● Real GDP growth at four-quarter high in 4QFY25: Real GDP growth came in higher than expected at 7.4% in 4QFY25 (highest in four quarters) vs. 7.3%/6.4% in 4QFY24. The acceleration in GDP growth was led by robust growth in investments and a higher contribution of net exports to real GDP growth. Full year private consumption picked up in terms of growth while government consumption dragged down real GDP growth.

● US tariffs would lead to uncertanities: The US government’s 90-day suspension of reciprocal tariffs for most countries (excluding China) has offered temporary relief to Indian markets. However, with no shift in the US’s long-term trade strategy, significant uncertainties remain. With 90 day period is about to over, we believe the uncertanities would increase.

● GST Collection colled off: After robust GST collection in May-25, the june GST collection have colled off to 1.85tn, a growt of mrer 6% on YoY. This is slowest growth in last 4 years.

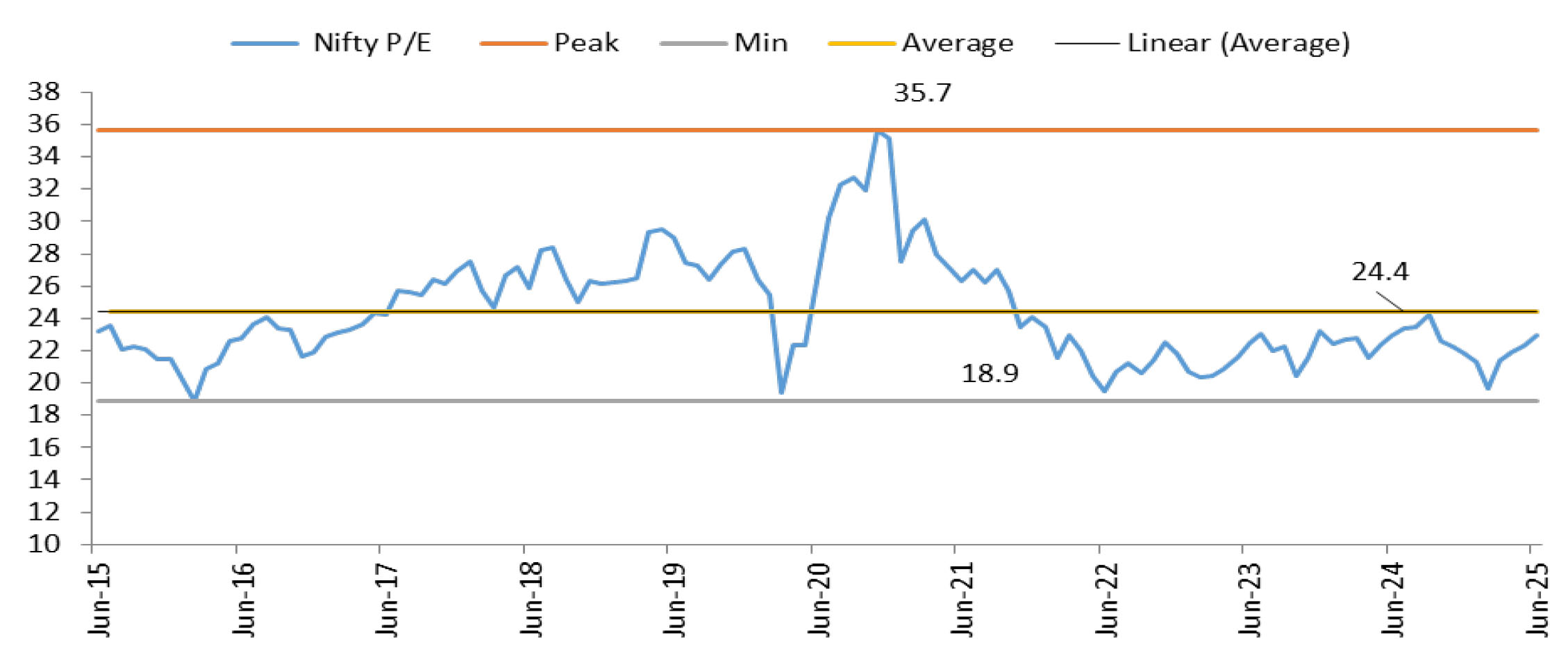

● Outlook: Early monsoon arival, weak demand and continued slowdown in central government capex continue to weigh on corporate earnings, rising disposable incomes. The recent government initiatives including direct benefit transfers (DBT) and personal income tax cuts—should support a recovery in consumption. This was further aided by RBI rate cut and CRR cut to boost liquidity in the system. We remain positive on the Indian Equities from medium term.