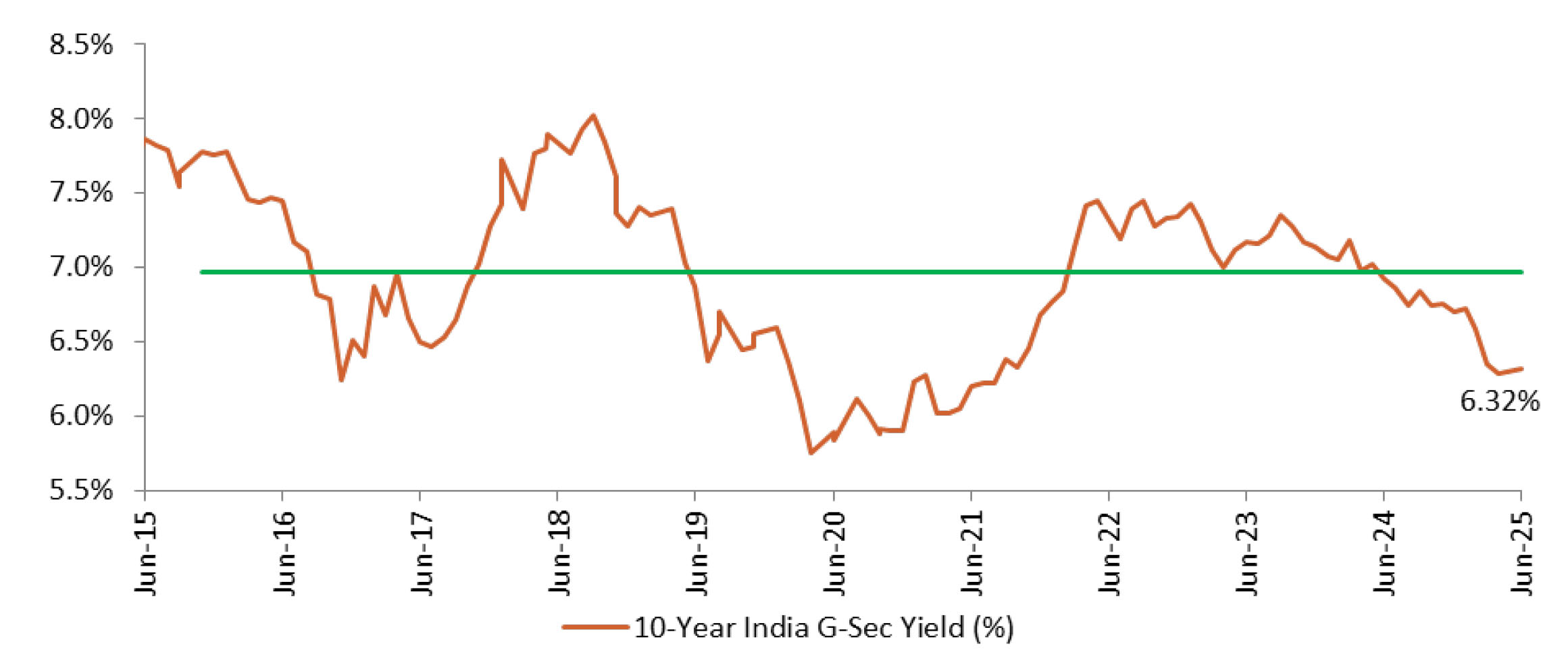

The RBI surprised the markets by cutting the policy rate by 50 basis points—double the expected 25bps—and announced a 100bps reduction in the Cash Reserve Ratio (CRR), effective later this year. Despite these dovish moves, the Monetary Policy Committee shifted its stance back to neutral, signaling limited room for further monetary support. Governor Malhotra emphasized that the scope for additional rate cuts is minimal, setting a high bar for future easing that would require significant downside surprises in growth or inflation. While the RBI maintained its FY26 GDP growth forecast at 6.5% and lowered its inflation projection from 4% to 3.7%, modest downside risks to inflation persist, leaving the door slightly open for further easing later in the year, though the likelihood remains low.