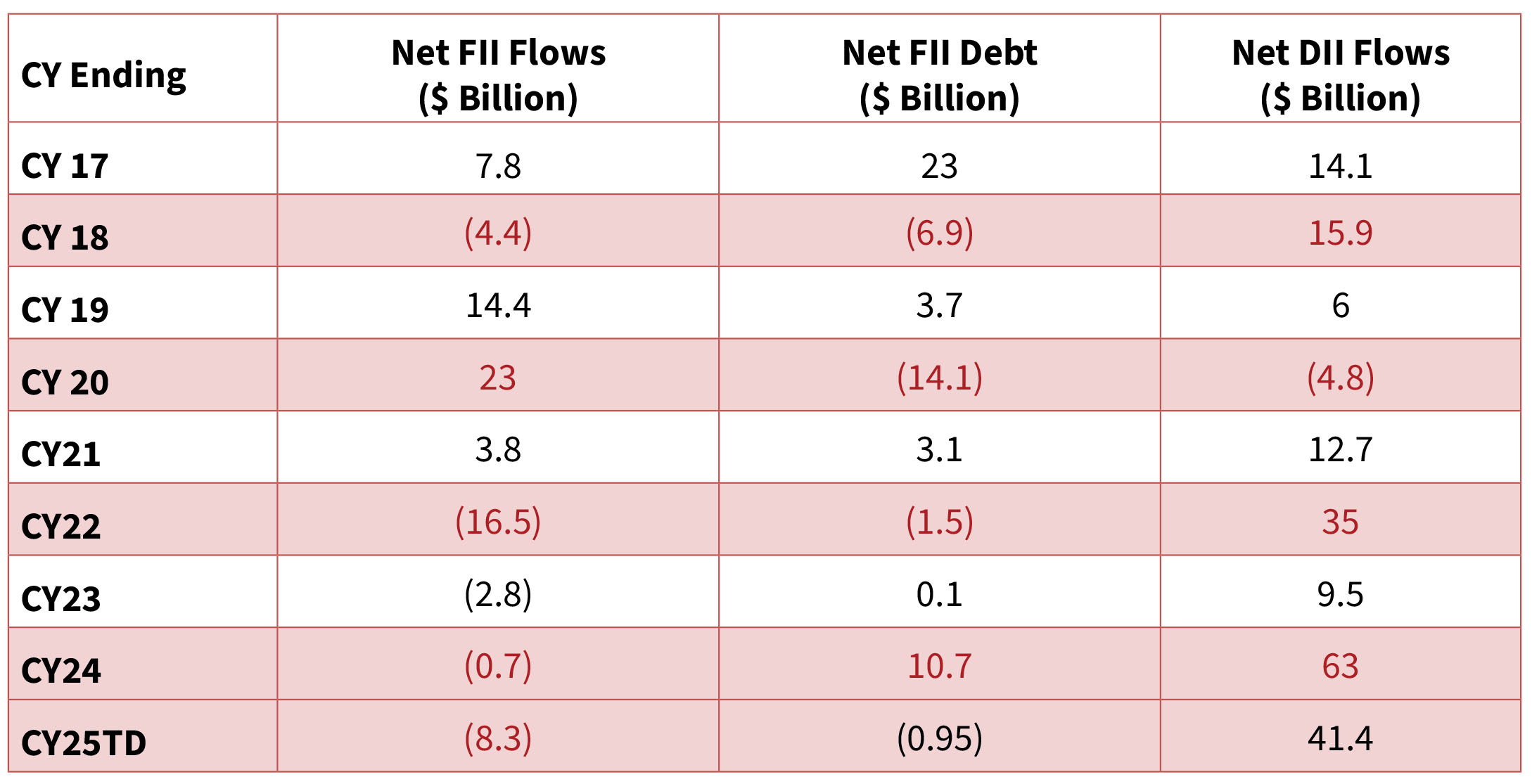

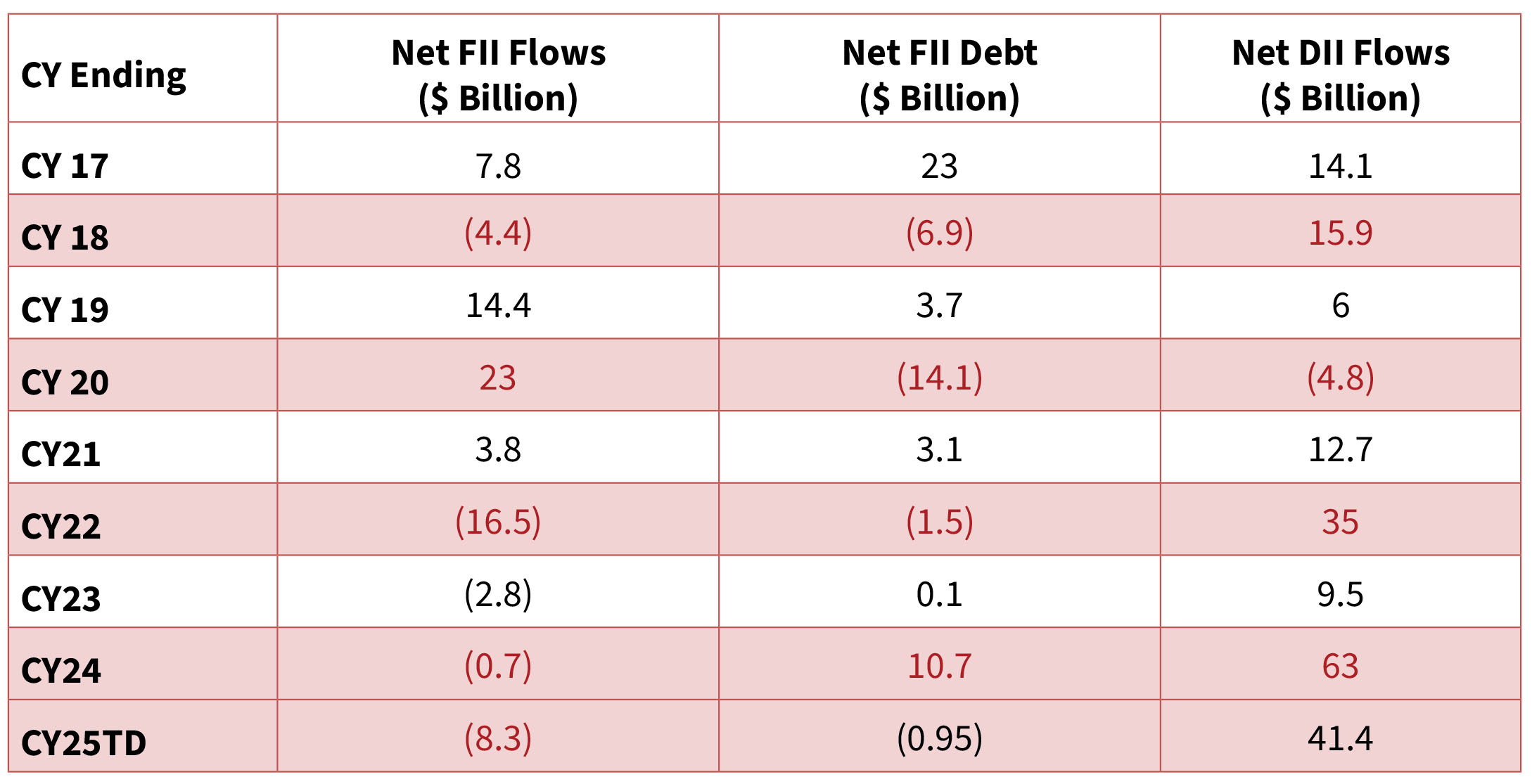

The first half of June witnessed a selling of $0.1bn, while there was a buying of $2.4bn in the second half. FIIs were sellers in the bond

markets with $0.7bn selling in June, following the$0.2bn buying seen in May. FII bought $2.3bn in June (vs $1.7bn in May). DIIs remained

net buyers for the 23rd consecutive month, with inflows of $8.5bn in June (vs. inflows of $7.9bn in May). Mutual funds were net buyers in

June, with inflows of +$5.0bn (vs +$6.5bn in May). Insurance funds were also net buyers, with inflows of +$3.4bn (vs+$1.4bn in May). Retail

were modest buyers with ~$0.1bn of inflows in June (vs. $0.5bn of outflows seen in May).